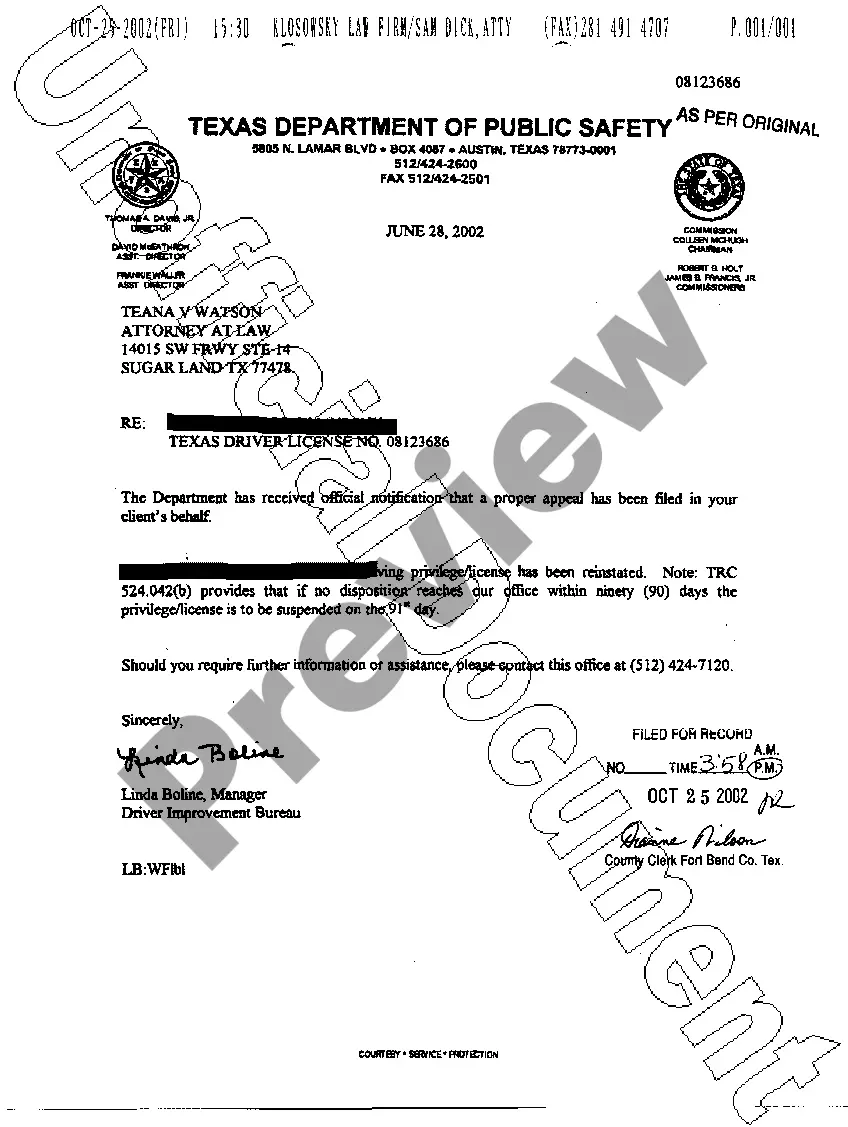

The Austin Texas Financial Responsibility Insurance Certificate refers to a document that serves as proof of an individual or entity's compliance with the financial responsibility requirements set forth by the state of Texas in terms of auto insurance coverage. This certificate is obtained by individuals or entities residing in Austin, Texas, to demonstrate their ability to afford potential damages resulting from an accident involving their vehicle. In Austin, like in the rest of Texas, drivers are legally obligated to carry liability insurance coverage to ensure they can cover the costs of injuries or damages they may cause in a car accident. This requirement ensures that all parties involved are financially protected and minimizes the burden of expenses on victims. The Financial Responsibility Insurance Certificate acts as evidence of meeting this necessitated coverage. There are generally three types of Austin Texas Financial Responsibility Insurance Certificates available, which cater to different individuals based on their unique circumstances. These certificates include: 1. Owner's Certificate: This type of certificate is exclusively for individuals who own vehicles in Austin, Texas. It demonstrates that the vehicle owner holds the minimum liability insurance coverage as required by the state law. 2. Non-Owner's Certificate: This certificate is issued to individuals who do not own a vehicle but frequently rent or borrow cars. It verifies that the non-owner has obtained the necessary liability insurance coverage to comply with the state's financial responsibility requirements. 3. Fleet Certificate: Fleet certificates are designed for companies or entities that own multiple vehicles. This certificate confirms that the organization has secured the appropriate liability insurance coverage for all their vehicles, ensuring the financial responsibility of the entity in case of accidents. Whether it is an owner's, non-owner's, or fleet certificate, all Austin Texas Financial Responsibility Insurance Certificates necessitate proof of auto liability insurance coverage. The coverage typically includes bodily injury liability, which pays for medical expenses and related damages for injuries sustained by other individuals in an accident caused by the insured party, and property damage liability, which covers the costs of repairing or replacing damaged property of others resulting from an accident. The insurance coverage amount must meet the minimum limits set by the state, which are subject to change and compliance with any new regulations is vital. In summary, the Austin Texas Financial Responsibility Insurance Certificate is a crucial document that affirms an individual or entity's adherence to the state's financial responsibility requirements concerning auto insurance coverage. It comes in various types, namely owner's, non-owner's, and fleet certificates, tailored to the circumstances of vehicle ownership or usage. The certificate's purpose is to demonstrate proof of adequate liability coverage, encompassing bodily injury liability and property damage liability, providing peace of mind to both the insured party and potential accident victims.

Austin Texas Financial Responsibility Insurance Certificate

State:

Texas

City:

Austin

Control #:

TX-G0037

Format:

PDF

Instant download

This form is available by subscription

Description

A05 Financial Responsibility Insurance Certificate

The Austin Texas Financial Responsibility Insurance Certificate refers to a document that serves as proof of an individual or entity's compliance with the financial responsibility requirements set forth by the state of Texas in terms of auto insurance coverage. This certificate is obtained by individuals or entities residing in Austin, Texas, to demonstrate their ability to afford potential damages resulting from an accident involving their vehicle. In Austin, like in the rest of Texas, drivers are legally obligated to carry liability insurance coverage to ensure they can cover the costs of injuries or damages they may cause in a car accident. This requirement ensures that all parties involved are financially protected and minimizes the burden of expenses on victims. The Financial Responsibility Insurance Certificate acts as evidence of meeting this necessitated coverage. There are generally three types of Austin Texas Financial Responsibility Insurance Certificates available, which cater to different individuals based on their unique circumstances. These certificates include: 1. Owner's Certificate: This type of certificate is exclusively for individuals who own vehicles in Austin, Texas. It demonstrates that the vehicle owner holds the minimum liability insurance coverage as required by the state law. 2. Non-Owner's Certificate: This certificate is issued to individuals who do not own a vehicle but frequently rent or borrow cars. It verifies that the non-owner has obtained the necessary liability insurance coverage to comply with the state's financial responsibility requirements. 3. Fleet Certificate: Fleet certificates are designed for companies or entities that own multiple vehicles. This certificate confirms that the organization has secured the appropriate liability insurance coverage for all their vehicles, ensuring the financial responsibility of the entity in case of accidents. Whether it is an owner's, non-owner's, or fleet certificate, all Austin Texas Financial Responsibility Insurance Certificates necessitate proof of auto liability insurance coverage. The coverage typically includes bodily injury liability, which pays for medical expenses and related damages for injuries sustained by other individuals in an accident caused by the insured party, and property damage liability, which covers the costs of repairing or replacing damaged property of others resulting from an accident. The insurance coverage amount must meet the minimum limits set by the state, which are subject to change and compliance with any new regulations is vital. In summary, the Austin Texas Financial Responsibility Insurance Certificate is a crucial document that affirms an individual or entity's adherence to the state's financial responsibility requirements concerning auto insurance coverage. It comes in various types, namely owner's, non-owner's, and fleet certificates, tailored to the circumstances of vehicle ownership or usage. The certificate's purpose is to demonstrate proof of adequate liability coverage, encompassing bodily injury liability and property damage liability, providing peace of mind to both the insured party and potential accident victims.

Free preview

How to fill out Austin Texas Financial Responsibility Insurance Certificate?

Irrespective of social or vocational standing, finishing legal documents is an unfortunate requirement in today’s society.

Too frequently, it’s nearly impossible for an individual without legal education to create such paperwork from scratch, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms provides assistance.

Ensure the form you have selected is appropriate for your area since the regulations of one state or county may not apply to another.

Examine the form and review a brief description (if available) regarding scenarios for which the document can be utilized.

- Our service offers a substantial library containing over 85,000 state-specific documents that are suitable for nearly any legal circumstance.

- US Legal Forms is also an excellent asset for associates or legal advisors seeking to conserve time by utilizing our DIY forms.

- Regardless of whether you need the Austin Texas Financial Responsibility Insurance Certificate or any other document that is valid in your region or county, with US Legal Forms, everything is readily accessible.

- Here’s how to swiftly obtain the Austin Texas Financial Responsibility Insurance Certificate using our trustworthy service.

- If you are already a customer, you can go ahead and Log In/">Log In to your account to acquire the necessary form.

- However, if you are new to our library, make sure to follow these steps before downloading the Austin Texas Financial Responsibility Insurance Certificate.