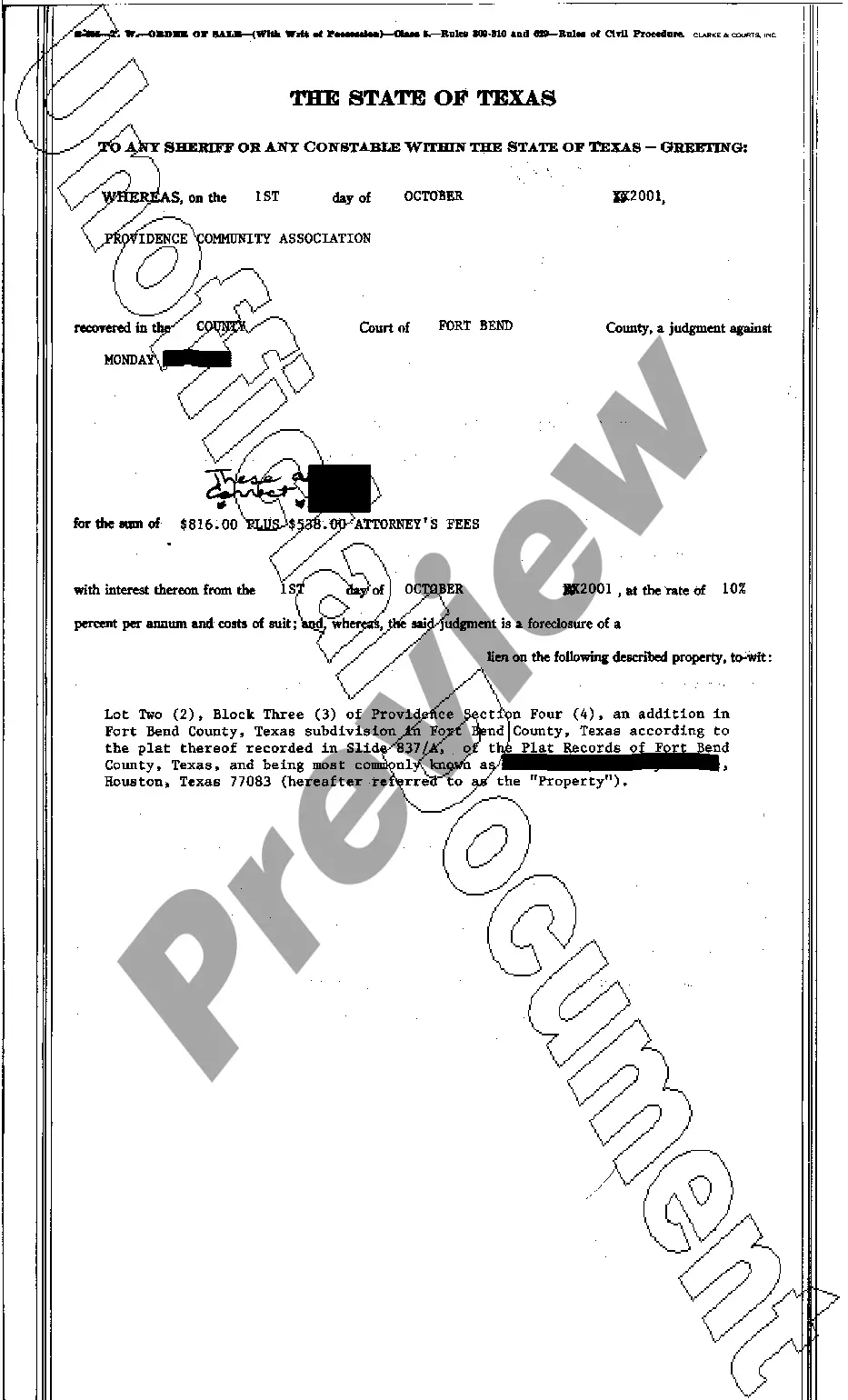

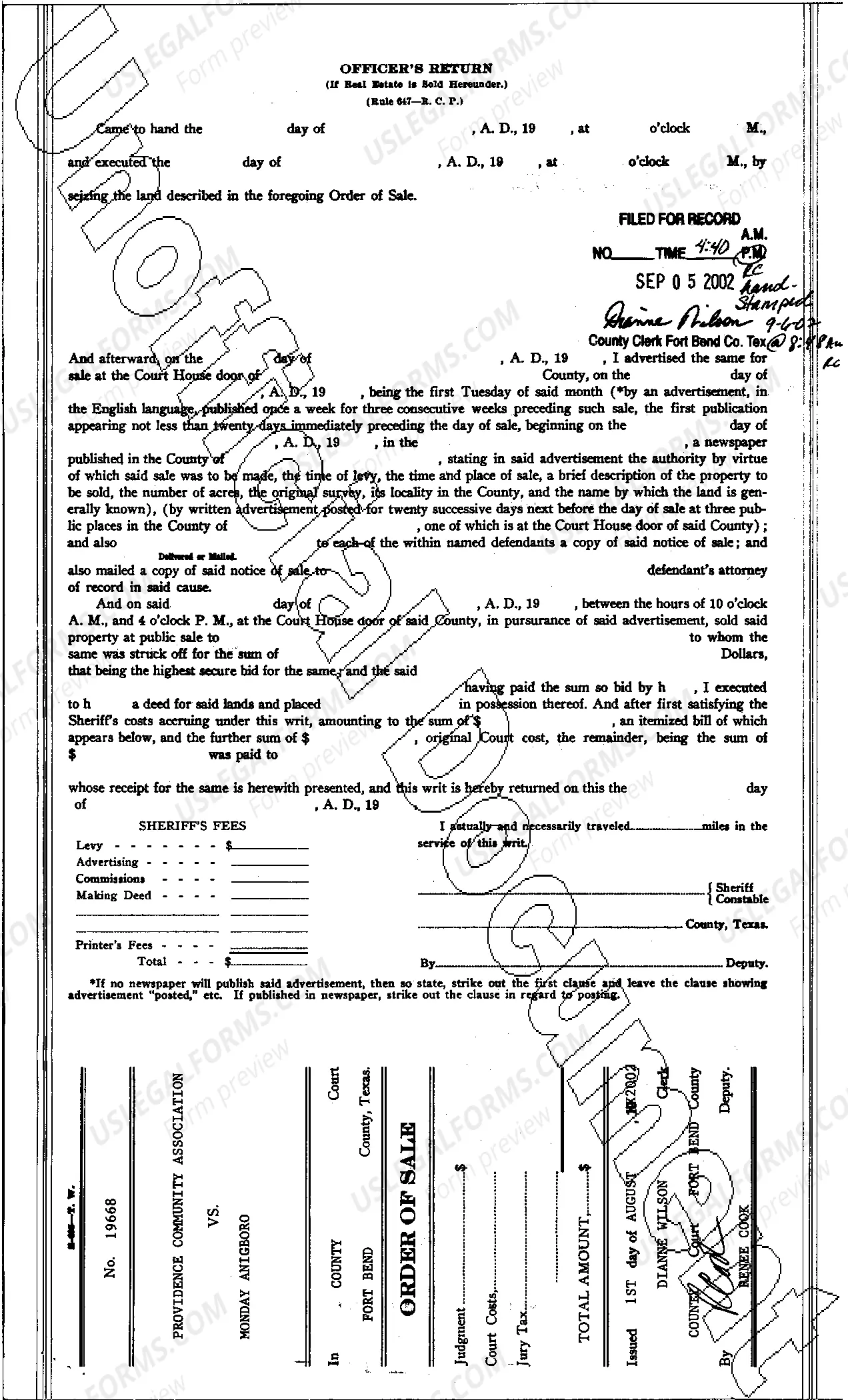

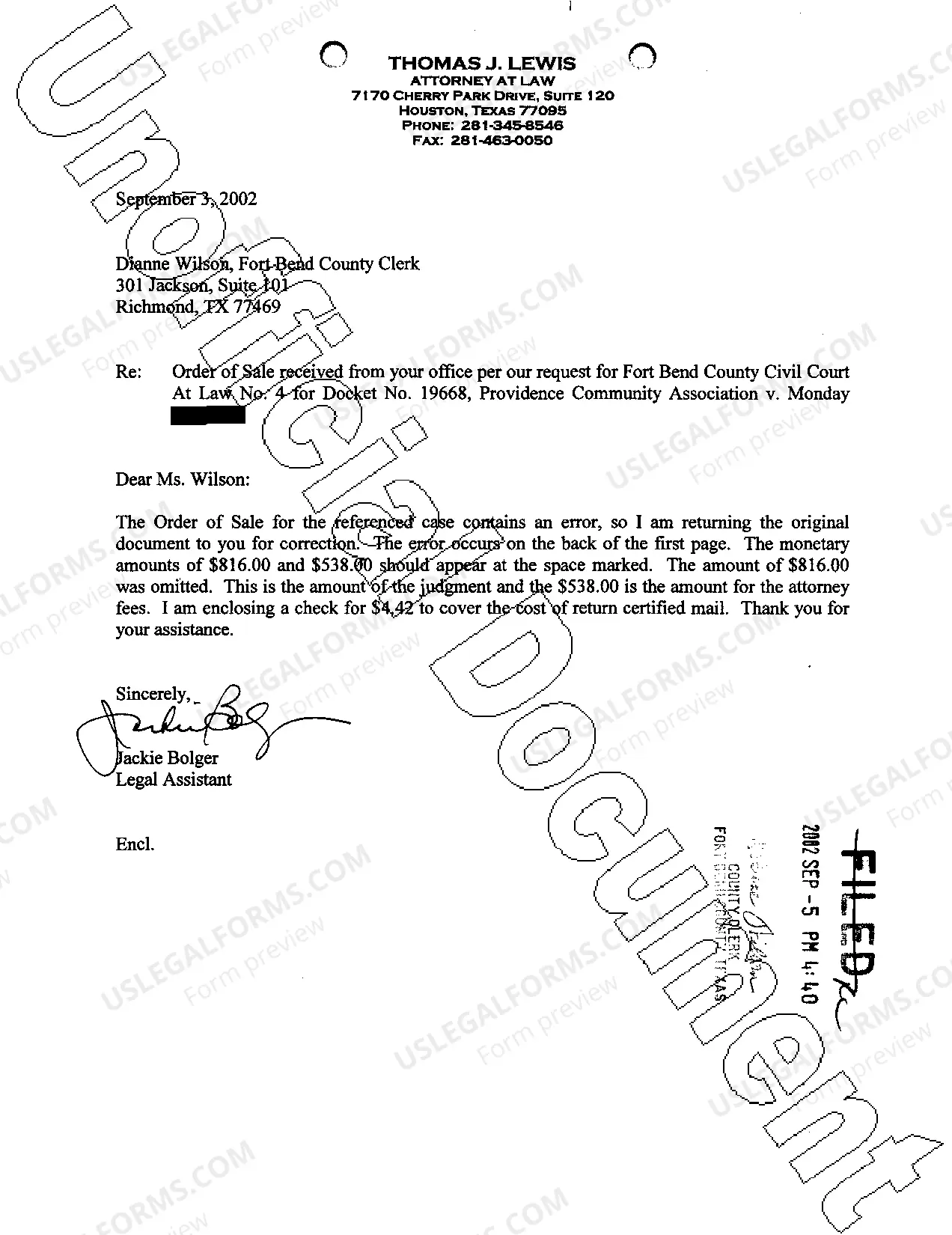

The Beaumont Texas Order of Sale is a legal process initiated to sell a property due to non-payment of debts or foreclosure. It is carried out by the court system to satisfy outstanding obligations and regain monetary value from the property in question. This description will outline the concept of Order of Sale in Beaumont, Texas, providing essential information about its purpose, procedure, and different types. The Order of Sale in Beaumont, Texas serves as a crucial step in the foreclosure process when a property owner fails to fulfill their financial obligations, such as mortgage payments, unpaid taxes, or other liens. Once a court declares the property as subject to foreclosure, the process begins, leading up to the Order of Sale. The purpose of an Order of Sale is to facilitate the auctioning of the property to the highest bidder, ensuring that the lender or creditor recovers the outstanding amount owed. The proceeds from the sale are used to pay off the debts, including any outstanding charges associated with the foreclosure process. There are several types of Order of Sale in Beaumont, Texas: 1. Judicial Order of Sale: This is the most common type, where the court oversees the entire foreclosure process. The court appoints a trustee or sheriff to conduct the sale, ensuring transparency and fairness. The property is typically auctioned at a public auction, and the highest bidder becomes the new owner. 2. Tax Order of Sale: This type of Order of Sale is specific to unpaid property taxes. Beaumont, Texas imposes strict penalties for delinquent tax payments, and if the owner fails to settle the outstanding taxes within a specified period, the property can be subject to a tax Order of Sale. The tax authorities conduct the auction, and the highest bidder obtains ownership. 3. Mortgage Order of Sale: When a property owner defaults on mortgage payments, the lender can initiate a foreclosure process, which may eventually lead to an Order of Sale. The lender files a lawsuit against the borrower, and if the court finds the borrower in default, an Order of Sale is issued. The property is then sold to the highest bidder, and the lender recovers the outstanding amount. It is important for property owners in Beaumont, Texas to be aware of the implications of an Order of Sale. It is advisable to seek the assistance of legal professionals and explore options to avoid foreclosure and the subsequent Order of Sale.

Beaumont Texas Order of Sale

State:

Texas

City:

Beaumont

Control #:

TX-G0155

Format:

PDF

Instant download

This form is available by subscription

Description

A08 Order of Sale

The Beaumont Texas Order of Sale is a legal process initiated to sell a property due to non-payment of debts or foreclosure. It is carried out by the court system to satisfy outstanding obligations and regain monetary value from the property in question. This description will outline the concept of Order of Sale in Beaumont, Texas, providing essential information about its purpose, procedure, and different types. The Order of Sale in Beaumont, Texas serves as a crucial step in the foreclosure process when a property owner fails to fulfill their financial obligations, such as mortgage payments, unpaid taxes, or other liens. Once a court declares the property as subject to foreclosure, the process begins, leading up to the Order of Sale. The purpose of an Order of Sale is to facilitate the auctioning of the property to the highest bidder, ensuring that the lender or creditor recovers the outstanding amount owed. The proceeds from the sale are used to pay off the debts, including any outstanding charges associated with the foreclosure process. There are several types of Order of Sale in Beaumont, Texas: 1. Judicial Order of Sale: This is the most common type, where the court oversees the entire foreclosure process. The court appoints a trustee or sheriff to conduct the sale, ensuring transparency and fairness. The property is typically auctioned at a public auction, and the highest bidder becomes the new owner. 2. Tax Order of Sale: This type of Order of Sale is specific to unpaid property taxes. Beaumont, Texas imposes strict penalties for delinquent tax payments, and if the owner fails to settle the outstanding taxes within a specified period, the property can be subject to a tax Order of Sale. The tax authorities conduct the auction, and the highest bidder obtains ownership. 3. Mortgage Order of Sale: When a property owner defaults on mortgage payments, the lender can initiate a foreclosure process, which may eventually lead to an Order of Sale. The lender files a lawsuit against the borrower, and if the court finds the borrower in default, an Order of Sale is issued. The property is then sold to the highest bidder, and the lender recovers the outstanding amount. It is important for property owners in Beaumont, Texas to be aware of the implications of an Order of Sale. It is advisable to seek the assistance of legal professionals and explore options to avoid foreclosure and the subsequent Order of Sale.

Free preview

How to fill out Beaumont Texas Order Of Sale?

If you’ve already used our service before, log in to your account and download the Beaumont Texas Order of Sale on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Beaumont Texas Order of Sale. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!