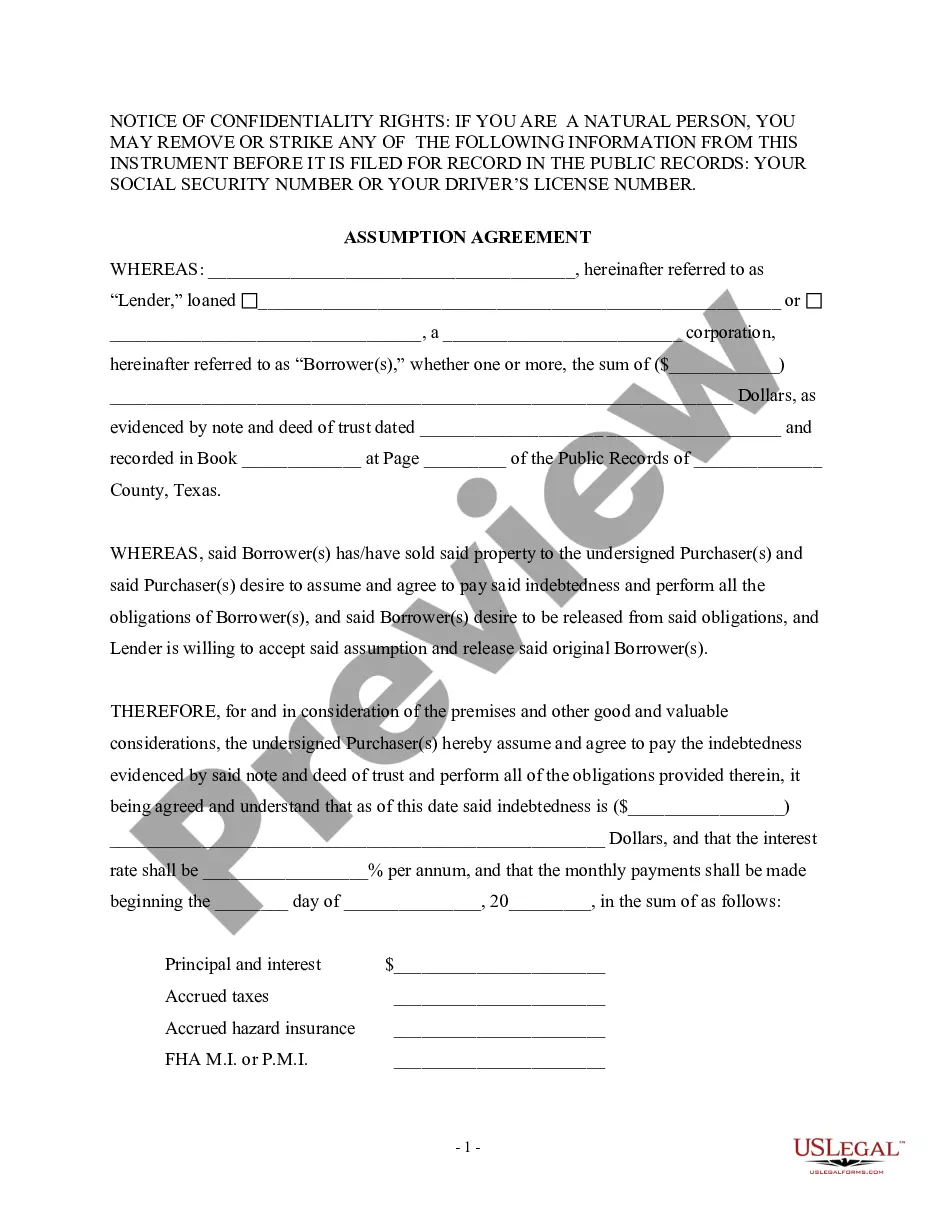

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Laredo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a property's debt obligation from the original mortgagors to a new party, often referred to as the assumptive party or the new mortgagors. This agreement allows the new party to assume the responsibilities of the original mortgage and continue making regular payments to the lender. The Laredo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is crucial in cases where the existing property owner wants to sell their property, but the buyer is unable to secure a new mortgage due to various reasons like credit history, income stability, or other factors. By assuming the existing mortgage, the buyer saves time and effort in securing a new loan while ensuring a smooth transfer of property ownership. Different types of Laredo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors may include: 1. Full Assumption: In this scenario, the new mortgagor fully assumes all the obligations of the original mortgage, including making regular payments and upholding the terms and conditions of the original loan agreement. The original mortgagors are released from any further liability and are no longer responsible for the mortgage payments or property. 2. Partial Assumption: This type of assumption agreement allows the new mortgagor to assume only a portion of the original mortgage, typically a specific amount or a defined percentage. The original mortgagors retain liability for the remaining balance and continue paying off the remaining debt. 3. Subject-to Assumption: In a subject-to assumption agreement, the new mortgagor agrees to take over the mortgage payments without officially assuming the liability of the original mortgage. The original mortgagors remain responsible for the loan, but the new party makes the payments on their behalf. This type of agreement may be suitable when the original mortgagors want to sell their property quickly, but cannot find a buyer who can assume the full liability. The Laredo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legally binding document that protects the rights of both the original and new mortgagors. It ensures a smooth transition of property ownership while providing clarity on the division of mortgage responsibility. This agreement should be drafted and reviewed by legal professionals to ensure compliance with relevant laws and regulations.Laredo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that outlines the transfer of a property's debt obligation from the original mortgagors to a new party, often referred to as the assumptive party or the new mortgagors. This agreement allows the new party to assume the responsibilities of the original mortgage and continue making regular payments to the lender. The Laredo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is crucial in cases where the existing property owner wants to sell their property, but the buyer is unable to secure a new mortgage due to various reasons like credit history, income stability, or other factors. By assuming the existing mortgage, the buyer saves time and effort in securing a new loan while ensuring a smooth transfer of property ownership. Different types of Laredo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors may include: 1. Full Assumption: In this scenario, the new mortgagor fully assumes all the obligations of the original mortgage, including making regular payments and upholding the terms and conditions of the original loan agreement. The original mortgagors are released from any further liability and are no longer responsible for the mortgage payments or property. 2. Partial Assumption: This type of assumption agreement allows the new mortgagor to assume only a portion of the original mortgage, typically a specific amount or a defined percentage. The original mortgagors retain liability for the remaining balance and continue paying off the remaining debt. 3. Subject-to Assumption: In a subject-to assumption agreement, the new mortgagor agrees to take over the mortgage payments without officially assuming the liability of the original mortgage. The original mortgagors remain responsible for the loan, but the new party makes the payments on their behalf. This type of agreement may be suitable when the original mortgagors want to sell their property quickly, but cannot find a buyer who can assume the full liability. The Laredo Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legally binding document that protects the rights of both the original and new mortgagors. It ensures a smooth transition of property ownership while providing clarity on the division of mortgage responsibility. This agreement should be drafted and reviewed by legal professionals to ensure compliance with relevant laws and regulations.