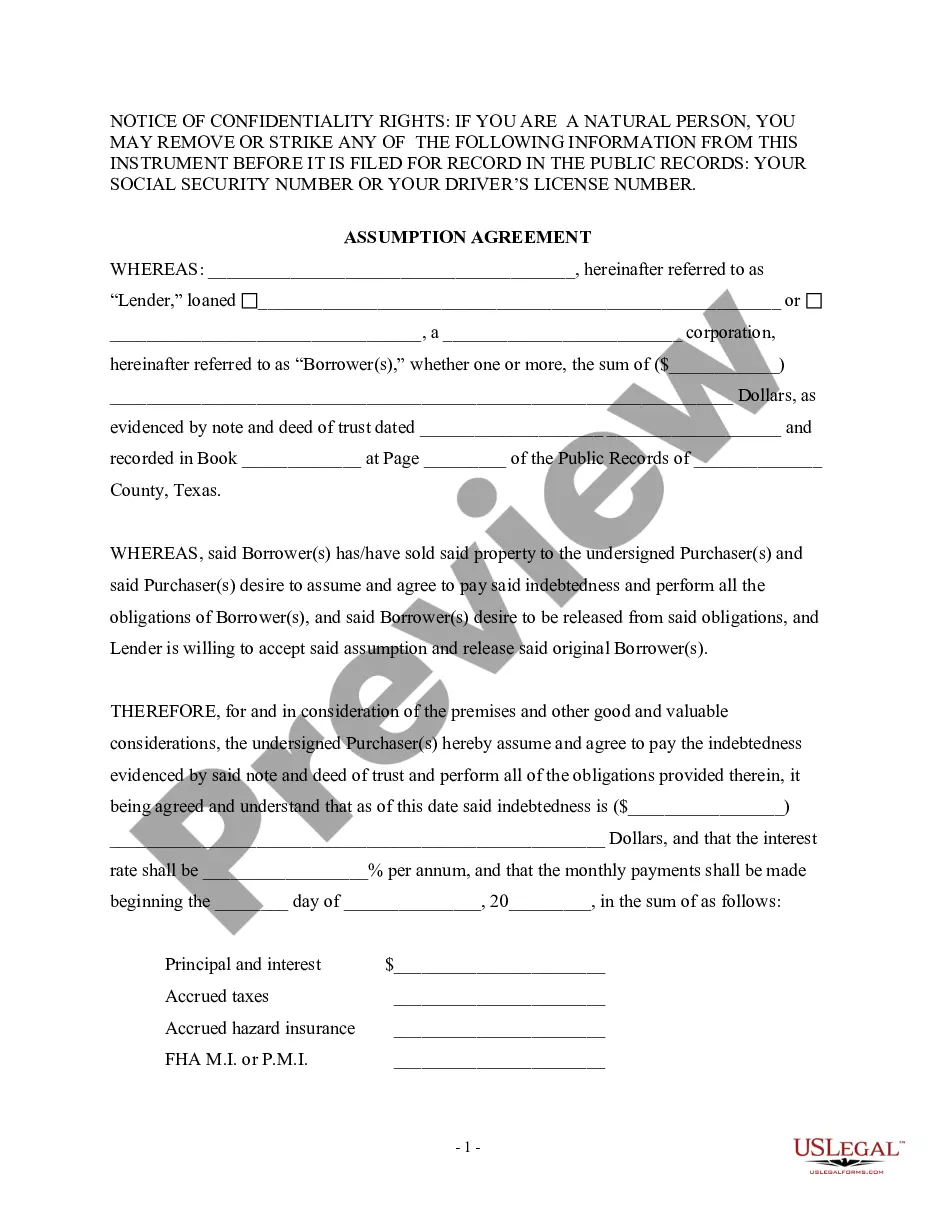

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

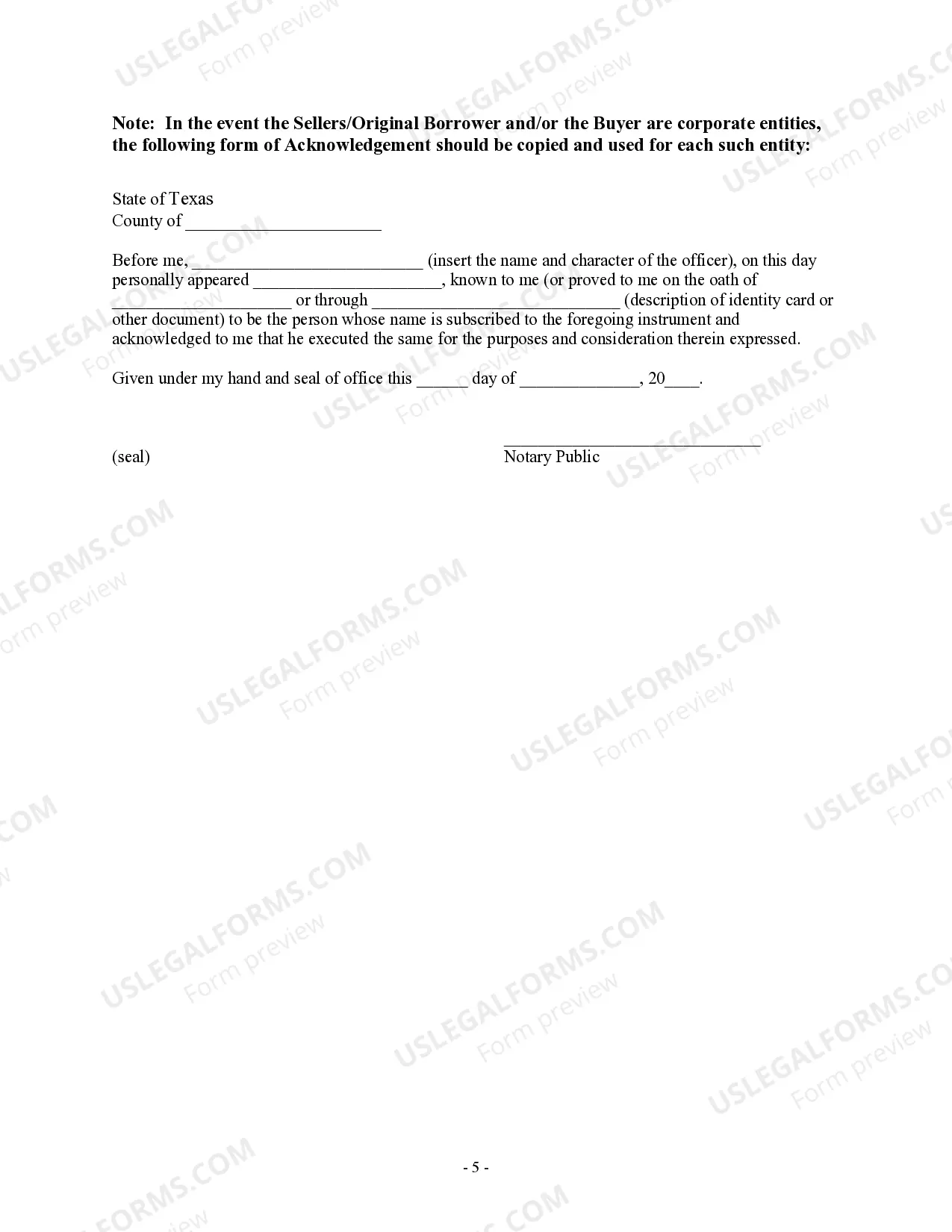

Harris Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an important legal document pertaining to real estate transactions in Harris County, Texas. This agreement outlines the terms and conditions under which a new party assumes the obligations of the original mortgagor in a mortgage loan and releases the original borrowers from their responsibilities. The purpose of a Harris Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is to facilitate the transfer of ownership rights and mortgage liabilities from the original borrower to a new party. This can occur in various situations, such as when a property is sold, transferred between family members, or when a borrower enters into a loan assumption agreement. Key terms and elements included in this agreement typically encompass: 1. Parties Involved: The agreement identifies the original mortgagor(s) (borrower), the new assumption(s), and any other relevant parties, such as the lender. 2. Property Description: A detailed description of the property being mortgaged is provided, including its address, legal description, and any unique identifying details. 3. Loan Details: The agreement contains information regarding the original mortgage, such as the loan amount, interest rate, payment schedule, and any outstanding balances. 4. Assumption Provisions: This section outlines the terms under which the new assumption agrees to take over the responsibilities of the original borrower. It specifies any conditions or qualifications that must be met for the assumption to be valid. 5. Release of Original Mortgagors: The agreement includes a release clause that formally releases the original borrower(s) from any further obligations and liabilities related to the mortgage loan, upon successful assumption by the new party. 6. Representations and Warranties: Both the original borrower(s) and the new assumption(s) typically provide representations and warranties confirming that they have the legal capacity to enter into this agreement and that all provided information is accurate. 7. Default and Remedies: This section outlines the consequences of default by the new assumption(s) and the remedies available to the lender in such cases. It may include details regarding foreclosure proceedings or other legal actions. It is worth noting that there might be variations of the Harris Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors based on specific circumstances or individual requirements. For instance, some agreements may include additional provisions related to loan assumptions involving VA or FHA loans. In conclusion, the Harris Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legally binding document that formalizes the transfer of mortgage responsibilities from the original borrower to a new party. It safeguards the interests of all parties involved and ensures a smooth transition of ownership and liabilities.Harris Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an important legal document pertaining to real estate transactions in Harris County, Texas. This agreement outlines the terms and conditions under which a new party assumes the obligations of the original mortgagor in a mortgage loan and releases the original borrowers from their responsibilities. The purpose of a Harris Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is to facilitate the transfer of ownership rights and mortgage liabilities from the original borrower to a new party. This can occur in various situations, such as when a property is sold, transferred between family members, or when a borrower enters into a loan assumption agreement. Key terms and elements included in this agreement typically encompass: 1. Parties Involved: The agreement identifies the original mortgagor(s) (borrower), the new assumption(s), and any other relevant parties, such as the lender. 2. Property Description: A detailed description of the property being mortgaged is provided, including its address, legal description, and any unique identifying details. 3. Loan Details: The agreement contains information regarding the original mortgage, such as the loan amount, interest rate, payment schedule, and any outstanding balances. 4. Assumption Provisions: This section outlines the terms under which the new assumption agrees to take over the responsibilities of the original borrower. It specifies any conditions or qualifications that must be met for the assumption to be valid. 5. Release of Original Mortgagors: The agreement includes a release clause that formally releases the original borrower(s) from any further obligations and liabilities related to the mortgage loan, upon successful assumption by the new party. 6. Representations and Warranties: Both the original borrower(s) and the new assumption(s) typically provide representations and warranties confirming that they have the legal capacity to enter into this agreement and that all provided information is accurate. 7. Default and Remedies: This section outlines the consequences of default by the new assumption(s) and the remedies available to the lender in such cases. It may include details regarding foreclosure proceedings or other legal actions. It is worth noting that there might be variations of the Harris Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors based on specific circumstances or individual requirements. For instance, some agreements may include additional provisions related to loan assumptions involving VA or FHA loans. In conclusion, the Harris Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legally binding document that formalizes the transfer of mortgage responsibilities from the original borrower to a new party. It safeguards the interests of all parties involved and ensures a smooth transition of ownership and liabilities.