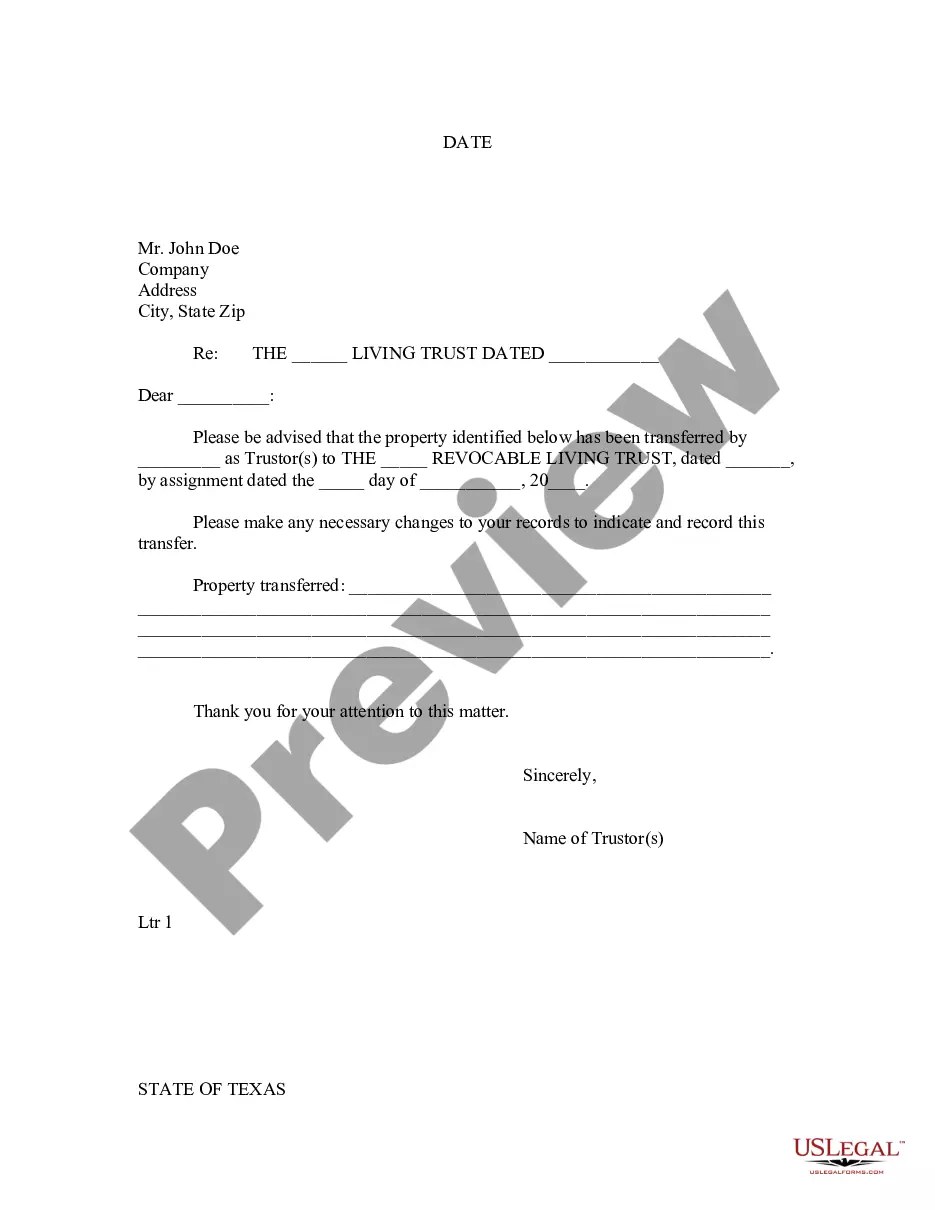

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Title: Killeen Texas Letter to Lien holder to Notify of Trust: A Comprehensive Guide Introduction: In Killeen, Texas, individuals seeking to establish a trust for their assets must notify their lien holder of this decision. A Killeen Texas Letter to Lien holder to Notify of Trust serves as a vital communication tool to inform lien holders about the development of a trust arrangement. This letter acts as a formal notice while detailing the necessary information to ensure a smooth transition of assets to the trust. In this article, we will delve into the specifics of drafting such a letter, discussing its purpose, content, and possible variants depending on the type of trust. 1. Purpose of the Killeen Texas Letter to Lien holder: The primary objective of the Killeen Texas Letter to Lien holder to Notify of Trust is to legally inform the lien holder about the creation of a trust. This notice is crucial for maintaining transparency and protecting the interests of all parties involved. By notifying the lien holder, the trust creator ensures that the lien holder is aware of the trust's existence, thereby enabling a seamless transfer of assets as per the trust agreement. 2. Key Components of the Letter: — Sender Information: Begin the letter by providing your full name, current address, and contact details. This establishes your identity as the trust creator. Lien holderer Information: Clearly state the lien holder's name, lending institution, address, and any pertinent account or agreement numbers to ensure accurate identification. — Introduction: Start by formally addressing the lien holder and express your intention to establish a trust for your assets. — Trust Information: Provide a detailed explanation of the trust arrangement, including the trust's name, date of creation, and any other relevant identification details. — Trustee Information: Specify the appointed trustee's full name, address, and contact details. Clearly state that the trustee is authorized to manage assets held in trust. — Asset Details: List the assets intended for inclusion in the trust. It is advisable to attach a separate document that includes an exhaustive inventory of assets for reference. — Desired Actions: Clearly state the actions you want the lien holder to undertake. This may include updating their records, refraining from contacting you for future lien-related matters, or providing written confirmation of receiving the letter. — Enclosures: Mention any additional documents you have included, such as trust agreements, inventory lists, or any legal endorsements required to solidify the trust arrangement. — Proof of Delivery: Request written acknowledgement from the lien holder, confirming receipt of the notification letter. 3. Variants of Killeen Texas Letter to Lien holder to Notify of Trust: While the general framework of the letter remains the same, the specific type of trust being established may require slight modifications. Common types of trusts that may warrant different notifications include: — Revocable Living Trust: Notifiethenesoldererer that the trust creator has established a trust, designating themselves as the primary trustee and beneficiary. — Irrevocable Trust: Informthenesoldererer about the creation of an irrevocable trust, emphasizing that the trust creator no longer has control or ownership of the assets mentioned. — Testamentary Trust: This variant involves notifying the lien holder that the trust provisions will only come into effect upon the trust creator's demise, ensuring smooth asset transfer to the designated beneficiaries. — Special Needs Trust: Notifiethenesoldererer about the establishment of a trust arrangement dedicated to providing for the needs and well-being of a dependent with special needs. Conclusion: The Killeen Texas Letter to Lien holder to Notify of Trust serves as a crucial legal document to inform lien holders about the establishment of a trust and facilitate the smooth transition of assets. By following the guidelines mentioned above, individuals can draft comprehensive and informative letters, tailored to their specific trust arrangements, ensuring compliance with legal requirements and maintaining a transparent relationship with their lien holders.Title: Killeen Texas Letter to Lien holder to Notify of Trust: A Comprehensive Guide Introduction: In Killeen, Texas, individuals seeking to establish a trust for their assets must notify their lien holder of this decision. A Killeen Texas Letter to Lien holder to Notify of Trust serves as a vital communication tool to inform lien holders about the development of a trust arrangement. This letter acts as a formal notice while detailing the necessary information to ensure a smooth transition of assets to the trust. In this article, we will delve into the specifics of drafting such a letter, discussing its purpose, content, and possible variants depending on the type of trust. 1. Purpose of the Killeen Texas Letter to Lien holder: The primary objective of the Killeen Texas Letter to Lien holder to Notify of Trust is to legally inform the lien holder about the creation of a trust. This notice is crucial for maintaining transparency and protecting the interests of all parties involved. By notifying the lien holder, the trust creator ensures that the lien holder is aware of the trust's existence, thereby enabling a seamless transfer of assets as per the trust agreement. 2. Key Components of the Letter: — Sender Information: Begin the letter by providing your full name, current address, and contact details. This establishes your identity as the trust creator. Lien holderer Information: Clearly state the lien holder's name, lending institution, address, and any pertinent account or agreement numbers to ensure accurate identification. — Introduction: Start by formally addressing the lien holder and express your intention to establish a trust for your assets. — Trust Information: Provide a detailed explanation of the trust arrangement, including the trust's name, date of creation, and any other relevant identification details. — Trustee Information: Specify the appointed trustee's full name, address, and contact details. Clearly state that the trustee is authorized to manage assets held in trust. — Asset Details: List the assets intended for inclusion in the trust. It is advisable to attach a separate document that includes an exhaustive inventory of assets for reference. — Desired Actions: Clearly state the actions you want the lien holder to undertake. This may include updating their records, refraining from contacting you for future lien-related matters, or providing written confirmation of receiving the letter. — Enclosures: Mention any additional documents you have included, such as trust agreements, inventory lists, or any legal endorsements required to solidify the trust arrangement. — Proof of Delivery: Request written acknowledgement from the lien holder, confirming receipt of the notification letter. 3. Variants of Killeen Texas Letter to Lien holder to Notify of Trust: While the general framework of the letter remains the same, the specific type of trust being established may require slight modifications. Common types of trusts that may warrant different notifications include: — Revocable Living Trust: Notifiethenesoldererer that the trust creator has established a trust, designating themselves as the primary trustee and beneficiary. — Irrevocable Trust: Informthenesoldererer about the creation of an irrevocable trust, emphasizing that the trust creator no longer has control or ownership of the assets mentioned. — Testamentary Trust: This variant involves notifying the lien holder that the trust provisions will only come into effect upon the trust creator's demise, ensuring smooth asset transfer to the designated beneficiaries. — Special Needs Trust: Notifiethenesoldererer about the establishment of a trust arrangement dedicated to providing for the needs and well-being of a dependent with special needs. Conclusion: The Killeen Texas Letter to Lien holder to Notify of Trust serves as a crucial legal document to inform lien holders about the establishment of a trust and facilitate the smooth transition of assets. By following the guidelines mentioned above, individuals can draft comprehensive and informative letters, tailored to their specific trust arrangements, ensuring compliance with legal requirements and maintaining a transparent relationship with their lien holders.