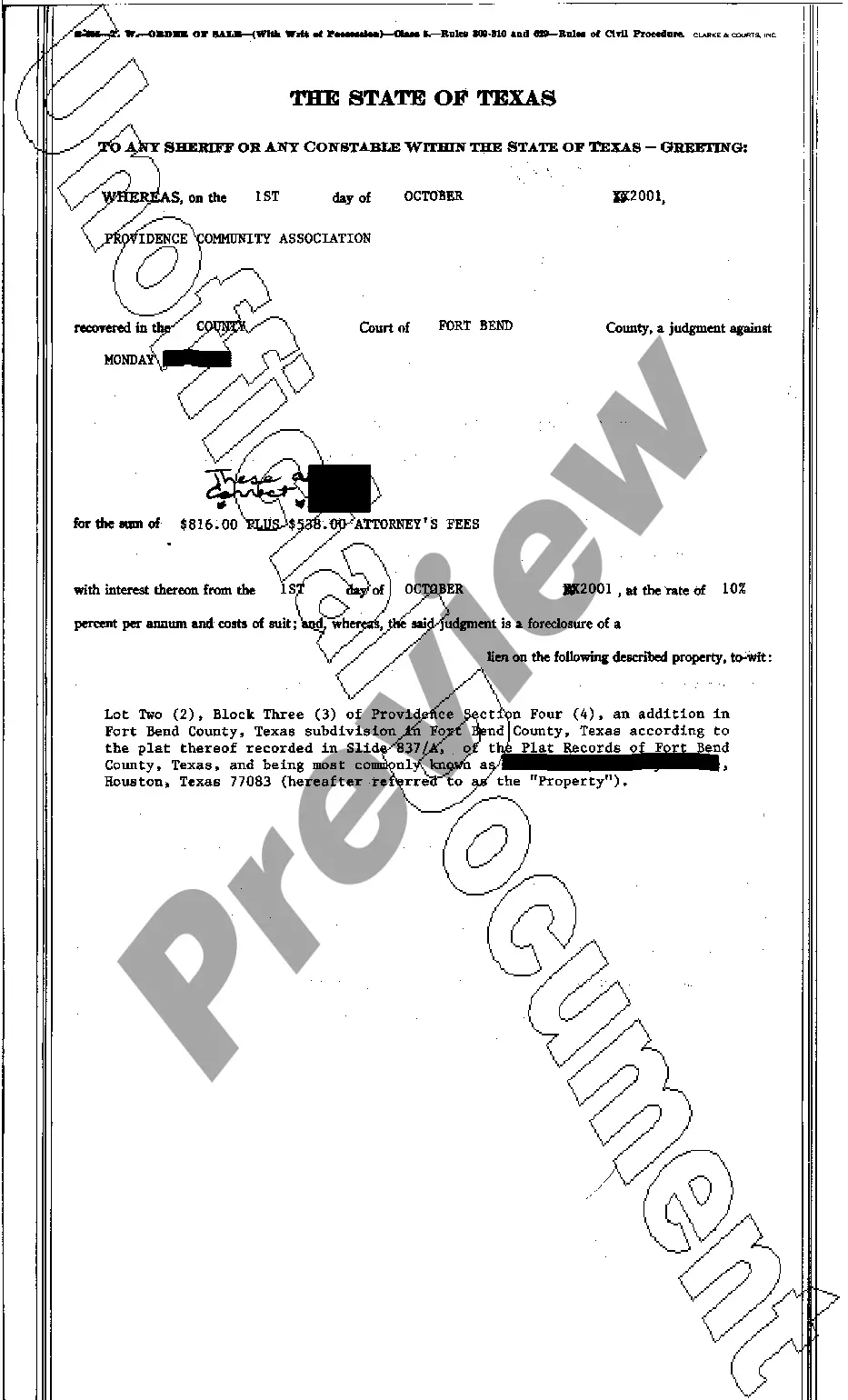

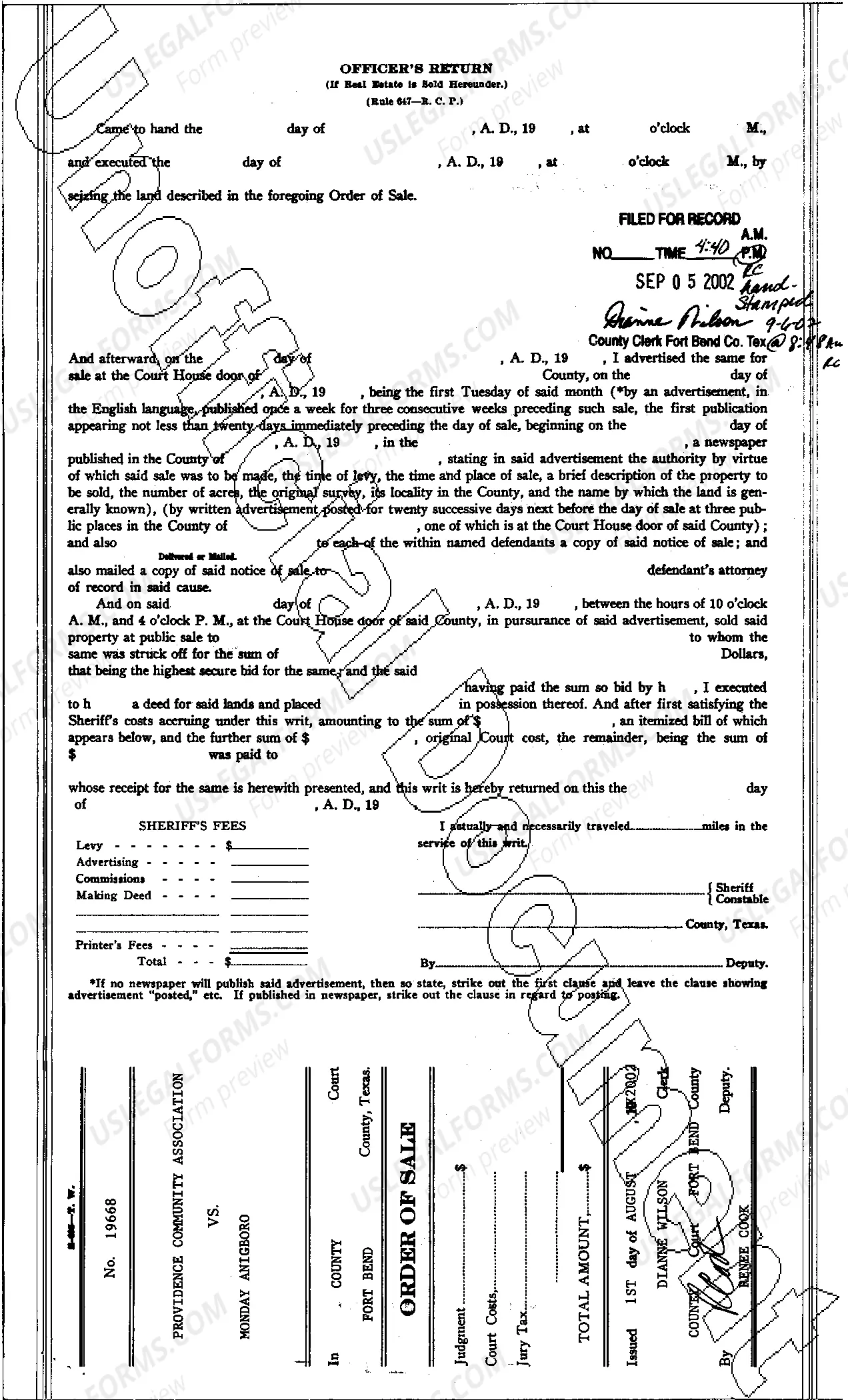

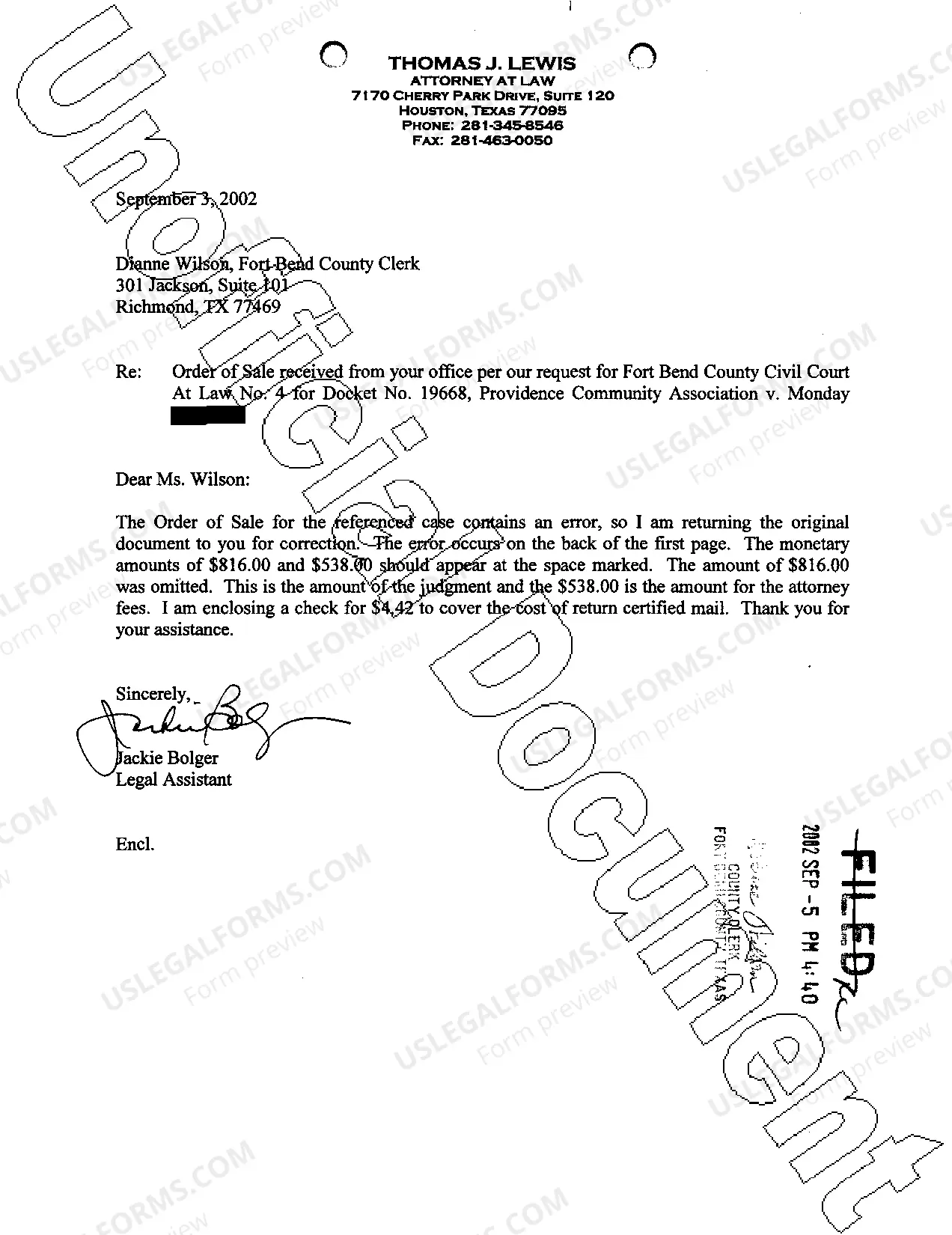

Collin Texas Order of Sale is a legal process that occurs in Collin County, Texas, which involves the sale of real estate properties to satisfy outstanding debts or unpaid taxes. This court-ordered sale aims to recover the dues owed to creditors or the government. In Collin County, Texas, there are primarily two types of Order of Sale: 1. Collin Texas Tax Order of Sale: This type of order is initiated by the Collin County Tax Assessor-Collector's office to collect unpaid property taxes. When property owners fail to fulfill their tax obligations, the county can file a tax suit against them. If the court finds the owner in default, it may issue a Collin Texas Tax Order of Sale, allowing the sale of the property to recover the unpaid taxes. 2. Collin Texas Judicial Order of Sale: This order of sale is typically issued by the court in response to a lawsuit filed by a creditor who has obtained a judgment against a property owner. When the debtor fails to honor their financial obligations, a judicial order can be issued, allowing the sale of the property. The proceeds from the sale are then used to satisfy the outstanding debt. The Collin Texas Order of Sale process involves various steps that include: 1. Lawsuit and Judgment: In the case of a judicial order, a lawsuit must be filed by the creditor, and a judgment must be obtained against the property owner. 2. Notice of Sale: Once the order of sale is issued by the court, a notice of sale is published in local newspapers as mandated by Texas law. This notice informs potential buyers about the upcoming sale and provides information about the property being sold. 3. Auction: The property is typically sold through a public auction where prospective buyers can bid on the property. The highest bidder secures the right to purchase the property. 4. Confirmation of Sale: After the auction, the court reviews the sale and must confirm that it was fair and conducted according to legal requirements. If confirmed, the sale is finalized. 5. Distribution of Proceeds: The proceeds from the sale are used to pay off the outstanding debt, including any applicable taxes, liens, and costs associated with the order of sale. Any remaining balance is returned to the property owner if applicable. It is important for property owners and potential buyers to be aware of the Collin Texas Order of Sale process and seek professional legal advice when involved in such proceedings. Keywords for this topic may include Collin County, Texas, property auction, tax delinquency, judgment, lawsuit, creditor, notice of sale, public auction, sale confirmation, property owner rights, and legal implications.

Collin Texas Order of Sale

Description

How to fill out Collin Texas Order Of Sale?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney services that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Collin Texas Order of Sale or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Collin Texas Order of Sale complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Collin Texas Order of Sale would work for your case, you can select the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!