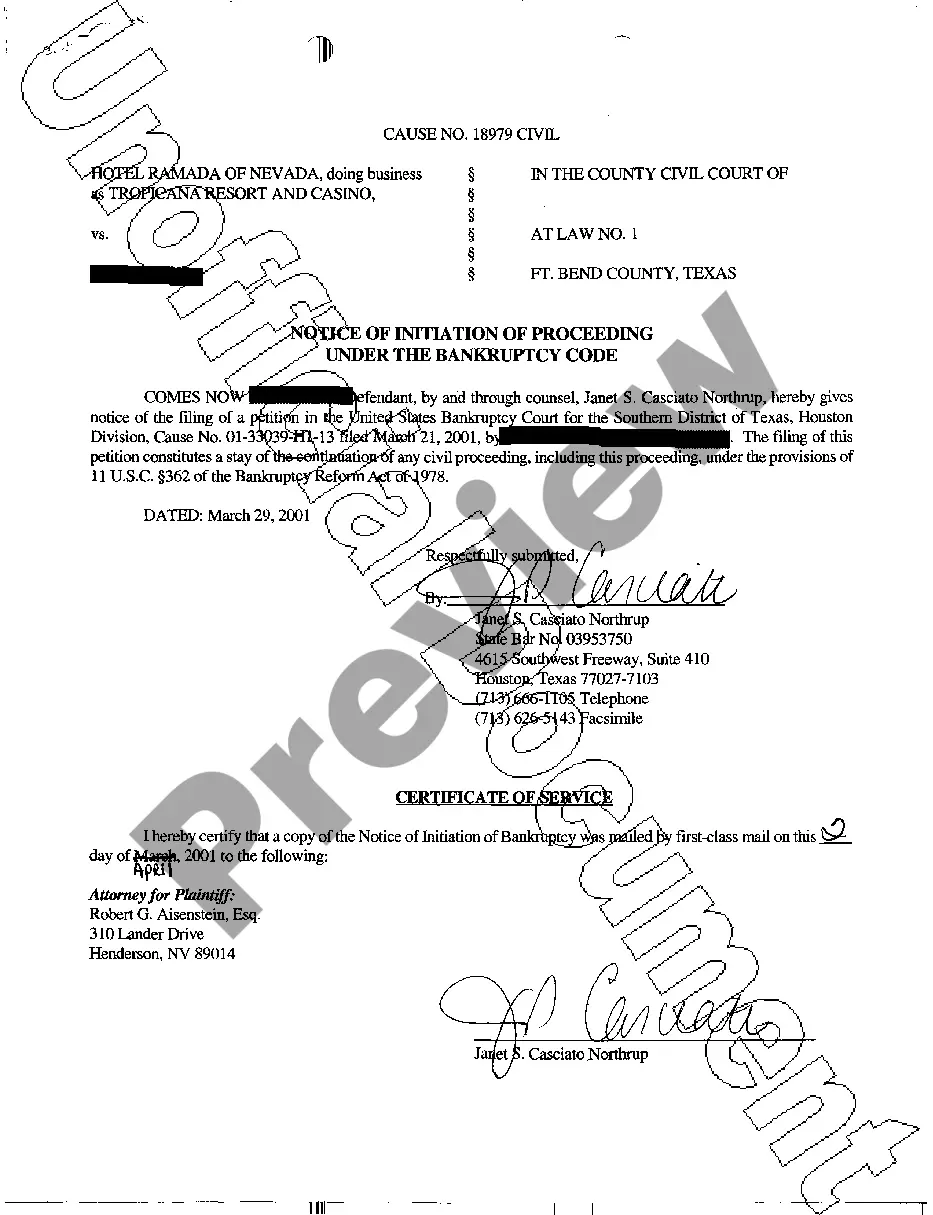

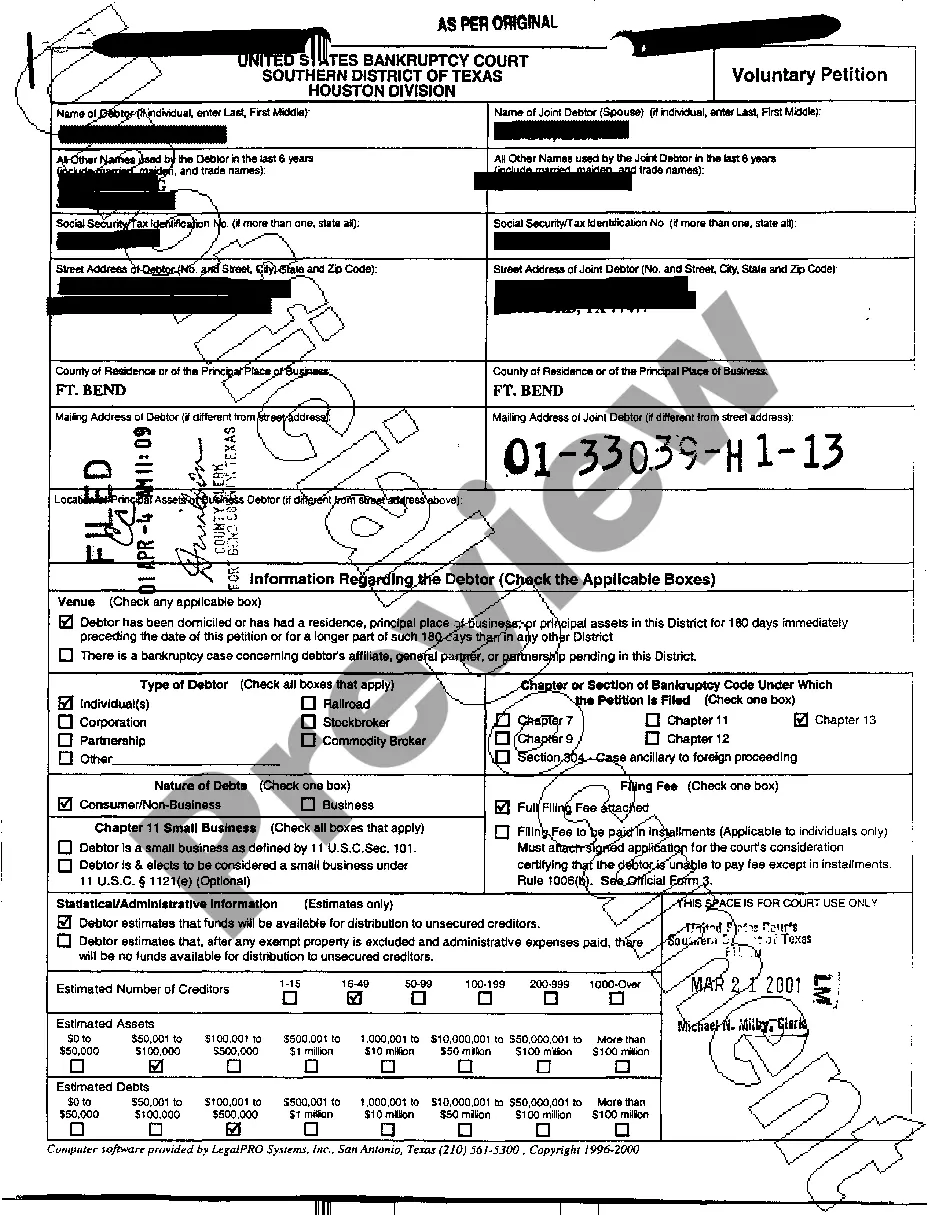

Waco Texas Notice of Bankruptcy: Explained and Types You Should Know In Waco, Texas, individuals and businesses who face overwhelming debt and financial challenges may consider filing for bankruptcy as a means of obtaining a fresh start. The Waco Texas Notice of Bankruptcy plays a crucial role in the bankruptcy process by notifying creditors, courts, and other parties about the debtor's intention to seek debt relief under the U.S. Bankruptcy Code. This detailed description will shed light on what the Waco Texas Notice of Bankruptcy entails and highlight different types of bankruptcy filings commonly seen in Waco. The Waco Texas Notice of Bankruptcy, also referred to as the Bankruptcy Notice or Notice of Commencement, acts as the legal documentation that initiates and notifies interested parties of a bankruptcy case. Filed with the bankruptcy court, this notice provides vital information about the debtor, their attorney, the specific chapter under which they filed bankruptcy, and details regarding scheduled creditor meetings and court hearings. In Waco, two primary types of bankruptcy filings are prevalent: Chapter 7 bankruptcy and Chapter 13 bankruptcy. While both chapters aim to provide debt relief, they have distinct differences in terms of eligibility requirements, debt discharge, and repayment plans. 1. Waco Texas Notice of Chapter 7 Bankruptcy: Chapter 7 bankruptcy, often referred to as "liquidation bankruptcy," is the most common type of bankruptcy filing in Waco. Debtors who file for Chapter 7 bankruptcy typically have limited or no disposable income, making it challenging for them to repay their debts. The Notice of Chapter 7 Bankruptcy provides creditors with essential information such as the appointment of a bankruptcy trustee, the deadline for filing claims, and the date of the meeting of creditors (341 meeting). 2. Waco Texas Notice of Chapter 13 Bankruptcy: Chapter 13 bankruptcy, also known as "reorganization bankruptcy," allows individuals with a steady income to create a court-approved repayment plan to repay a portion of their debts over a specified period, usually three to five years. Debtors intending to file for Chapter 13 bankruptcy in Waco must submit a comprehensive Notice of Chapter 13 Bankruptcy, including their proposed repayment plan and other relevant financial information. This notice enables creditors to review and participate in the repayment plan confirmation process, ensuring their rights and interests are considered. It's worth noting that Waco Texas Notice of Bankruptcy may also apply to other bankruptcy chapters, such as Chapter 11 (reorganization for businesses) and Chapter 12 (specifically for farmers and fishermen). However, Chapter 7 and Chapter 13 are primarily observed in consumer bankruptcy cases in Waco. In summary, the Waco Texas Notice of Bankruptcy is a vital document that initiates and informs interested parties about a debtor's bankruptcy filing. It enables creditors and other entities to actively participate in the process, ensuring their rights are protected. By understanding the different types of bankruptcy filings prevalent in Waco, individuals and businesses can make informed decisions regarding which chapter best suits their financial circumstances. Whether it's Chapter 7 or Chapter 13 bankruptcy, seeking professional advice from an experienced bankruptcy attorney in Waco is crucial to navigate through the complex bankruptcy process successfully.

Waco Texas Notice of Bankruptcy

Description

How to fill out Waco Texas Notice Of Bankruptcy?

Do you need a reliable and inexpensive legal forms supplier to buy the Waco Texas Notice of Bankruptcy? US Legal Forms is your go-to choice.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Waco Texas Notice of Bankruptcy conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is good for.

- Restart the search if the template isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Waco Texas Notice of Bankruptcy in any available format. You can get back to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal paperwork online for good.