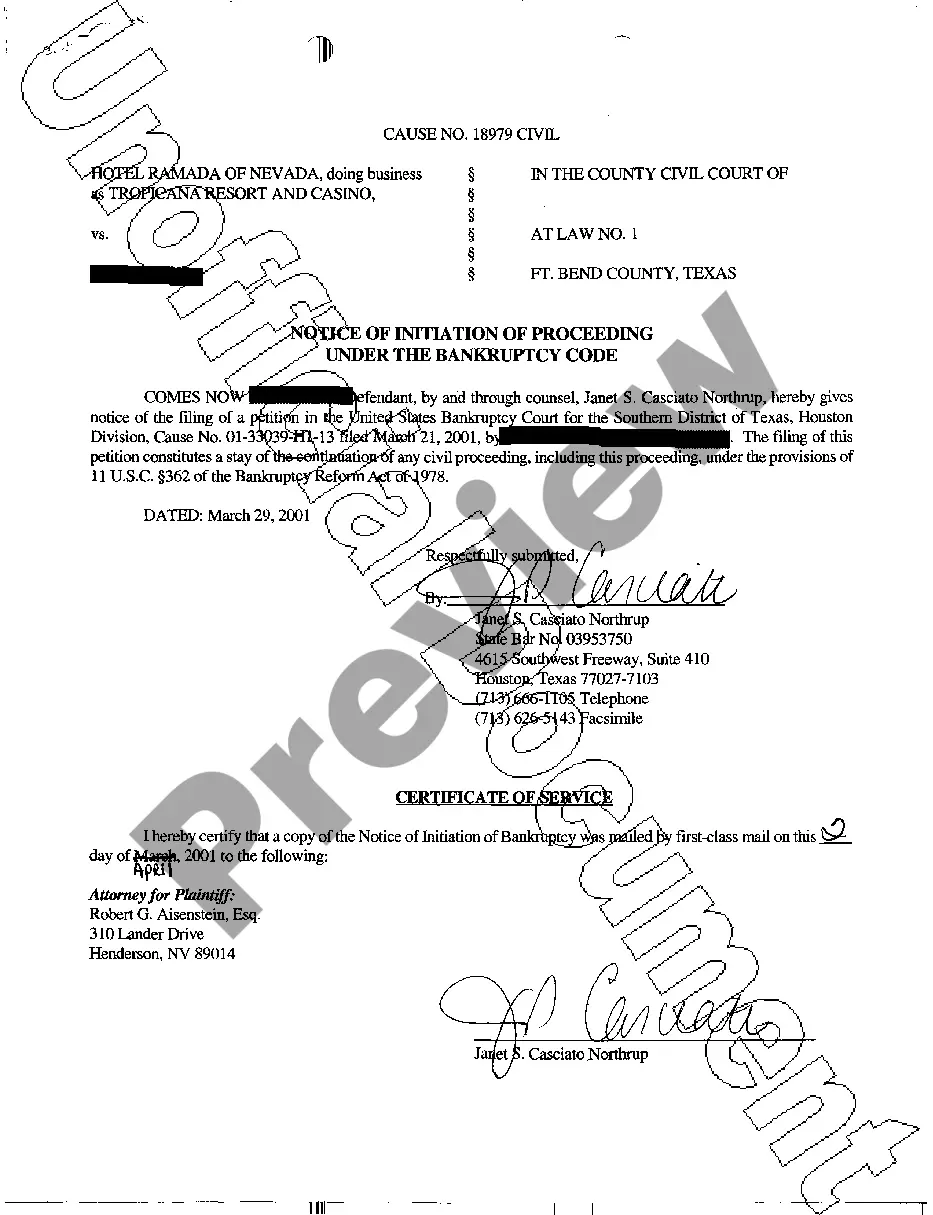

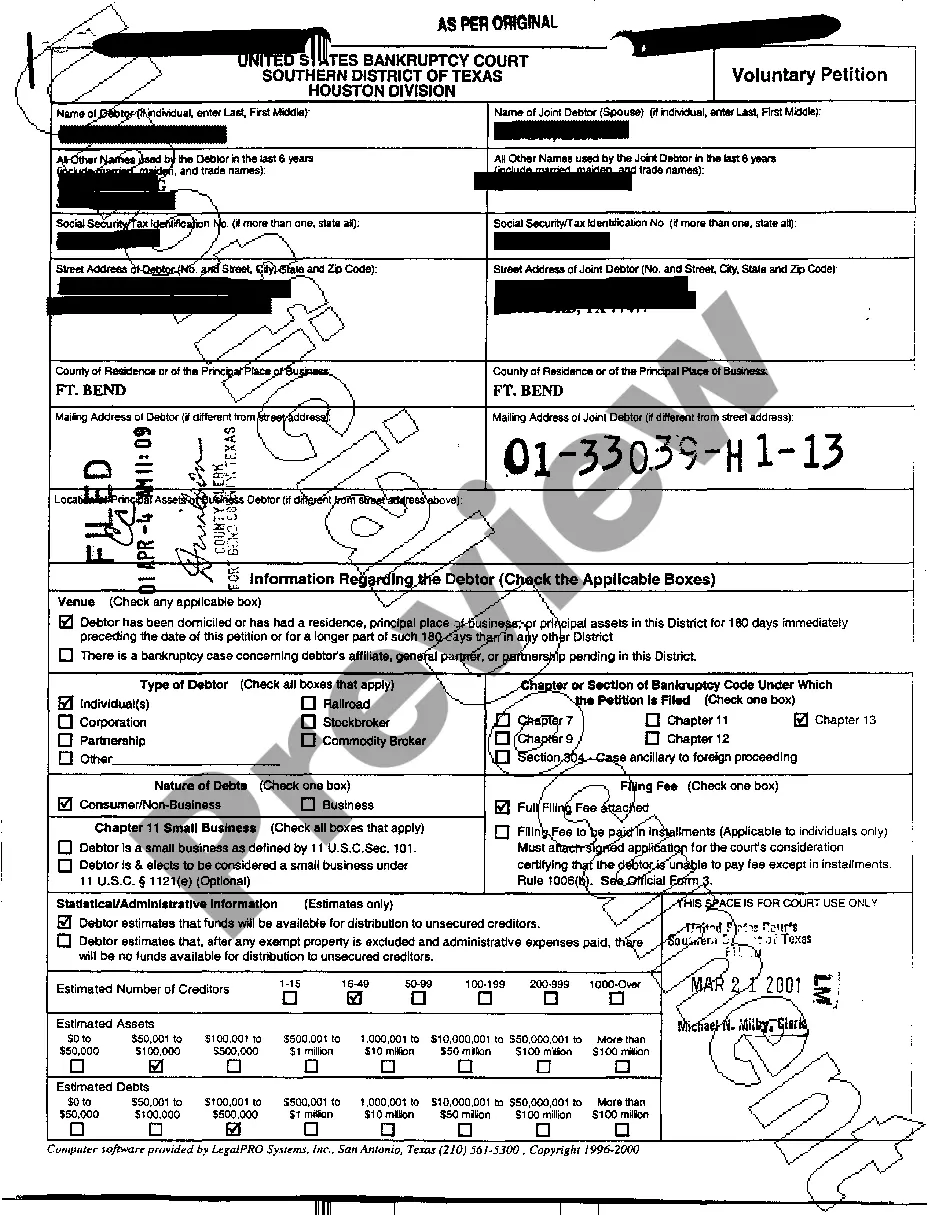

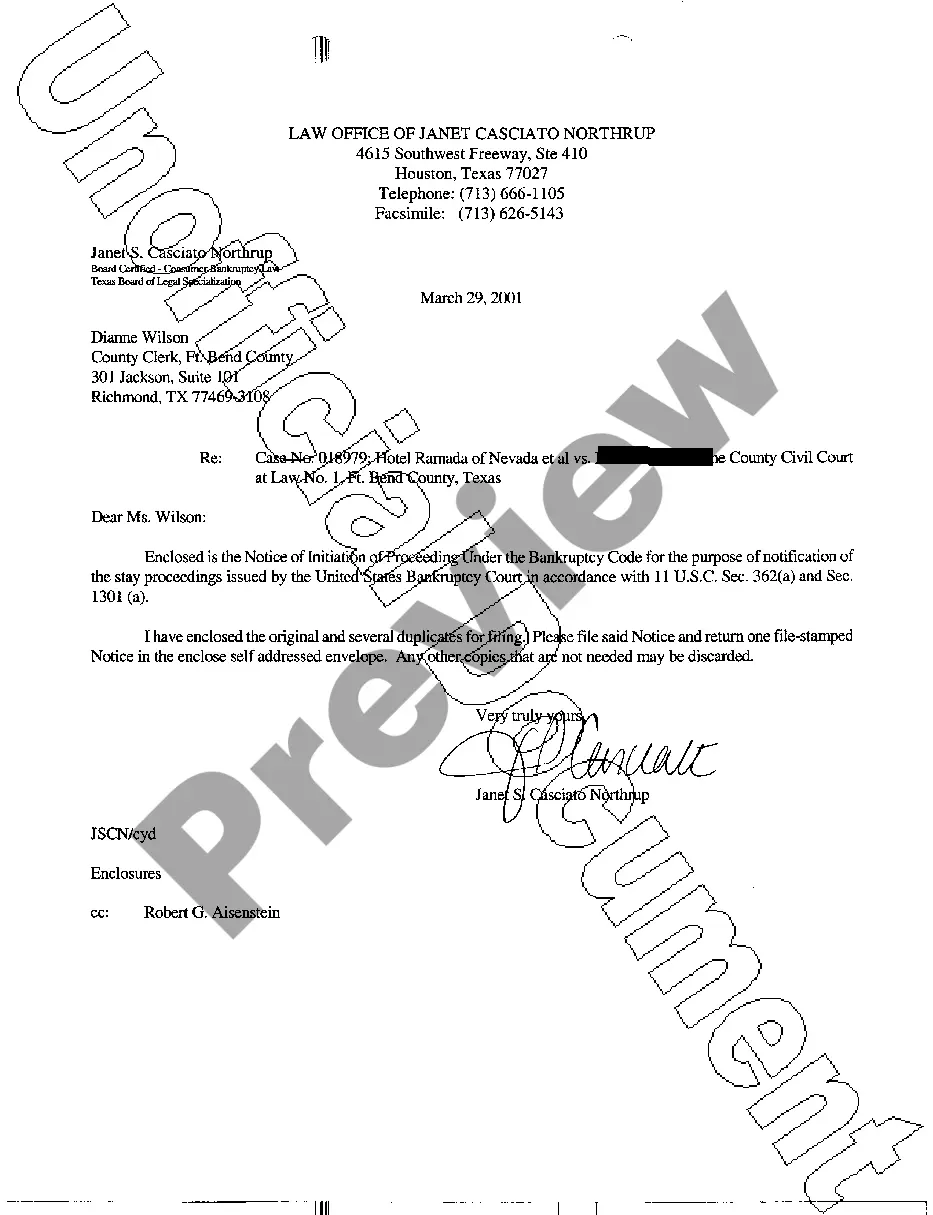

Title: Understanding the Irving Texas Notice of Bankruptcy: Types and Detailed Explanation Keywords: Irving Texas, Notice of Bankruptcy, bankruptcy process, Chapter 7, Chapter 13, bankruptcy protection, debtor, creditor, automatic stay, discharge, bankruptcy trustee Introduction: The Irving Texas Notice of Bankruptcy is a legal document that serves as an official notification indicating an individual or business entity's intention to seek bankruptcy protection. Bankruptcy is a legal process designed to address overwhelming debt burdens, enabling debtors to obtain financial relief and potentially find a fresh start. This comprehensive guide highlights the different types of Irving Texas Notice of Bankruptcy and provides a detailed overview of the bankruptcy process. 1. Chapter 7 Bankruptcy: Chapter 7 bankruptcy, commonly referred to as a "liquidation bankruptcy," involves the sale of non-exempt assets to repay creditors. Debtors opting for Chapter 7 eliminate most of their unsecured debts, typically within a few months. The Irving Texas Notice of Bankruptcy for Chapter 7 ensures that creditors are informed of the debtor's intention to pursue this specific type of bankruptcy relief. 2. Chapter 13 Bankruptcy: Chapter 13 bankruptcy, known as a "reorganization bankruptcy," provides debtors with an opportunity to create a manageable repayment plan, allowing them to retain their assets and repay creditors over a period of three to five years. The Irving Texas Notice of Bankruptcy for Chapter 13 includes details of the debtor's proposed repayment plan and notifies creditors about the proceedings. 3. Bankruptcy Process: The filing of the Irving Texas Notice of Bankruptcy initiates the bankruptcy process, which involves several crucial steps: a. Automatic Stay: Upon filing the Notice of Bankruptcy, an automatic stay is issued, providing immediate relief from creditor collection activities such as foreclosure, wage garnishment, or lawsuits. This stay temporarily halts all legal actions against the debtor, offering crucial breathing space for financial evaluation and planning. b. Meeting of Creditors: A mandatory meeting of creditors, known as the 341 meeting, is held within 20-40 days of filing the bankruptcy notice. This meeting allows creditors to ask questions specific to the debtor's financial situation and proposed repayment plan, overseen by the appointed bankruptcy trustee. c. Discharge of Debts: Once the debtor successfully completes all requirements, such as attending financial education courses and complying with the repayment plan, a discharge of debts is granted. This eliminates the debtor's legal obligation to repay discharged debts, providing a fresh financial start. Conclusion: Understanding the process and types of Irving Texas Notice of Bankruptcy is essential for debtors pursuing bankruptcy protection. Filing for bankruptcy can be a complex and challenging endeavor, requiring professional guidance and support. If you find yourself in a situation where bankruptcy seems inevitable, consulting with an experienced bankruptcy attorney will help navigate the process and provide tailored advice based on your specific circumstances.

Irving Texas Notice of Bankruptcy

State:

Texas

City:

Irving

Control #:

TX-G0064

Format:

PDF

Instant download

This form is available by subscription

Description

A11 Notice of Bankruptcy

Title: Understanding the Irving Texas Notice of Bankruptcy: Types and Detailed Explanation Keywords: Irving Texas, Notice of Bankruptcy, bankruptcy process, Chapter 7, Chapter 13, bankruptcy protection, debtor, creditor, automatic stay, discharge, bankruptcy trustee Introduction: The Irving Texas Notice of Bankruptcy is a legal document that serves as an official notification indicating an individual or business entity's intention to seek bankruptcy protection. Bankruptcy is a legal process designed to address overwhelming debt burdens, enabling debtors to obtain financial relief and potentially find a fresh start. This comprehensive guide highlights the different types of Irving Texas Notice of Bankruptcy and provides a detailed overview of the bankruptcy process. 1. Chapter 7 Bankruptcy: Chapter 7 bankruptcy, commonly referred to as a "liquidation bankruptcy," involves the sale of non-exempt assets to repay creditors. Debtors opting for Chapter 7 eliminate most of their unsecured debts, typically within a few months. The Irving Texas Notice of Bankruptcy for Chapter 7 ensures that creditors are informed of the debtor's intention to pursue this specific type of bankruptcy relief. 2. Chapter 13 Bankruptcy: Chapter 13 bankruptcy, known as a "reorganization bankruptcy," provides debtors with an opportunity to create a manageable repayment plan, allowing them to retain their assets and repay creditors over a period of three to five years. The Irving Texas Notice of Bankruptcy for Chapter 13 includes details of the debtor's proposed repayment plan and notifies creditors about the proceedings. 3. Bankruptcy Process: The filing of the Irving Texas Notice of Bankruptcy initiates the bankruptcy process, which involves several crucial steps: a. Automatic Stay: Upon filing the Notice of Bankruptcy, an automatic stay is issued, providing immediate relief from creditor collection activities such as foreclosure, wage garnishment, or lawsuits. This stay temporarily halts all legal actions against the debtor, offering crucial breathing space for financial evaluation and planning. b. Meeting of Creditors: A mandatory meeting of creditors, known as the 341 meeting, is held within 20-40 days of filing the bankruptcy notice. This meeting allows creditors to ask questions specific to the debtor's financial situation and proposed repayment plan, overseen by the appointed bankruptcy trustee. c. Discharge of Debts: Once the debtor successfully completes all requirements, such as attending financial education courses and complying with the repayment plan, a discharge of debts is granted. This eliminates the debtor's legal obligation to repay discharged debts, providing a fresh financial start. Conclusion: Understanding the process and types of Irving Texas Notice of Bankruptcy is essential for debtors pursuing bankruptcy protection. Filing for bankruptcy can be a complex and challenging endeavor, requiring professional guidance and support. If you find yourself in a situation where bankruptcy seems inevitable, consulting with an experienced bankruptcy attorney will help navigate the process and provide tailored advice based on your specific circumstances.

Free preview

How to fill out Irving Texas Notice Of Bankruptcy?

If you’ve already utilized our service before, log in to your account and download the Irving Texas Notice of Bankruptcy on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Irving Texas Notice of Bankruptcy. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!