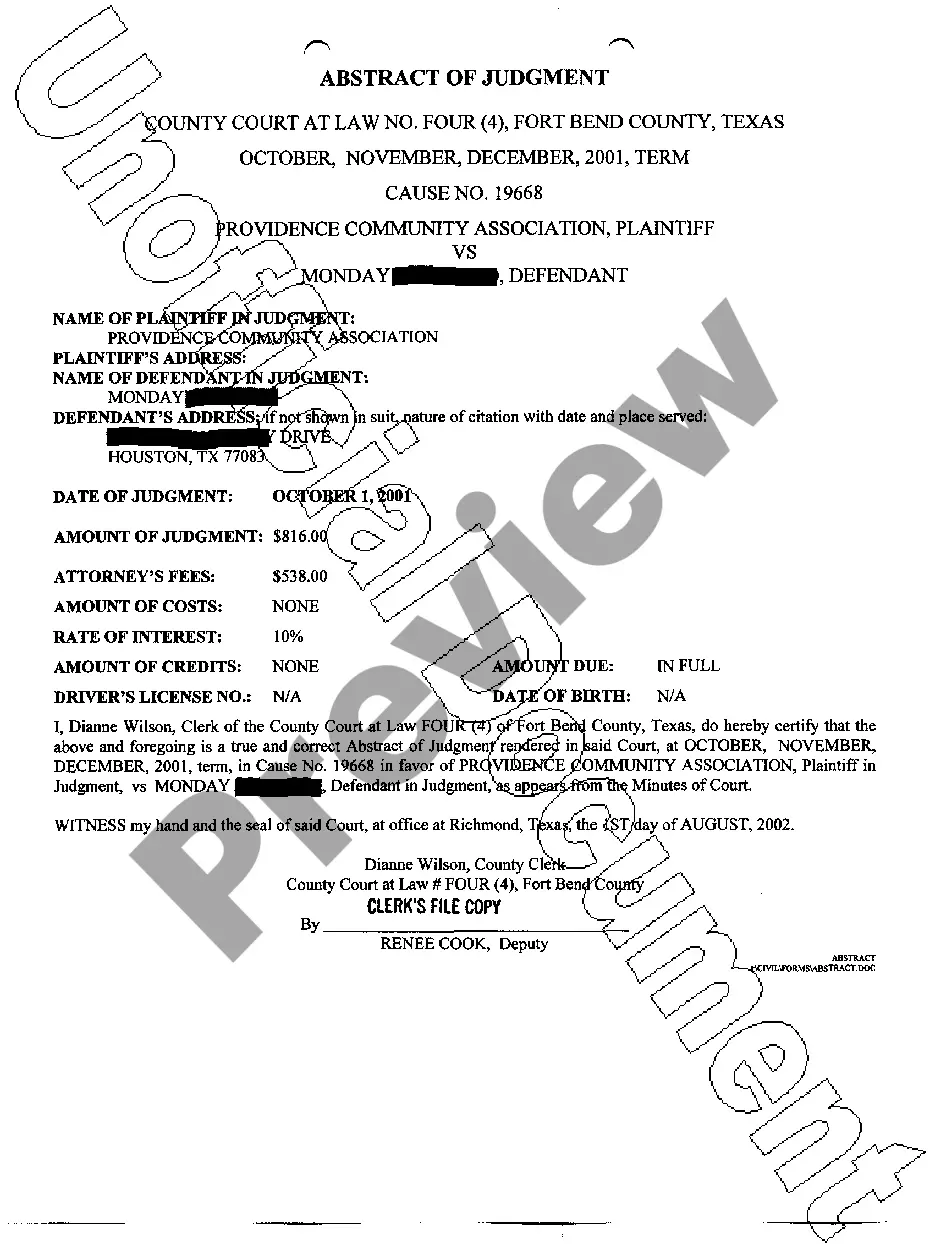

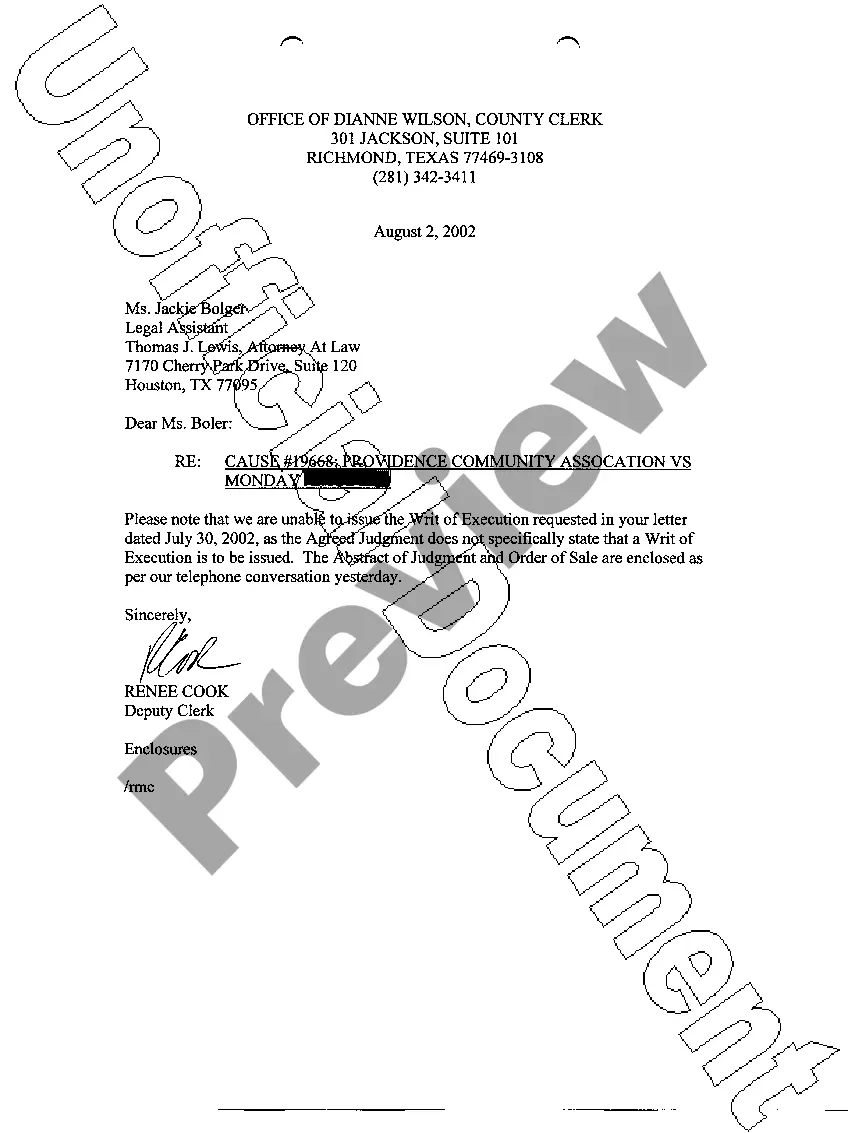

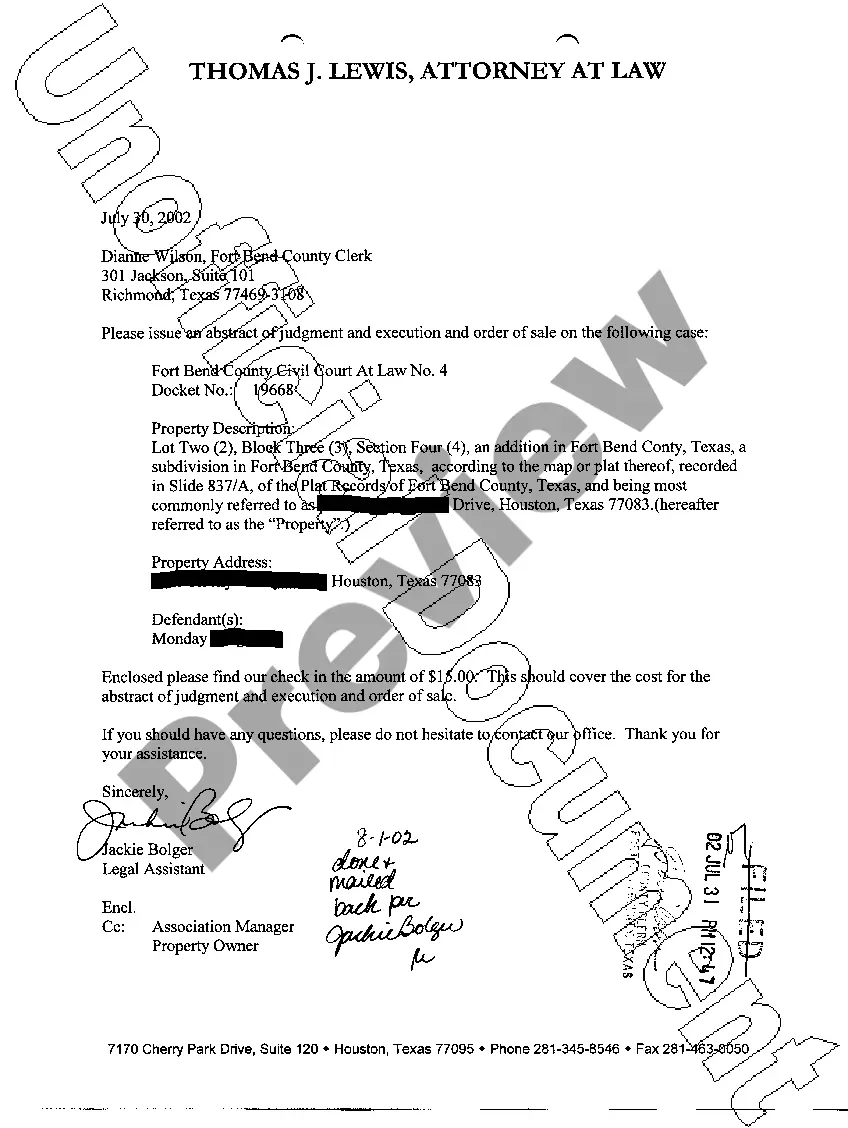

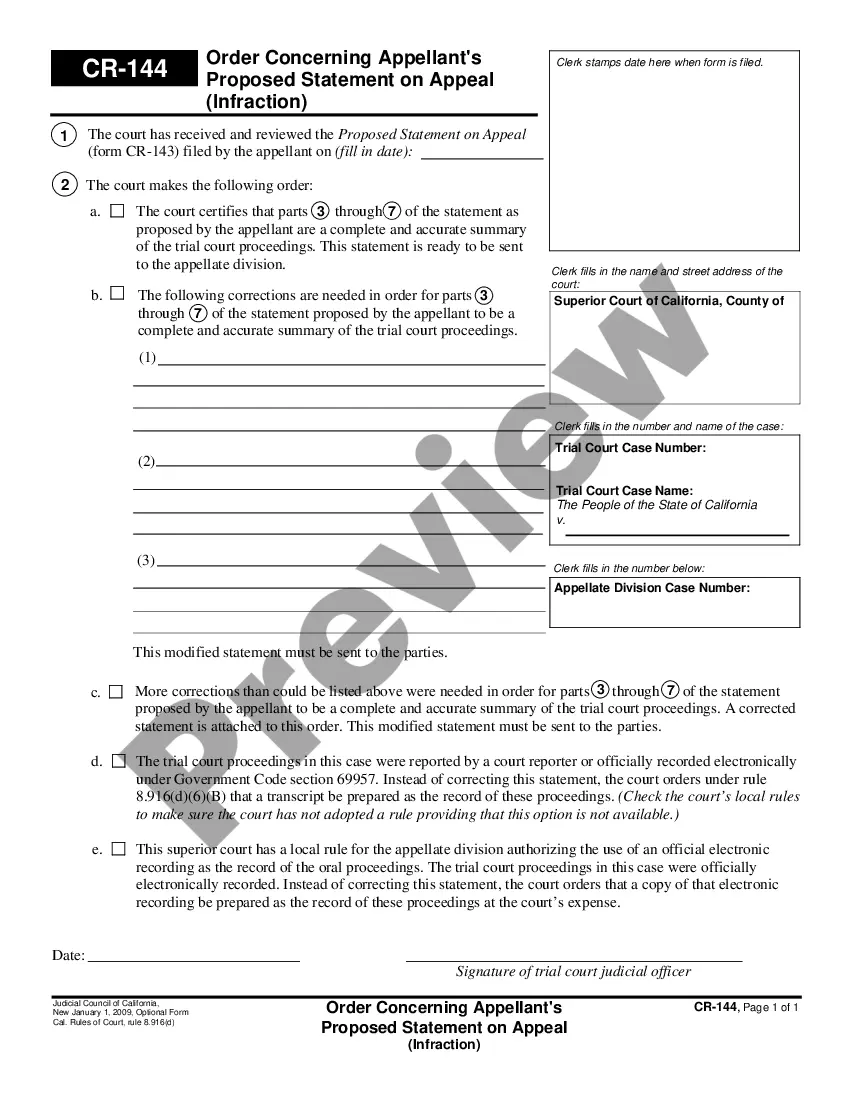

Fort Worth Texas Abstract of Judgment is a legal document that represents a court judgment against a debtor in Tarrant County, Texas. It serves as a notice to the public that a judgment has been entered against an individual or entity and provides the creditor with the right to collect the judgment debt from the debtor's assets. An Abstract of Judgment is typically filed by a creditor after obtaining a favorable judgment in a civil case. The abstract includes essential information, such as the names of the parties involved, the case number, the date of the judgment, the amount of money owed (including any interest or fees), and the court where the judgment was entered. It essentially acts as a tangible record of the judgment for future reference. The purpose of filing an Abstract of Judgment is to create a lien against the debtor's real property located in Tarrant County, Texas. This means that if the debtor owns any property in the county, such as a house or land, the creditor's claim will be secured by a lien on that property. If the debtor attempts to sell the property, the Abstract of Judgment must be satisfied (paid) before the property can be transferred to another individual or entity. There are several types of Abstracts of Judgment that may be issued in Fort Worth, Texas, depending on the specific circumstances: 1. General Abstract of Judgment: This is the most common type of Abstract of Judgment and applies in cases where the judgment is based on a debt owed by the debtor. It is typically filed when the debtor fails to pay a monetary judgment within the timeframe set by the court. 2. Child Support Abstract of Judgment: This type of Abstract of Judgment is used in cases where the judgment is related to unpaid child support or alimony payments. It ensures that the delinquent payments are secured by a lien on the debtor's property. 3. Tax Abstract of Judgment: This type of Abstract of Judgment is typically issued by the Internal Revenue Service (IRS) or the Texas Comptroller of Public Accounts when the debtor owes unpaid taxes. It provides the government with the authority to collect the owed taxes from the debtor's assets. It is important to note that filing an Abstract of Judgment does not guarantee immediate payment. Furthermore, it merely establishes the creditor's right to collect the debt from the debtor's assets if and when they become available. The creditor may still need to take further legal action, such as wage garnishment or bank account levies, to enforce the judgment and ensure payment.

Fort Worth Texas Abstract of Judgment

Description

How to fill out Fort Worth Texas Abstract Of Judgment?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Fort Worth Texas Abstract of Judgment or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Fort Worth Texas Abstract of Judgment adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Fort Worth Texas Abstract of Judgment is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!