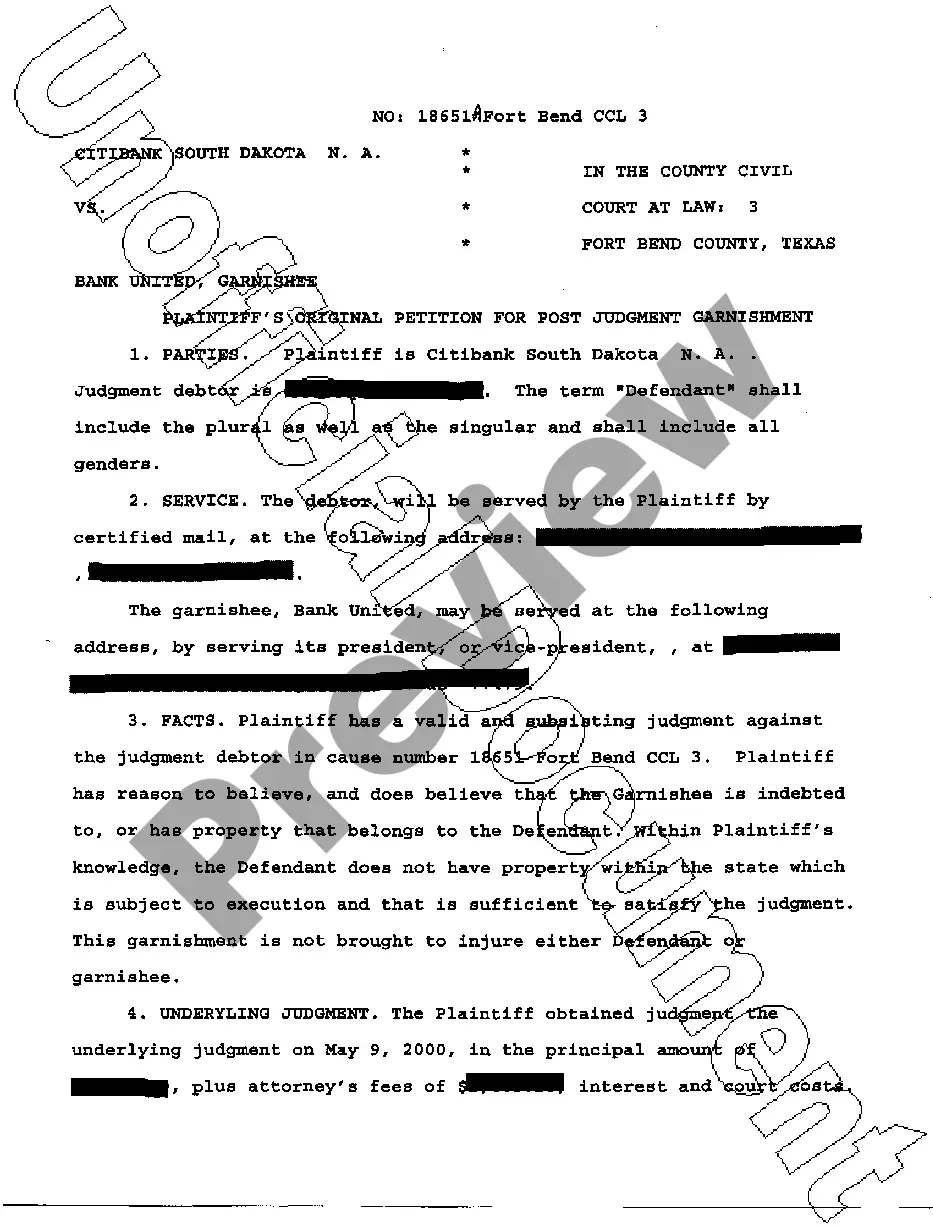

Bexar Texas Petition Writ of Garnishment

Description

How to fill out Texas Petition Writ Of Garnishment?

Are you searching for a trustworthy and affordable supplier of legal forms to purchase the Bexar Texas Petition Writ of Garnishment? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish rules for living with your partner or a set of documents to progress your divorce through the court system, we have you covered. Our website offers over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are tailored to the requirements of specific states and regions.

To obtain the form, you must Log In to your account, find the required form, and click the Download button beside it. Please remember that you can download your previously acquired form templates at any time from the My documents section.

Are you unfamiliar with our platform? No problem. You can create an account in just a few minutes, but first, ensure to do the following.

Now, you can establish your account. Then, select the subscription plan and continue to payment. Once the payment is finalized, download the Bexar Texas Petition Writ of Garnishment in any provided format. You can return to the website at any time and redownload the form without any additional charges.

Finding current legal documents has never been simpler. Give US Legal Forms a shot today, and say goodbye to spending hours looking for legal paperwork online once and for all.

- Verify that the Bexar Texas Petition Writ of Garnishment adheres to your state and local regulations.

- Review the form’s specifications (if available) to understand its intended purpose and audience.

- Initiate the search anew if the form isn’t suitable for your particular situation.

Form popularity

FAQ

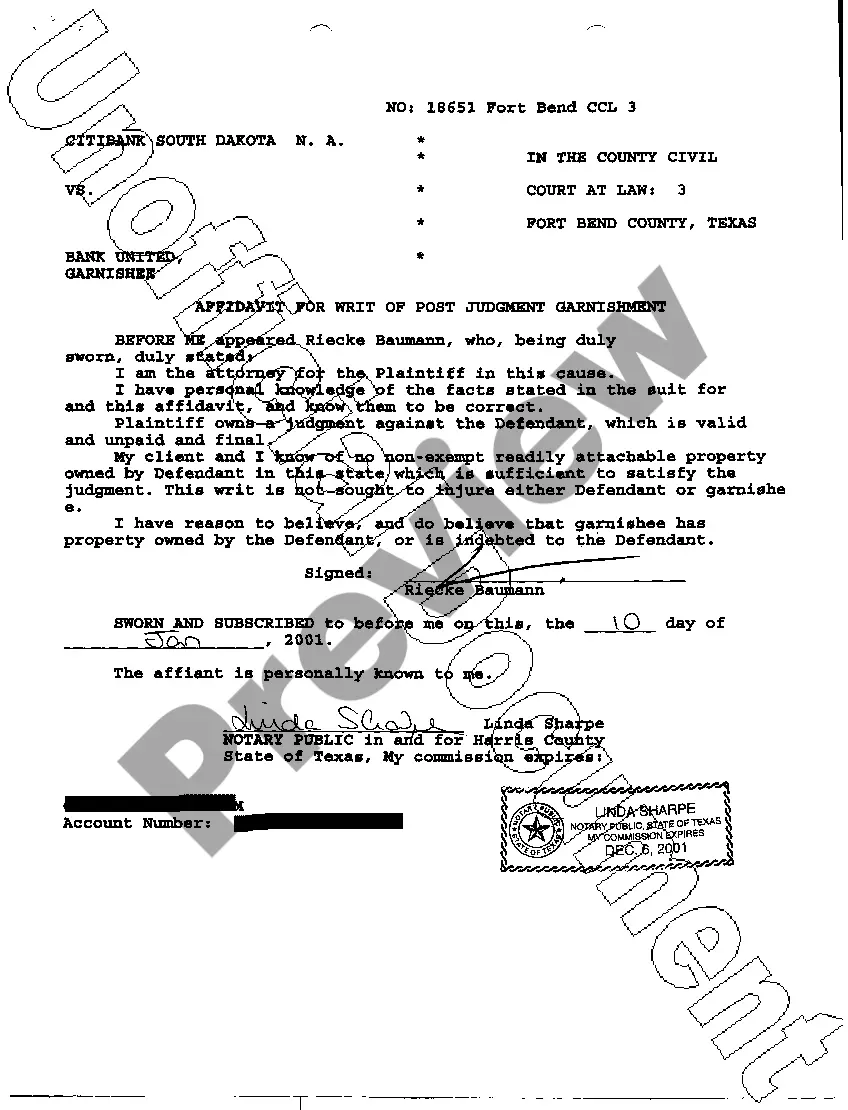

Getting a Bexar Texas Petition Writ of Garnishment involves filing a formal request with the appropriate court. You must provide evidence of your judgment and details about the debtor's finances. Once the court approves your petition, you will receive the writ for service. Utilizing resources like US Legal Forms can streamline this process, offering you the right forms and step-by-step support.

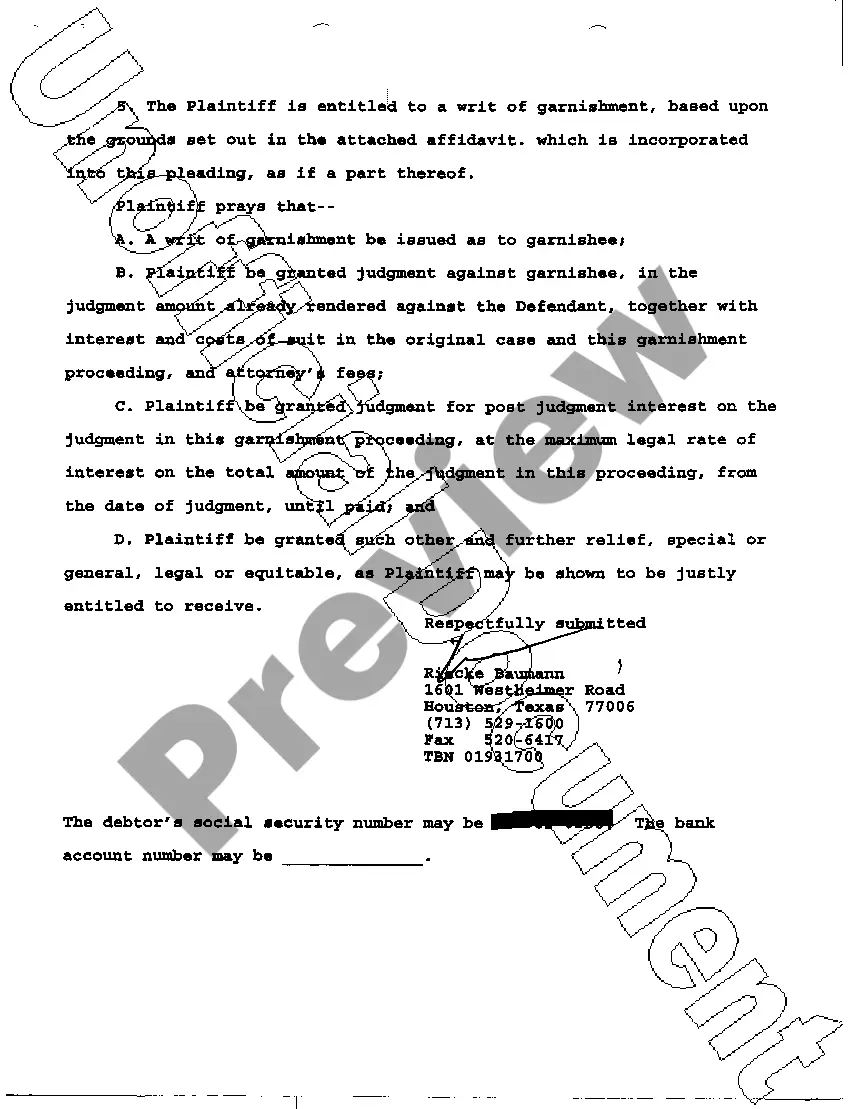

In Texas, a writ can be served by a sheriff, constable, or any person authorized by the court. This ensures that the serving process adheres to legal standards. It is important that the person serving the Bexar Texas Petition Writ of Garnishment is not involved in the case to maintain impartiality. To ensure compliance with these regulations, consider using US Legal Forms to guide you through the legal requirements.

Once the Bexar Texas Petition Writ of Garnishment is served, the debtor's financial institution freezes the specified accounts or assets. The bank then has a duty to withhold funds until the court resolves the matter. The debtor can challenge the garnishment, but this must be done in court. Ensuring you understand these processes helps in navigating any potential disputes.

To obtain a Bexar Texas Petition Writ of Garnishment, you must first file a petition with the court that holds your judgment. Include necessary details about the debtor and their financial institutions. After filing, you will receive a court order allowing you to garnish the debtor's assets. Using services like US Legal Forms can simplify this process by providing the correct forms and instructions.

The process of a writ of garnishment involves several steps, starting with a creditor obtaining a judgment against you. Next, they will file a petition in court, which may include a Bexar Texas Petition Writ of Garnishment. Once issued, this writ allows the creditor to collect from your wages or bank account. You have the right to contest this writ by filing your objections and seeking legal information.

Writing a letter to stop wage garnishment after it has begun requires you to include your personal details and the specifics of the garnishment. Explain why you believe the garnishment should cease, and include any new evidence that supports your case. If you are taking legal action, such as filing a Bexar Texas Petition Writ of Garnishment, mention that to show your proactive approach.

To answer a debt collection lawsuit in Texas, you must file your written answer with the court within 14 days after being served. In your response, specify your position on the debt and any defenses you may have, including potential errors in the garnishment process. If applicable, you may wish to reference a Bexar Texas Petition Writ of Garnishment to illustrate your right to challenge the claim.

A judgment proof letter should convey that you have no income or assets that can be garnished. Start by outlining your financial situation clearly and concisely. This letter can be vital in negotiations with creditors so that they understand your circumstances. Also, consider referencing your intent to file a Bexar Texas Petition Writ of Garnishment if necessary.

When drafting an objection letter for wage garnishment, commence with your personal information and information about the creditor. Clearly outline your objections to the garnishment, citing any mistakes or hardships. Be sure to express your commitment to resolving the debt. If you are considering a Bexar Texas Petition Writ of Garnishment, mention this in your letter to emphasize your legal rights.

Filling out a challenge to garnishment form involves providing your personal information and details regarding the original garnishment order. You should include reasons for contesting the garnishment, such as a legal error or financial hardship. It's essential to be concise and clear. You might also want to reference the Bexar Texas Petition Writ of Garnishment, as this can strengthen your argument.