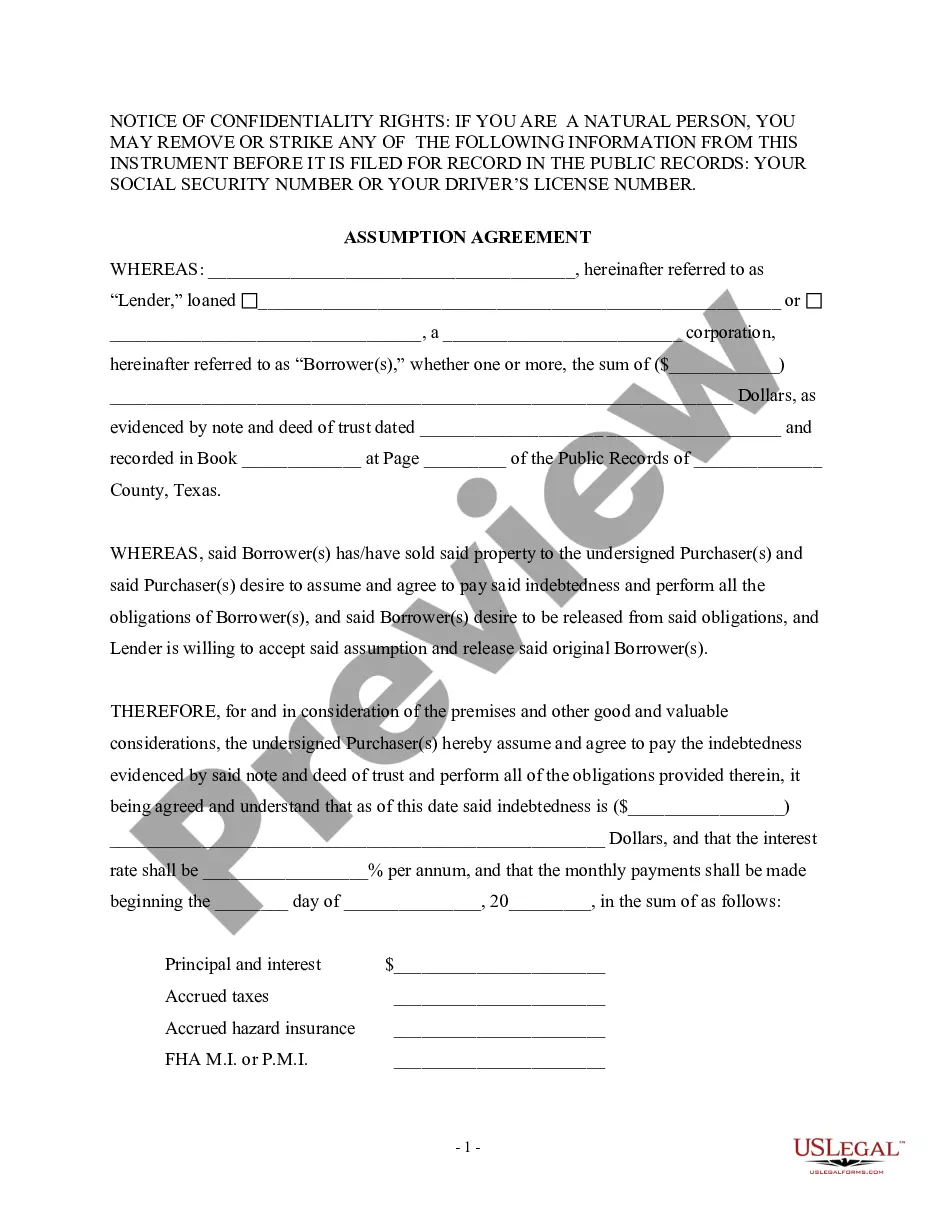

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The McKinney Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an essential document involved in the transfer of property ownership and the assumption of an existing mortgage in the city of McKinney, Texas. This agreement is used when a new buyer or party assumes the responsibility of an existing mortgage loan instead of obtaining a new mortgage. The main purpose of the McKinney Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is to legally acknowledge the transfer of property ownership and release the original mortgagors from all obligations and liabilities associated with the existing mortgage. This agreement ensures that the new buyer becomes solely responsible for the remaining mortgage payments, interest, and other obligations. There are different types of McKinney Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, which may vary based on the specific conditions and terms negotiated between the involved parties. These may include: 1. Residential Assumption Agreement: This type of agreement is commonly used when a residential property, such as a house or condominium, is being transferred to a new buyer who assumes the existing mortgage. The agreement details the terms of assumption and release of the original mortgagors, as well as the responsibilities of the new buyer. 2. Commercial Assumption Agreement: In the case of commercial properties, such as office buildings, retail spaces, or industrial facilities, a commercial assumption agreement is utilized. This agreement specifies the terms and conditions under which the new buyer takes over the existing mortgage and releases the original mortgagors from any further obligations. 3. Assumption Agreement with Modification: Sometimes, the new buyer may negotiate modifications to the existing mortgage terms, such as adjusting the interest rate or extending the loan period. This type of assumption agreement involves additional clauses that outline the modified terms agreed upon by both parties. 4. FHA Assumption Agreement: The Federal Housing Administration (FHA) provides assumable mortgage loans. In the case of an FHA loan, an FHA assumption agreement is required when the new buyer takes over the loan. This agreement ensures compliance with FHA rules and regulations. It is important to consult with legal professionals, such as real estate attorneys or mortgage brokers, when drafting or entering into a McKinney Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors. These professionals can provide guidance in negotiating the terms and ensuring that all legal requirements are met, protecting the rights and interests of both parties involved in the property transfer and mortgage assumption process.The McKinney Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an essential document involved in the transfer of property ownership and the assumption of an existing mortgage in the city of McKinney, Texas. This agreement is used when a new buyer or party assumes the responsibility of an existing mortgage loan instead of obtaining a new mortgage. The main purpose of the McKinney Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors is to legally acknowledge the transfer of property ownership and release the original mortgagors from all obligations and liabilities associated with the existing mortgage. This agreement ensures that the new buyer becomes solely responsible for the remaining mortgage payments, interest, and other obligations. There are different types of McKinney Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors, which may vary based on the specific conditions and terms negotiated between the involved parties. These may include: 1. Residential Assumption Agreement: This type of agreement is commonly used when a residential property, such as a house or condominium, is being transferred to a new buyer who assumes the existing mortgage. The agreement details the terms of assumption and release of the original mortgagors, as well as the responsibilities of the new buyer. 2. Commercial Assumption Agreement: In the case of commercial properties, such as office buildings, retail spaces, or industrial facilities, a commercial assumption agreement is utilized. This agreement specifies the terms and conditions under which the new buyer takes over the existing mortgage and releases the original mortgagors from any further obligations. 3. Assumption Agreement with Modification: Sometimes, the new buyer may negotiate modifications to the existing mortgage terms, such as adjusting the interest rate or extending the loan period. This type of assumption agreement involves additional clauses that outline the modified terms agreed upon by both parties. 4. FHA Assumption Agreement: The Federal Housing Administration (FHA) provides assumable mortgage loans. In the case of an FHA loan, an FHA assumption agreement is required when the new buyer takes over the loan. This agreement ensures compliance with FHA rules and regulations. It is important to consult with legal professionals, such as real estate attorneys or mortgage brokers, when drafting or entering into a McKinney Texas Assumption Agreement of Deed of Trust and Release of Original Mortgagors. These professionals can provide guidance in negotiating the terms and ensuring that all legal requirements are met, protecting the rights and interests of both parties involved in the property transfer and mortgage assumption process.