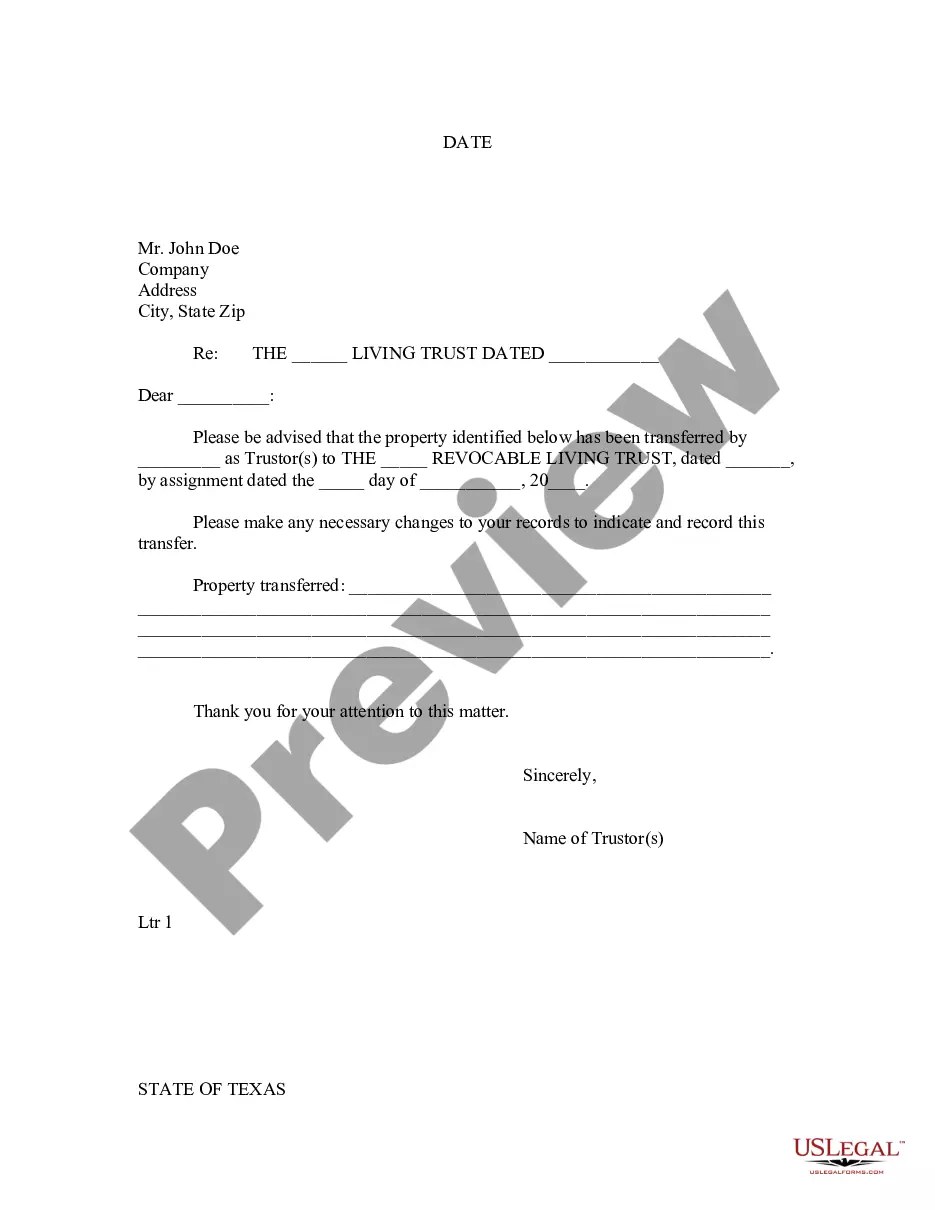

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

The Tarrant Texas Letter to Lien holder to Notify of Trust is a legally binding document used to inform a lien holder of the creation of a trust over certain property located in Tarrant County, Texas. This letter serves as an official notification and is crucial for protecting the rights and interests of all involved parties. The purpose of this letter is to notify the lien holder that the property in question has been transferred into a trust. By doing so, the property's ownership and management are now under the control of the designated trustee, who acts on behalf of the trust beneficiaries. This transfer of ownership allows for a more streamlined and efficient management of the property. Various types of Tarrant Texas Letter to Lien holder to Notify of Trust may exist depending on the specific circumstances. Some common types include: 1. Revocable Living Trust Notification: This letter is used when a property owner transfers their assets, such as real estate, into a revocable living trust. By creating a revocable living trust, the property owner maintains control over the assets during their lifetime while ensuring a smooth transition of ownership upon their death. 2. Irrevocable Trust Notification: In this case, the property owner transfers the property into an irrevocable trust, which cannot be altered or revoked without the consent of the beneficiaries. This type of trust is often used for estate planning purposes as it provides considerable tax benefits. 3. Special Needs Trust Notification: This letter is specific to properties that have been transferred into a special needs trust, which is designed to financially support individuals with disabilities without jeopardizing their eligibility for government benefits. In all instances, the Tarrant Texas Letter to Lien holder to Notify of Trust includes crucial details such as the property's legal description, the name of the lien holder, the trustee's name and contact information, and any relevant supporting documentation, such as trust agreements or deeds. It is important to consult with an attorney or legal professional experienced in trust law to ensure the accuracy and legality of all contents within the Tarrant Texas Letter to Lien holder to Notify of Trust. This letter plays a vital role in establishing and maintaining the trust's integrity, protecting the rights and interests of all parties involved.The Tarrant Texas Letter to Lien holder to Notify of Trust is a legally binding document used to inform a lien holder of the creation of a trust over certain property located in Tarrant County, Texas. This letter serves as an official notification and is crucial for protecting the rights and interests of all involved parties. The purpose of this letter is to notify the lien holder that the property in question has been transferred into a trust. By doing so, the property's ownership and management are now under the control of the designated trustee, who acts on behalf of the trust beneficiaries. This transfer of ownership allows for a more streamlined and efficient management of the property. Various types of Tarrant Texas Letter to Lien holder to Notify of Trust may exist depending on the specific circumstances. Some common types include: 1. Revocable Living Trust Notification: This letter is used when a property owner transfers their assets, such as real estate, into a revocable living trust. By creating a revocable living trust, the property owner maintains control over the assets during their lifetime while ensuring a smooth transition of ownership upon their death. 2. Irrevocable Trust Notification: In this case, the property owner transfers the property into an irrevocable trust, which cannot be altered or revoked without the consent of the beneficiaries. This type of trust is often used for estate planning purposes as it provides considerable tax benefits. 3. Special Needs Trust Notification: This letter is specific to properties that have been transferred into a special needs trust, which is designed to financially support individuals with disabilities without jeopardizing their eligibility for government benefits. In all instances, the Tarrant Texas Letter to Lien holder to Notify of Trust includes crucial details such as the property's legal description, the name of the lien holder, the trustee's name and contact information, and any relevant supporting documentation, such as trust agreements or deeds. It is important to consult with an attorney or legal professional experienced in trust law to ensure the accuracy and legality of all contents within the Tarrant Texas Letter to Lien holder to Notify of Trust. This letter plays a vital role in establishing and maintaining the trust's integrity, protecting the rights and interests of all parties involved.