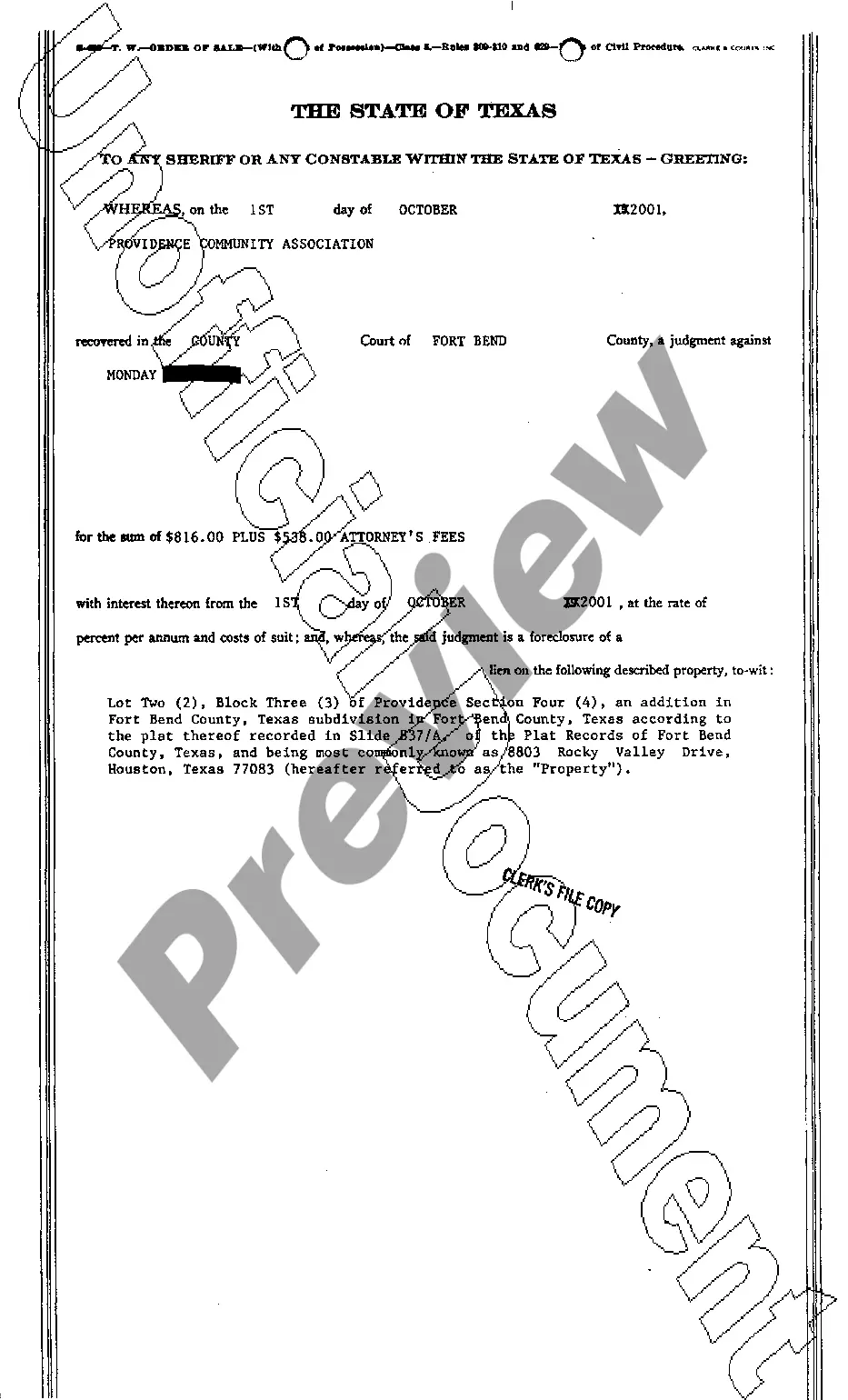

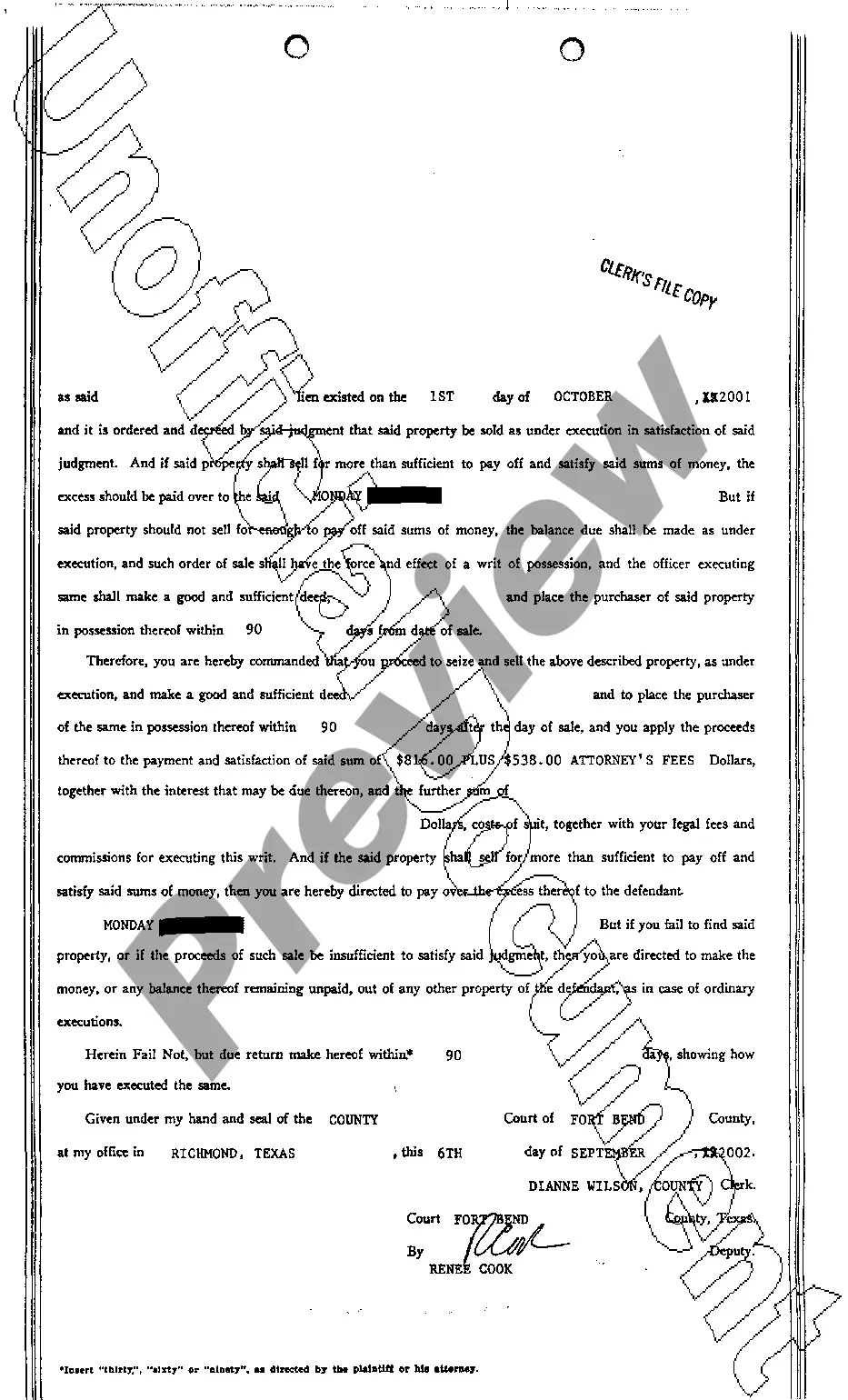

Pearland Texas Order of Sale refers to a legal process that occurs when a property is being sold through a public auction in Pearland, Texas. It is important to note that this description focuses on the general concept of an order of sale in Pearland, Texas and may not cover all the specific variations or types of orders that may exist. During the order of sale in Pearland, Texas, a property owner may face foreclosure or have unpaid property taxes. In such cases, the court may issue an order to sell the property through a public auction to help cover the outstanding debts or taxes. The auction is typically conducted by an appointed trustee or sheriff, following specific legal procedures. The Pearland Texas Order of Sale process typically involves several steps. Initially, a lender, tax authority, or creditor files a lawsuit against the property owner for foreclosure or unpaid taxes. Once the court approves the petition, it issues a judgment of sale, which initiates the order of sale process. This judgment sets a specific date and time for the auction. Prior to the auction date, public notices (also known as Order of Sale notices) are typically published in local newspapers or online platforms. These notices contain key information about the property, including its location, description, legal boundaries, and the date, time, and location of the auction. On the specified auction day, the property is presented to potential buyers at a public venue, often at the county courthouse or a designated auction site. The auctioneer starts the bidding process, and interested buyers raise their bids until the property is sold to the highest bidder. The winning bidder is required to provide payment, usually in the form of a cashier's check or a certified check, immediately following the conclusion of the auction. It is worth mentioning that the type of Pearland Texas Order of Sale can vary depending on the nature of the outstanding debts. Some common variations include foreclosure auctions, tax lien auctions, and mortgage lien auctions. Foreclosure auctions occur when a property owner defaults on mortgage payments, while tax lien auctions are conducted to recover unpaid property taxes. Mortgage lien auctions may involve the sale of a property to cover debts secured by a mortgage. In conclusion, the Pearland Texas Order of Sale is a legal process involving the public auction of a property to repay outstanding debts or unpaid taxes. It includes filing a lawsuit, court approval, public notices, and the auction itself. Variations of the order may exist, such as foreclosure auctions, tax lien auctions, and mortgage lien auctions.

Pearland Texas Order of Sale

Description

How to fill out Pearland Texas Order Of Sale?

Take advantage of the US Legal Forms and get instant access to any form you require. Our helpful platform with a huge number of document templates simplifies the way to find and get virtually any document sample you want. It is possible to export, complete, and sign the Pearland Texas Order of Sale in a couple of minutes instead of surfing the Net for many hours trying to find the right template.

Using our collection is a wonderful strategy to increase the safety of your document filing. Our professional legal professionals on a regular basis check all the records to ensure that the forms are relevant for a particular region and compliant with new laws and polices.

How can you get the Pearland Texas Order of Sale? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Find the form you need. Make sure that it is the form you were seeking: verify its name and description, and utilize the Preview feature when it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you like. Then, create an account and process your order using a credit card or PayPal.

- Download the document. Select the format to get the Pearland Texas Order of Sale and edit and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy template libraries on the internet. We are always happy to assist you in virtually any legal procedure, even if it is just downloading the Pearland Texas Order of Sale.

Feel free to take advantage of our platform and make your document experience as convenient as possible!