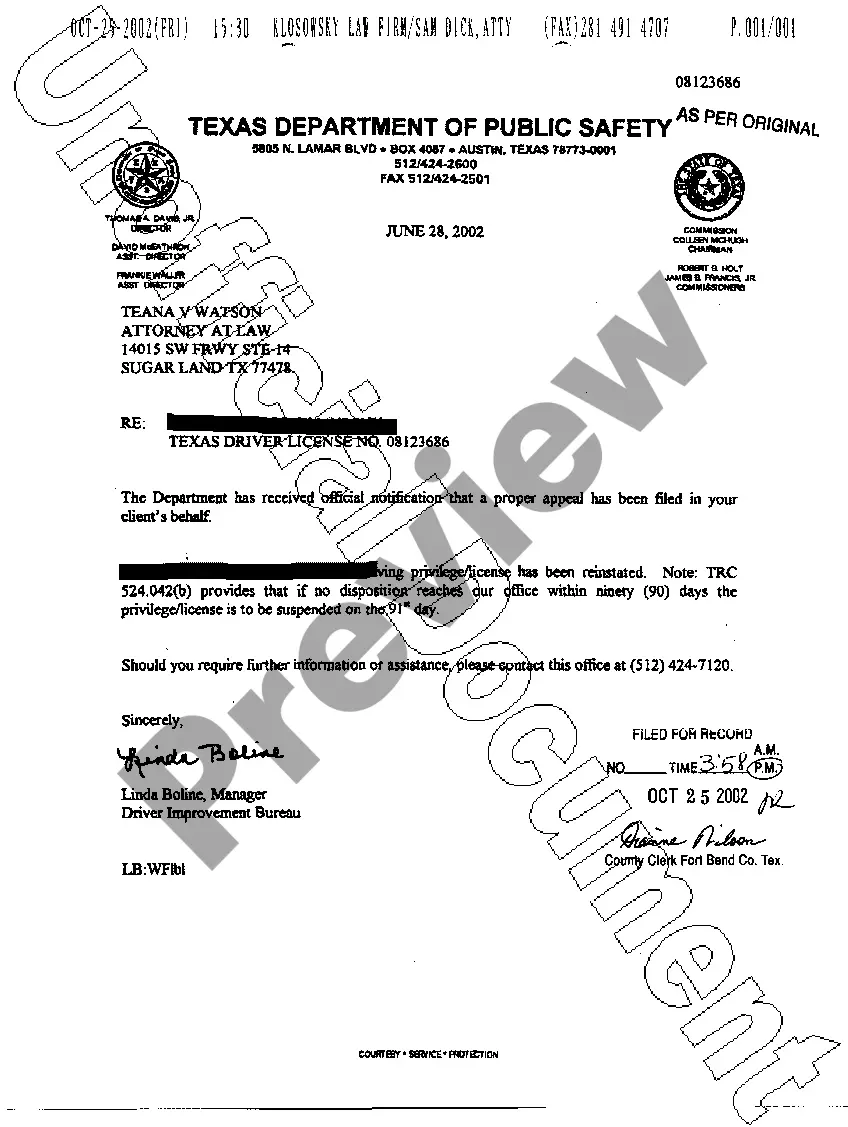

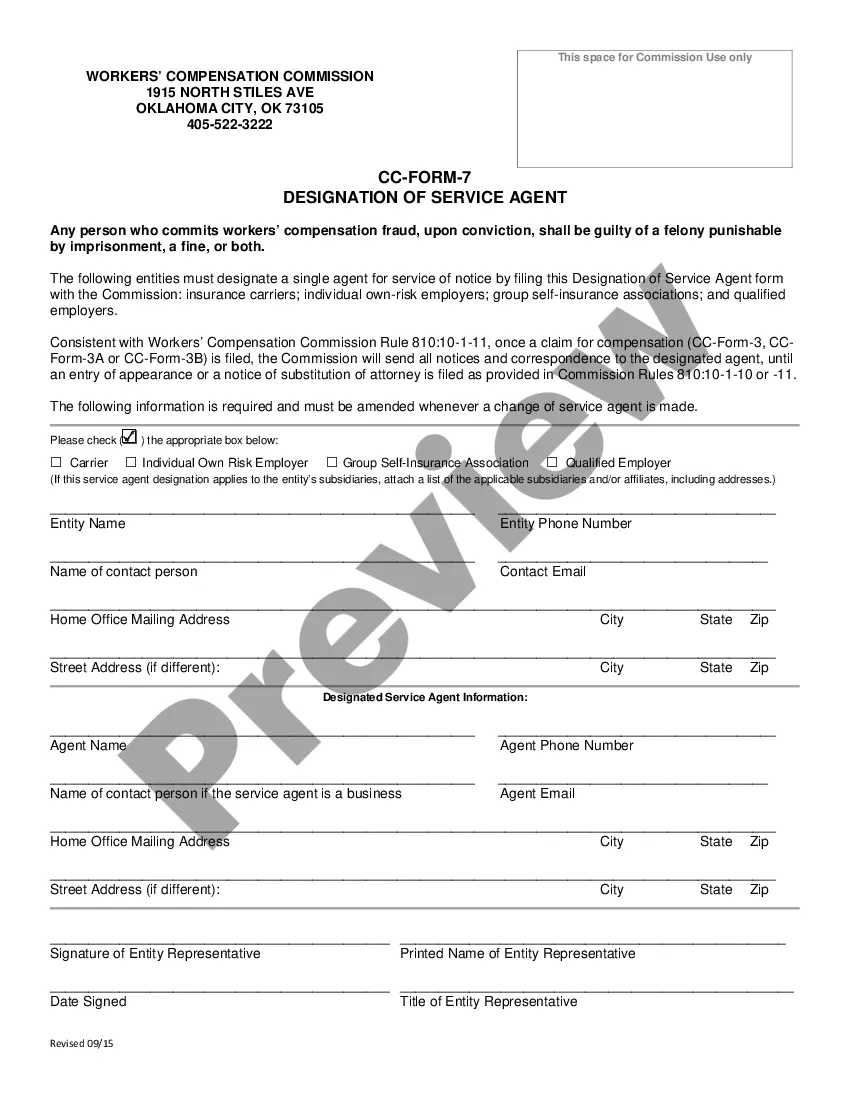

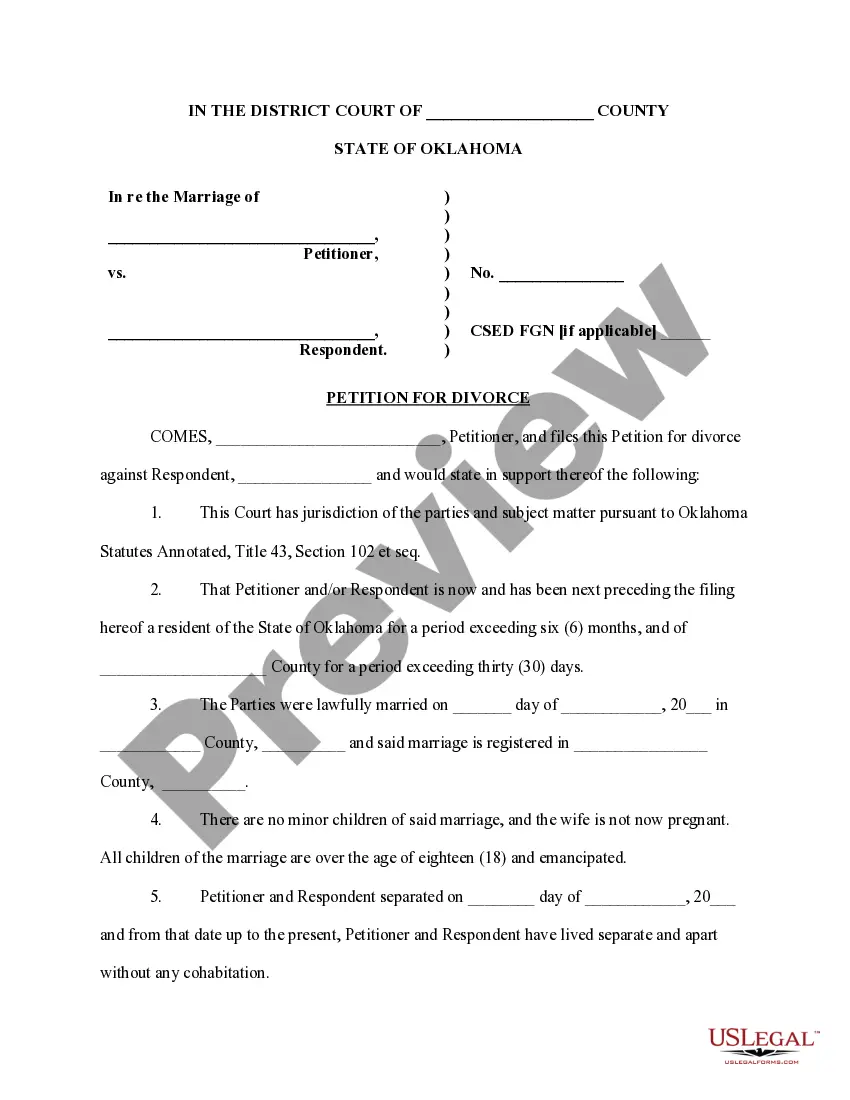

The San Antonio Texas Financial Responsibility Insurance Certificate is an essential document that verifies an individual's compliance with the state's financial responsibility laws for operating a motor vehicle. It serves as proof of insurance coverage and is required by the Texas Department of Public Safety (DPS) to register a vehicle or renew a driver's license. The certificate showcases that the vehicle owner or operator has obtained liability insurance coverage, which is mandatory in the state of Texas. Liability insurance protects the policyholder from potential financial losses resulting from accidents where they are at fault. It covers bodily injury and property damage expenses of the other party involved in the accident. The minimum liability coverage limits set by the state are $30,000 for each injured person, up to $60,000 in total bodily injury liability per incident, and $25,000 for property damage liability. There are different types of San Antonio Texas Financial Responsibility Insurance Certificates available, depending on the type of vehicle and circumstances. For regular passenger vehicles, drivers typically need to obtain a standard auto insurance policy. This policy provides coverage for personal vehicles used for commuting, running errands, or recreational purposes. However, some specific types of vehicles require additional types of insurance policies. For example, commercial vehicles, such as trucks, buses, or taxis, may require commercial auto insurance due to the higher risks associated with their operation. Motorcycle owners need motorcycle insurance, which provides coverage tailored to the unique risks and requirements of motorcycles. Other types of San Antonio Texas Financial Responsibility Insurance Certificates include non-owner car insurance, which covers individuals who frequently drive but do not own a vehicle, and SR-22 insurance, which is required for individuals who have been convicted of specific traffic offenses or have had their driver's license suspended. Obtaining a San Antonio Texas Financial Responsibility Insurance Certificate involves contacting an insurance provider licensed to operate in Texas and purchasing an appropriate insurance policy that meets the state's minimum requirements. The insurance company will issue a certificate that details the policyholder's name, policy number, effective dates, and coverage limits. This certificate must be carried in the vehicle at all times and presented upon request by law enforcement officers or other authorities to demonstrate financial responsibility compliance.

San Antonio Texas Financial Responsibility Insurance Certificate

Description

How to fill out San Antonio Texas Financial Responsibility Insurance Certificate?

Benefit from the US Legal Forms and have instant access to any form sample you need. Our useful website with a large number of documents makes it easy to find and obtain virtually any document sample you will need. You can download, complete, and certify the San Antonio Texas Financial Responsibility Insurance Certificate in a matter of minutes instead of browsing the web for many hours seeking the right template.

Using our catalog is an excellent way to increase the safety of your record filing. Our experienced lawyers on a regular basis review all the records to make sure that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you obtain the San Antonio Texas Financial Responsibility Insurance Certificate? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. In addition, you can find all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, stick to the instructions listed below:

- Open the page with the template you require. Make certain that it is the form you were looking for: verify its name and description, and take take advantage of the Preview option when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and select the pricing plan you prefer. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Indicate the format to get the San Antonio Texas Financial Responsibility Insurance Certificate and revise and complete, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy template libraries on the web. Our company is always happy to help you in virtually any legal process, even if it is just downloading the San Antonio Texas Financial Responsibility Insurance Certificate.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!