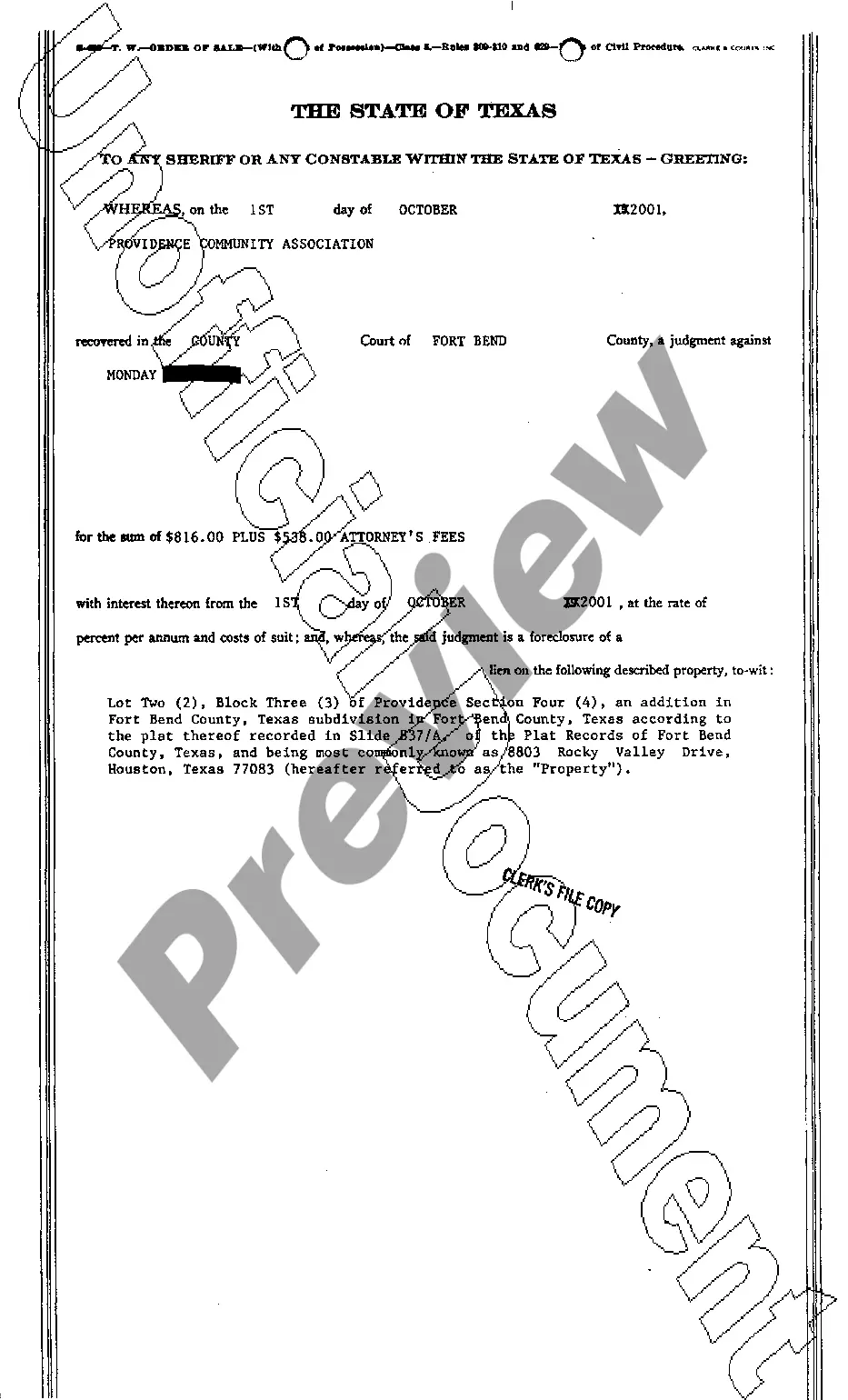

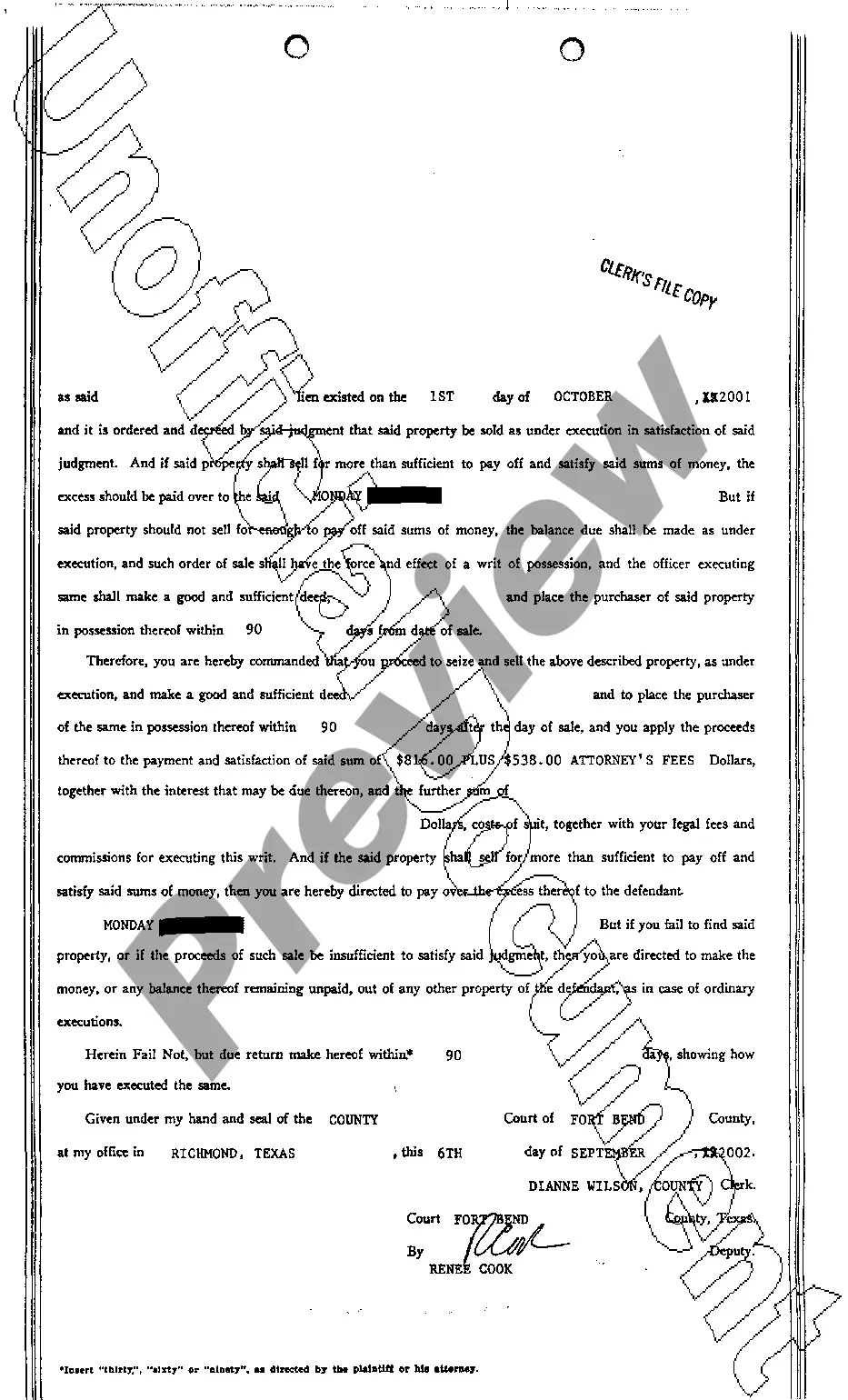

Killeen Texas Order of Sale refers to the legal process through which properties are sold by the court to repay outstanding debts or taxes. This type of sale occurs when a property owner fails to fulfill their financial obligations, leading to legal action taken against them. There are primarily two types of Killeen Texas Order of Sale: 1. Tax Order of Sale: When property owners fail to pay their property taxes, the local government may initiate a tax order of sale. This involves the sale of the property to recoup the unpaid tax amount. The tax order of sale is a form of public auction, where interested buyers bid on the property, and the highest bidder becomes the new owner. 2. Foreclosure Order of Sale: In cases where property owners default on their mortgage payments, the lender can seek a foreclosure order of sale to recover the outstanding loan amount. The foreclosure process involves several stages, including legal notices, auctions, and potential redemption periods for the property owner. Ultimately, the property is sold to the highest bidder during a public auction conducted by the court. The Killeen Texas Order of Sale process generally involves a thorough legal procedure to protect the rights of all parties involved. It typically requires filing a lawsuit, providing notice to the property owner, and conducting a public auction. The proceeds from the sale are used to cover outstanding debts, taxes, or mortgage obligations. Any excess funds may be returned to the property owner, while in some cases, they may be claimed by other creditors. It is important to note that the Killeen Texas Order of Sale can impact property owners negatively, as they may lose their homes or face financial repercussions. However, it also provides opportunities for interested buyers to acquire properties at potentially lower prices through public auctions. Overall, the Killeen Texas Order of Sale is a legal process utilized for the sale of properties due to unpaid debts or taxes. It encompasses tax order of sale for unpaid property taxes and foreclosure order of sale for defaulted mortgages. It is imperative for property owners to stay informed about their financial obligations to avoid entering into the Order of Sale situation.

Killeen Texas Order of Sale

Description

How to fill out Killeen Texas Order Of Sale?

Regardless of social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person with no legal background to create such paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you need the Killeen Texas Order of Sale or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Killeen Texas Order of Sale in minutes employing our reliable platform. In case you are already an existing customer, you can go on and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before obtaining the Killeen Texas Order of Sale:

- Ensure the template you have chosen is suitable for your area considering that the regulations of one state or area do not work for another state or area.

- Preview the document and go through a short outline (if available) of cases the document can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start again and search for the needed form.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your login information or create one from scratch.

- Select the payment gateway and proceed to download the Killeen Texas Order of Sale as soon as the payment is completed.

You’re good to go! Now you can go on and print the document or complete it online. Should you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.