A Round Rock Texas Financial Responsibility Insurance Certificate is an essential document that proves the financial ability of an individual or business to cover expenses in the event of a car accident or personal injury. This certificate is a legal requirement in the state of Texas and is mandatory for all drivers to carry. The Round Rock Texas Financial Responsibility Insurance Certificate serves as proof of financial responsibility and acts as a guarantee that the policyholder has adequate insurance coverage. It provides compensation for any damages caused by the insured party to others in case of an accident. There are different types of insurance certificates related to financial responsibility in Round Rock, Texas, including: 1. Liability Insurance Certificate: This type of certificate ensures that the driver has sufficient coverage to pay for any damages or injuries caused to another person or their property. It is the most basic form of insurance required to legally operate a vehicle in Round Rock, Texas. 2. Uninsured Motorist Insurance Certificate: This certificate provides coverage to the policyholder if they are involved in an accident with an uninsured or under insured driver. It ensures that the insured individual will still receive compensation for damages caused by the other party, even if they lack insurance. 3. Personal Injury Protection Insurance Certificate: Also known as PIP, this certificate covers the medical expenses of the policyholder and their passengers in the event of an accident. It provides benefits for medical bills, lost wages, and other related costs. 4. Comprehensive Coverage Insurance Certificate: This type of certificate covers damage to the insured vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters. 5. Collision Coverage Insurance Certificate: This certificate covers damage to the insured vehicle in the event of a collision with another vehicle or object, regardless of fault. Obtaining a Round Rock Texas Financial Responsibility Insurance Certificate is crucial for complying with the state's legal requirements and ensuring financial protection in case of an accident. Failure to carry a valid certificate can result in fines, license suspension, and other legal consequences. It is advisable to consult with an insurance agent to determine the appropriate coverage limits and types of insurance certificates required for individual needs and circumstances.

Round Rock Texas Financial Responsibility Insurance Certificate

State:

Texas

City:

Round Rock

Control #:

TX-G0037

Format:

PDF

Instant download

This form is available by subscription

Description

A05 Financial Responsibility Insurance Certificate

A Round Rock Texas Financial Responsibility Insurance Certificate is an essential document that proves the financial ability of an individual or business to cover expenses in the event of a car accident or personal injury. This certificate is a legal requirement in the state of Texas and is mandatory for all drivers to carry. The Round Rock Texas Financial Responsibility Insurance Certificate serves as proof of financial responsibility and acts as a guarantee that the policyholder has adequate insurance coverage. It provides compensation for any damages caused by the insured party to others in case of an accident. There are different types of insurance certificates related to financial responsibility in Round Rock, Texas, including: 1. Liability Insurance Certificate: This type of certificate ensures that the driver has sufficient coverage to pay for any damages or injuries caused to another person or their property. It is the most basic form of insurance required to legally operate a vehicle in Round Rock, Texas. 2. Uninsured Motorist Insurance Certificate: This certificate provides coverage to the policyholder if they are involved in an accident with an uninsured or under insured driver. It ensures that the insured individual will still receive compensation for damages caused by the other party, even if they lack insurance. 3. Personal Injury Protection Insurance Certificate: Also known as PIP, this certificate covers the medical expenses of the policyholder and their passengers in the event of an accident. It provides benefits for medical bills, lost wages, and other related costs. 4. Comprehensive Coverage Insurance Certificate: This type of certificate covers damage to the insured vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters. 5. Collision Coverage Insurance Certificate: This certificate covers damage to the insured vehicle in the event of a collision with another vehicle or object, regardless of fault. Obtaining a Round Rock Texas Financial Responsibility Insurance Certificate is crucial for complying with the state's legal requirements and ensuring financial protection in case of an accident. Failure to carry a valid certificate can result in fines, license suspension, and other legal consequences. It is advisable to consult with an insurance agent to determine the appropriate coverage limits and types of insurance certificates required for individual needs and circumstances.

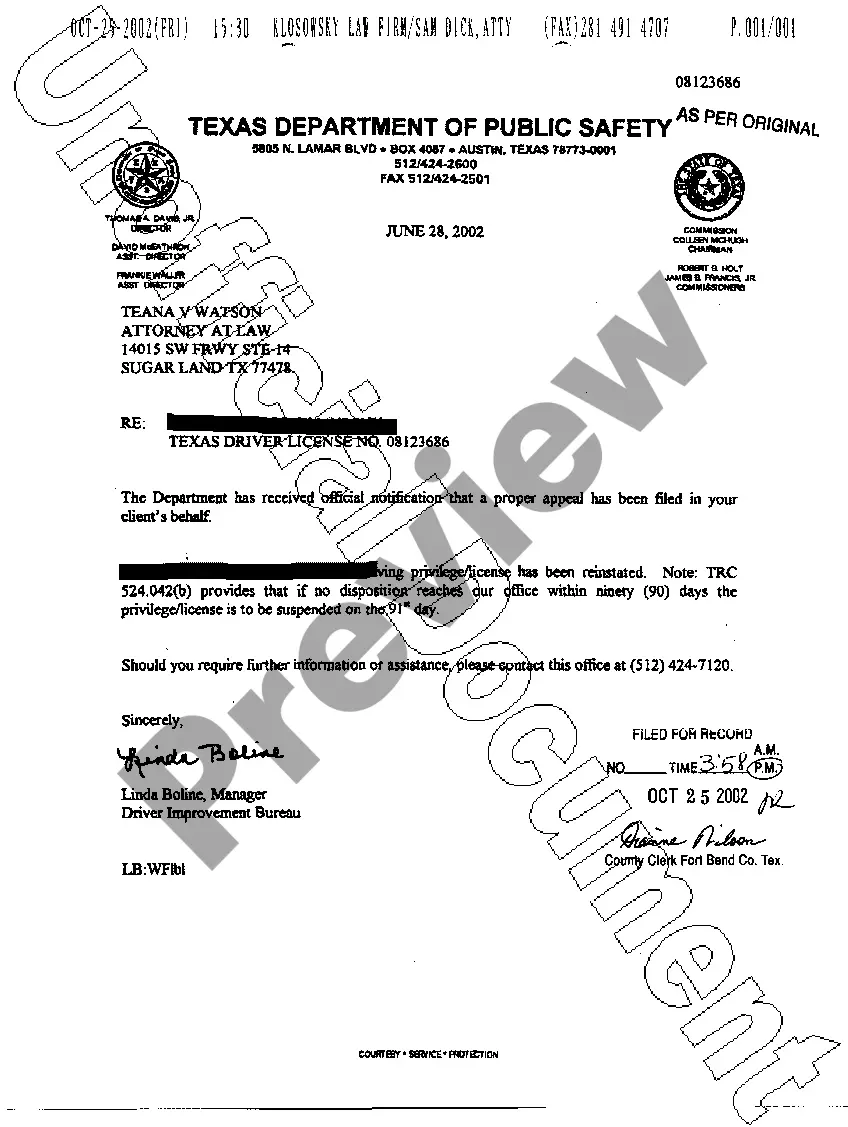

Free preview

How to fill out Round Rock Texas Financial Responsibility Insurance Certificate?

If you’ve already used our service before, log in to your account and save the Round Rock Texas Financial Responsibility Insurance Certificate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Round Rock Texas Financial Responsibility Insurance Certificate. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!