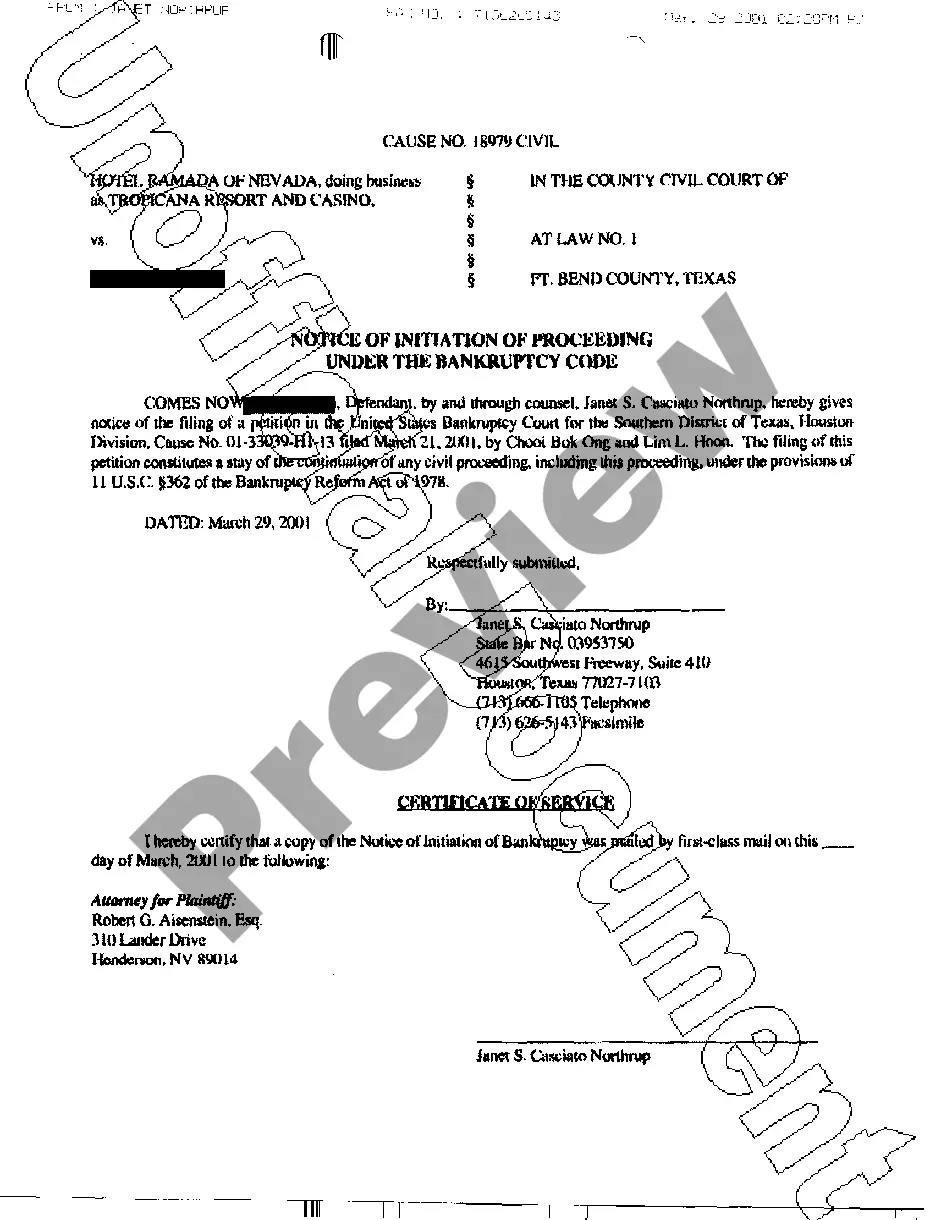

Irving Texas Notice of Bankruptcy is a legal document that serves as a notification to inform creditors, debtors, and other interested parties about the bankruptcy filing of an individual or business entity in the city of Irving, Texas. This notice plays a crucial role in the bankruptcy process, as it provides important information about the case and its proceedings. Keywords: Irving Texas, Notice of Bankruptcy, legal document, notification, creditors, debtors, interested parties, bankruptcy filing, bankruptcy process, case, proceedings. There are primarily two types of Irving Texas Notice of Bankruptcy, which include: 1. Chapter 7 Bankruptcy Notice: This notice typically indicates that an individual or business entity has filed for Chapter 7 bankruptcy in Irving, Texas. Chapter 7 bankruptcy, also known as "liquidation bankruptcy," involves the sale of non-exempt assets to pay off debts. The specific details of the bankruptcy, such as the exact assets being sold or exempted, will be mentioned in this notice. 2. Chapter 13 Bankruptcy Notice: This notice implies that an individual or business entity has filed for Chapter 13 bankruptcy in Irving, Texas. Chapter 13 bankruptcy, also referred to as "reorganization bankruptcy" or "wage earner's plan," allows debtors to create a repayment plan to settle their debts over a specified period usually spanning three to five years. The notice will outline the proposed repayment plan and other crucial information related to the case. In both cases, the Irving Texas Notice of Bankruptcy will include various essential elements, such as the name and address of the debtor, details regarding the bankruptcy court handling the case, the assigned bankruptcy trustee, the deadline for creditors to file claims, and relevant instructions for interested parties and creditors. It is vital for all stakeholders to carefully review this notice to understand their rights, obligations, and any necessary actions they may need to take within the specified timeframes. In conclusion, the Irving Texas Notice of Bankruptcy is a critical legal document that provides notification and essential details about an individual's or business entity's bankruptcy filing in Irving, Texas. Creditors, debtors, and other interested parties must carefully review this notice to ensure they are adequately informed about the case's proceedings and any associated deadlines or requirements.

Irving Texas Notice of Bankruptcy

Description

How to fill out Irving Texas Notice Of Bankruptcy?

If you have previously made use of our service, Log In to your account and retrieve the Irving Texas Notice of Bankruptcy onto your device by pressing the Download button. Ensure that your subscription is active. If not, renew it based on your payment scheme.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You will always have access to every document you have purchased: it can be found in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to quickly find and store any template for your personal or professional requirements!

- Confirm that you’ve found a suitable document. Browse through the description and utilize the Preview feature, if available, to verify if it suits your requirements. If it’s not suitable, use the Search tab above to find the right one.

- Purchase the document. Click the Buy Now button and select either a monthly or annual subscription plan.

- Establish an account and make a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Irving Texas Notice of Bankruptcy. Choose the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

In a bankruptcy case, the burden of proof typically lies with the party making the objection. This means you must provide sufficient evidence to support your claim. When responding to an Irving Texas Notice of Bankruptcy, it’s essential to gather all relevant documentation and facts. Strong evidence increases your chances of a favorable outcome, and utilizing legal resources can aid your efforts.

You usually have about 14 to 30 days to respond to an Irving Texas Notice of Bankruptcy, depending on the specific type of notice you receive. Meeting this deadline is crucial to ensure your rights are upheld. Failing to respond may lead to automatic rulings that could affect your financial standing negatively. Consult with an attorney for precise timelines based on your situation.

To get your bankruptcy dismissed, you generally need to file a motion with the court explaining your reasons. Factors such as changes in your financial situation or errors in the filing process could support your case. It's essential to provide convincing evidence to the court to support your request. Engaging a legal professional can significantly improve your chances of success in this process.

To notify creditors of your bankruptcy, you should provide them with a formal notice, including details from the Irving Texas Notice of Bankruptcy. Typically, your attorney or bankruptcy trustee will assist you in this process. Make sure you send the notice to all relevant creditors to avoid complications. Informing them accurately can help manage their expectations during the bankruptcy process.

You typically have 30 days to respond to a bankruptcy complaint after receiving the Irving Texas Notice of Bankruptcy. It's crucial to adhere to this timeframe to protect your rights and interests. If you fail to respond in time, the court could rule against you by default. For detailed steps, consider using resources available at uslegalforms.

Writing a letter regarding an Irving Texas Notice of Bankruptcy involves clearly stating your intentions and financial situation. Start with a professional greeting, then outline your circumstances, including your debts and assets. Be honest and precise in your request, and ensure you provide all necessary details to avoid misunderstandings. If needed, uslegalforms can assist you with templates for such letters.

In Texas, certain circumstances can disqualify you from filing for bankruptcy. For instance, if you have filed for bankruptcy multiple times within a short period, you may face restrictions. Additionally, if you owe specific tax debts or alimony, these factors might affect your eligibility. Always consult an attorney to explore your options.

To respond to an Irving Texas Notice of Bankruptcy, you typically need to file an official response with the court. This involves filling out necessary forms and submitting them by the deadline. It’s important to address the allegations in the notice accurately. Seeking legal assistance can help ensure you meet all requirements.

In Texas, having a lawyer is not a legal requirement to file for bankruptcy, but it is highly beneficial. A qualified attorney can guide you through the intricate legal system and help ensure that all paperwork is completed accurately. This support can substantially improve your chances of a successful outcome. Consider utilizing resources like the Irving Texas Notice of Bankruptcy to find legal assistance if needed.

While it is possible to file bankruptcy without a lawyer in Texas, it is generally not recommended. The process can be complex, involving various forms and detailed requirements. Doing it yourself may lead to mistakes that could affect the outcome of your case. The Irving Texas Notice of Bankruptcy provides valuable information that can help, but consulting a legal expert is advisable for a smoother experience.