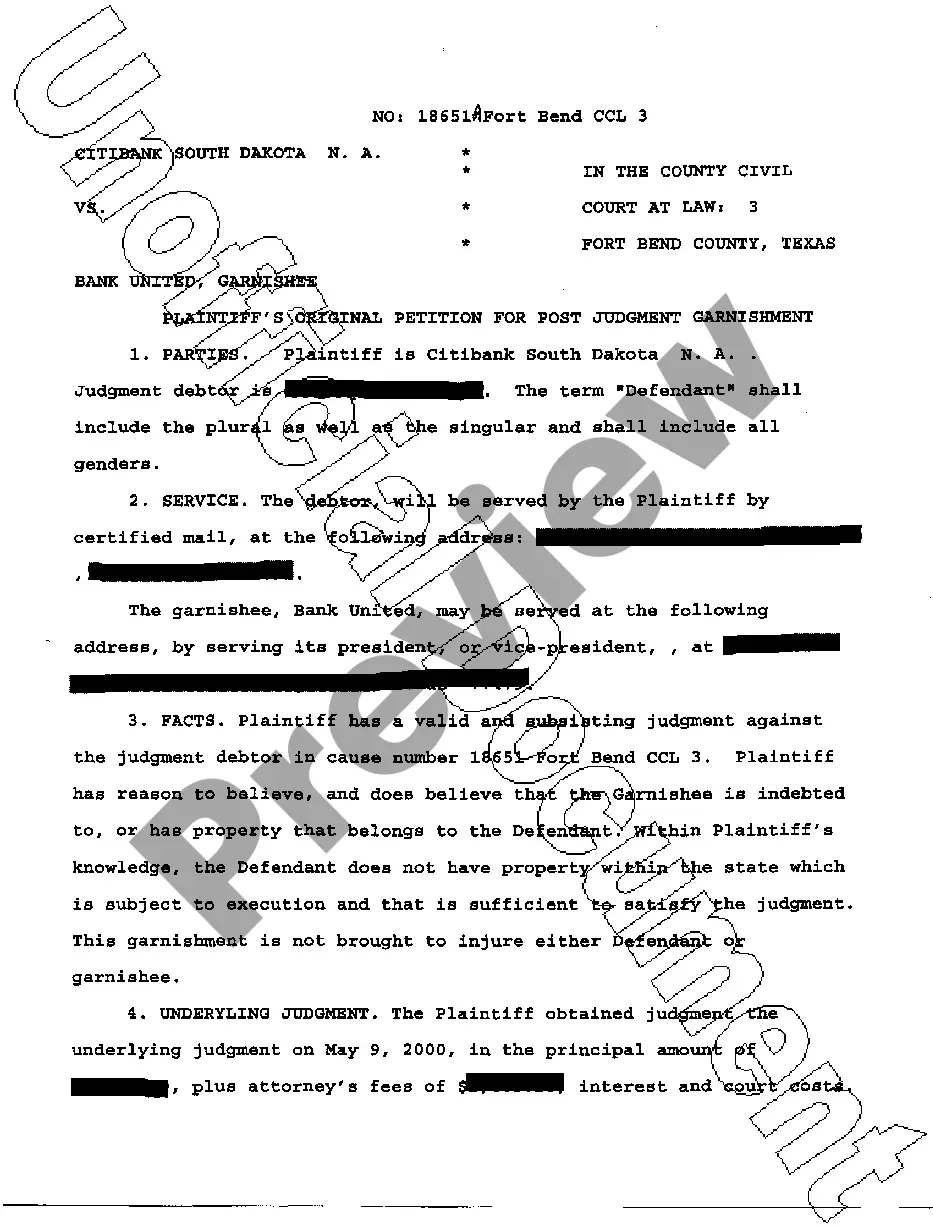

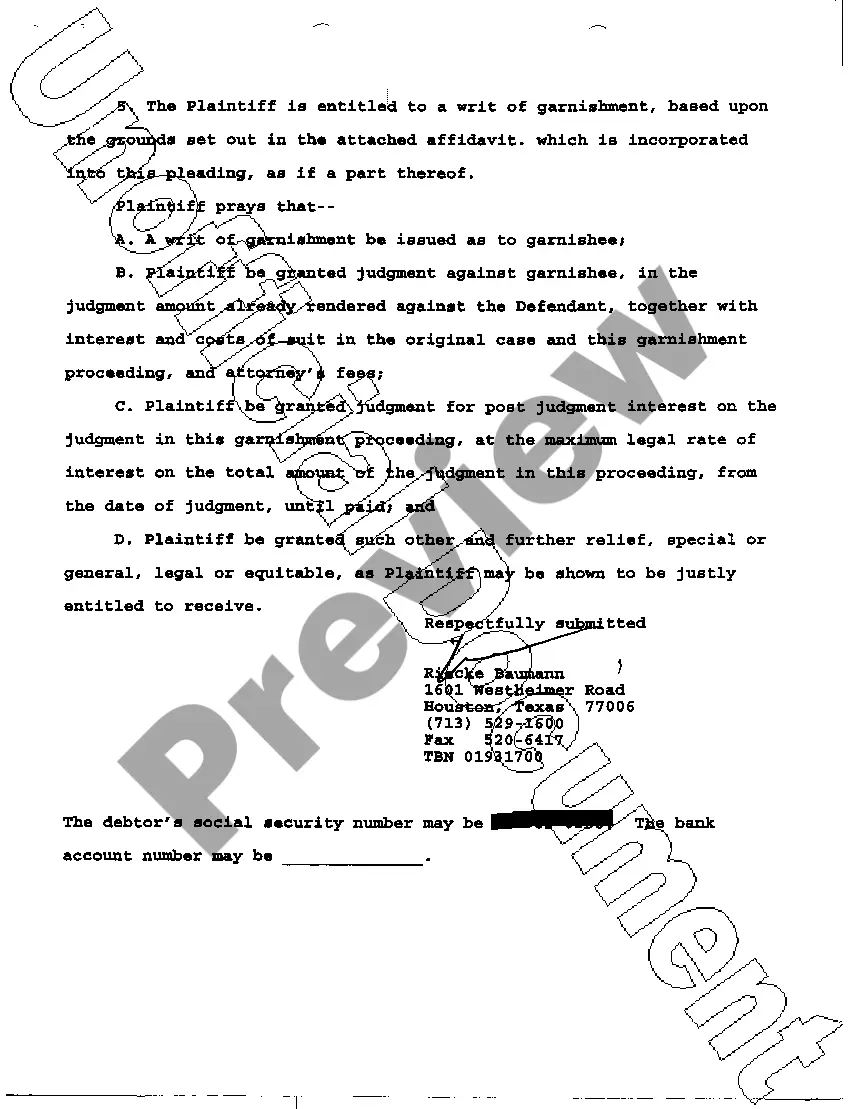

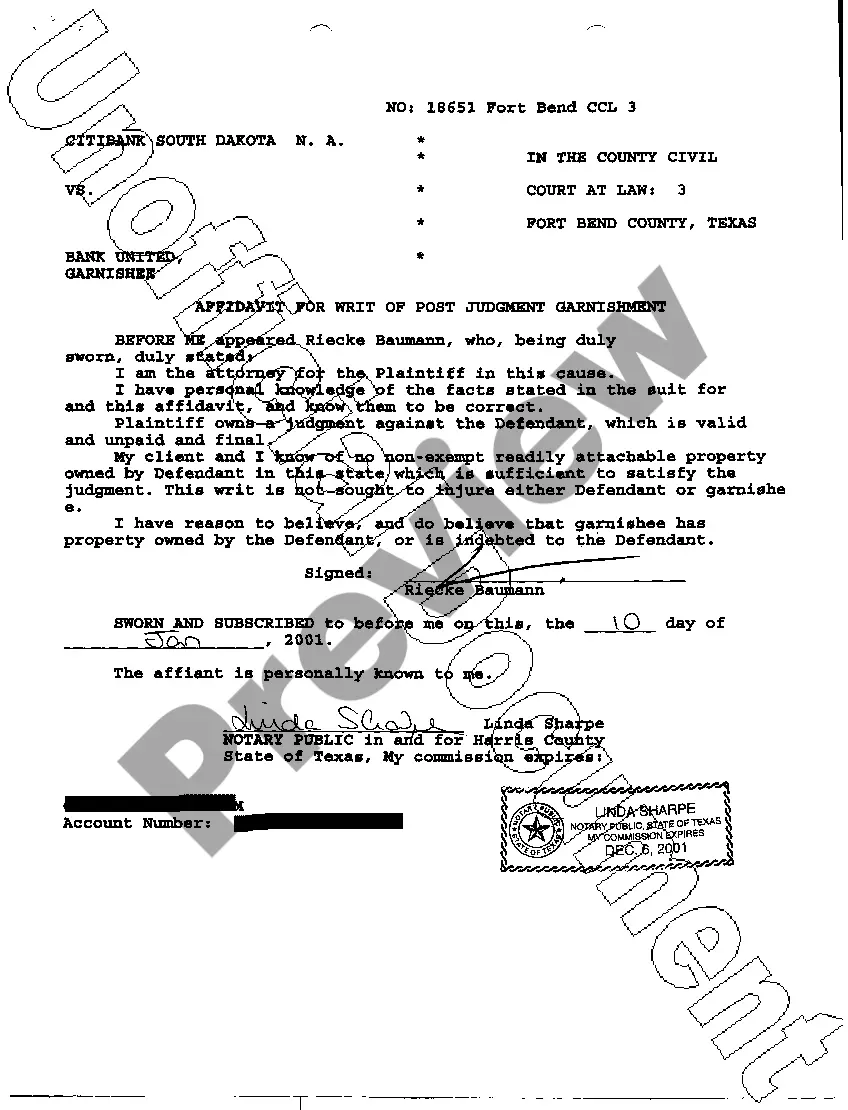

The Edinburg Texas Petition Writ of Garnishment is a legal process that allows a judgment creditor to collect money owed by a debtor from their wages, bank accounts, or other assets. It is an important tool for enforcing judgments and ensuring payment for unpaid debts in the Edinburg, Texas area. The process begins with the filing of a petition for a writ of garnishment by the judgment creditor. This petition outlines the details of the debt, the amount owed, and provides evidence of judgment against the debtor. The court reviews the petition and, if approved, issues a writ of garnishment. Once the writ of garnishment is issued, it is served upon the garnishee, who is often the debtor's employer or financial institution. The garnishee is legally mandated to withhold a portion of the debtor's wages or freeze their bank accounts, as specified in the writ. The withheld amount is then remitted to the judgment creditor to satisfy the outstanding debt. There are different types of Edinburg Texas Petition Writ of Garnishment, including: 1. Writ of Continuing Garnishment: This type of garnishment allows for ongoing wage or bank account deductions until the debt is fully satisfied. It can be particularly useful for long-term debts or recurring payments. 2. Writ of Garnishment after Judgment: This is the most common type of writ of garnishment, used when a judgment has been obtained against the debtor. It allows the creditor to collect the debt owed in a more efficient manner. 3. Child Support Garnishment: In cases involving unpaid child support, a writ of garnishment can be used to enforce payment. This type of garnishment ensures that the child's financial needs are met by deducting the owed amount from the debtor's income. 4. Writ of Garnishment for Tax Debts: In situations where the debtor owes unpaid taxes, the government may obtain a writ of garnishment to collect the outstanding amount directly from the debtor's income or assets. Overall, the Edinburg Texas Petition Writ of Garnishment plays a crucial role in enforcing judgments and securing payments for unpaid debts. By utilizing this legal process, creditors can pursue their claims and debtors can be held accountable for their financial obligations.

Edinburg Texas Petition Writ of Garnishment

Description

How to fill out Edinburg Texas Petition Writ Of Garnishment?

Are you looking for a trustworthy and inexpensive legal forms provider to get the Edinburg Texas Petition Writ of Garnishment? US Legal Forms is your go-to choice.

Whether you need a simple arrangement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of particular state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Edinburg Texas Petition Writ of Garnishment conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is intended for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the Edinburg Texas Petition Writ of Garnishment in any available file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal papers online for good.