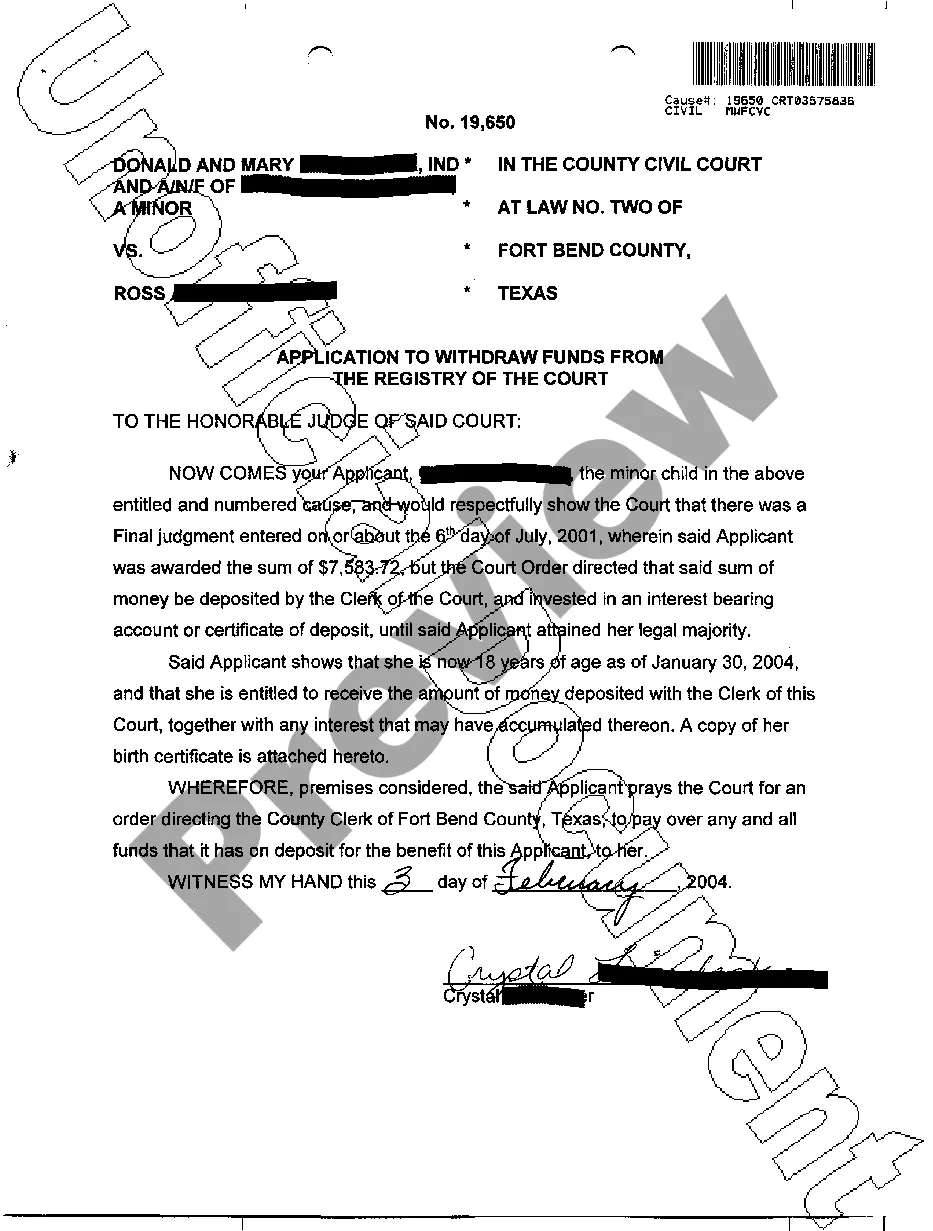

Dallas Texas Application To Withdraw Funds From Registry is a legal document used by individuals or organizations in Dallas, Texas, to request the withdrawal of funds from a registry account. The application serves as a formal and official request for the release of funds held in a registry account for various purposes. It is an essential step in the process and must be completed accurately and in compliance with the specific regulations governing the withdrawal of funds from a registry. There are several types of Dallas Texas Application To Withdraw Funds From Registry, depending on the nature and purpose of the funds being withdrawn. Some common types include: 1. Personal Accounts: These applications are used by individuals who are requesting the withdrawal of their personal funds held in a registry account. This could include funds placed in the account for safekeeping, prior to their intended use or transfer to another entity. 2. Business Accounts: Businesses often utilize registry accounts to hold funds for specific purposes, such as litigation settlements, employee benefits, or escrow services. Withdrawal applications for business accounts require additional documentation, such as proof of business ownership and authorization. 3. Trust Accounts: Trust funds are commonly held in registry accounts, and the withdrawal of these funds requires a special application. Trustees or beneficiaries must submit a withdrawal application along with supporting trust documents, such as trust agreements and distribution authorizations. 4. Court-Ordered Withdrawals: In certain legal scenarios, a court may order the withdrawal of funds from a registry account. This could happen during divorce proceedings, inheritance disputes, or other legal matters. In such cases, the application must include a court order specifying the details of the withdrawal. When completing a Dallas Texas Application To Withdraw Funds From Registry, it is crucial to provide accurate information, including the account holder's name, contact details, account number, and the specific amount to be withdrawn. Additionally, any supporting documents relevant to the purpose of the withdrawal should be attached to the application. The application form usually requires a signature from the account holder or an authorized representative, certifying the accuracy and validity of the information provided. It is advisable to carefully review the application and seek legal advice if necessary to ensure compliance with all applicable laws and regulations. Overall, the Dallas Texas Application To Withdraw Funds From Registry is a critical document for individuals, businesses, trustees, and beneficiaries seeking to access funds held in registry accounts. By completing this application accurately and providing the required supporting documentation, applicants can initiate the process of withdrawing funds for their intended purposes.

Dallas Texas Application To Withdraw Funds From Registry

Description

How to fill out Dallas Texas Application To Withdraw Funds From Registry?

If you are searching for a valid form template, it’s impossible to find a more convenient place than the US Legal Forms website – probably the most considerable libraries on the web. With this library, you can get a huge number of form samples for company and personal purposes by categories and regions, or keywords. Using our high-quality search feature, getting the most up-to-date Dallas Texas Application To Withdraw Funds From Registry is as elementary as 1-2-3. In addition, the relevance of each record is confirmed by a team of professional lawyers that regularly check the templates on our platform and revise them based on the newest state and county demands.

If you already know about our platform and have a registered account, all you need to receive the Dallas Texas Application To Withdraw Funds From Registry is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have discovered the sample you want. Read its description and use the Preview feature (if available) to see its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to discover the appropriate document.

- Affirm your decision. Select the Buy now button. Following that, pick your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the form. Select the file format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the obtained Dallas Texas Application To Withdraw Funds From Registry.

Each and every form you save in your user profile does not have an expiry date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you need to have an extra version for modifying or printing, you may return and download it again whenever you want.

Make use of the US Legal Forms extensive catalogue to get access to the Dallas Texas Application To Withdraw Funds From Registry you were looking for and a huge number of other professional and state-specific templates in a single place!