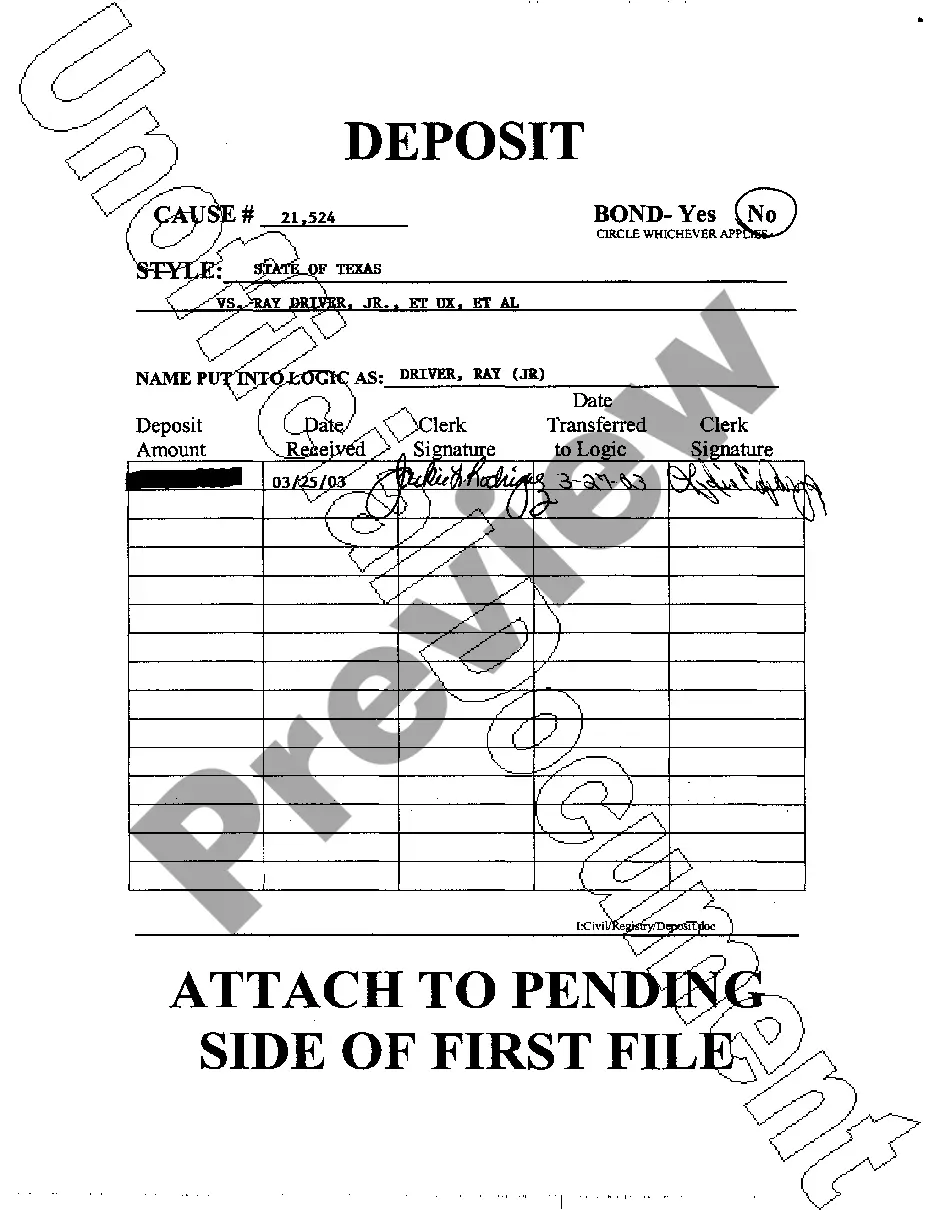

Dallas Texas Deposit for Compensation refers to the process of compensating individuals or entities by depositing funds in Dallas, Texas. This payment method ensures that the recipients receive their compensation securely and conveniently. It is commonly used in various legal and financial transactions, such as court settlements, insurance claims, employee benefits, and contractor payments. There are several types of Dallas Texas Deposits for Compensation available, depending on the specific circumstances and requirements. Some common types include: 1. Court-Ordered Deposits: These are deposits made as part of court settlements or judgments. When a court orders compensation to be paid to a plaintiff or a beneficiary, the liable party is required to deposit the designated amount with the relevant court in Dallas, Texas. This ensures that the compensation is available to the recipient when needed. 2. Insurance Claim Deposits: Insurance companies often need to deposit compensation funds for policyholders or claimants. Dallas Texas Deposit for Compensation provides a secure method for insurance companies to fulfill their financial obligations promptly. This can include deposits for property damage claims, personal injury claims, or even life insurance payouts. 3. Employee Benefit Deposits: Many companies and organizations have employee benefit programs that require periodic deposits into employee accounts. This could include deposits for retirement plans, health savings accounts (Has), or employee stock ownership plans (Sops). Dallas Texas Deposit for Compensation enables these transactions to be processed efficiently and accurately. 4. Contractor Payment Deposits: Companies that hire contractors or freelancers may need to deposit compensation funds into specified accounts. This ensures that contractors receive their payments in a timely manner and is commonly used in industries such as construction, marketing, and consulting. It is important to note that Dallas Texas Deposit for Compensation is subject to legal and financial regulations. The funds deposited must comply with the applicable laws, including tax obligations and reporting requirements. Additionally, the recipients of compensation should be aware of the necessary procedures to access and utilize the deposited funds. In conclusion, Dallas Texas Deposit for Compensation is a crucial process for ensuring the secure and efficient transfer of funds as compensation. It encompasses various types of deposits, including court-ordered deposits, insurance claim deposits, employee benefit deposits, and contractor payment deposits. By utilizing this method, both the payers and recipients can have confidence in the financial integrity of their transactions.

Dallas Texas Deposit for Compensation

Description

How to fill out Dallas Texas Deposit For Compensation?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, as a rule, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Dallas Texas Deposit for Compensation or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Dallas Texas Deposit for Compensation adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Dallas Texas Deposit for Compensation would work for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!