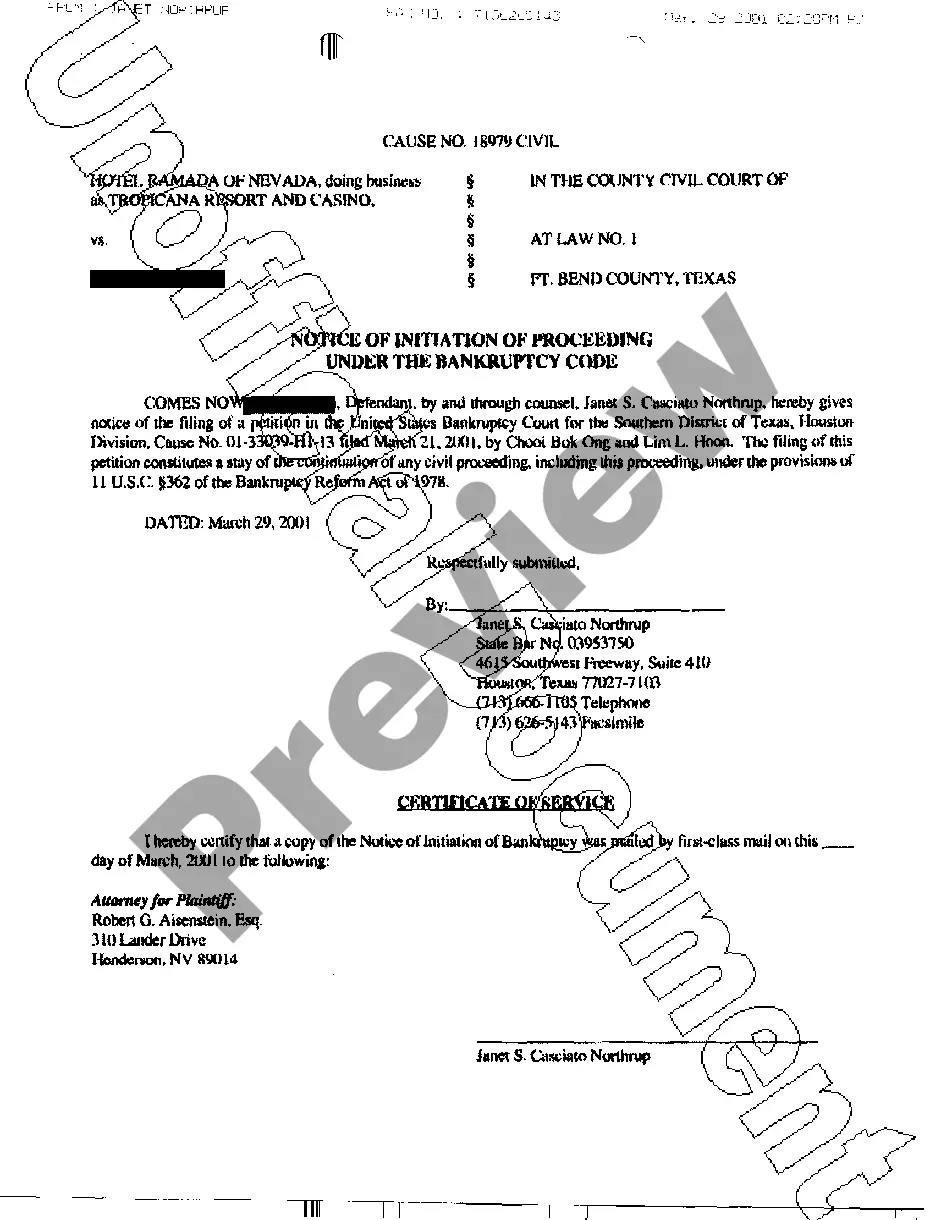

The Fort Worth Texas Notice of Bankruptcy is a legal document that declares an individual or business entity's filing for bankruptcy protection in the city of Fort Worth, Texas. This notice is an essential step in the bankruptcy process and serves as formal notification to all creditors, the court, and other relevant parties involved. Bankruptcy is a legal status that individuals or businesses can acquire when they are unable to pay their debts. It provides a legal framework for the debtor to either eliminate or restructure their debts under the supervision of the bankruptcy court. Once the decision to file for bankruptcy is made, the Notice of Bankruptcy must be filed with the appropriate bankruptcy court in Fort Worth, Texas. There are different types of bankruptcy that an individual or business can file, depending on their specific financial situation. In Fort Worth, Texas, the most common types of bankruptcy include Chapter 7 and Chapter 13 bankruptcies. Chapter 7 bankruptcy, also known as "liquidation bankruptcy," involves the individual or business selling off their non-exempt assets to repay their debts. However, certain exemptions may allow the debtor to retain essential possessions such as a residence, vehicle, or personal belongings. Chapter 7 bankruptcy is typically geared towards individuals or businesses with limited income and significant unmanageable debt. On the other hand, Chapter 13 bankruptcy, often referred to as "reorganization bankruptcy" or "wage earner's plan," allows individuals or businesses to develop a repayment plan that extends over three to five years. This type of bankruptcy is useful for debtors who have a regular income and wish to restructure their debts while keeping their assets. The Fort Worth Texas Notice of Bankruptcy, irrespective of the type, serves several essential purposes. Firstly, it informs all creditors of the debtor's intention to pursue bankruptcy protection, effectively halting any ongoing collection actions, including foreclosure, repossession, or wage garnishment. This halt in collection activities is due to an automatic stay imposed by the filing of the bankruptcy notice. Secondly, the Notice of Bankruptcy provides the court and creditors with pertinent details regarding the debtor's financial status, including a list of all assets, liabilities, income, and expenses. This comprehensive disclosure helps the court and creditors assess the debtor's financial situation and develop appropriate relief measures. Moreover, the Notice of Bankruptcy alerts the court and creditors to any potential fraudulent transfers or preferential payments made by the debtor before the bankruptcy filing. Fraudulent transfers involve the intentional transfer of property or assets to avoid creditors, while preferential payments denote giving preferential treatment to certain creditors over others in the months leading up to the bankruptcy filing. In conclusion, the Fort Worth Texas Notice of Bankruptcy is a critical legal document that initiates the bankruptcy process and formally notifies all parties of the debtor's financial distress. Whether it is a Chapter 7 or Chapter 13 bankruptcy, this notice helps establish an organized resolution for the debtor's outstanding liabilities while affording them legal protection and the opportunity for a fresh financial start.

Fort Worth Texas Notice of Bankruptcy

Description

How to fill out Fort Worth Texas Notice Of Bankruptcy?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney solutions that, as a rule, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We offer access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Fort Worth Texas Notice of Bankruptcy or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Fort Worth Texas Notice of Bankruptcy complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Fort Worth Texas Notice of Bankruptcy is proper for you, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any available format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!