The Pasadena Texas Notice of Bankruptcy is a legal document that serves as official notice to the public and creditors that an individual or entity located in Pasadena, Texas has filed for bankruptcy. This written notice is required by federal law to provide transparency and to initiate the bankruptcy proceedings. Bankruptcy is a legal process where an individual or business is declared unable to repay their outstanding debts. It provides an opportunity for debt relief and a fresh financial start. The Pasadena Texas Notice of Bankruptcy is an important step in this process as it marks the beginning of the case and notifies interested parties about the situation. Keywords: Pasadena Texas, Notice of Bankruptcy, bankruptcy proceedings, debt relief, financial start, legal process, creditors, federal law. There are different types of Pasadena Texas Notices of Bankruptcy that can be filed based on the bankruptcy chapter chosen by the debtor. The most common types include: 1. Chapter 7 Bankruptcy: Also known as "liquidation bankruptcy," Chapter 7 allows individuals and businesses to wipe out their debts by selling off non-exempt assets to repay creditors. This type of bankruptcy is suitable for those with limited income or assets. 2. Chapter 13 Bankruptcy: Also referred to as a "reorganization bankruptcy," Chapter 13 enables individuals with a regular income source to create a repayment plan to settle their debts over a period of three to five years. This form of bankruptcy allows debtors to keep their assets while gradually repaying their creditors. 3. Chapter 11 Bankruptcy: Primarily utilized by businesses, Chapter 11 bankruptcy permits reorganization and debt restructuring while the business remains operational. Debtors can propose a plan to repay their creditors, reduce debts, and continue operations. This chapter is often employed by corporations or partnerships. 4. Chapter 12 Bankruptcy: Specifically designed for family farmers and fishermen, Chapter 12 bankruptcy offers a reorganization plan that allows them to keep their assets and repay their debts through affordable payments over a specified period of time. 5. Chapter 9 Bankruptcy: Designed for municipalities, Chapter 9 bankruptcy assists financially distressed local governments in restructuring their debts. It provides a means to obtain relief from creditors and regain financial stability. These various types of Pasadena Texas Notices of Bankruptcy cater to different financial situations and circumstances, offering debtors options that align with their needs and goals. Keywords: Chapter 7 Bankruptcy, Chapter 13 Bankruptcy, Chapter 11 Bankruptcy, Chapter 12 Bankruptcy, Chapter 9 Bankruptcy, liquidation bankruptcy, reorganization bankruptcy, debt restructuring, financially distressed, fresh start.

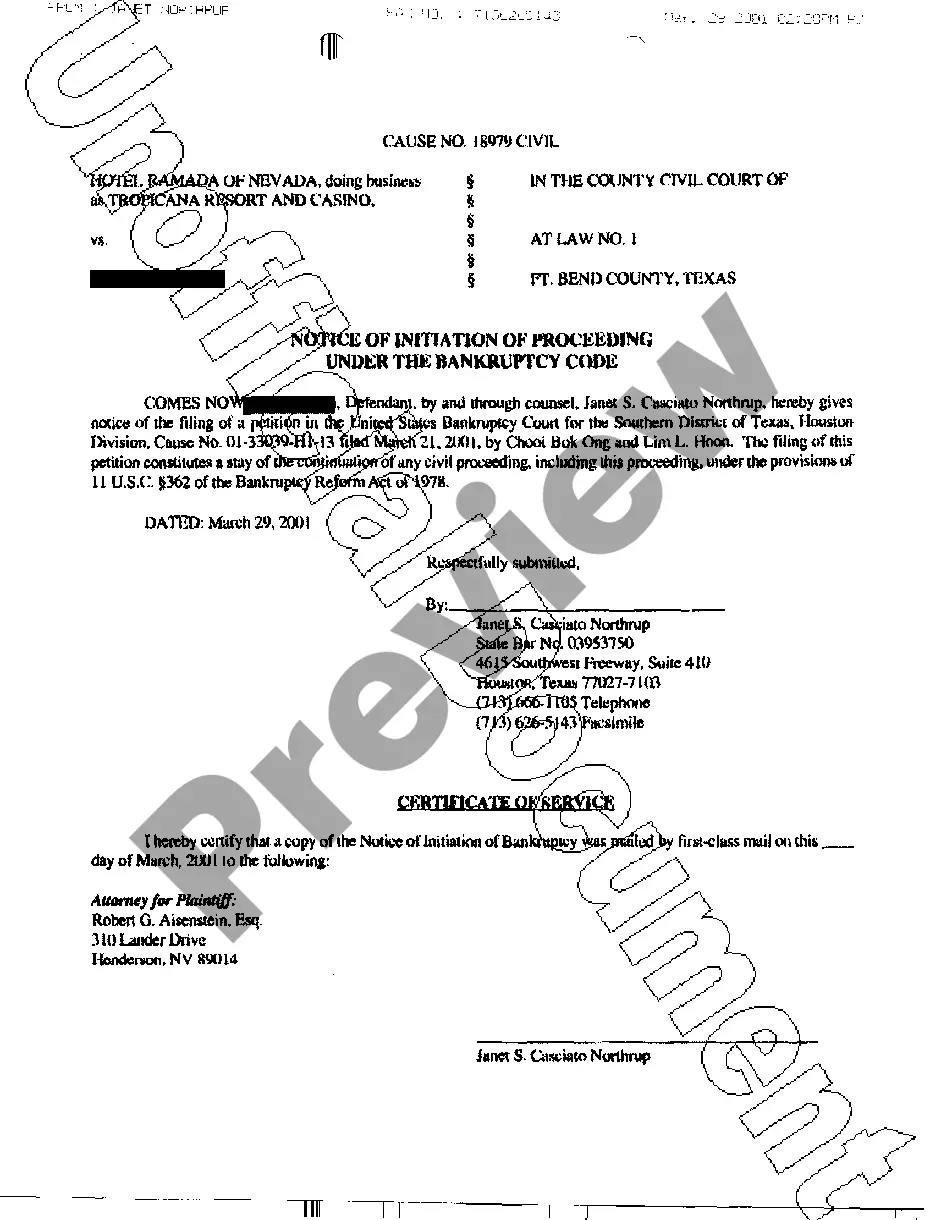

Pasadena Texas Notice of Bankruptcy

Description

How to fill out Pasadena Texas Notice Of Bankruptcy?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone with no law education to create this sort of papers cfrom the ground up, mostly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our platform provides a huge library with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you require the Pasadena Texas Notice of Bankruptcy or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Pasadena Texas Notice of Bankruptcy in minutes employing our reliable platform. If you are already an existing customer, you can go on and log in to your account to download the appropriate form.

However, if you are new to our library, ensure that you follow these steps prior to downloading the Pasadena Texas Notice of Bankruptcy:

- Ensure the template you have found is suitable for your location considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a brief outline (if provided) of scenarios the paper can be used for.

- In case the one you picked doesn’t meet your requirements, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- with your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Pasadena Texas Notice of Bankruptcy once the payment is done.

You’re all set! Now you can go on and print out the form or complete it online. If you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.