Frisco Texas Notice of Bankruptcy is a legal document that initiates the bankruptcy process for individuals or businesses located in Frisco, Texas. When filing for bankruptcy, it is essential to understand the various types of bankruptcy notices to ensure compliance with the law. Let's explore the different types of Frisco Texas Notice of Bankruptcy: 1. Chapter 7 Bankruptcy Notice: Chapter 7 bankruptcy, also known as liquidation bankruptcy, is the most common type of bankruptcy filed by individuals and businesses. The Frisco Texas Notice of Chapter 7 Bankruptcy notifies creditors, court-appointed trustees, and interested parties of the debtor's intent to liquidate assets and discharge certain debts under Chapter 7 bankruptcy laws. 2. Chapter 13 Bankruptcy Notice: The Frisco Texas Notice of Chapter 13 Bankruptcy is served when an individual or business intends to file for Chapter 13 bankruptcy. Chapter 13 allows debtors to reorganize their debts and create a manageable repayment plan over three to five years. The notice provides creditors and other parties involved with information about the debtor's repayment plan and the upcoming proceedings. 3. Chapter 11 Bankruptcy Notice: In Frisco, Texas, businesses looking to restructure their debts while remaining operational might file for Chapter 11 bankruptcy. The Frisco Texas Notice of Chapter 11 Bankruptcy is served to creditors, shareholders, and other interested parties, informing them about the company's intent to reorganize finances, renegotiate contracts, and develop a plan to repay debts. 4. Chapter 12 Bankruptcy Notice: The Frisco Texas Notice of Chapter 12 Bankruptcy is specific to family farmers or fishermen who qualify for Chapter 12 bankruptcy protection. This type of bankruptcy allows qualifying individuals engaged in these occupations to develop a repayment plan based on their seasonal income fluctuations. The notice is sent to creditors, interested parties, and court-appointed trustees. 5. Creditor's Notice of Bankruptcy: This type of notice is sent to creditors upon the commencement of the bankruptcy proceedings. It informs creditors about the debtor's bankruptcy filing, the specific chapter under which the filing occurred, and important deadlines for participating in the bankruptcy process, such as filing proofs of claim. 6. Notice of Meeting of Creditors: As required by bankruptcy law, the Notice of Meeting of Creditors is sent to all creditors, the debtor, and any other parties involved, informing them about an upcoming meeting of creditors. This meeting allows creditors to question the debtor about their financial affairs and verify the accuracy of the bankruptcy petition. Understanding the different types of Frisco Texas Notice of Bankruptcy is crucial for debtors, creditors, and other interested parties involved in bankruptcy proceedings. By adhering to the specific procedures and deadlines outlined in these notices, all parties can ensure compliance with the bankruptcy laws and contribute to a fair and efficient resolution of the bankruptcy case.

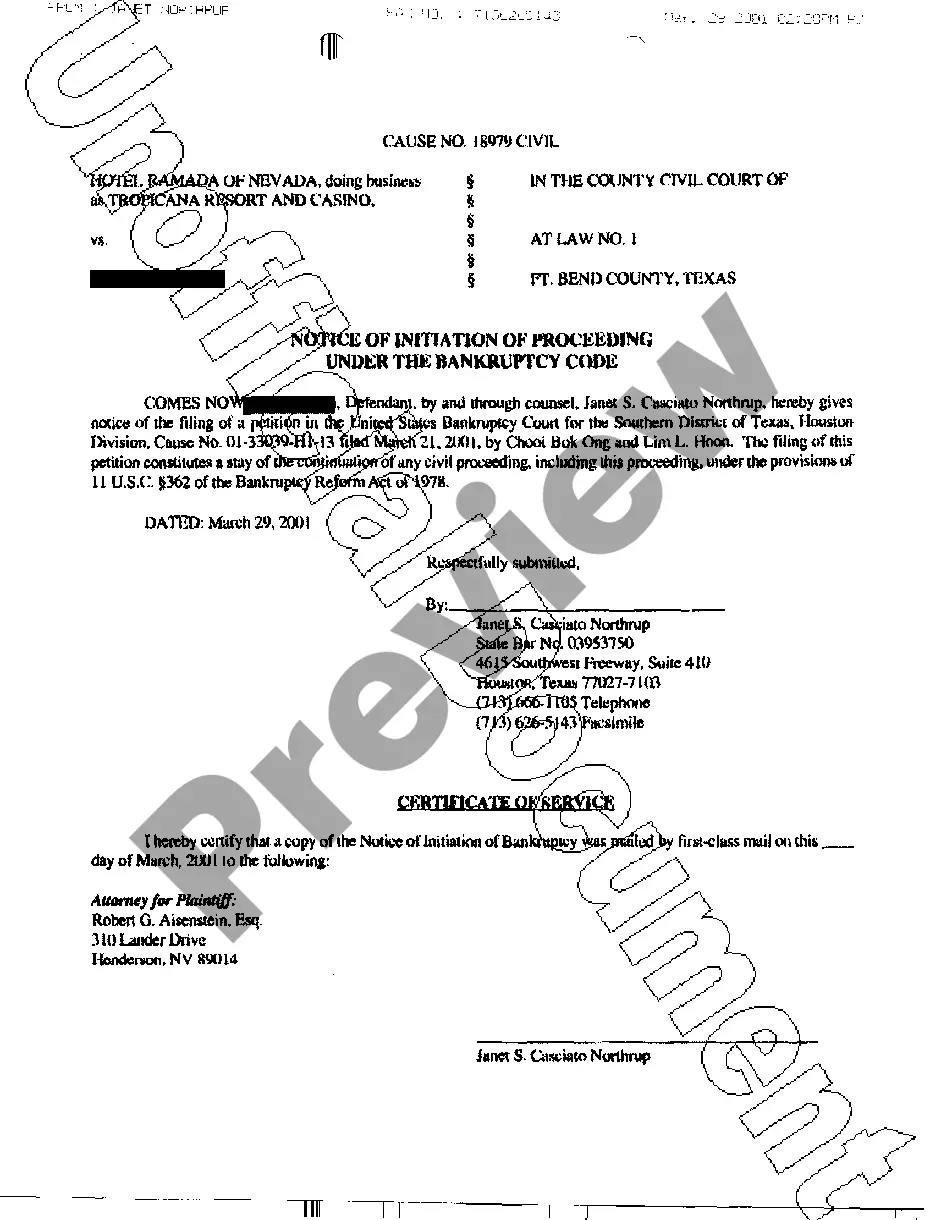

Frisco Texas Notice of Bankruptcy

Description

How to fill out Frisco Texas Notice Of Bankruptcy?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no law background to create this sort of paperwork cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our service offers a huge catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Frisco Texas Notice of Bankruptcy or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Frisco Texas Notice of Bankruptcy quickly using our reliable service. If you are already a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, in case you are new to our platform, make sure to follow these steps before obtaining the Frisco Texas Notice of Bankruptcy:

- Ensure the form you have found is suitable for your location considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a short outline (if available) of scenarios the document can be used for.

- If the form you picked doesn’t suit your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription option that suits you the best.

- with your login information or create one from scratch.

- Choose the payment method and proceed to download the Frisco Texas Notice of Bankruptcy once the payment is done.

You’re all set! Now you can go ahead and print out the form or complete it online. In case you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.