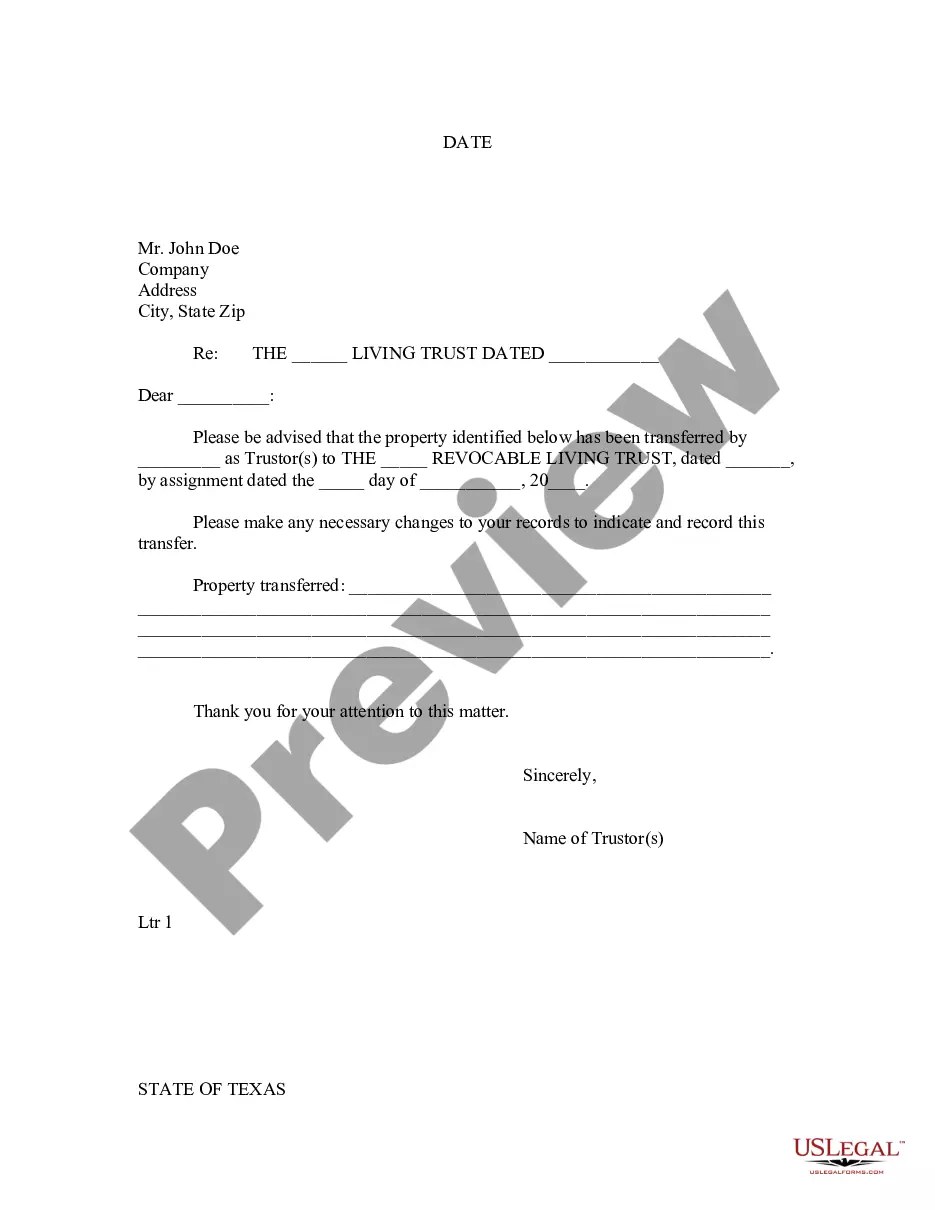

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

A Round Rock Texas Letter to Lien holder to Notify of Trust is a written document used to inform the lien holder of a trust that has been established on a property in Round Rock, Texas. This letter serves as a formal notification and typically includes various important details to ensure legal compliance and transparency in property transactions. Keywords: Round Rock Texas, Letter, Lien holder, Notify, Trust Description: 1. Introduction: The Round Rock Texas Letter to Lien holder to Notify of Trust begins with a concise introduction that states the purpose of the letter. It clearly indicates that the letter serves to notify the lien holder about the establishment of a trust on a specific property in Round Rock, Texas, and intends to provide all necessary information regarding the trust. 2. Identification of Parties: The letter should include the full legal names and contact details of both the lien holder and the trustee. This ensures proper identification and facilitates communication between the parties involved. 3. Property Details: The letter must specify the details of the property that the trust has been established on. This includes the property's complete address, legal description, and any other relevant identifying information. 4. Trust Information: The Round Rock Texas Letter to Lien holder to Notify of Trust should state the name of the trust and provide any additional information related to its establishment. This may include the date the trust was created, the purpose of the trust, and any specific terms or conditions associated with it. 5. Legal Authorization: To maintain transparency and ensure compliance with legal requirements, the letter should mention the relevant legal statutes and regulations that confer the authority to establish the trust. This helps to establish the legal validity of the trust and provides confidence to both the lien holder and trustee. 6. Lien holder Actions: In this section, the letter should outline any specific actions or responsibilities expected from the lien holder in regard to the trust. This may include updating their records, modifying the lien holder's interest in the property, or providing certain documents to the trustee as necessary. Possible Types of Round Rock Texas Letter to Lien holder to Notify of Trust: 1. Round Rock Texas Letter to Lien holder to Notify of Revocable Living Trust 2. Round Rock Texas Letter to Lien holder to Notify of Irrevocable Trust 3. Round Rock Texas Letter to Lien holder to Notify of Testamentary Trust 4. Round Rock Texas Letter to Lien holder to Notify of Special Needs Trust 5. Round Rock Texas Letter to Lien holder to Notify of Charitable Trust 6. Round Rock Texas Letter to Lien holder to Notify of Land Trust Please note that the specific contents and sections of the letter may vary depending on the type of trust being established and the requirements set forth by the lien holder or relevant legal authorities. It is always advisable to consult an attorney or legal professional when drafting or submitting any formal legal documents.A Round Rock Texas Letter to Lien holder to Notify of Trust is a written document used to inform the lien holder of a trust that has been established on a property in Round Rock, Texas. This letter serves as a formal notification and typically includes various important details to ensure legal compliance and transparency in property transactions. Keywords: Round Rock Texas, Letter, Lien holder, Notify, Trust Description: 1. Introduction: The Round Rock Texas Letter to Lien holder to Notify of Trust begins with a concise introduction that states the purpose of the letter. It clearly indicates that the letter serves to notify the lien holder about the establishment of a trust on a specific property in Round Rock, Texas, and intends to provide all necessary information regarding the trust. 2. Identification of Parties: The letter should include the full legal names and contact details of both the lien holder and the trustee. This ensures proper identification and facilitates communication between the parties involved. 3. Property Details: The letter must specify the details of the property that the trust has been established on. This includes the property's complete address, legal description, and any other relevant identifying information. 4. Trust Information: The Round Rock Texas Letter to Lien holder to Notify of Trust should state the name of the trust and provide any additional information related to its establishment. This may include the date the trust was created, the purpose of the trust, and any specific terms or conditions associated with it. 5. Legal Authorization: To maintain transparency and ensure compliance with legal requirements, the letter should mention the relevant legal statutes and regulations that confer the authority to establish the trust. This helps to establish the legal validity of the trust and provides confidence to both the lien holder and trustee. 6. Lien holder Actions: In this section, the letter should outline any specific actions or responsibilities expected from the lien holder in regard to the trust. This may include updating their records, modifying the lien holder's interest in the property, or providing certain documents to the trustee as necessary. Possible Types of Round Rock Texas Letter to Lien holder to Notify of Trust: 1. Round Rock Texas Letter to Lien holder to Notify of Revocable Living Trust 2. Round Rock Texas Letter to Lien holder to Notify of Irrevocable Trust 3. Round Rock Texas Letter to Lien holder to Notify of Testamentary Trust 4. Round Rock Texas Letter to Lien holder to Notify of Special Needs Trust 5. Round Rock Texas Letter to Lien holder to Notify of Charitable Trust 6. Round Rock Texas Letter to Lien holder to Notify of Land Trust Please note that the specific contents and sections of the letter may vary depending on the type of trust being established and the requirements set forth by the lien holder or relevant legal authorities. It is always advisable to consult an attorney or legal professional when drafting or submitting any formal legal documents.