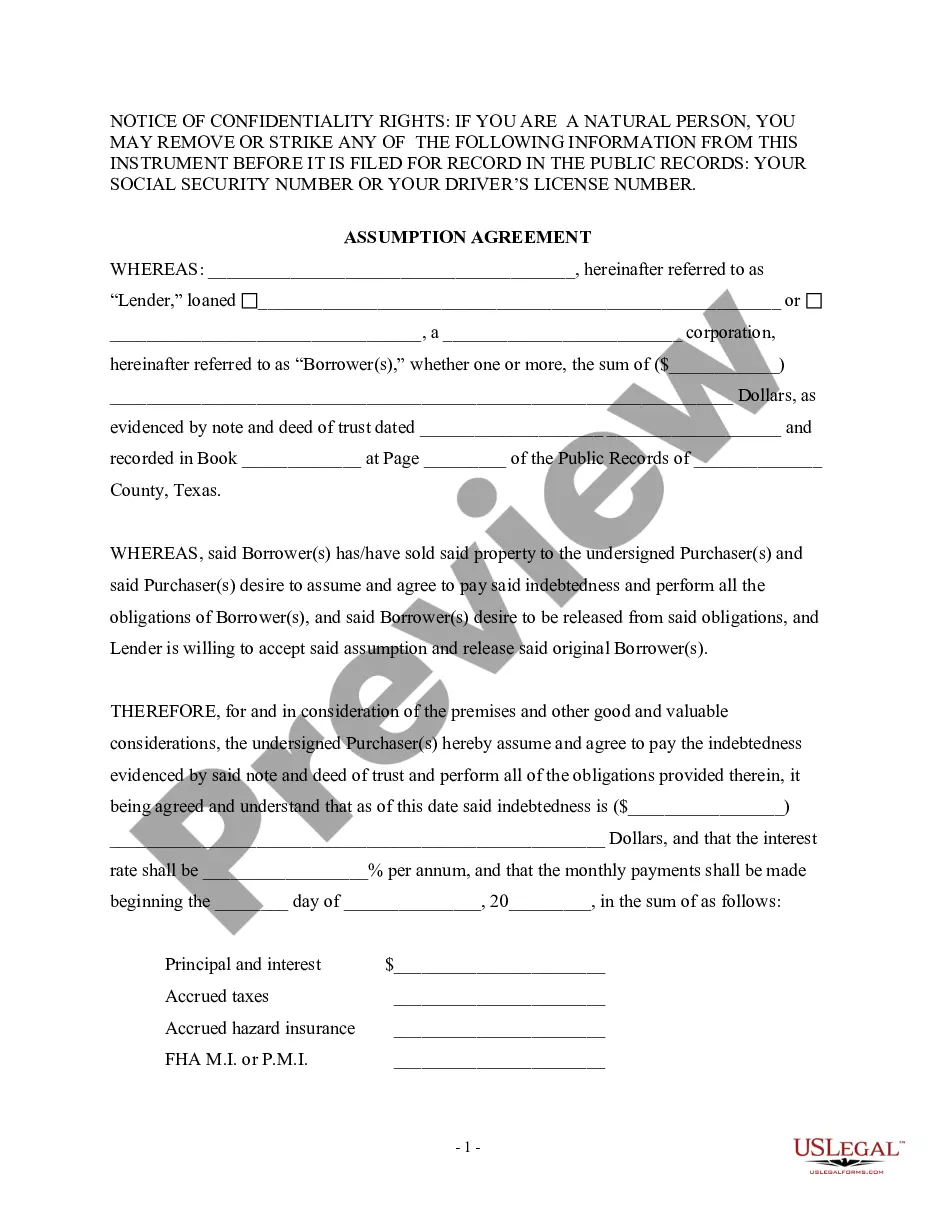

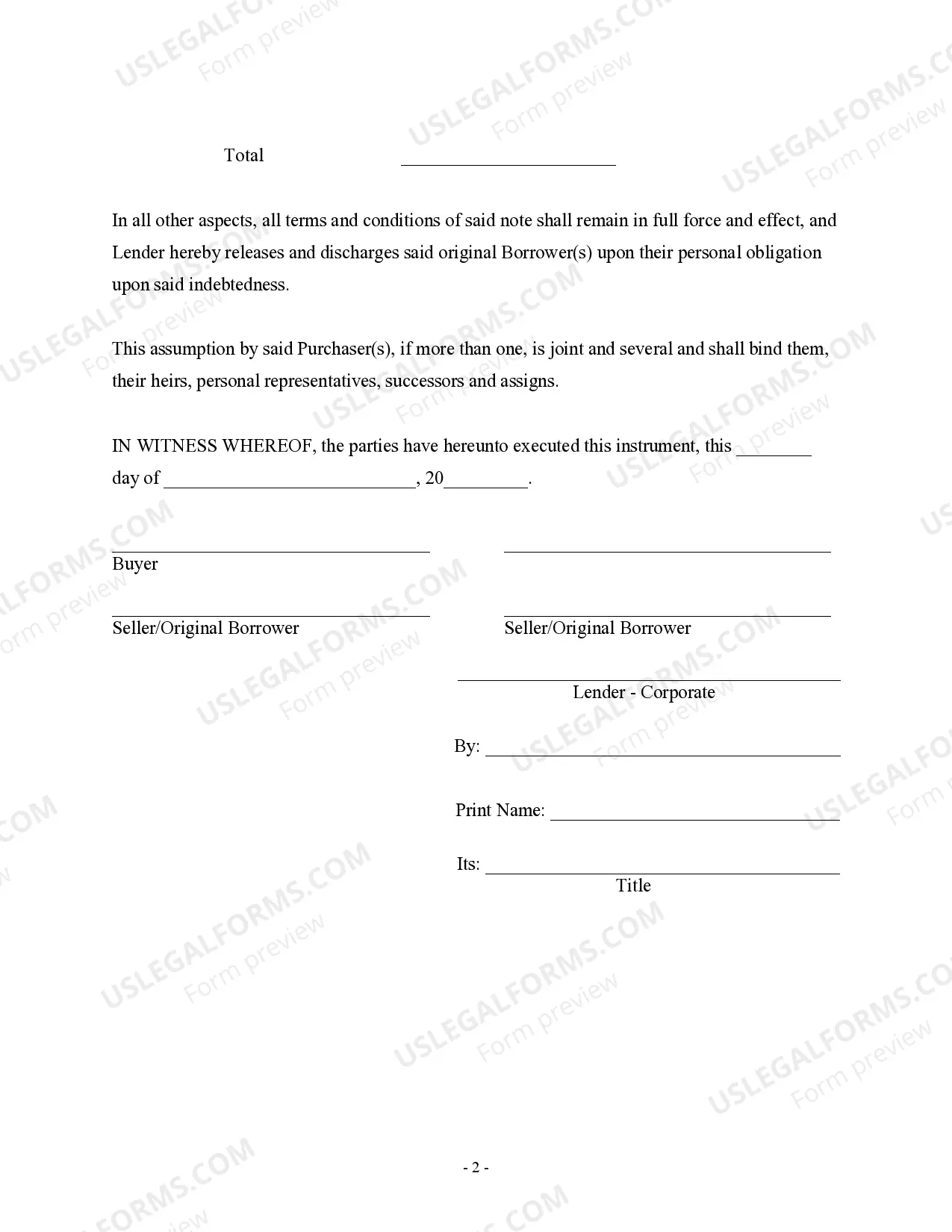

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Killeen Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an essential legal document that plays a crucial role in real estate transactions. This agreement facilitates the transfer of an existing mortgage from the original mortgagors to a new buyer, relieving the original mortgagors of further liability. In Killeen, Texas, there are generally two types of Assumption Agreement of Deed of Trust and Release of Original Mortgagors: 1. Full Assumption Agreement: This type of agreement allows the new buyer to assume the mortgage in its entirety. The new buyer becomes responsible for all the terms and conditions stipulated in the original deed of trust. Through this agreement, the original mortgagors are completely released from their obligations related to the mortgage. 2. Qualified Assumption Agreement: In this scenario, the new buyer takes on the responsibility for the mortgage but is not fully released from all obligations. The original mortgagors may still retain some liability in case the new buyer defaults on the loan. This type of agreement requires the lender's approval and involves negotiations between the original mortgagors, the new buyer, and the lender to determine the extent of liability for each party. The process of executing a Killeen Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors involves several crucial steps: 1. Reviewing the Original Mortgage: The original mortgage terms need to be carefully examined to ensure that they allow for an assumption agreement. This includes checking for any due-on-sale clauses or other restrictions. 2. Obtaining Lender's Approval: Prior to executing the assumption agreement, the new buyer must seek approval from the lender. The lender may require a creditworthiness assessment or request additional documentation to assess the buyer's ability to assume the mortgage. 3. Negotiating Terms and Conditions: If a qualified assumption is being pursued, negotiations between the original mortgagors, new buyer, and lender are necessary to determine the extent of liability for each party involved in the agreement. 4. Drafting and Executing the Agreement: Once the terms have been agreed upon, a legally binding assumption agreement is drafted. This document outlines the responsibilities and obligations of the new buyer, original mortgagors, and lender. All parties must sign the agreement to finalize the transaction. 5. Notifying Relevant Parties: With the assumption agreement executed, it is essential to notify relevant parties, such as the county recorder's office, homeowner's insurance provider, and any other pertinent parties involved in the mortgage transaction. The Killeen Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a critical legal instrument that allows for the transfer of mortgage liability, benefiting both the original mortgagors and the new buyer. Ultimately, the specific terms and conditions of the agreement will vary based on the type of assumption being pursued and the negotiations between the parties involved.The Killeen Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an essential legal document that plays a crucial role in real estate transactions. This agreement facilitates the transfer of an existing mortgage from the original mortgagors to a new buyer, relieving the original mortgagors of further liability. In Killeen, Texas, there are generally two types of Assumption Agreement of Deed of Trust and Release of Original Mortgagors: 1. Full Assumption Agreement: This type of agreement allows the new buyer to assume the mortgage in its entirety. The new buyer becomes responsible for all the terms and conditions stipulated in the original deed of trust. Through this agreement, the original mortgagors are completely released from their obligations related to the mortgage. 2. Qualified Assumption Agreement: In this scenario, the new buyer takes on the responsibility for the mortgage but is not fully released from all obligations. The original mortgagors may still retain some liability in case the new buyer defaults on the loan. This type of agreement requires the lender's approval and involves negotiations between the original mortgagors, the new buyer, and the lender to determine the extent of liability for each party. The process of executing a Killeen Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors involves several crucial steps: 1. Reviewing the Original Mortgage: The original mortgage terms need to be carefully examined to ensure that they allow for an assumption agreement. This includes checking for any due-on-sale clauses or other restrictions. 2. Obtaining Lender's Approval: Prior to executing the assumption agreement, the new buyer must seek approval from the lender. The lender may require a creditworthiness assessment or request additional documentation to assess the buyer's ability to assume the mortgage. 3. Negotiating Terms and Conditions: If a qualified assumption is being pursued, negotiations between the original mortgagors, new buyer, and lender are necessary to determine the extent of liability for each party involved in the agreement. 4. Drafting and Executing the Agreement: Once the terms have been agreed upon, a legally binding assumption agreement is drafted. This document outlines the responsibilities and obligations of the new buyer, original mortgagors, and lender. All parties must sign the agreement to finalize the transaction. 5. Notifying Relevant Parties: With the assumption agreement executed, it is essential to notify relevant parties, such as the county recorder's office, homeowner's insurance provider, and any other pertinent parties involved in the mortgage transaction. The Killeen Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a critical legal instrument that allows for the transfer of mortgage liability, benefiting both the original mortgagors and the new buyer. Ultimately, the specific terms and conditions of the agreement will vary based on the type of assumption being pursued and the negotiations between the parties involved.