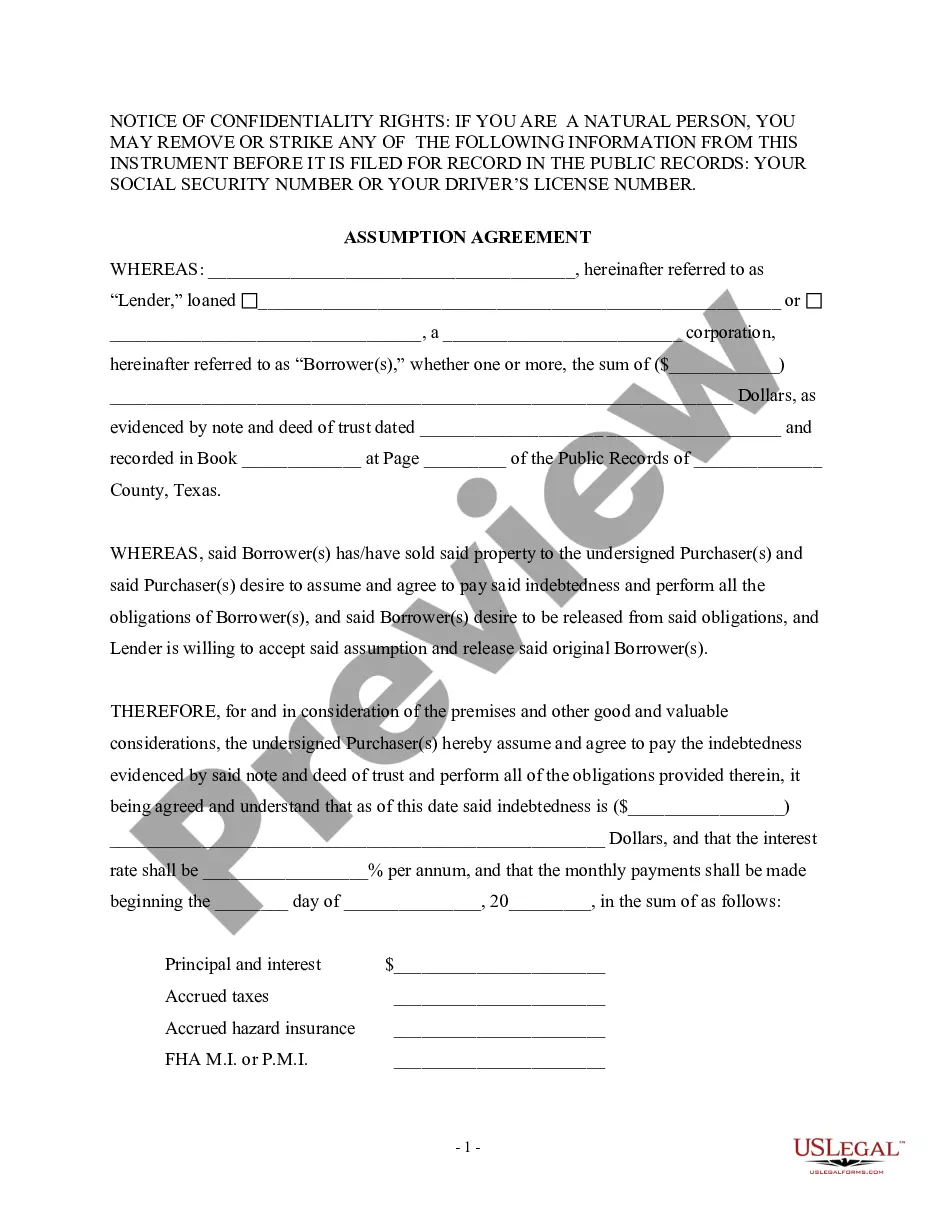

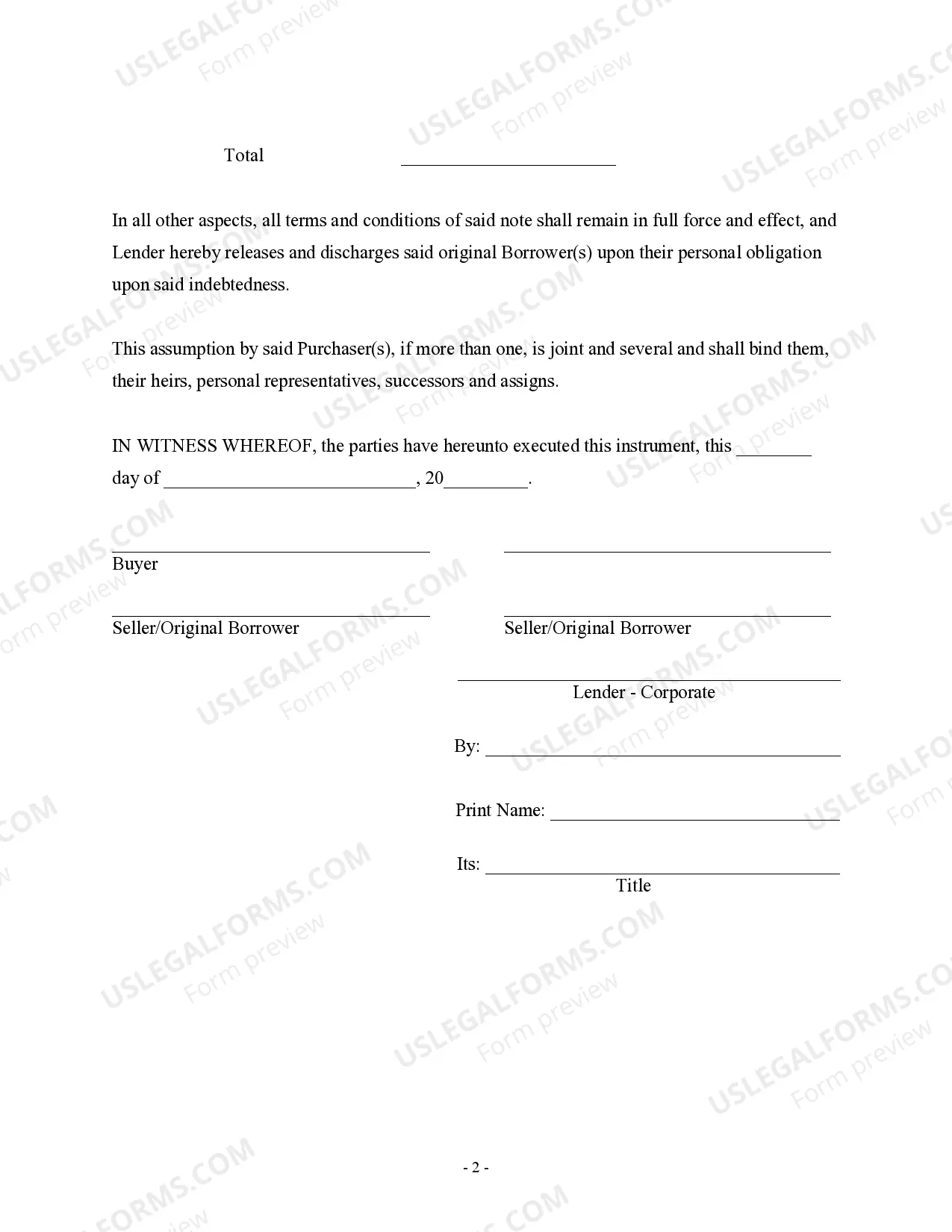

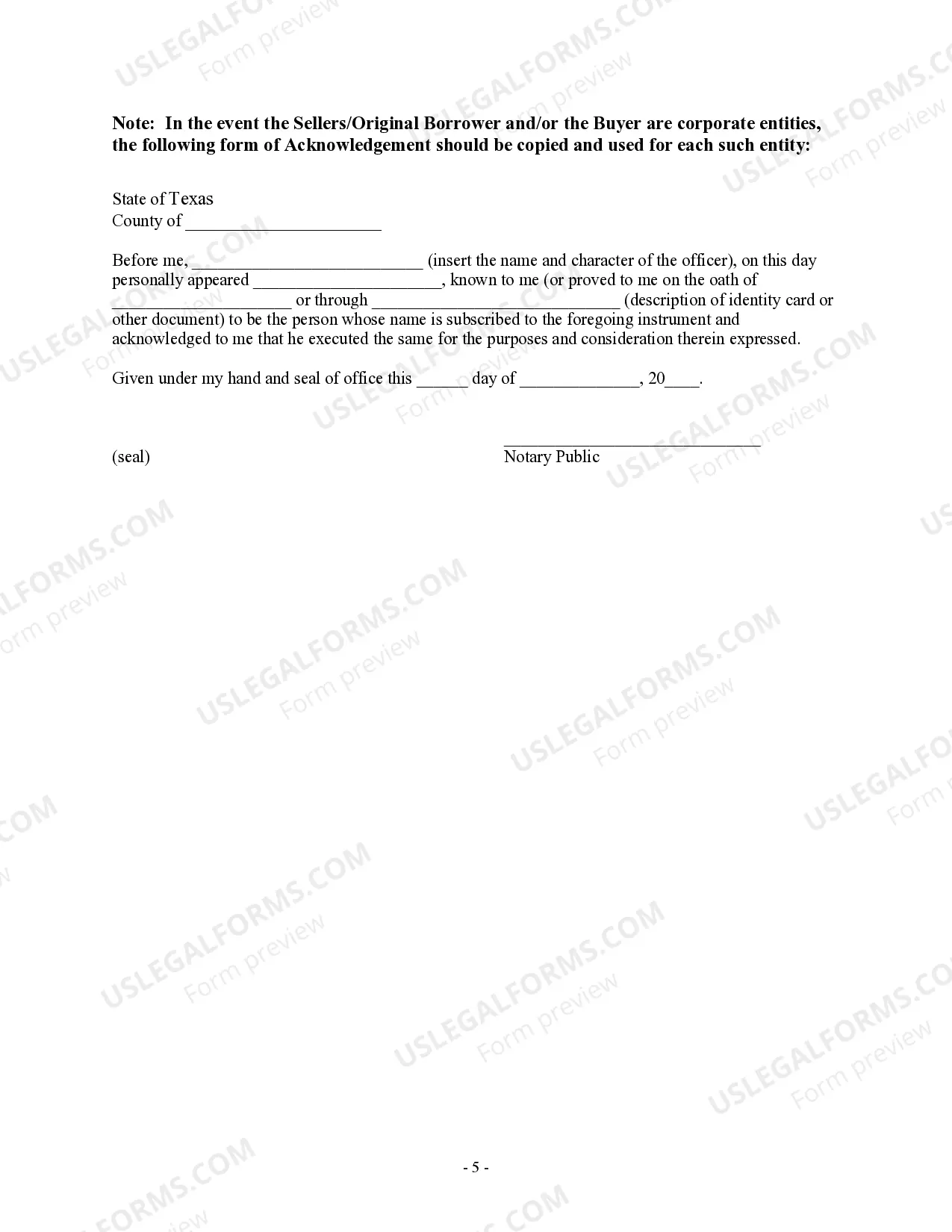

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Texas Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

We consistently aim to minimize or avert legal repercussions in handling intricate legal or financial matters.

To achieve this, we enroll in legal solutions that are typically very expensive.

However, not every legal issue is similarly complicated.

Many can be managed independently.

Utilize US Legal Forms whenever you require to obtain and download the College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors or any other document swiftly and securely. Simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the form, you can always re-download it in the My documents section. The process is equally simple if you’re a newcomer to the site! You can set up your account in a matter of minutes. Ensure that the College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors adheres to the laws and regulations of your state and locality. Furthermore, it’s essential to review the form’s description (if available), and if you notice any inconsistencies with what you are searching for initially, look for an alternative template. Once you've confirmed that the College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is suitable for your situation, you can select the subscription option and proceed to payment. You can then download the form in any appropriate file format. For over 24 years in the industry, we’ve assisted millions of individuals by offering customizable and current legal forms. Take advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is a web-based directory of current do-it-yourself legal forms encompassing various documents, such as wills, powers of attorney, articles of incorporation, and petitions for dissolution.

- Our platform empowers you to take charge of your situations without the necessity of employing legal professionals.

- We provide access to legal document templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, significantly streamlining the search process.

Form popularity

FAQ

While you do not legally need a lawyer to transfer a deed in Texas, having one can significantly ease the process. A qualified attorney can guide you through the complexities of real estate law, ensuring that all necessary documents comply with state regulations. Additionally, when dealing with a College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, an expert can provide valuable advice to avoid any potential pitfalls. Utilizing USLegalForms can also help you navigate the necessary forms effectively.

To transfer a deed in Texas, you typically need to prepare a new deed that outlines the details of the property transfer. This will include information about the current title holder, the new owner, and the legal description of the property. It is essential to also gather any applicable documentation, such as the original deed and any necessary signatures. When considering a College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, ensuring clarity in your paperwork can facilitate a smoother process.

Lenders often favor a deed of trust because it allows for a quicker and simpler process in case of default. With a deed of trust, lenders can initiate a non-judicial foreclosure, which saves time and legal costs. This aspect is particularly significant in College Station, Texas, where the Assumption Agreement of Deed of Trust and Release of Original Mortgagors can streamline transactions and enhance recovery efforts.

An assumption with a release of liability occurs when a new borrower takes over an existing mortgage, relieving the original mortgagors of their obligations. This process allows for the smooth transfer of debt while protecting all parties involved. If you're considering such an arrangement, the US Legal platform can provide the necessary documentation and resources for a College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

In Texas, licensed attorneys typically handle the drafting of deeds of trust and promissory notes. This ensures that the documents comply with state laws and properly protect the rights of both parties. However, individuals can also use self-help platforms like US Legal to create these documents efficiently, especially for a College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Filling out a Texas warranty deed involves several key steps. First, clearly state the names of both the grantor and the grantee, along with their addresses. Next, include a description of the property being transferred, and specify any conditions, if applicable. For a seamless experience, consider utilizing the US Legal platform, which offers templates and guidance specifically related to the College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

An assumption letter for a mortgage serves as official permission from the lender for the transfer of the mortgage from one party to another. It is a key component in the College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, as it ensures that the new borrower is fully vetted and approved. This document protects both the lender and the new owner by clearly defining the terms of the assumption.

Mortgage assumptions can be a smart choice for certain buyers, especially if the existing mortgage carries favorable terms. With the College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, you might benefit from a lower rate or avoid additional fees. However, it’s essential to evaluate your financial situation and consult a professional to determine if this option aligns with your long-term goals.

In Texas, a deed of trust can be prepared by various professionals, including attorneys, title companies, or experienced real estate agents. It’s important to ensure that the individual or organization you choose is familiar with the laws and requirements surrounding the College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors. This experience helps prevent costly errors and ensures your interests are protected.

Yes, there can be aspects to consider with assumable mortgages. While these arrangements, including the College Station Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, can offer benefits, such as lower interest rates and an easier transfer process, they may also have hidden costs or requirements. It's crucial to review the terms of the existing mortgage and understand the financial responsibilities involved before proceeding.