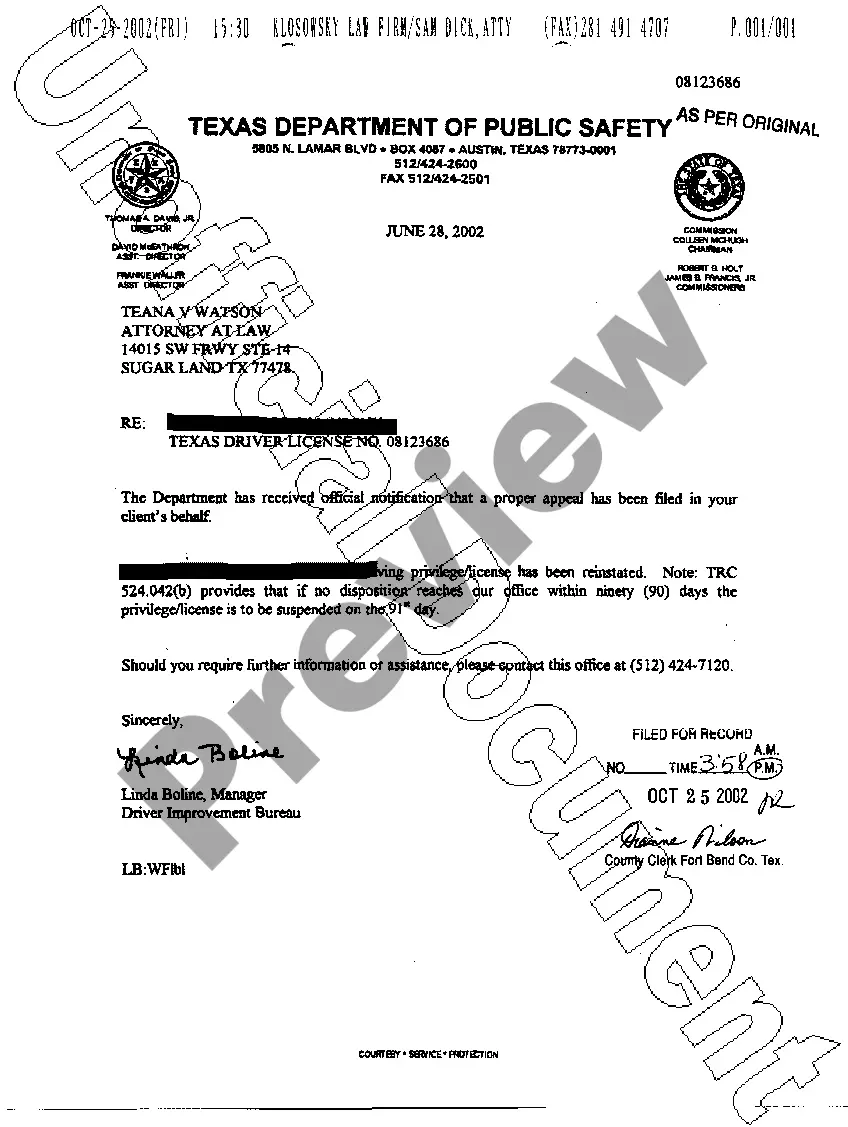

Lewisville Texas Financial Responsibility Insurance Certificate is a legal document that serves as proof of an individual's compliance with financial responsibility laws in the state of Texas. This certificate demonstrates that the certificate holder possesses the required liability insurance coverage to legally operate a motor vehicle in Lewisville, Texas. Keywords: Lewisville Texas, financial responsibility, insurance certificate, liability insurance, motor vehicle. In Lewisville, Texas, there are different types of Financial Responsibility Insurance Certificates available, including: 1. Minimum Liability Insurance Certificate: This is the standard form of insurance certificate required by the state of Texas. It provides coverage for bodily injury and property damage liability, with specific minimum limits set by the state. The certificate holder must maintain coverage equal to or higher than the state-mandated minimums. 2. SR-22 Certificate: An SR-22 certificate is a specialized financial responsibility insurance certificate often required for individuals who have been convicted of certain driving offenses, such as DUI or driving without insurance. It guarantees that the individual maintains the required liability insurance for a specific period. The SR-22 certificate is usually required for high-risk drivers to regain their driving privileges. 3. FR-44 Certificate: Although not specific to Lewisville, Texas, the FR-44 certificate is worth mentioning. It is similar to an SR-22 certificate but is required in certain states, including Texas, for individuals who have been convicted of driving under the influence (DUI) or driving while intoxicated (DWI). The FR-44 certificate generally carries higher liability insurance coverage requirements than the traditional SR-22 certificate. Complying with Lewisville, Texas Financial Responsibility Insurance Certificate requirements is crucial for all drivers to ensure legal compliance and protect themselves from potential liabilities in case of accidents or violations. It is important to consult with an insurance professional to understand and meet all the necessary obligations to obtain and maintain the appropriate certificate.

Lewisville Texas Financial Responsibility Insurance Certificate

Description

How to fill out Lewisville Texas Financial Responsibility Insurance Certificate?

If you are searching for a relevant form template, it’s impossible to find a more convenient service than the US Legal Forms site – probably the most extensive libraries on the internet. Here you can get a large number of form samples for organization and individual purposes by categories and regions, or keywords. Using our advanced search option, getting the latest Lewisville Texas Financial Responsibility Insurance Certificate is as elementary as 1-2-3. Additionally, the relevance of every document is confirmed by a group of professional attorneys that regularly review the templates on our website and update them according to the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to get the Lewisville Texas Financial Responsibility Insurance Certificate is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have opened the form you require. Check its information and use the Preview feature (if available) to explore its content. If it doesn’t suit your needs, use the Search option at the top of the screen to discover the appropriate file.

- Affirm your choice. Select the Buy now button. Following that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the received Lewisville Texas Financial Responsibility Insurance Certificate.

Each and every template you add to your profile has no expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you need to receive an extra copy for enhancing or creating a hard copy, you can come back and export it again anytime.

Take advantage of the US Legal Forms extensive library to gain access to the Lewisville Texas Financial Responsibility Insurance Certificate you were looking for and a large number of other professional and state-specific samples on a single platform!