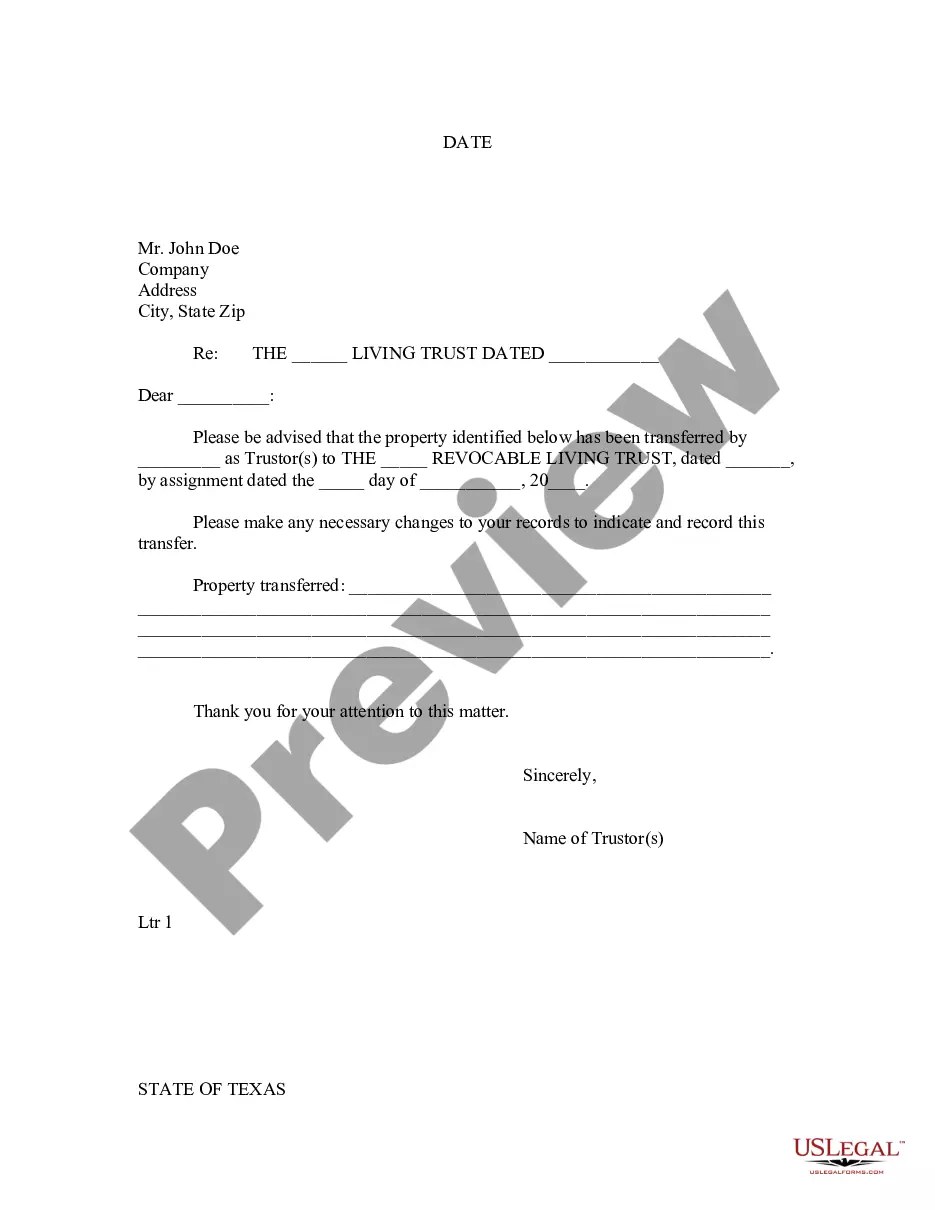

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Title: Pasadena Texas Letter to Lien holder to Notify of Trust: An In-depth Overview Introduction: Pasadena, Texas, serves as the backdrop for numerous legal processes and transactions, including the creation of trusts. When establishing a trust, it is crucial to notify the lien holder, typically a financial institution or lender, to ensure all parties are aware of the trust and its implications. In this article, we will provide a detailed description of what a Pasadena Texas Letter to Lien holder to Notify of Trust entails, its significance, and potential variations or types. Keywords: Pasadena Texas, letter, lien holder, trust, notification, significance, legal process, financial institution, lender, implications, variations. 1. Purpose and Importance: A Pasadena Texas Letter to Lien holder to Notify of Trust is a formal written communication aimed at informing the lien holder about the creation or existence of a trust. This notification holds paramount importance as it safeguards the interests of all parties involved, ensures seamless transfer of assets, and enables the proper administration of the trust. Keywords: purpose, importance, formal written communication, creation, existence, trust, notification, safeguard, interests, transfer of assets, administration. 2. Key Elements of the Letter: To ensure clarity and relevance, a Pasadena Texas Letter to Lien holder to Notify of Trust should include specific details. These may comprise: a) Trust Identification: Clearly state the name of the trust, date of its creation, and any reference numbers or legal documentation associated with it. b) Lien holder Information: Provide accurate details of the lien holder, including their name, address, contact information, and any pertinent account or loan numbers. c) Trustee Information: Specify the name, contact information, and address of the trustee responsible for managing the trust. d) Trust Terms and Conditions: Provide a brief overview of the trust's purpose, beneficiaries, and any other relevant information. e) Request for Acknowledgment: Politely request the lien holder's confirmation of receipt and understanding of the trust notification. f) Supporting Documents: Mention any accompanying legal documents, such as the trust agreement or certificate of trust, that the lien holder may require for their records. Keywords: trust identification, lien holder information, trustee information, trust terms and conditions, request for acknowledgment, supporting documents. 3. Possible Variations: Although the core components remain consistent, there may be slight variations in Pasadena Texas Letter to Lien holder to Notify of Trust, depending on the specific circumstances. Some noteworthy variations include: a) Revocable Living Trust Notification: Pertaining to a trust created for estate planning, this letter notifies the lien holder of a revocable living trust and provides instructions for handling the assets held as collateral in case of the granter's incapacitation or death. b) Irrevocable Trust Notification: In situations where an irrevocable trust is established, this letter notifies the lien holder of the transfer of assets, clearly stating that they are no longer collateral for the loan or debt. c) Testamentary Trust Notification: When a trust is established through a will, this letter informs the lien holder of the trust's existence upon the death of the testator and provides instructions regarding the management of the trust assets. Keywords: revocable living trust, estate planning, irrevocable trust, transfer of assets, collateral, testamentary trust, testator, management of trust assets. Conclusion: In Pasadena, Texas, accurately notifying the lien holder about the creation or existence of a trust is a crucial step to ensure efficient asset management and avoid any legal or financial complications. By following the guidelines outlined in a Pasadena Texas Letter to Lien holder to Notify of Trust, all parties can protect their interests and promote a smooth administration of the trust. Keywords: Pasadena Texas, notifying lien holder, creation, existence, trust, asset management, legal complications, financial complications, protect interests, smooth administration.Title: Pasadena Texas Letter to Lien holder to Notify of Trust: An In-depth Overview Introduction: Pasadena, Texas, serves as the backdrop for numerous legal processes and transactions, including the creation of trusts. When establishing a trust, it is crucial to notify the lien holder, typically a financial institution or lender, to ensure all parties are aware of the trust and its implications. In this article, we will provide a detailed description of what a Pasadena Texas Letter to Lien holder to Notify of Trust entails, its significance, and potential variations or types. Keywords: Pasadena Texas, letter, lien holder, trust, notification, significance, legal process, financial institution, lender, implications, variations. 1. Purpose and Importance: A Pasadena Texas Letter to Lien holder to Notify of Trust is a formal written communication aimed at informing the lien holder about the creation or existence of a trust. This notification holds paramount importance as it safeguards the interests of all parties involved, ensures seamless transfer of assets, and enables the proper administration of the trust. Keywords: purpose, importance, formal written communication, creation, existence, trust, notification, safeguard, interests, transfer of assets, administration. 2. Key Elements of the Letter: To ensure clarity and relevance, a Pasadena Texas Letter to Lien holder to Notify of Trust should include specific details. These may comprise: a) Trust Identification: Clearly state the name of the trust, date of its creation, and any reference numbers or legal documentation associated with it. b) Lien holder Information: Provide accurate details of the lien holder, including their name, address, contact information, and any pertinent account or loan numbers. c) Trustee Information: Specify the name, contact information, and address of the trustee responsible for managing the trust. d) Trust Terms and Conditions: Provide a brief overview of the trust's purpose, beneficiaries, and any other relevant information. e) Request for Acknowledgment: Politely request the lien holder's confirmation of receipt and understanding of the trust notification. f) Supporting Documents: Mention any accompanying legal documents, such as the trust agreement or certificate of trust, that the lien holder may require for their records. Keywords: trust identification, lien holder information, trustee information, trust terms and conditions, request for acknowledgment, supporting documents. 3. Possible Variations: Although the core components remain consistent, there may be slight variations in Pasadena Texas Letter to Lien holder to Notify of Trust, depending on the specific circumstances. Some noteworthy variations include: a) Revocable Living Trust Notification: Pertaining to a trust created for estate planning, this letter notifies the lien holder of a revocable living trust and provides instructions for handling the assets held as collateral in case of the granter's incapacitation or death. b) Irrevocable Trust Notification: In situations where an irrevocable trust is established, this letter notifies the lien holder of the transfer of assets, clearly stating that they are no longer collateral for the loan or debt. c) Testamentary Trust Notification: When a trust is established through a will, this letter informs the lien holder of the trust's existence upon the death of the testator and provides instructions regarding the management of the trust assets. Keywords: revocable living trust, estate planning, irrevocable trust, transfer of assets, collateral, testamentary trust, testator, management of trust assets. Conclusion: In Pasadena, Texas, accurately notifying the lien holder about the creation or existence of a trust is a crucial step to ensure efficient asset management and avoid any legal or financial complications. By following the guidelines outlined in a Pasadena Texas Letter to Lien holder to Notify of Trust, all parties can protect their interests and promote a smooth administration of the trust. Keywords: Pasadena Texas, notifying lien holder, creation, existence, trust, asset management, legal complications, financial complications, protect interests, smooth administration.