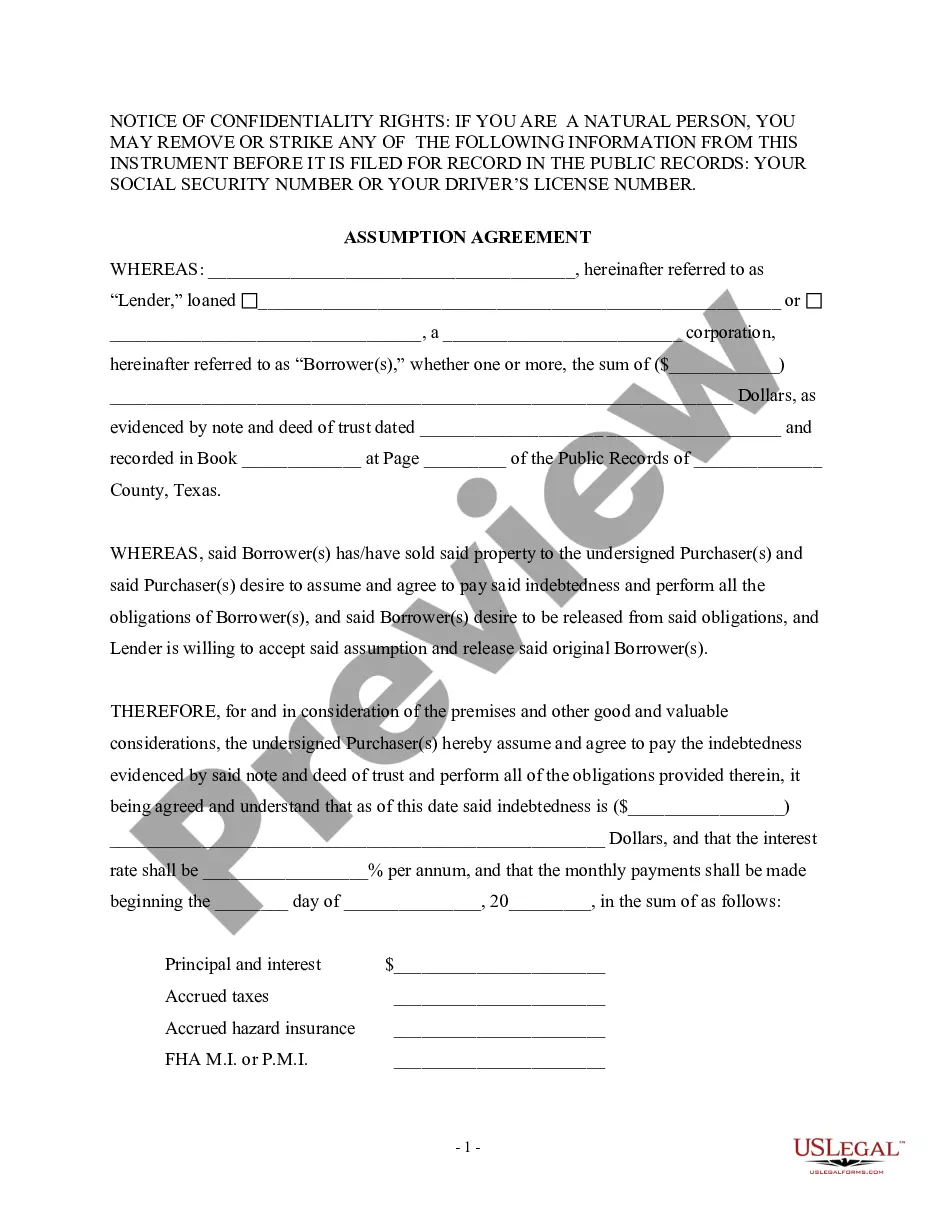

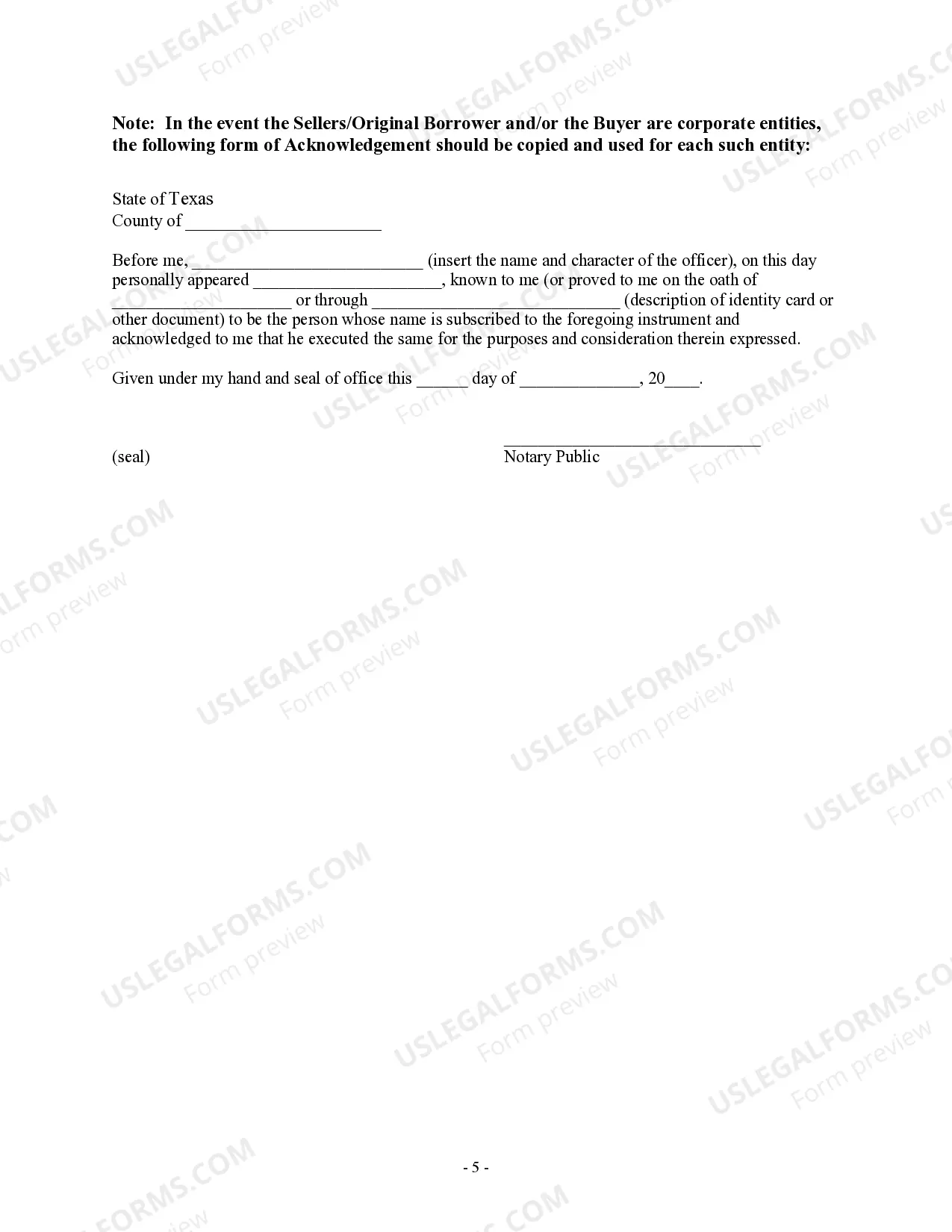

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Amarillo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the terms and conditions under which a new party assumes the responsibilities and obligations of an existing mortgage. This agreement allows for a smooth transfer of ownership without necessitating the payment of the mortgage in full. In this regard, an assumption agreement of deed of trust allows a buyer to take over the existing mortgage of a property rather than obtaining a new one. This type of agreement can be beneficial for both the buyer and the original mortgagor. The mortgage assumption relieves the original mortgagor of their debt obligations, while providing the buyer with the opportunity to acquire the property without incurring the costs associated with obtaining a new mortgage. Amarillo, Texas being a vibrant city with a growing real estate market, witnesses different types of Amarillo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors. Some common types include: 1. Conventional Amarillo Texas Assumption Agreement: This type of agreement is commonly used when a buyer assumes a conventional mortgage. It outlines the terms and conditions, including the interest rate, payment schedule, and legal responsibilities of the new mortgagor. 2. FHA (Federal Housing Administration) Amarillo Texas Assumption Agreement: This agreement is specific to mortgages insured by the Federal Housing Administration. It ensures that the new mortgagor complies with the FHA guidelines and regulations. 3. VA (Department of Veterans Affairs) Amarillo Texas Assumption Agreement: This agreement is applicable when a buyer assumes a mortgage backed by the Department of Veterans Affairs. It includes provisions that cater to the unique needs and requirements of veterans and their families. 4. Adjustable-Rate Mortgage (ARM) Amarillo Texas Assumption Agreement: This agreement pertains to mortgages with an adjustable interest rate. It outlines the terms and conditions for adjusting the interest rate over the term of the loan. In conclusion, the Amarillo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a crucial legal document that facilitates the interchanging of ownership and mortgage responsibilities. It is essential for both the parties to carefully review and understand the terms and conditions mentioned in the agreement to ensure a smooth and seamless transfer of the mortgage.