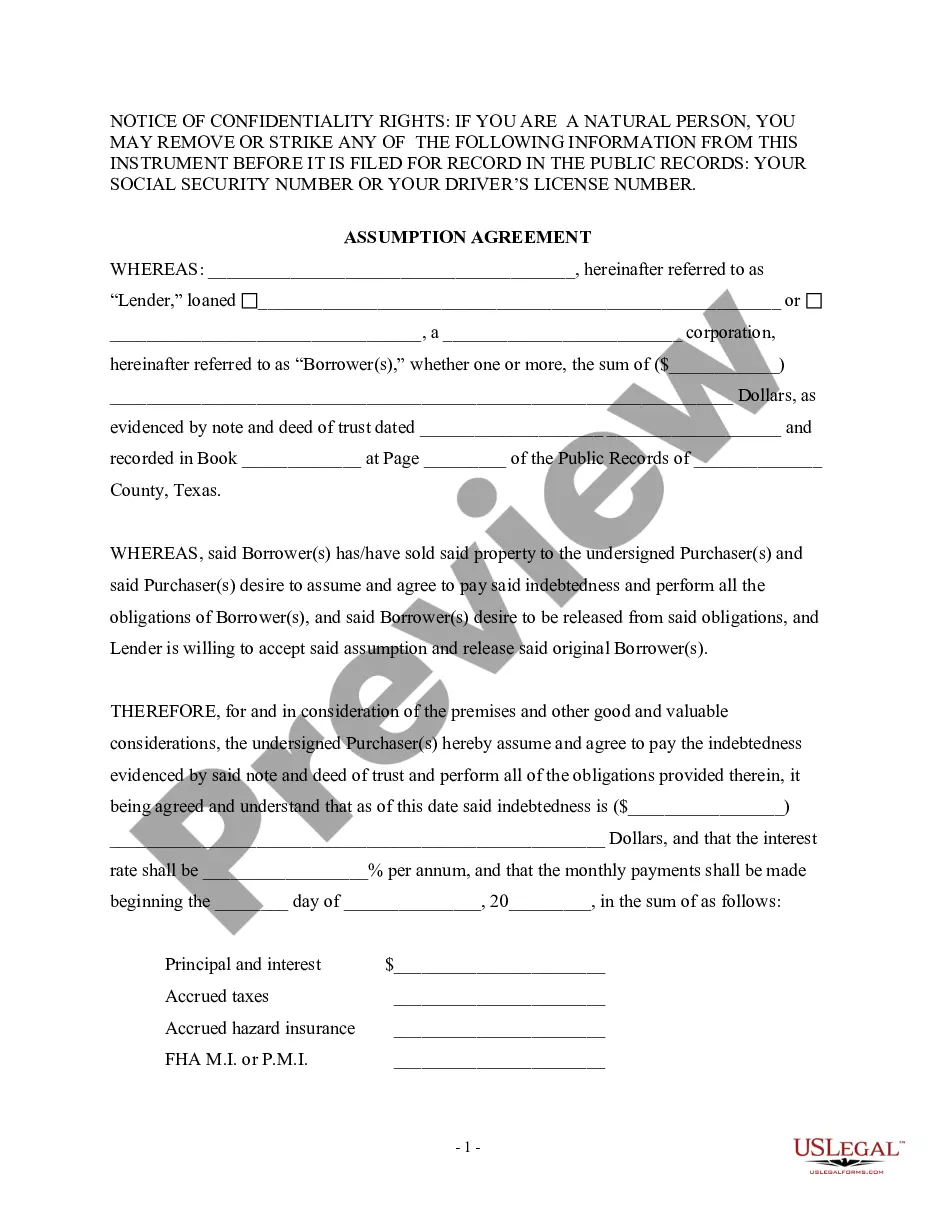

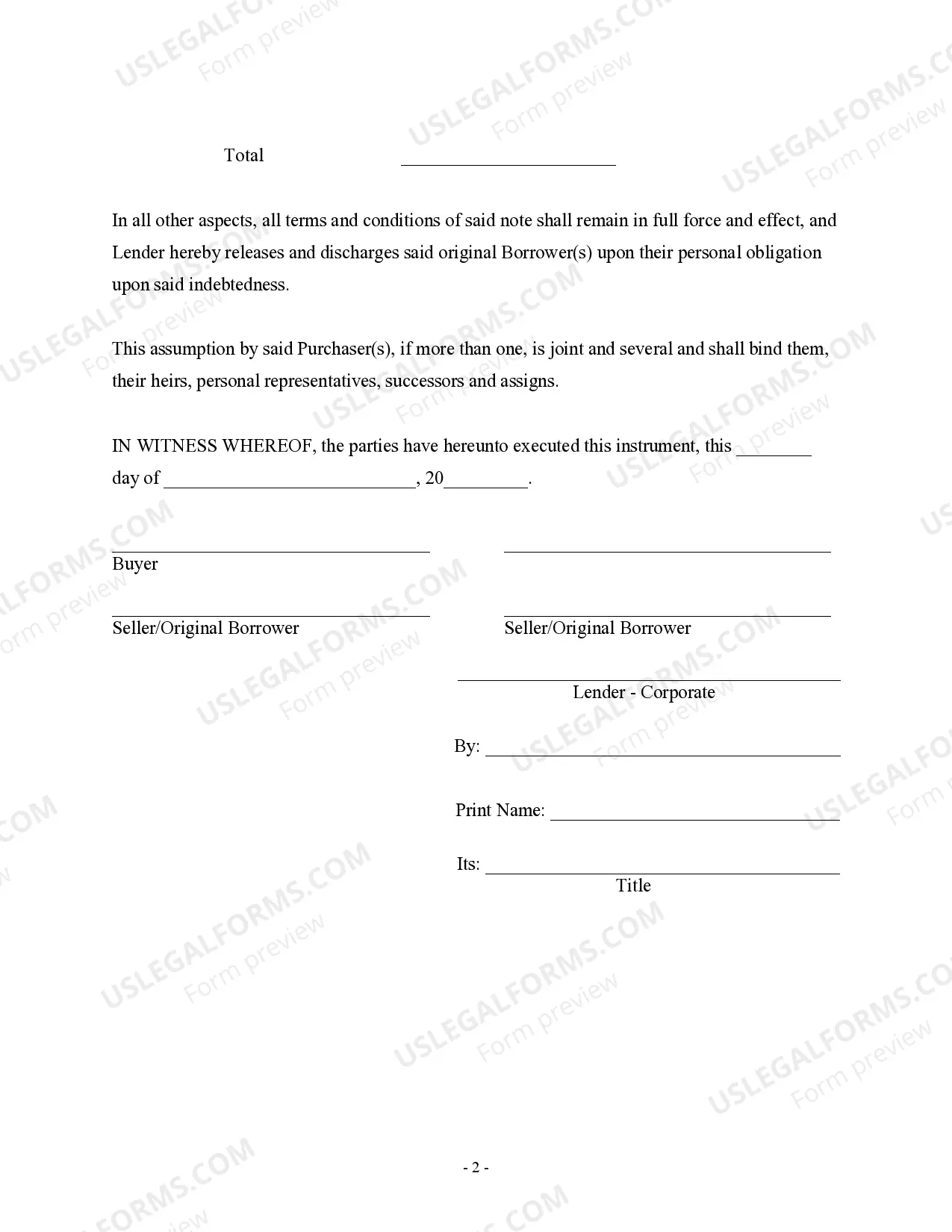

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Bexar Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a mortgage from the original borrower to a new borrower, with the release and discharge of the original borrower from any further liability. This agreement is commonly used in mortgage transactions in Bexar County, Texas. Keywords: Bexar Texas, Assumption Agreement, Deed of Trust, Release of Original Mortgagors, mortgage transfer, liability release, Bexar County, Texas. There are different types of Bexar Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, based on specific scenarios and requirements. Here are a few examples: 1. Standard Assumption Agreement: This agreement is used when a buyer assumes an existing mortgage from the original borrower, who wishes to be released from their mortgage obligations. The new borrower agrees to take over all the terms and conditions of the original mortgage, including payment responsibility and property ownership. 2. Assumption Agreement with Qualification: In some cases, the lender may require the new borrower to meet certain qualification criteria or go through a credit check before they can assume the mortgage. This type of agreement outlines the conditions and terms related to the borrower's qualification process, in addition to the standard assumption terms. 3. Assumption Agreement with Release of Liability: This agreement is used when the original borrower wants to transfer the mortgage to a new borrower, who agrees to assume all liabilities and responsibilities associated with the mortgage. The original borrower's debts are released, and the new borrower becomes solely accountable for the mortgage repayment. 4. Assumption Agreement with Partial Release: In situations where multiple properties are mortgaged under one deed of trust, this agreement allows the release of one or more properties from the original mortgagor's obligations. The agreement outlines which properties are being released, while the remaining properties stay subject to the original mortgage. 5. Assumption Agreement with Private Financing: Sometimes, a buyer and seller may negotiate a private financing arrangement, where the original borrower's mortgage is assumed by the new borrower without involving a traditional lender. This agreement outlines the terms, conditions, and payment schedule of the private financing arrangement. These are just a few examples of the various types of Bexar Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors. It is essential to consult with a legal professional to determine the specific type of agreement that suits your unique situation and comply with Bexar County regulations.