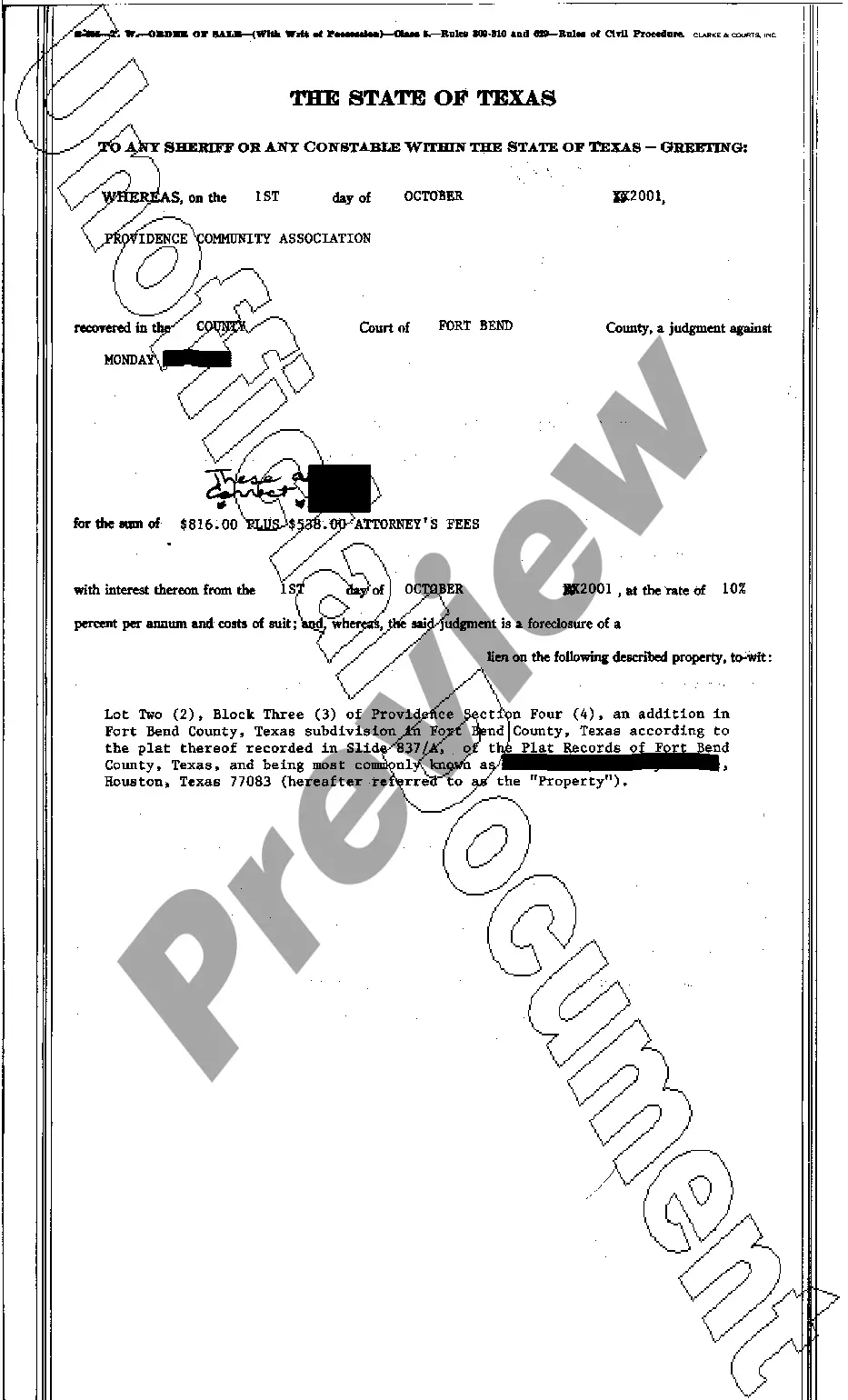

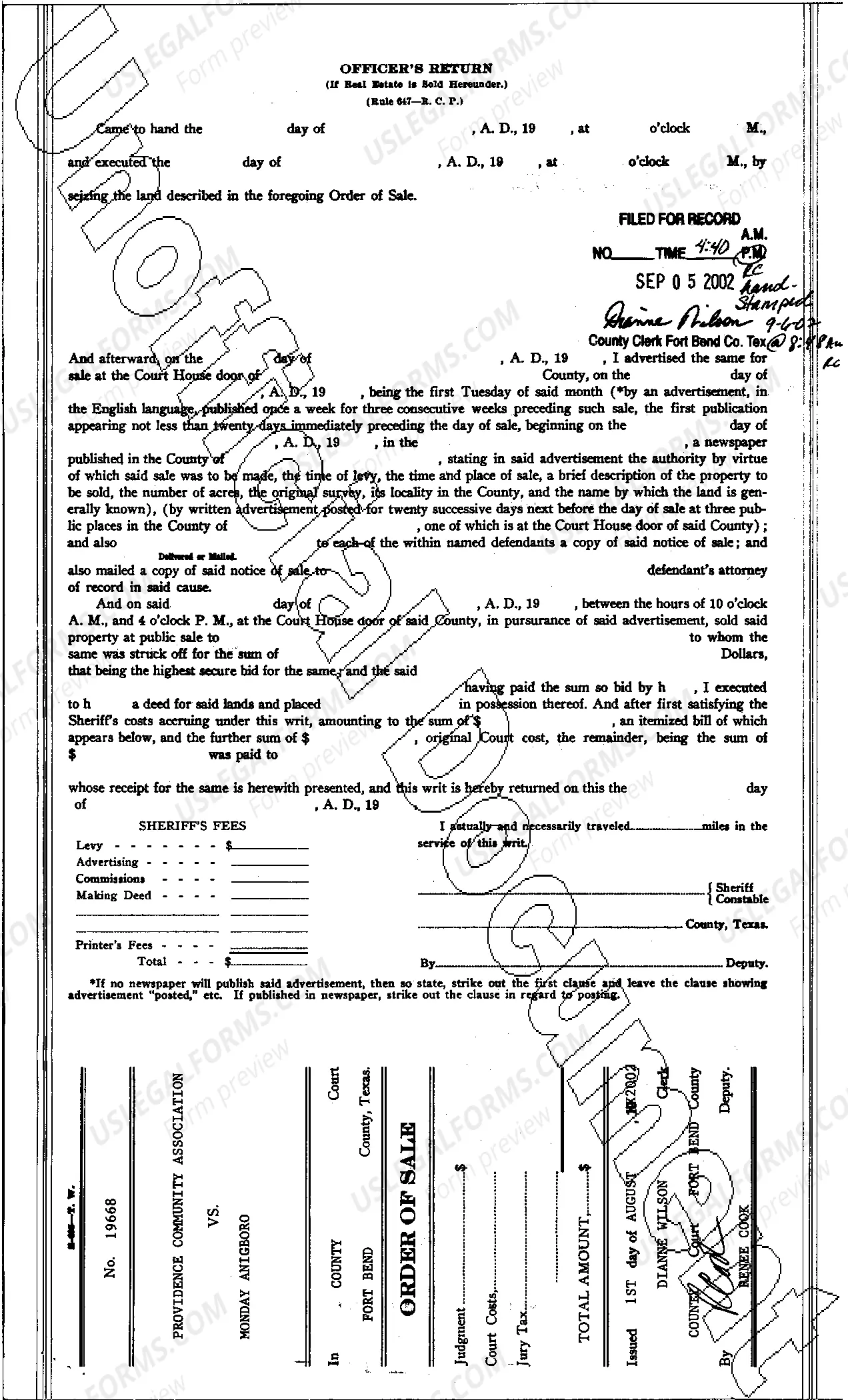

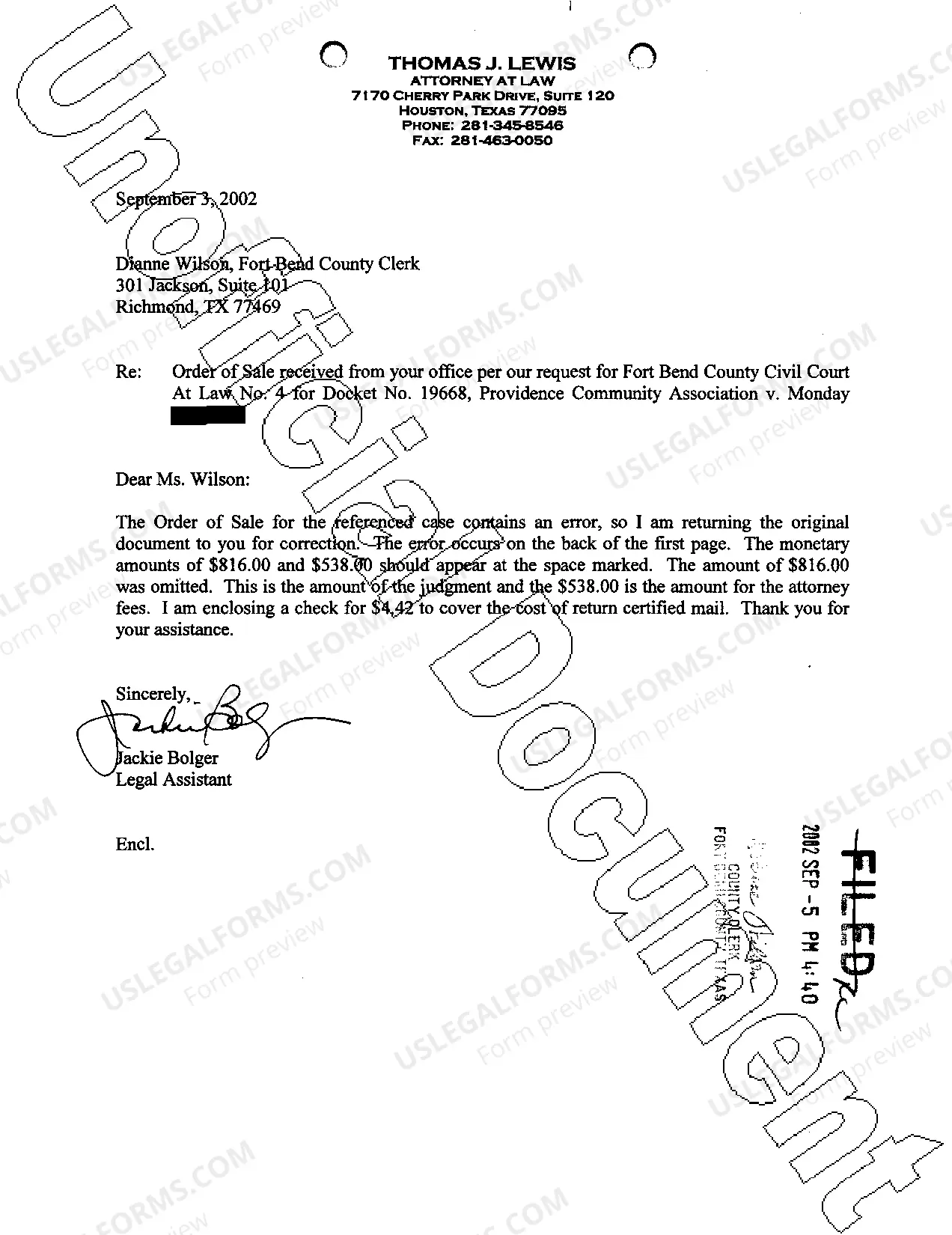

Pasadena Texas Order of Sale refers to the legal process through which a property is sold in Pasadena, Texas due to non-payment of mortgage or tax obligations. It is important to note that the specifics of Order of Sale may vary depending on the jurisdiction and the type of sale involved. Here, we would discuss two primary types of Order of Sale in Pasadena, Texas: 1. Mortgage Order of Sale: When a property owner fails to make mortgage payments, the lender may initiate a foreclosure process to recover the outstanding debt. The lender files a lawsuit and obtains a court-ordered Order of Sale, which allows them to sell the property to cover the unpaid mortgage. The Pasadena Texas Order of Sale for mortgage foreclosures typically involves advertising the sale, conducting an auction, and awarding the property to the highest bidder. The proceeds from the sale are then used to pay off the mortgage debt. 2. Tax Order of Sale: In Pasadena, Texas, if property taxes are left unpaid, the county government may initiate a tax foreclosure process. The county files a lawsuit against the property owner, and if the taxes remain unpaid, the court may issue an Order of Sale, allowing the property to be sold at a public auction. The proceeds from the tax Order of Sale are used to cover the unpaid taxes and any associated costs. This type of sale is typically conducted by the county tax assessor's office or a designated auctioneer. During the Pasadena Texas Order of Sale process, the property is advertised to notify potential buyers about the upcoming auction. Interested parties can participate by attending the auction and placing bids. Once the bidding is complete, the property is awarded to the highest bidder, subject to court confirmation. Successful bidders are required to provide a deposit and complete the remaining payment within a specified time frame. It is crucial for potential buyers to thoroughly research the property, review any liens or encumbrances, and assess its market value before participating in the Order of Sale auction. Additionally, buyers should follow all legal procedures and seek professional advice if needed to ensure a smooth and successful purchase. In summary, Pasadena Texas Order of Sale encompasses the legal processes involved in selling a property due to non-payment of mortgages or taxes. The two main types are mortgage Order of Sale and tax Order of Sale, each with its specific procedures. It is essential for both buyers and property owners to understand the intricacies of these processes to navigate through them effectively.

Pasadena Texas Order of Sale

Description

How to fill out Pasadena Texas Order Of Sale?

If you have previously made use of our service, Log In to your account and retrieve the Pasadena Texas Order of Sale on your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have permanent access to every document you have purchased: you can find it in your profile within the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to conveniently locate and save any template for your personal or business needs!

- Ensure you’ve found a relevant document. Review the description and use the Preview feature, if available, to determine if it fits your requirements. If it doesn’t meet your expectations, use the Search tab above to find the right one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Retrieve your Pasadena Texas Order of Sale. Select the file format for your document and store it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

No, in Pasadena, TX, a garage sale does not require a permit. It’s important, however, to adhere to certain guidelines and local regulations. Familiarizing yourself with the Pasadena Texas Order of Sale will help you understand any conditions for your sale, ensuring it runs smoothly. Enjoy the process of sharing your items with neighbors, all while being compliant.

In Pasadena, permits are typically required for organized events, construction, and specific business activities. For example, if you plan to host a larger event that involves gathering large crowds, you may need a permit. Understanding the Pasadena Texas Order of Sale guidelines helps ensure that you know what requires a permit. This way, you can stay compliant and avoid complications.

If you ever need a permit in Pasadena, Texas, the process is usually straightforward. Start by visiting the city's official website or contacting the local government office for specific instructions. While permits aren’t required for garage sales, understanding how to navigate the permitting process can be beneficial for larger events under the Pasadena Texas Order of Sale. Always stay informed, and you will find the right solutions.

The terms 'yard sale' and 'garage sale' are often used interchangeably, but they can have slight differences. A yard sale typically occurs in the front yard, while a garage sale happens in the garage or driveway. Regardless of the term, both types of sales allow you to sell unwanted items and declutter your home under the Pasadena Texas Order of Sale guidelines. This makes them a great option for recycling goods within your community.

In Texas, you generally do not need specific permission to hold a garage sale. However, it's smart to check local ordinances or neighborhood rules before planning your sale. The Pasadena Texas Order of Sale guidelines can provide clarity on any local regulations that may apply. Always ensure you comply with these guidelines to avoid potential issues.

Finding probate records online is simpler than you might think. You can visit the Harris County Clerk's website, which offers easy access to various public records, including probate files. Use the search tools available to look up specific cases or estates. This resource can be particularly helpful when researching matters related to the Pasadena Texas Order of Sale.

To get a copy of a probated will in Harris County, you can visit the Probate Court of Harris County. They maintain records of all probated wills in the area. You can request documents online or in person at their office. Make sure to have any pertinent information, as this will aid in your search, particularly if tied to the Pasadena Texas Order of Sale.

A writ of execution is a court order that allows the enforcement of a judgment. In Harris County, this document directs law enforcement to carry out actions such as seizing property. It typically comes into play after a court judgment that favors one party. Understanding this can be crucial for those dealing with the Pasadena Texas Order of Sale, as it may impact property ownership and sales.

The length of probate in Harris County can vary depending on the complexity of the estate. Generally, the process may take several months to over a year. Factors such as disputes among heirs, estate size, and the presence of debts can influence the timeline. Utilizing resources like USLegalForms can help simplify the process and provide necessary documentation for a smoother experience.

Yes, you can obtain a copy of a probated Will in Texas. Typically, these documents are filed in the county’s probate court where the Will was probated. You may need to visit the court in person or check their website for online access. This can be beneficial, especially if you are navigating the Pasadena Texas Order of Sale process.