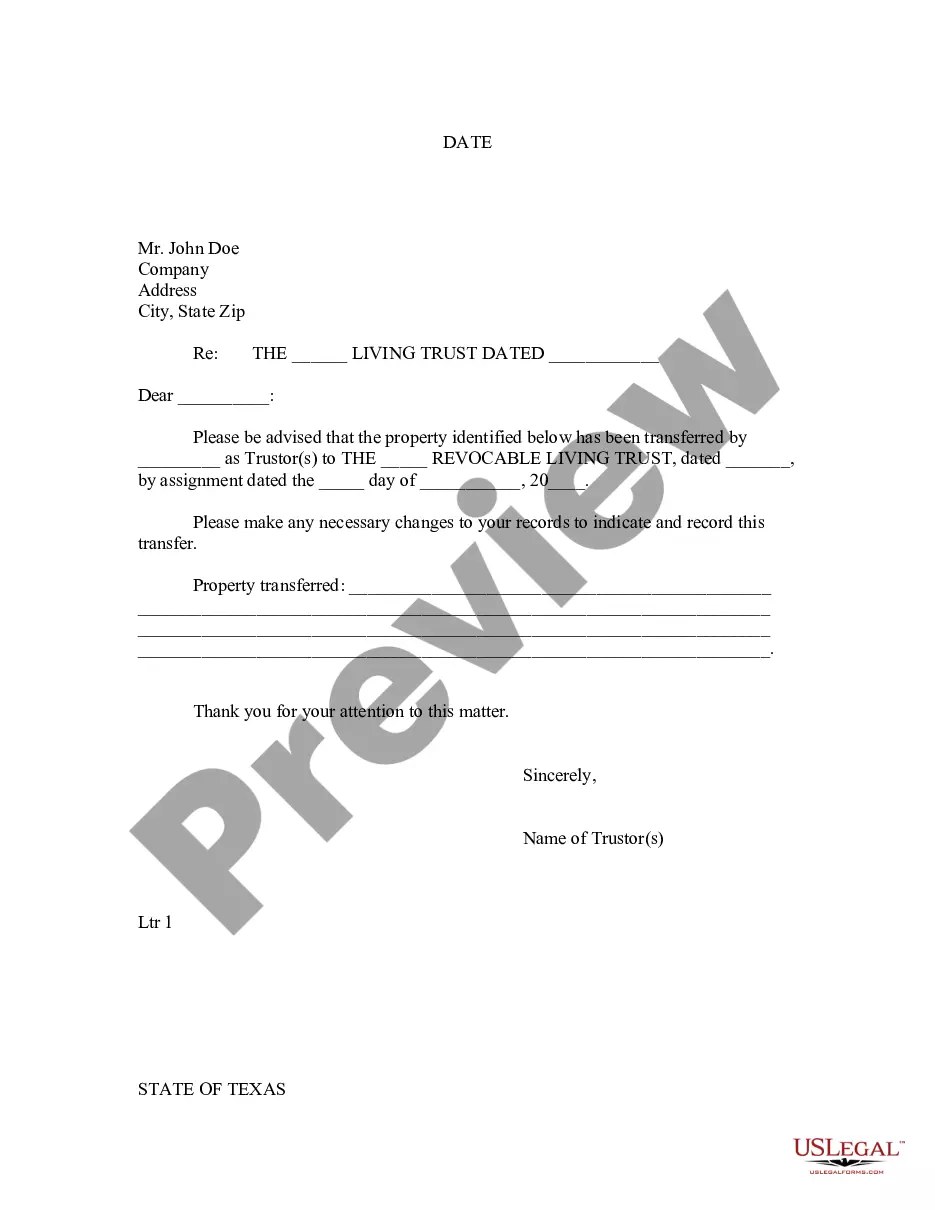

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Title: San Angelo Texas Letter to Lien holder to Notify of Trust — Detailed Description and Types Introduction: A San Angelo Texas Letter to Lien holder to Notify of Trust is a legal document that serves as a notification to a lien holder about the establishment of a trust involving a property located in San Angelo, Texas. This letter plays a crucial role in safeguarding the interests of all parties involved, including the lien holder and the beneficiaries of the trust. Here, we will provide a comprehensive overview of this letter, its importance, and its different types. Detailed Description: 1. Purpose and Importance: The San Angelo Texas Letter to Lien holder to Notify of Trust is essential because it ensures transparency and protects the interests of all parties involved in a property transaction. By notifying the lien holder about the establishment of a trust, this letter helps to avoid potential conflicts and informs the lender about any changes in the property's ownership structure. 2. Key Components: The letter should be precise, concise, and include the following vital information: — Date of the letter: It is important to mention the exact date the letter is written to document the timeline of the trust establishment. Lien holderer's information: Include the name, address, and contact details of the lien holder to ensure the letter reaches the intended recipient. — Trust details: Clearly state the type of trust being established, such as revocable or irrevocable trust. — Property details: Provide the complete address of the property located in San Angelo, Texas, that is subject to the trust. — Trustee details: Include the name, address, and contact information of the trustee(s) responsible for managing the trust. — Beneficiary details: Mention the name(s), address(BS), and contact information of the beneficiary(IES) who will receive the trust's benefits. 3. Types of San Angelo Texas Letter to Lien holder to Notify of Trust: a. Revocable Trust Notification: This type of letter is used when a revocable trust is established. It informs the lien holder that the property's ownership structure has changed, but the trust can be amended or revoked at any time by the granter. b. Irrevocable Trust Notification: This letter is used when an irrevocable trust is established. It notifies the lien holder that the property's ownership has been transferred to the trust and cannot be altered or revoked without the consent of beneficiaries. Conclusion: In San Angelo, Texas, a letter to notify a lien holder of a trust is an integral part of property transactions. It ensures transparency, protects the interests of lenders and beneficiaries, and clarifies any changes in property ownership. By providing detailed and accurate information, this letter streamlines the trust establishment process and fosters a smoother relationship between the lien holder, trustee(s), and beneficiary(IES).Title: San Angelo Texas Letter to Lien holder to Notify of Trust — Detailed Description and Types Introduction: A San Angelo Texas Letter to Lien holder to Notify of Trust is a legal document that serves as a notification to a lien holder about the establishment of a trust involving a property located in San Angelo, Texas. This letter plays a crucial role in safeguarding the interests of all parties involved, including the lien holder and the beneficiaries of the trust. Here, we will provide a comprehensive overview of this letter, its importance, and its different types. Detailed Description: 1. Purpose and Importance: The San Angelo Texas Letter to Lien holder to Notify of Trust is essential because it ensures transparency and protects the interests of all parties involved in a property transaction. By notifying the lien holder about the establishment of a trust, this letter helps to avoid potential conflicts and informs the lender about any changes in the property's ownership structure. 2. Key Components: The letter should be precise, concise, and include the following vital information: — Date of the letter: It is important to mention the exact date the letter is written to document the timeline of the trust establishment. Lien holderer's information: Include the name, address, and contact details of the lien holder to ensure the letter reaches the intended recipient. — Trust details: Clearly state the type of trust being established, such as revocable or irrevocable trust. — Property details: Provide the complete address of the property located in San Angelo, Texas, that is subject to the trust. — Trustee details: Include the name, address, and contact information of the trustee(s) responsible for managing the trust. — Beneficiary details: Mention the name(s), address(BS), and contact information of the beneficiary(IES) who will receive the trust's benefits. 3. Types of San Angelo Texas Letter to Lien holder to Notify of Trust: a. Revocable Trust Notification: This type of letter is used when a revocable trust is established. It informs the lien holder that the property's ownership structure has changed, but the trust can be amended or revoked at any time by the granter. b. Irrevocable Trust Notification: This letter is used when an irrevocable trust is established. It notifies the lien holder that the property's ownership has been transferred to the trust and cannot be altered or revoked without the consent of beneficiaries. Conclusion: In San Angelo, Texas, a letter to notify a lien holder of a trust is an integral part of property transactions. It ensures transparency, protects the interests of lenders and beneficiaries, and clarifies any changes in property ownership. By providing detailed and accurate information, this letter streamlines the trust establishment process and fosters a smoother relationship between the lien holder, trustee(s), and beneficiary(IES).