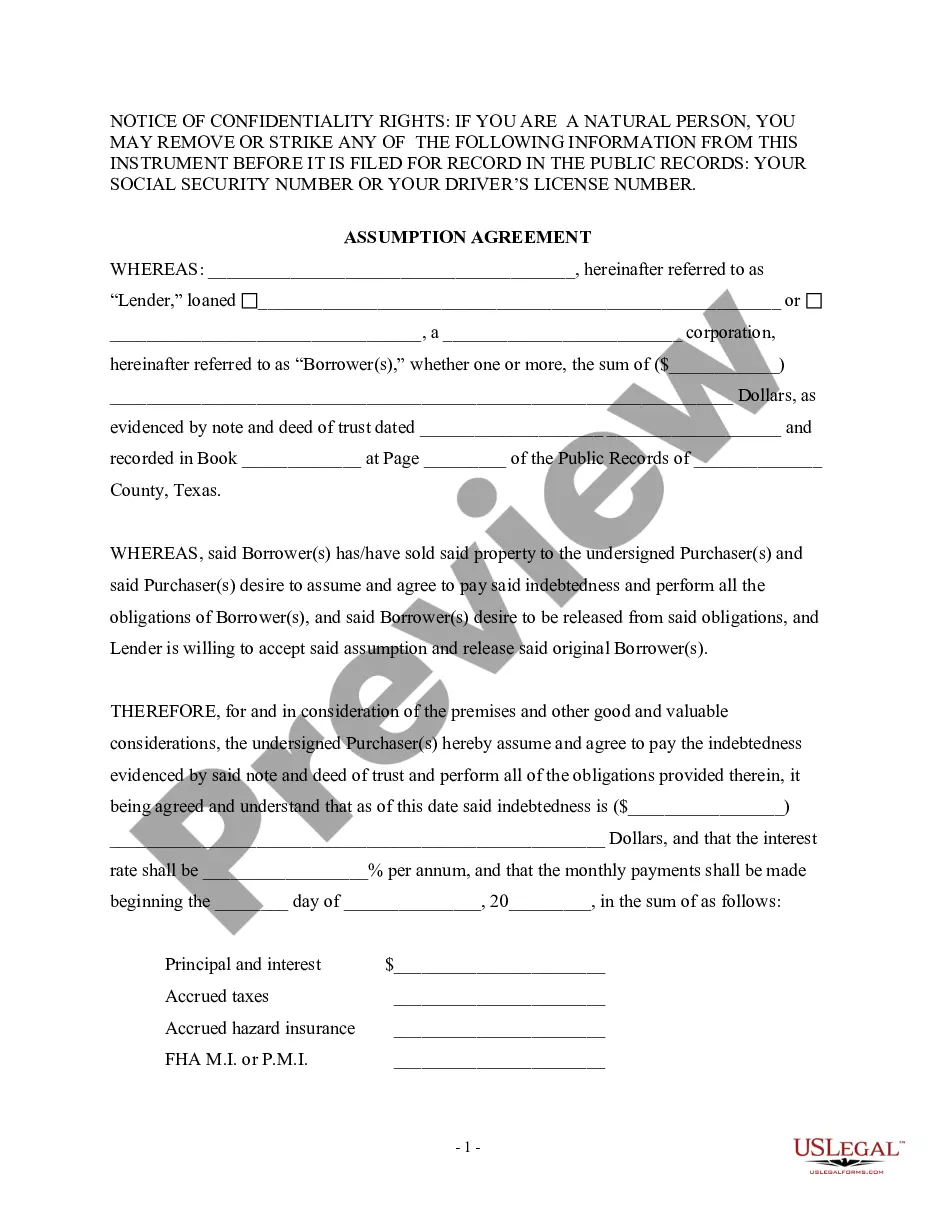

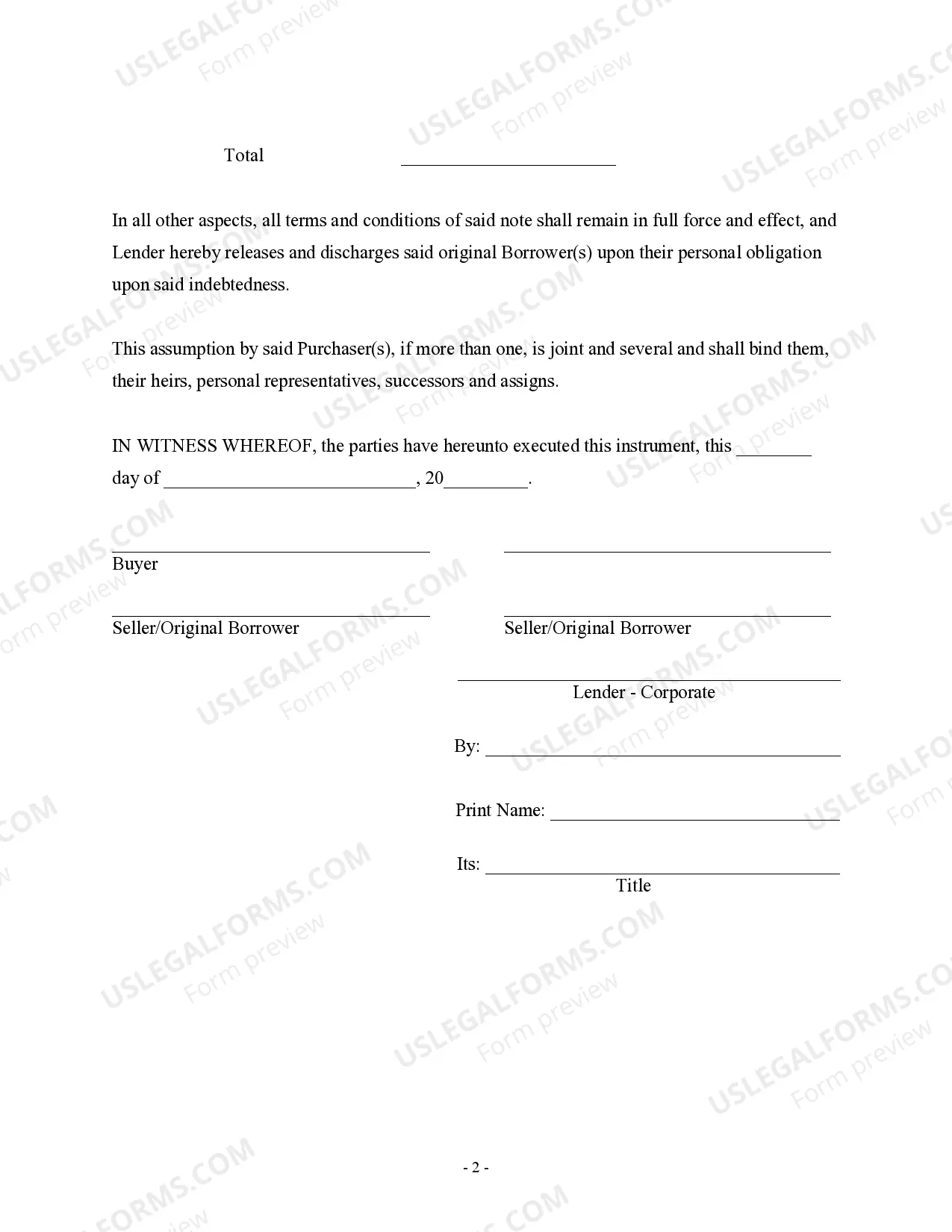

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Corpus Christi Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document related to property transactions in Corpus Christi, Texas. This agreement involves the transfer of a property's ownership rights and obligations from the original mortgagor(s) to a new party known as the assumed mortgagor. By executing this agreement, the original mortgagor(s) are released from their responsibilities and liabilities under the original mortgage. There are different variations of Corpus Christi Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, such as: 1. Standard Assumption Agreement: This is the most common type where the new owner or assumed mortgagor agrees to take over the mortgage payments and other obligations of the original mortgagor(s). This agreement ensures that the lender receives the mortgage payments from the new owner, thereby protecting their interests. 2. Non-Qualifying Assumption Agreement: In some cases, the original mortgagor(s) may not meet the lender's criteria for assuming the mortgage due to financial reasons or credit issues. In such cases, a non-qualifying assumption agreement may be used, allowing a new party to take over the property ownership without assuming the original mortgage. Instead, the new owner would secure a new mortgage with the lender. 3. Release of Original Mortgagor(s): This part of the agreement signifies the release of the original mortgagor(s) from all rights, obligations, and liabilities associated with the original mortgage. It absolves them of any future responsibilities related to mortgage payments, property maintenance, and any other obligations outlined in the original mortgage agreement. 4. Transfer of Title: Alongside the assumption of the mortgage, the agreement includes provisions for the transfer of the property's title from the original mortgagor(s) to the new owner or assumed mortgagor. This transfer is crucial for establishing legal ownership and protecting the rights of the parties involved. 5. Property Appraisal and Valuation: In some cases, the assumption agreement might necessitate a property appraisal to determine its current market value. This appraisal helps to ensure that the new owner assumes the mortgage based on the fair market value of the property. 6. Lender Approval: Prior to finalizing the assumption agreement, it is essential to obtain the lender's approval. Lenders assess the assumed mortgagor's creditworthiness, financial stability, and ability to make timely mortgage payments. This approval process is crucial in order to mitigate risks for the lender and ensure a smooth transition of mortgage ownership. Overall, the Corpus Christi Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors serves as a legal instrument to facilitate the transfer of property ownership and relieve the original mortgagor(s) of their obligations under the original mortgage. It protects the rights of all parties involved and ensures a transparent and lawful transition of property ownership.Corpus Christi Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document related to property transactions in Corpus Christi, Texas. This agreement involves the transfer of a property's ownership rights and obligations from the original mortgagor(s) to a new party known as the assumed mortgagor. By executing this agreement, the original mortgagor(s) are released from their responsibilities and liabilities under the original mortgage. There are different variations of Corpus Christi Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, such as: 1. Standard Assumption Agreement: This is the most common type where the new owner or assumed mortgagor agrees to take over the mortgage payments and other obligations of the original mortgagor(s). This agreement ensures that the lender receives the mortgage payments from the new owner, thereby protecting their interests. 2. Non-Qualifying Assumption Agreement: In some cases, the original mortgagor(s) may not meet the lender's criteria for assuming the mortgage due to financial reasons or credit issues. In such cases, a non-qualifying assumption agreement may be used, allowing a new party to take over the property ownership without assuming the original mortgage. Instead, the new owner would secure a new mortgage with the lender. 3. Release of Original Mortgagor(s): This part of the agreement signifies the release of the original mortgagor(s) from all rights, obligations, and liabilities associated with the original mortgage. It absolves them of any future responsibilities related to mortgage payments, property maintenance, and any other obligations outlined in the original mortgage agreement. 4. Transfer of Title: Alongside the assumption of the mortgage, the agreement includes provisions for the transfer of the property's title from the original mortgagor(s) to the new owner or assumed mortgagor. This transfer is crucial for establishing legal ownership and protecting the rights of the parties involved. 5. Property Appraisal and Valuation: In some cases, the assumption agreement might necessitate a property appraisal to determine its current market value. This appraisal helps to ensure that the new owner assumes the mortgage based on the fair market value of the property. 6. Lender Approval: Prior to finalizing the assumption agreement, it is essential to obtain the lender's approval. Lenders assess the assumed mortgagor's creditworthiness, financial stability, and ability to make timely mortgage payments. This approval process is crucial in order to mitigate risks for the lender and ensure a smooth transition of mortgage ownership. Overall, the Corpus Christi Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors serves as a legal instrument to facilitate the transfer of property ownership and relieve the original mortgagor(s) of their obligations under the original mortgage. It protects the rights of all parties involved and ensures a transparent and lawful transition of property ownership.