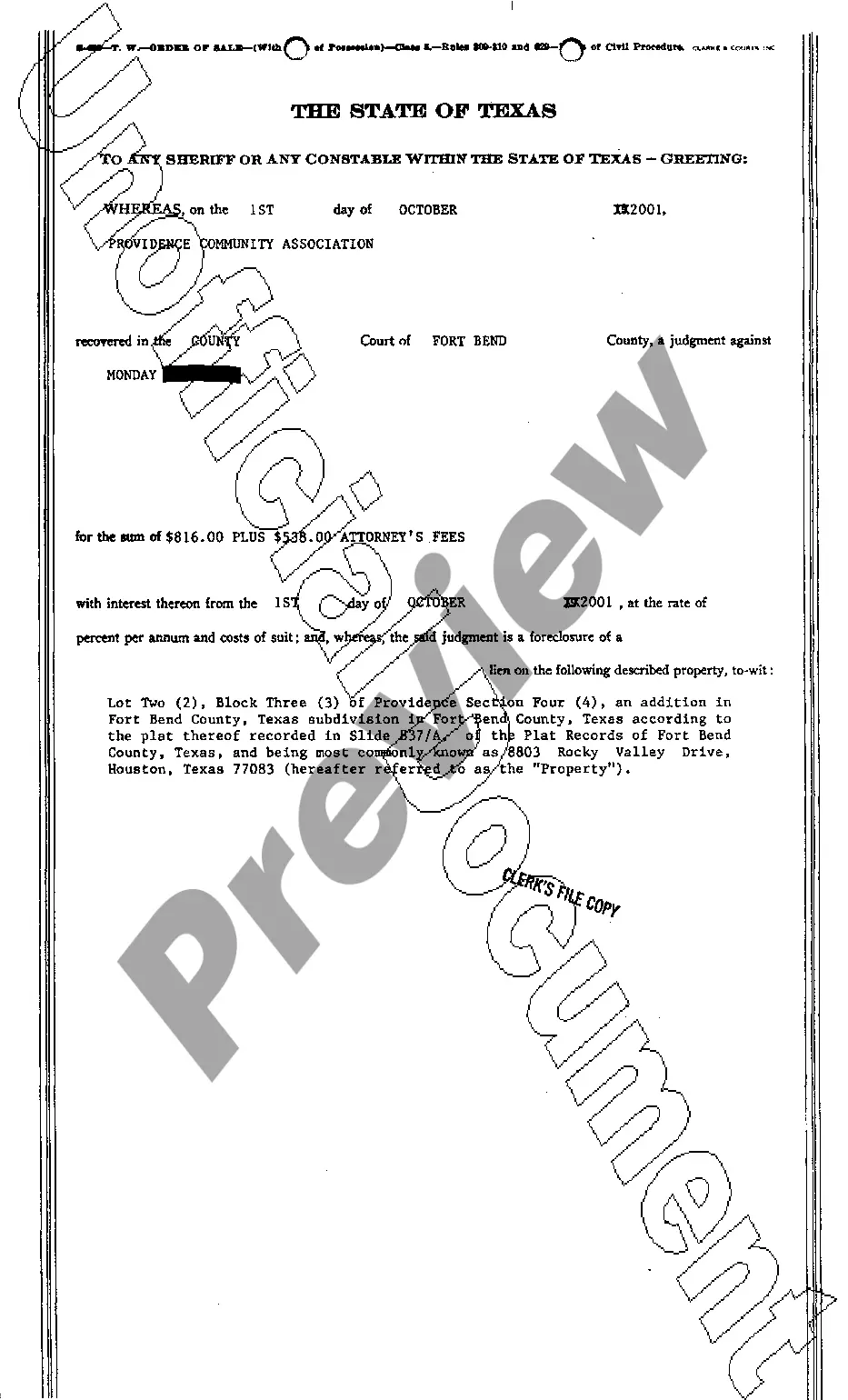

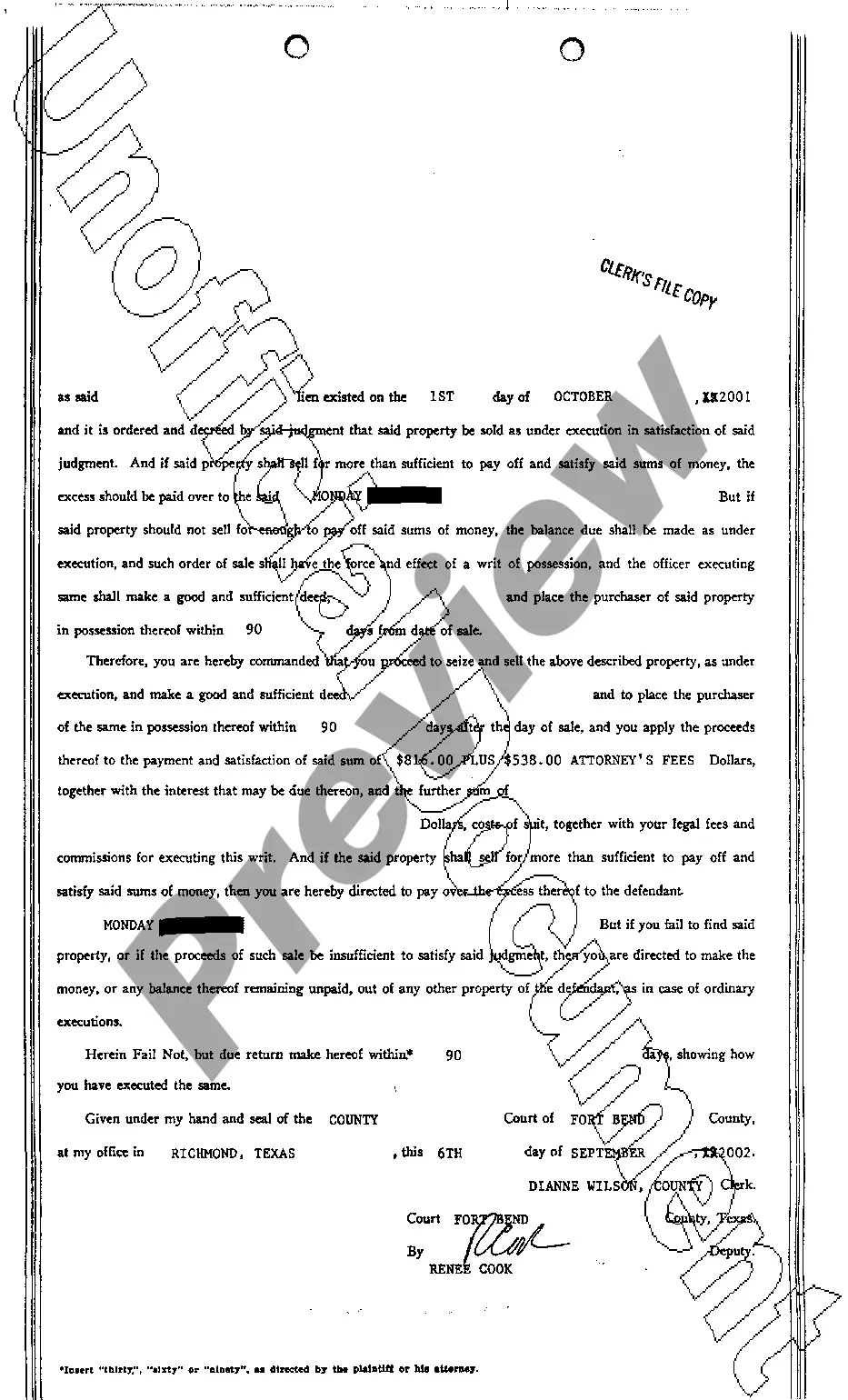

Pasadena Texas Order of Sale is a legal process in Pasadena, Texas that allows the court to sell a property to satisfy outstanding debts or liens against it. This order is issued by the court to initiate the sale of the property through a public auction or foreclosure sale. It is important to note that there are different types of Pasadena Texas Order of Sale, each serving a specific purpose in resolving various legal issues related to property ownership. One type of order is the Order of Judicial Sale, which is typically initiated to settle a foreclosure case. In this scenario, when a homeowner fails to make mortgage payments, the mortgage lender files a lawsuit to foreclose on the property. If the court approves the foreclosure, an Order of Judicial Sale is issued, authorizing the sale of the property to recover the outstanding loan amount. Another type of order is the Order of Tax Sale, which is initiated when property owners fail to pay their property taxes. In Pasadena, Texas, the county tax assessor-collector files a lawsuit against the delinquent property owner, seeking a court order to sell the property at a tax sale. This order grants permission to auction off the property to recoup the unpaid taxes. Additionally, there is the Order of Execution Sale, which is typically used when a court judgment has been obtained against the property owner. If the property owner fails to satisfy the judgment debt, the court may issue an Order of Execution Sale, allowing the sale of the property to repay the amount owed to the judgment creditor. Pasadena Texas Order of Sale plays a crucial role in resolving various legal issues related to property ownership, such as foreclosure, tax delinquency, or collection of outstanding debts. It is important for property owners to understand the implications and consequences of such orders as they can result in the loss of property if not properly addressed. Seeking professional legal assistance can help individuals navigate through these processes and protect their rights and interests.

Pasadena Texas Order of Sale

Description

How to fill out Pasadena Texas Order Of Sale?

Locating authenticated templates that adhere to your regional rules can be difficult unless you utilize the US Legal Forms repository.

This is an online collection of over 85,000 legal documents for personal and business necessities and various real-world situations.

All the paperwork is appropriately categorized by field of application and jurisdictional areas, making the search for the Pasadena Texas Order of Sale as straightforward and simple as ABC.

Maintaining orderly paperwork in compliance with legal standards is extremely important. Make use of the US Legal Forms library to always have crucial document templates ready for any requirements at your fingertips!

- Review the Preview mode and document description.

- Ensure that you have selected the correct document that fulfills your needs and completely aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- Once you discover any discrepancy, employ the Search tab above to find the correct document.

- If it fits your requirements, proceed to the next step.

Form popularity

FAQ

In Texas, lenders must provide a written notice of the foreclosure sale at least 21 days before the sale occurs. This notice should include details about the property and the sale date. To fully understand your rights and the process, refer to the Pasadena Texas Order of Sale, which outlines the necessary steps and requirements during foreclosure transactions.

Similar to payments, missing three mortgage payments is usually the threshold before your lender may start foreclosure proceedings in Texas. However, each lender has its own policies, so it's wise to review your mortgage terms closely. Knowing the details about the Pasadena Texas Order of Sale can help you navigate this critical period more effectively.

While it varies by lender, homeowners in Texas commonly face foreclosure risks after missing three monthly payments. However, initiating communication with your lender might provide options to avoid this outcome. Understanding the Pasadena Texas Order of Sale can also empower homeowners by clarifying their legal options and obligations.

To file a civil lawsuit in Harris County, you typically go to the Harris County District Clerk's office. This office manages the filing of all civil lawsuits, and you can submit your paperwork online or in person. The process can be complex, and understanding the Pasadena Texas Order of Sale may offer guidance on related legal matters you encounter during your filing.

In general, you can be behind by several months before foreclosure proceedings start, depending on the lender's policies. Usually, lenders will initiate action after three missed payments, but some might offer alternatives before this. If you are struggling, familiarize yourself with the Pasadena Texas Order of Sale as it provides critical information to navigate potential foreclosure.

In Texas, a homeowner can face foreclosure after missing only one payment, but most lenders will typically initiate foreclosure proceedings after three consecutive missed payments. It’s essential for homeowners to stay informed about their payment status. If you find yourself in this situation, you may need to explore options under the Pasadena Texas Order of Sale to understand your rights.

To get a permit for a garage sale in Pasadena Texas, visit the city’s website or the local city office. The application process is straightforward, often requiring minimal information about the sale. Once your application is approved, you’ll receive your permit, allowing you to legally conduct your sale. Utilizing platforms like USLegalForms can simplify your application process, especially when handling regulations related to your Pasadena Texas Order of Sale.

Yes, in Pasadena Texas, you need a permit to host a garage sale. The city requires you to obtain a permit to ensure that sales are properly regulated, maintaining neighborhood standards. You can apply for the permit easily online or at your local city office. Remember, having the right permit can help you avoid potential fines and make your Pasadena Texas Order of Sale a smooth experience.

A writ of execution in Harris County is a court order that allows the enforcement of a judgment. It directs law enforcement to seize property to satisfy a debt or judgment. Understanding how a writ of execution relates to the Pasadena Texas Order of Sale can provide clarity on your rights and responsibilities in property transactions, particularly if you seek legal assistance through platforms like US Legal Forms.

Getting a copy of a probated will in Harris County involves visiting the Harris County Probate Court. You can request the will in person or utilize their online resources. For convenience, US Legal Forms offers templates and guidance related to probate matters, including steps to access probated wills, making the Pasadena Texas Order of Sale process smoother for you and ensuring you have the information you need.