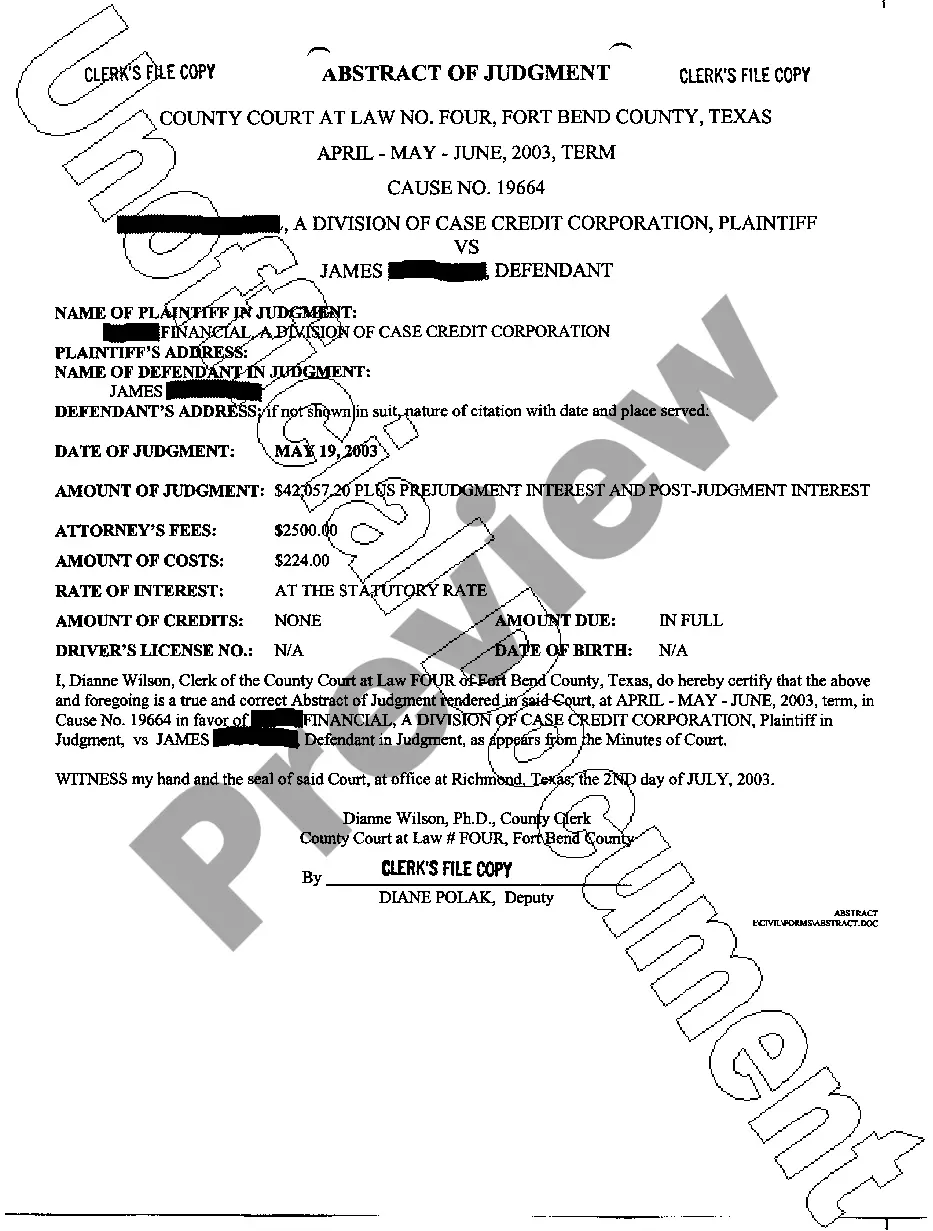

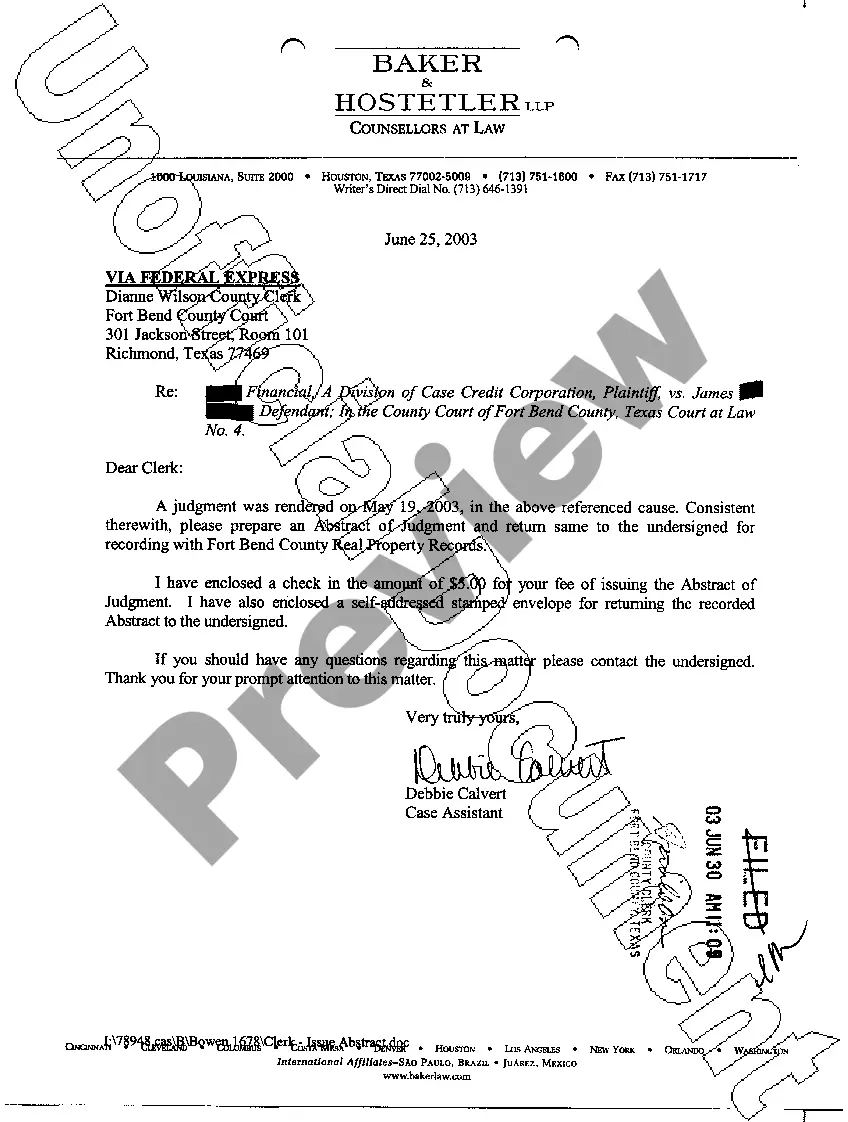

Title: Understanding McKinney Texas Abstract of Judgment: Types and Detailed Description Introduction: The McKinney Texas Abstract of Judgment is a legal document that serves to legally enforce the collection of a court-ordered monetary judgment in McKinney, Texas. It acts as a lien against the debtor's property, giving the creditor rights to enforce the judgment through various means. This article provides a detailed description of McKinney Texas Abstract of Judgment, including its purpose, significance, and different types. 1. Purpose of McKinney Texas Abstract of Judgment: The primary purpose of the McKinney Texas Abstract of Judgment is to record and establish a lien on the debtor's property. By doing so, it notifies potential buyers or lenders about the existence of a judgment against the debtor, preventing them from purchasing or financing the property without satisfying the judgment first. It also aids the creditor in collecting the debt by granting legal rights and options for enforcement. 2. Significance of McKinney Texas Abstract of Judgment: 2.1 Protecting the Creditor's Rights: By filing an abstract of judgment, the creditor ensures their priority in claiming the owed debt from the debtor's assets, safeguarding their interests. 2.2 Preventing Fraudulent Transfers: An abstract of judgment helps in preventing debtors from fraudulently transferring their assets to evade paying the judgment. It effectively maintains the creditor's claim on the property, regardless of any subsequent transfers. 2.3 Public Record: The abstract of judgment becomes a part of the public record, making it accessible to anyone interested in conducting due diligence on the property or the debtor's financial history. 3. Types of McKinney Texas Abstract of Judgment: 3.1 General Abstract of Judgment: This type of abstract of judgment is applicable to debts ranging from personal loans to business-related cases. It signifies the creditor's legal right to pursue and enforce the judgment against the debtor's property. 3.2 Child Support Abstract of Judgment: Specifically for child support debts, this type of abstract of judgment ensures that unpaid child support amounts become a priority for collection once other creditors are satisfied. It helps secure the unpaid support by establishing a lien on the debtor's property. 3.3 Tax Abstract of Judgment: Pertaining to unpaid tax debts owed to the state or federal government, this abstract of judgment authorizes the collection of taxes owed by placing a lien on the debtor's property, bank accounts, or other assets. Conclusion: McKinney Texas Abstract of Judgment plays a crucial role in enforcing court-ordered monetary judgments and protecting creditor's rights in McKinney, Texas. It serves as a lien against the debtor's property, notifying potential buyers or lenders of the existence of a judgment while providing legal means for enforcement. The different types, including general abstracts, child support abstracts, and tax abstracts, cater to specific types of debts, ensuring efficient collection and priority of payment.

McKinney Texas Abstract of Judgment

Description

How to fill out McKinney Texas Abstract Of Judgment?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we apply for legal services that, usually, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the McKinney Texas Abstract of Judgment or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the McKinney Texas Abstract of Judgment complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the McKinney Texas Abstract of Judgment is proper for you, you can choose the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!