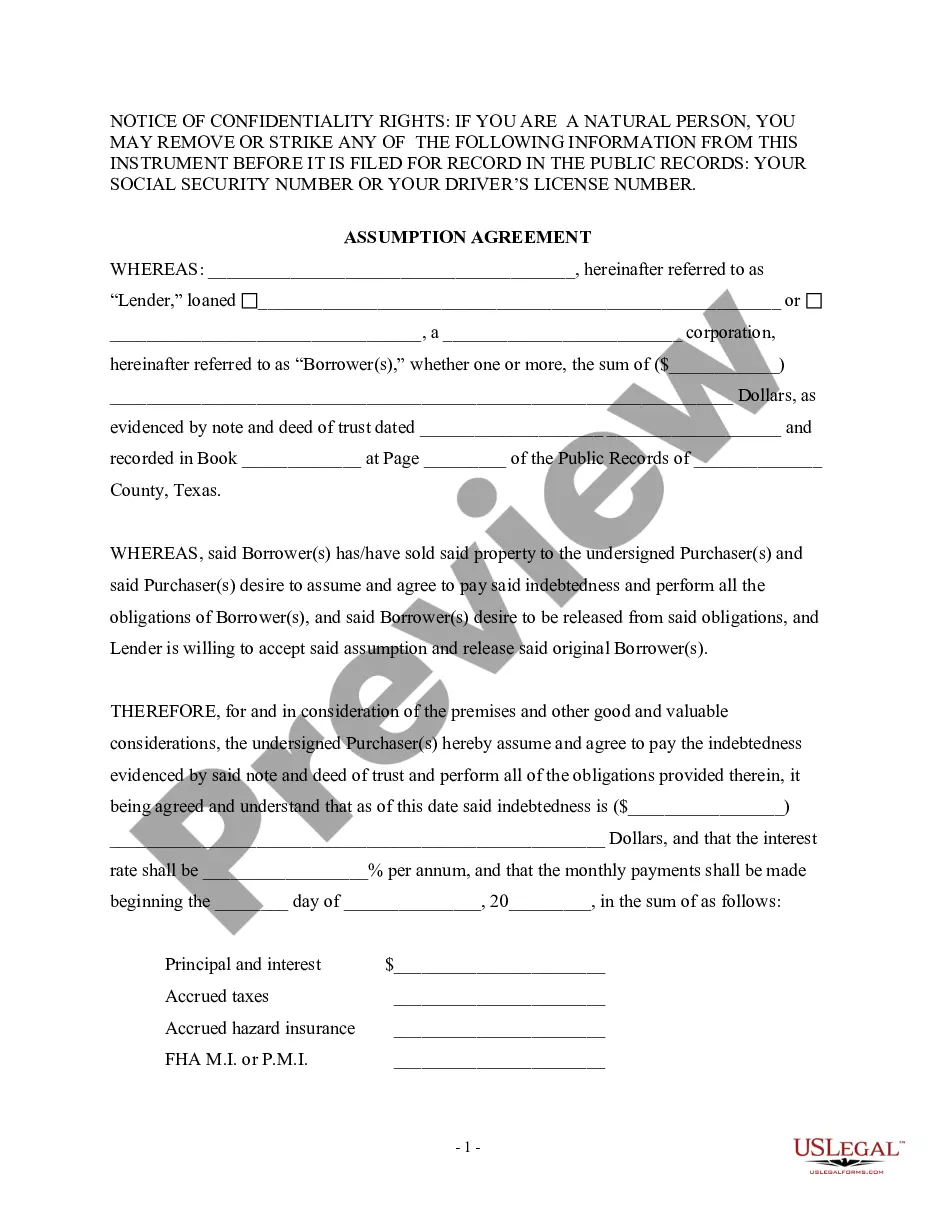

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Dallas Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a mortgage from the original mortgagors to a new party. This agreement is commonly used in real estate transactions in Dallas, Texas, when a buyer wishes to assume the existing mortgage on a property instead of obtaining a new loan. The Assumption Agreement of Deed of Trust and Release of Original Mortgagors contains several key elements. Firstly, it identifies the parties involved, including the original mortgagors, the new party assuming the mortgage, and any additional parties such as lenders or title companies. It also specifies the property address and legal description to ensure clarity. The agreement then details the terms and conditions of the assumption. This includes provisions regarding the release of liability for the original mortgagors, confirming that they are no longer responsible for the mortgage debt once the assumption is complete. It may also outline any financial arrangements, such as any assumption fees or payments required. Additionally, the agreement addresses the consent of the lender to the assumption. The new party assuming the mortgage must obtain the lender's approval, which may involve meeting certain financial requirements and undergoing a credit check. The lender's consent is essential to ensure the enforceability of the assumption. In some cases, there may be different types of Dallas Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors. These can include: 1. Full assumption: In this type of assumption, the new party takes over the entire mortgage obligation, assuming both the debt and ownership of the property. The original mortgagors are released from any liabilities and lose ownership rights. 2. Partial assumption: This type of agreement allows the new party to assume a portion of the mortgage debt while the original mortgagors remain responsible for the remaining amount. This arrangement is commonly used when the original mortgagors want to retain partial ownership of the property. 3. Subject-to assumption: In this scenario, the new party assumes the mortgage without becoming personally liable for the debt. The original mortgagors maintain their obligation to the lender, but the property ownership is transferred to the new party. This type of assumption is often utilized when the original mortgagors are facing financial difficulties and cannot qualify for a release of their personal liability. Overall, the Dallas Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors plays a crucial role in facilitating the transfer of a mortgage. It protects the interests of all parties involved and ensures a smooth transition of ownership and financial obligations.The Dallas Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a mortgage from the original mortgagors to a new party. This agreement is commonly used in real estate transactions in Dallas, Texas, when a buyer wishes to assume the existing mortgage on a property instead of obtaining a new loan. The Assumption Agreement of Deed of Trust and Release of Original Mortgagors contains several key elements. Firstly, it identifies the parties involved, including the original mortgagors, the new party assuming the mortgage, and any additional parties such as lenders or title companies. It also specifies the property address and legal description to ensure clarity. The agreement then details the terms and conditions of the assumption. This includes provisions regarding the release of liability for the original mortgagors, confirming that they are no longer responsible for the mortgage debt once the assumption is complete. It may also outline any financial arrangements, such as any assumption fees or payments required. Additionally, the agreement addresses the consent of the lender to the assumption. The new party assuming the mortgage must obtain the lender's approval, which may involve meeting certain financial requirements and undergoing a credit check. The lender's consent is essential to ensure the enforceability of the assumption. In some cases, there may be different types of Dallas Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors. These can include: 1. Full assumption: In this type of assumption, the new party takes over the entire mortgage obligation, assuming both the debt and ownership of the property. The original mortgagors are released from any liabilities and lose ownership rights. 2. Partial assumption: This type of agreement allows the new party to assume a portion of the mortgage debt while the original mortgagors remain responsible for the remaining amount. This arrangement is commonly used when the original mortgagors want to retain partial ownership of the property. 3. Subject-to assumption: In this scenario, the new party assumes the mortgage without becoming personally liable for the debt. The original mortgagors maintain their obligation to the lender, but the property ownership is transferred to the new party. This type of assumption is often utilized when the original mortgagors are facing financial difficulties and cannot qualify for a release of their personal liability. Overall, the Dallas Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors plays a crucial role in facilitating the transfer of a mortgage. It protects the interests of all parties involved and ensures a smooth transition of ownership and financial obligations.