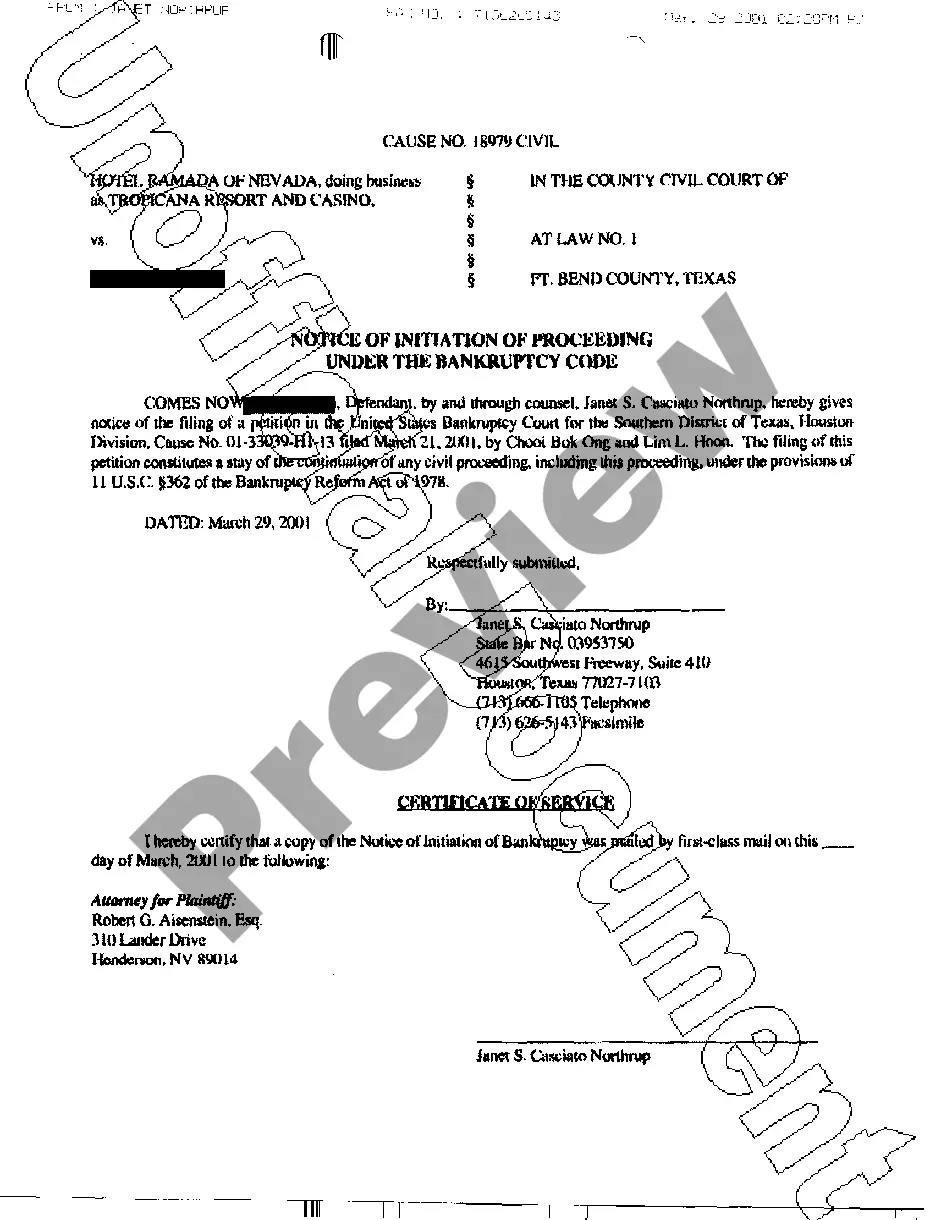

McKinney Texas Notice of Bankruptcy is an official legal document that signifies the initiation of a bankruptcy process for an individual or business entity located in McKinney, Texas. It is a crucial step in a bankruptcy case that provides notification to creditors, the court, and other involved parties about the debtor's inability to repay their debts. This notice serves as the first official communication in the bankruptcy process, indicating that the debtor has filed for bankruptcy protection. There are different types of McKinney Texas Notice of Bankruptcy, depending on the type of bankruptcy filing. The most common types include Chapter 7, Chapter 11, and Chapter 13 bankruptcies. 1. Chapter 7 Bankruptcy: This type of bankruptcy, also known as liquidation bankruptcy, involves the complete liquidation of the debtor's assets to repay outstanding debts. A McKinney Texas Notice of Chapter 7 Bankruptcy informs creditors that the debtor's assets will be sold or distributed to settle their debts. 2. Chapter 11 Bankruptcy: Typically utilized by businesses, Chapter 11 bankruptcy allows the debtor to reorganize while continuing their operations. The Notice of Chapter 11 Bankruptcy in McKinney Texas notifies creditors and other interested parties about the debtor's intention to restructure their debts and develop a repayment plan. 3. Chapter 13 Bankruptcy: This type of bankruptcy is designed for individuals with a regular income who wish to repay their debts over time. The Notice of Chapter 13 Bankruptcy in McKinney Texas informs creditors that the debtor will make affordable monthly repayments over a specified period, usually three to five years, under a court-approved repayment plan. In all types of McKinney Texas Bankruptcy Notices, the document includes essential information such as the debtor's name, address, bankruptcy chapter, case number, filing date, assigned bankruptcy trustee, and the address of the bankruptcy court where the case will be heard. It's important to note that the McKinney Texas Notice of Bankruptcy is a crucial document in the bankruptcy process and should be taken seriously by all parties involved. It acts as a legal notification and sets the stage for subsequent steps, including creditor meetings, evaluations of assets, formulation of repayment plans, and ultimate resolution of debts.

McKinney Texas Notice of Bankruptcy

Description

How to fill out McKinney Texas Notice Of Bankruptcy?

Are you looking for a trustworthy and affordable legal forms supplier to get the McKinney Texas Notice of Bankruptcy? US Legal Forms is your go-to option.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the required template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the McKinney Texas Notice of Bankruptcy conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Restart the search in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the McKinney Texas Notice of Bankruptcy in any provided format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal paperwork online once and for all.