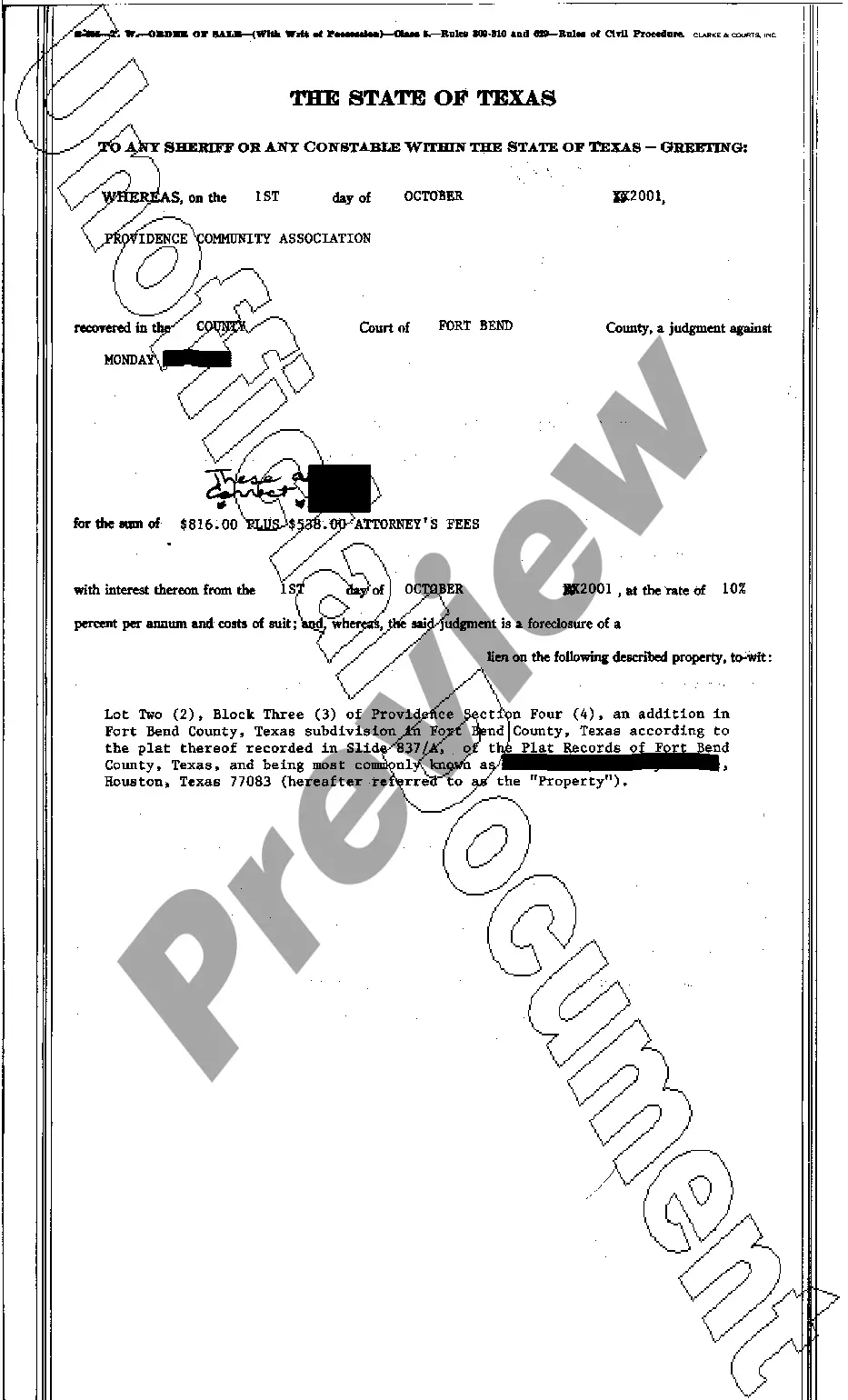

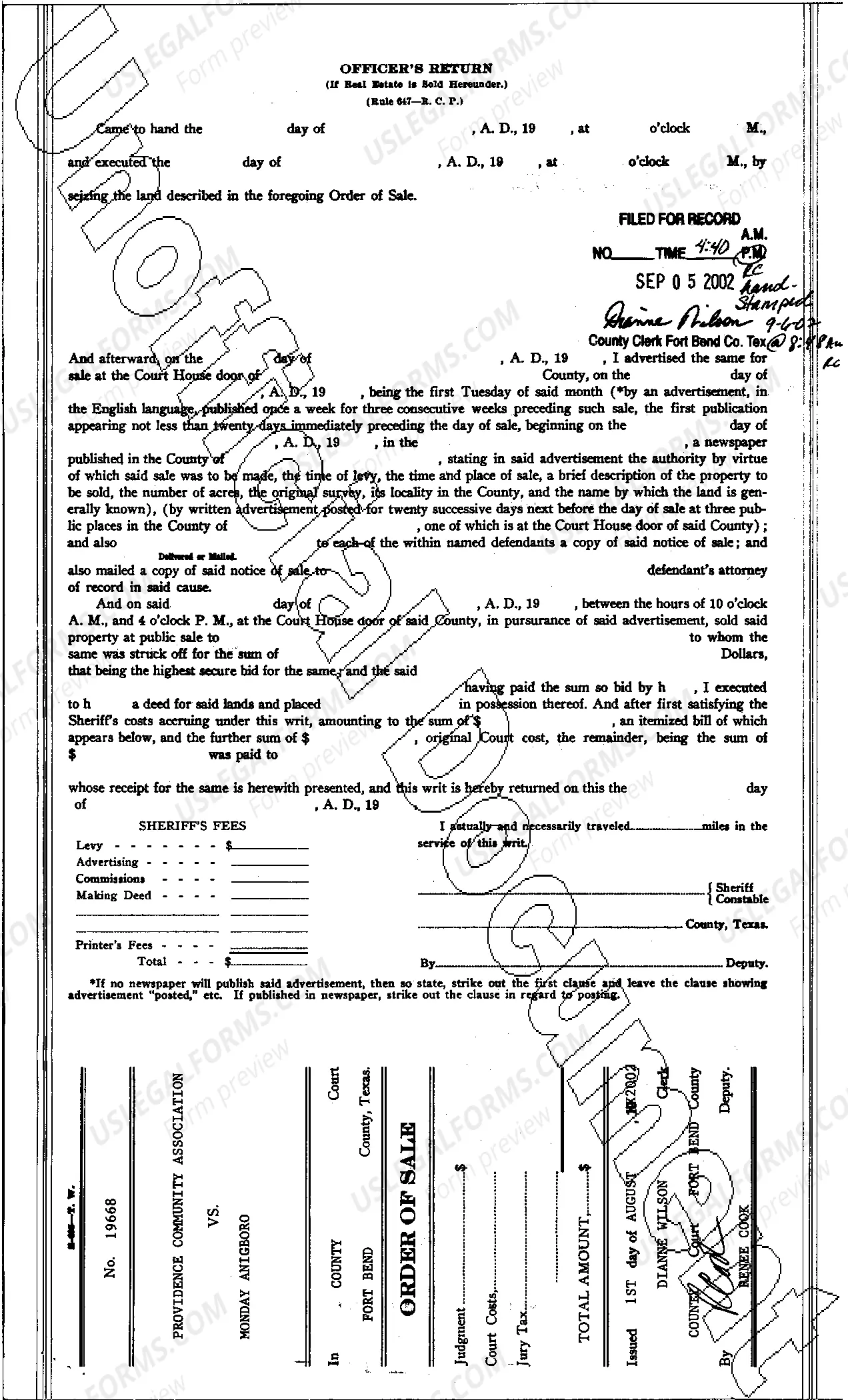

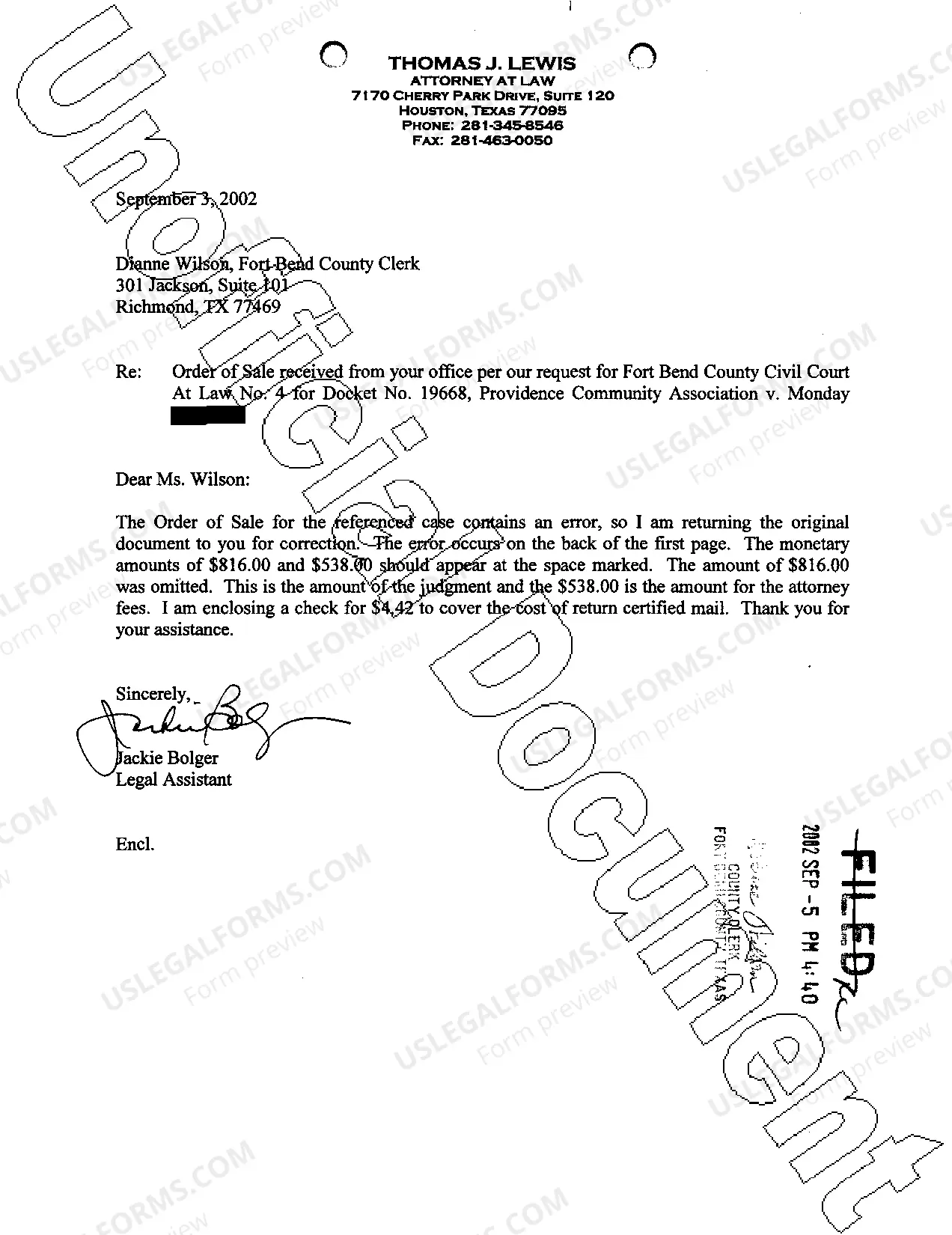

The Waco Texas Order of Sale is a legal process pertaining to the selling of properties in Waco, Texas. This order is typically initiated by a court in response to a foreclosure or tax lien situation, where the property owner fails to meet their financial obligations. When a property owner defaults on their mortgage payments or fails to pay property taxes, the lender or tax authority may file a lawsuit to obtain a judgment against the owner. Once the court declares a judgment, it issues an order of sale, which authorizes the sale of the property at a public auction or through other means. There are primarily two types of Waco Texas Order of Sale: foreclosure sale and tax sale. 1. Waco Texas Foreclosure Sale: In cases of mortgage default, the lender files a lawsuit against the property owner, seeking repayment of the outstanding debt. If successful, the court grants a judgment and orders the property to be sold as a foreclosure sale. The foreclosure auction is typically conducted by a trustee or sheriff, and the highest bidder becomes the new owner of the property. Keywords: Waco Texas foreclosure sale, mortgage default, lender, lawsuit, outstanding debt, judgment, auction, trustee, sheriff. 2. Waco Texas Tax Sale: When property owners fail to pay their property taxes, the tax authority can place a tax lien on the property. To recover the unpaid taxes, the tax authority follows a legal process that may result in an order of sale. The property is then sold at a tax sale auction, where bidders compete for ownership rights. The highest bidder either gains ownership of the property or a lien on the property, depending on the specific tax sale type (e.g., tax lien sale or tax deed sale). Keywords: Waco Texas tax sale, property taxes, tax lien, tax authority, unpaid taxes, order of sale, tax sale auction, bidders, ownership rights, tax lien sale, tax deed sale. In both types, the order of sale is an essential legal instrument that allows the property to be sold to recover outstanding debts (in foreclosure sale) or unpaid property taxes (in tax sale). Interested parties, such as real estate investors or individuals looking for potential property acquisitions, may participate in the auctions to acquire these distressed properties at potentially discounted prices. Whether it's a foreclosure sale or a tax sale, the Waco Texas Order of Sale plays a crucial role in the legal disposition of properties, facilitating the resolution of financial issues and providing opportunities for interested buyers in the real estate market.

Waco Texas Order of Sale

Description

How to fill out Waco Texas Order Of Sale?

Benefit from the US Legal Forms and obtain immediate access to any form template you require. Our helpful platform with a large number of templates allows you to find and obtain almost any document sample you need. You are able to download, fill, and certify the Waco Texas Order of Sale in just a couple of minutes instead of browsing the web for hours looking for the right template.

Using our catalog is an excellent strategy to improve the safety of your form filing. Our professional attorneys on a regular basis review all the documents to make sure that the forms are relevant for a particular state and compliant with new acts and regulations.

How can you obtain the Waco Texas Order of Sale? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. In addition, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Find the template you require. Make certain that it is the form you were hoping to find: examine its title and description, and take take advantage of the Preview feature if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Download the file. Pick the format to get the Waco Texas Order of Sale and edit and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable template libraries on the internet. We are always happy to help you in virtually any legal procedure, even if it is just downloading the Waco Texas Order of Sale.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!