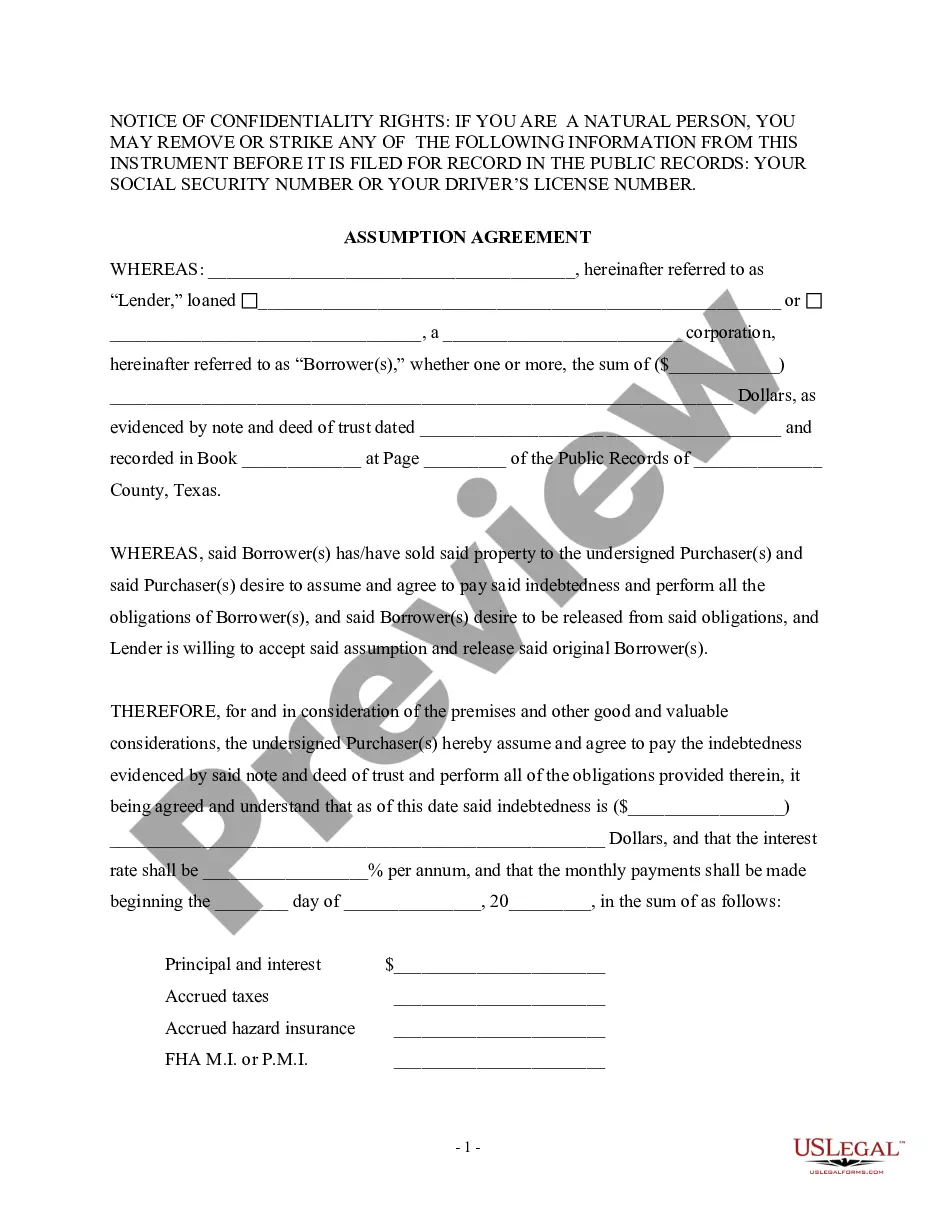

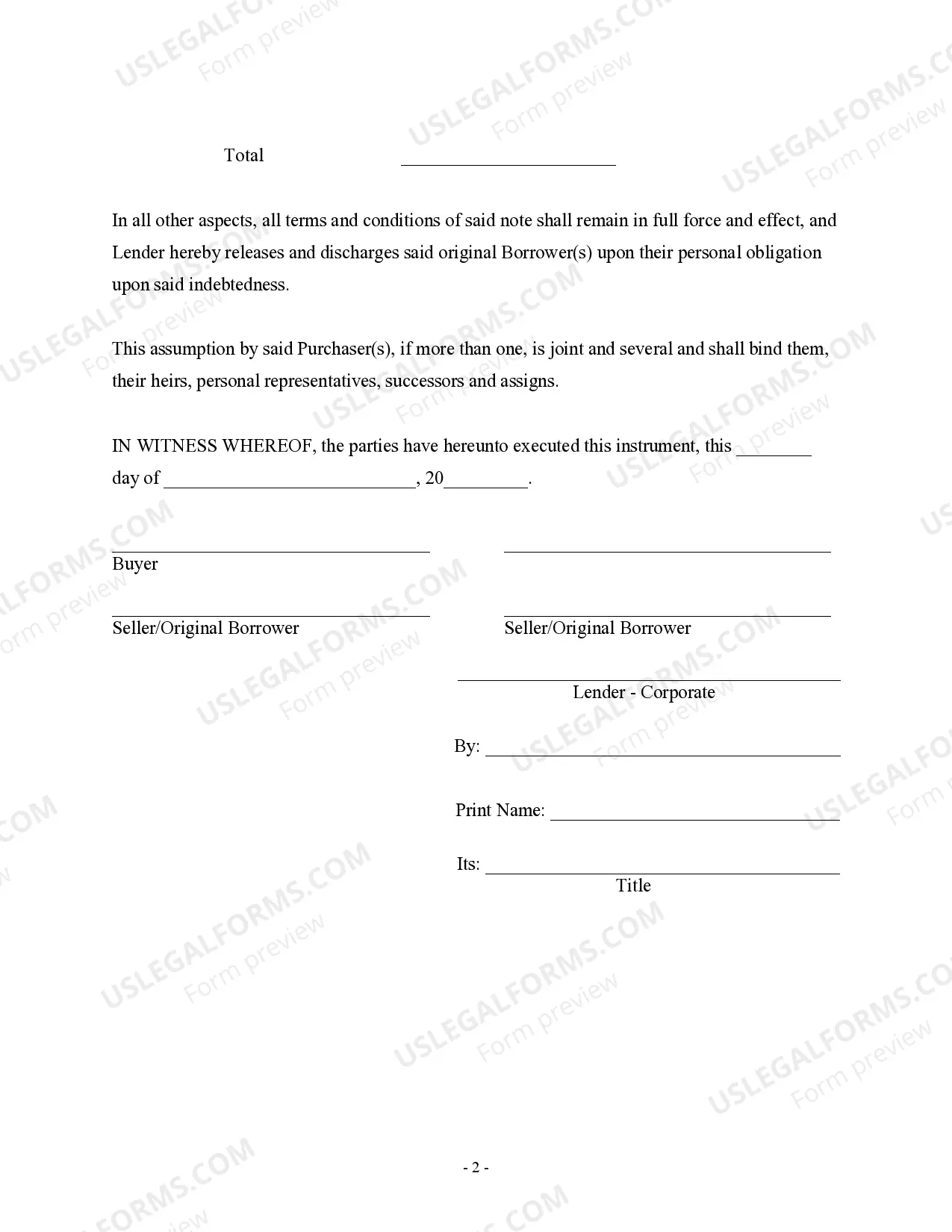

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Fort Worth Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a mortgage loan from the original borrowers (mortgagors) to a new borrower (assumption) in the city of Fort Worth, Texas. This agreement allows for the substitution of the original mortgagors with a new party who will be responsible for all the terms and conditions set forth in the original deed of trust. The assumption agreement serves as a contractual agreement between the mortgage lender, the original mortgagors, and the assumption. It is often used in situations where the original mortgagors are unable to continue making mortgage payments or wish to transfer the mortgage to a new party. The assumption assumes all the rights and obligations associated with the mortgage and essentially steps into the shoes of the original mortgagors. The assumption agreement includes vital information such as the names of the original mortgagors and the assumption, the property address, the loan number, and the terms of the mortgage being assumed. It outlines the terms and conditions under which the assumption is taking place, including any liabilities, responsibilities, and obligations of the assumption. In addition to the Fort Worth Texas Assumption Agreement of Deed of Trust, there may be variations or additional types of assumption agreements related to specific circumstances. These can include: 1. Non-recourse Assumption Agreement: This type of agreement limits the liability of the assumption to only the property securing the mortgage. In case of default, the lender cannot seek additional assets or personal guarantees from the assumption. 2. Full-recourse Assumption Agreement: In contrast to a non-recourse agreement, this type of assumption agreement holds the assumption fully responsible for the mortgage debt, even beyond the value of the property securing the loan. The lender can pursue legal action and seek additional assets or personal guarantees in case of default. 3. Assumption Agreement with Release of Liability: This variation allows the original mortgagors to be released from any further liability once the assumption is finalized. It provides clear distinctions of responsibilities and ensures that the original mortgagors are not held accountable for any future default or issues related to the mortgage. It is important to note that the specific terms and conditions of the Fort Worth Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors may vary depending on individual circumstances and agreements reached between the parties involved. Furthermore, it is advisable to consult with a legal professional or mortgage specialist for detailed guidance and to ensure compliance with all applicable laws and regulations.The Fort Worth Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a mortgage loan from the original borrowers (mortgagors) to a new borrower (assumption) in the city of Fort Worth, Texas. This agreement allows for the substitution of the original mortgagors with a new party who will be responsible for all the terms and conditions set forth in the original deed of trust. The assumption agreement serves as a contractual agreement between the mortgage lender, the original mortgagors, and the assumption. It is often used in situations where the original mortgagors are unable to continue making mortgage payments or wish to transfer the mortgage to a new party. The assumption assumes all the rights and obligations associated with the mortgage and essentially steps into the shoes of the original mortgagors. The assumption agreement includes vital information such as the names of the original mortgagors and the assumption, the property address, the loan number, and the terms of the mortgage being assumed. It outlines the terms and conditions under which the assumption is taking place, including any liabilities, responsibilities, and obligations of the assumption. In addition to the Fort Worth Texas Assumption Agreement of Deed of Trust, there may be variations or additional types of assumption agreements related to specific circumstances. These can include: 1. Non-recourse Assumption Agreement: This type of agreement limits the liability of the assumption to only the property securing the mortgage. In case of default, the lender cannot seek additional assets or personal guarantees from the assumption. 2. Full-recourse Assumption Agreement: In contrast to a non-recourse agreement, this type of assumption agreement holds the assumption fully responsible for the mortgage debt, even beyond the value of the property securing the loan. The lender can pursue legal action and seek additional assets or personal guarantees in case of default. 3. Assumption Agreement with Release of Liability: This variation allows the original mortgagors to be released from any further liability once the assumption is finalized. It provides clear distinctions of responsibilities and ensures that the original mortgagors are not held accountable for any future default or issues related to the mortgage. It is important to note that the specific terms and conditions of the Fort Worth Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors may vary depending on individual circumstances and agreements reached between the parties involved. Furthermore, it is advisable to consult with a legal professional or mortgage specialist for detailed guidance and to ensure compliance with all applicable laws and regulations.