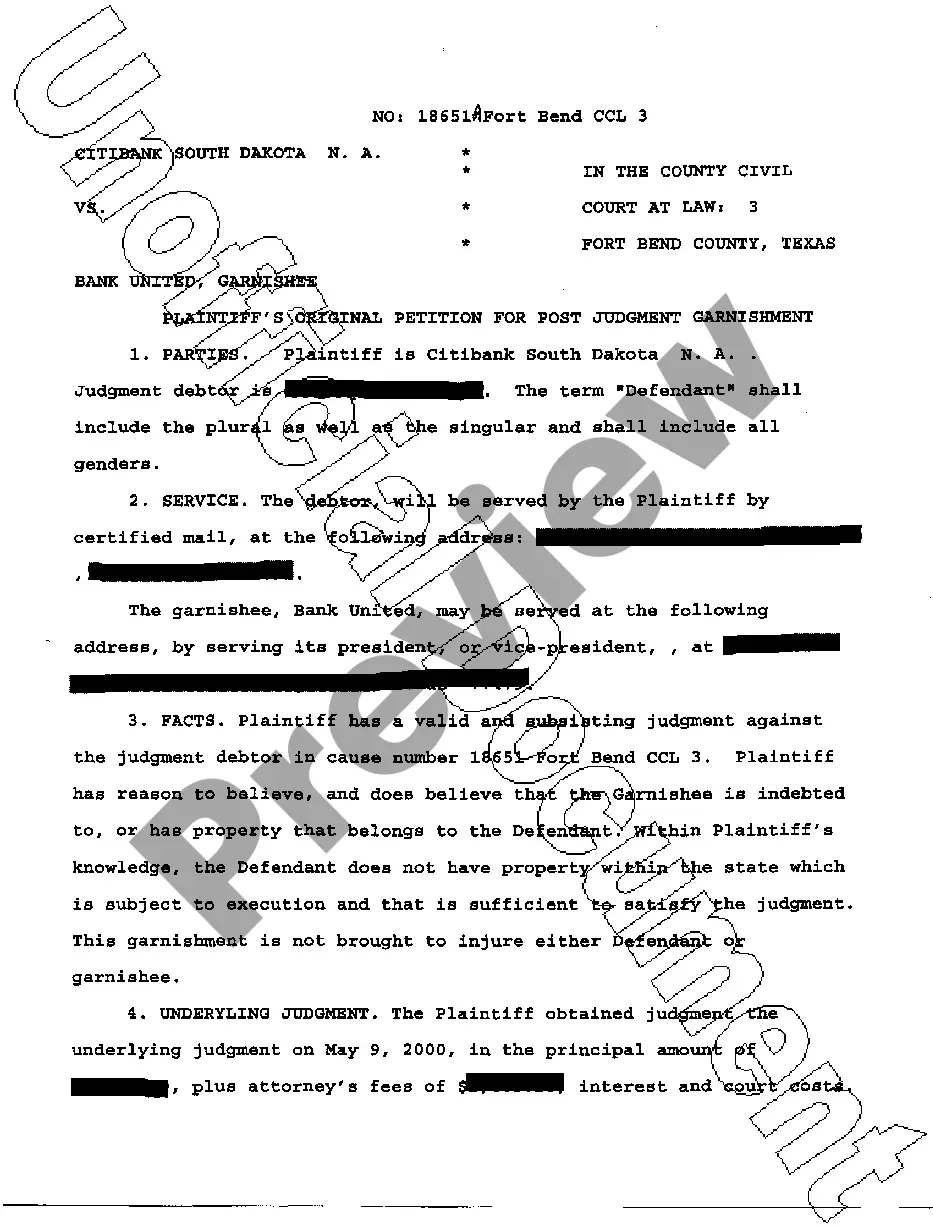

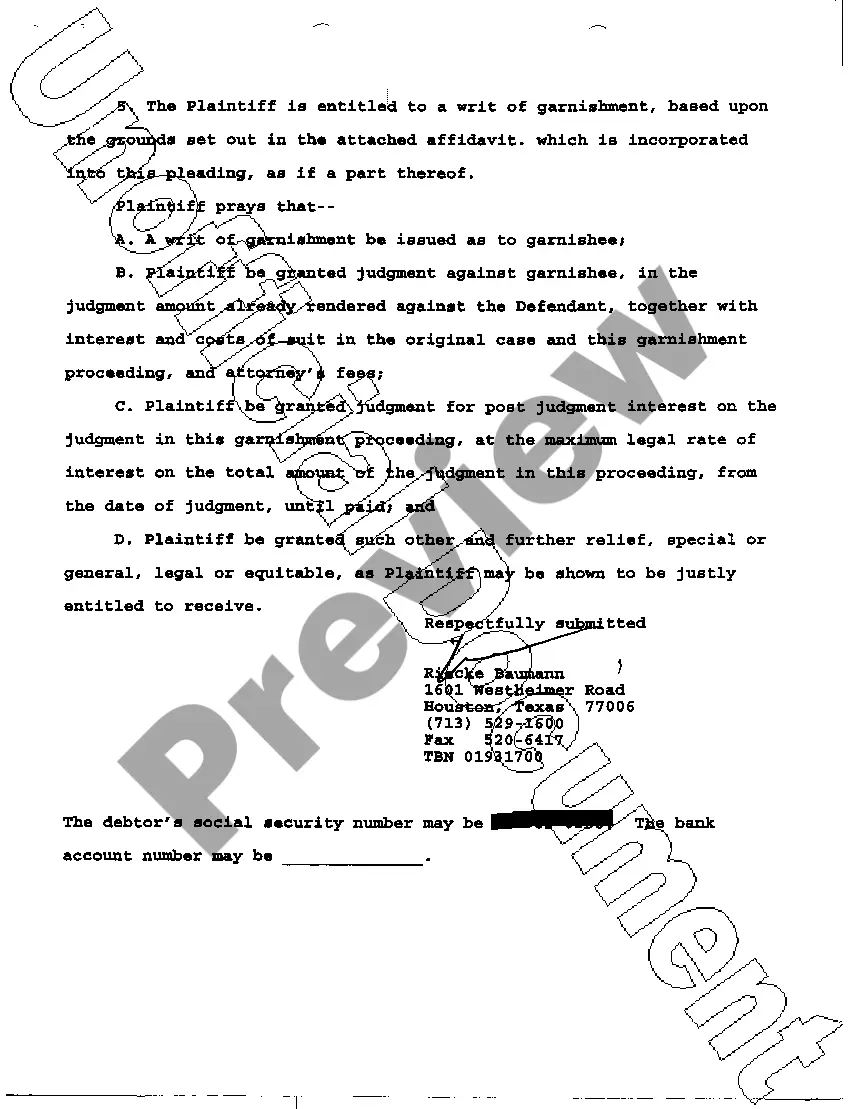

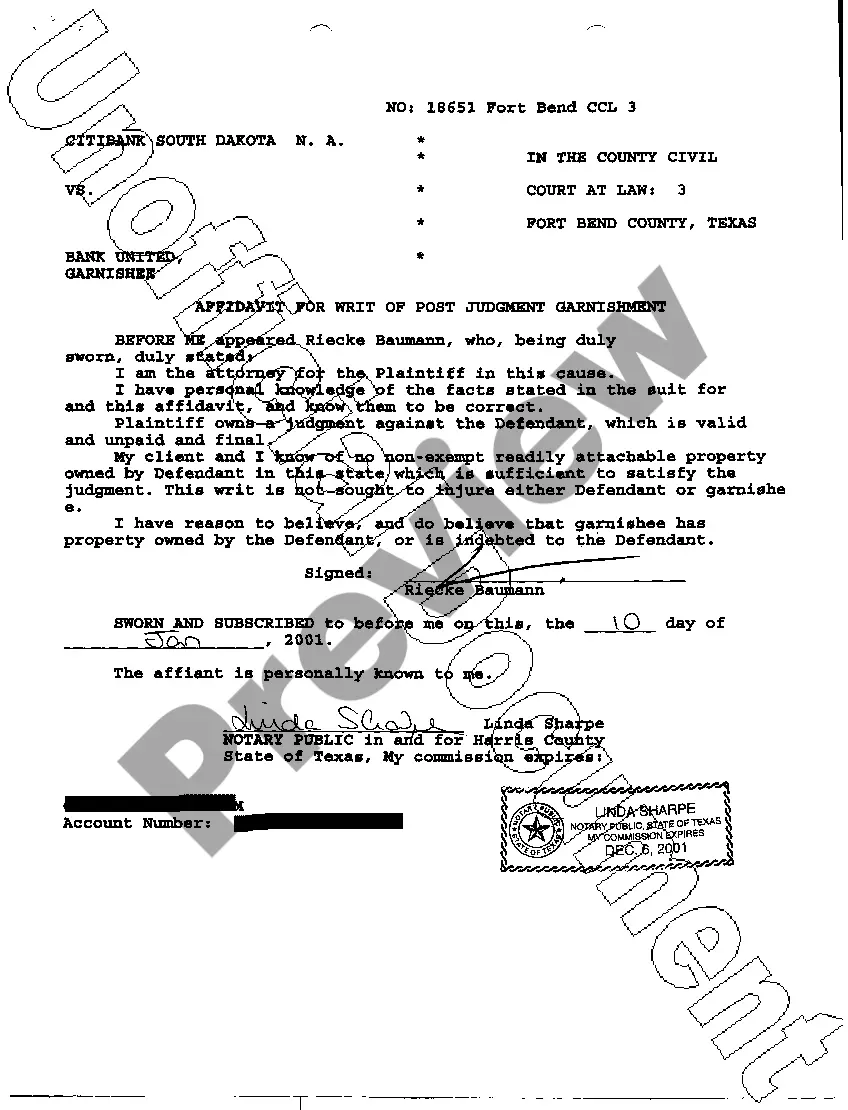

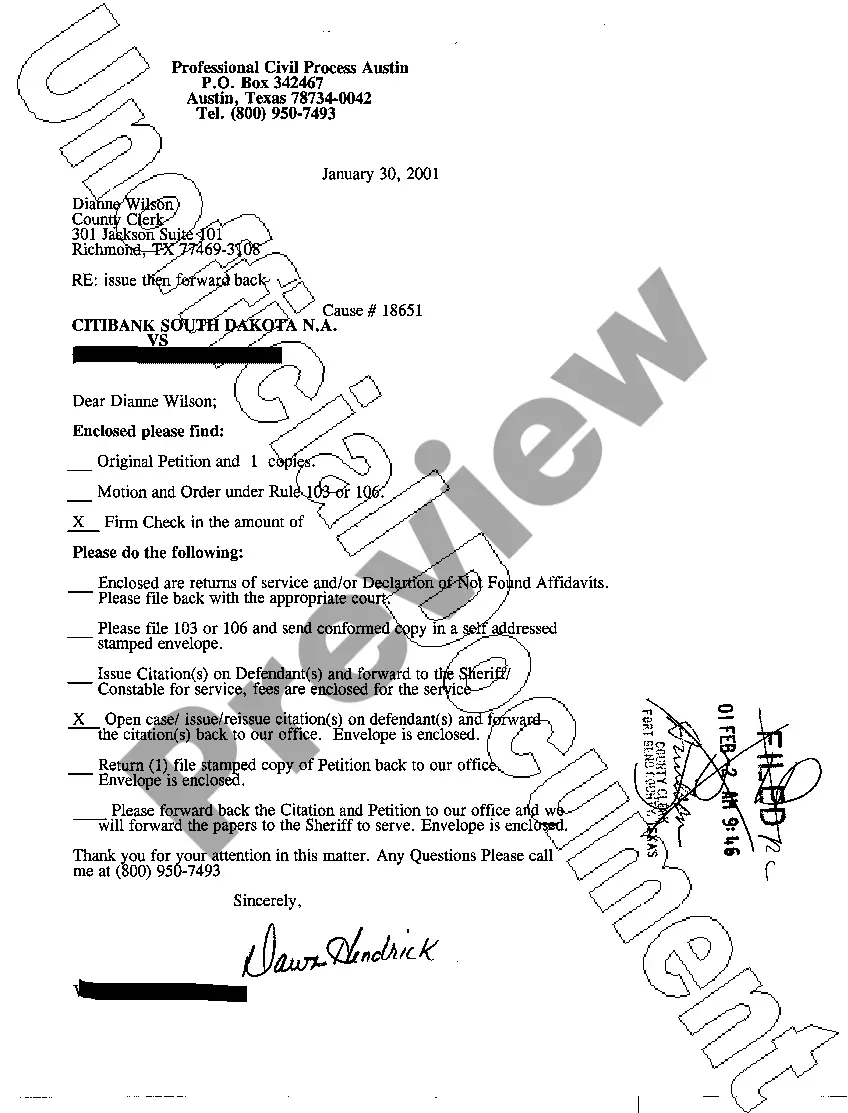

Title: Understanding the Harris Texas Petition Writ of Garnishment: Types and Overview Introduction: The Harris Texas Petition Writ of Garnishment is a legal proceeding designed to aid creditors in collecting their unpaid debts by obtaining access to a debtor's assets. This document plays a vital role in the garnishment process, allowing creditors to enforce their rights and seek payment for outstanding balances. In this article, we will provide a comprehensive overview of the Harris Texas Petition Writ of Garnishment, outlining its purpose, procedure, and various types. Keywords: Harris Texas, Petition Writ of Garnishment, creditors, unpaid debts, access to assets, garnishment process, enforce rights, seek payment, outstanding balances, purpose, procedure, types 1. The Purpose of the Harris Texas Petition Writ of Garnishment: — Debt Collection: Assist creditors in recovering unpaid debts from individuals or entities who owe them money. — Legal Enforcement: Legally enforce the rights of creditors to recoup the amounts owed by accessing a debtor's assets. 2. Overview of the Harris Texas Petition Writ of Garnishment Procedure: — Filing the Petition: The creditor initiates the process by filing a formal petition, providing relevant details, including the debtor's information, amount owed, and supporting documentation. — Court Review: The court examines the petition, ensuring legal sufficiency and compliance, and determines whether to issue the writ of garnishment or dismiss the case. — Writ Issuance: If the court approves the petition, it will issue the writ of garnishment authorizing the creditor to seize the debtor's assets or garnish wages. — Service of Writ: The writ is served to the garnishee, the person or entity holding the debtor's assets, who must then comply with the court order and release the funds or assets to the creditor. 3. Types of Harris Texas Petition Writ of Garnishment: a. Bank Account Garnishment: This type involves seizing funds from the debtor's bank account(s) to satisfy the outstanding debt. b. Wage Garnishment: This form enables the creditor to deduct a portion of the debtor's wages directly from their employer to fulfill the debt obligations. c. Property Garnishment: In cases where the debtor owns valuable assets such as real estate or vehicles, the creditor can seek to garnish these assets to satisfy the debt. d. Non-Wage Garnishment: Refers to the garnishment of funds from sources other than employment wages, such as pensions, insurance benefits, or government benefits. Conclusion: The Harris Texas Petition Writ of Garnishment serves as a crucial legal tool for creditors to collect unpaid debts by accessing a debtor's assets. With different types of garnishment available, including bank account, wage, property, and non-wage garnishment, creditors can choose the most suitable approach to secure repayment. Understanding the purpose, procedure, and types of the Harris Texas Petition Writ of Garnishment is essential for both creditors and debtors involved in the debt recovery process. Keywords: Harris Texas, Petition Writ of Garnishment, creditors, unpaid debts, garnishment process, debt collection, legal enforcement, overview, types, bank account garnishment, wage garnishment, property garnishment, non-wage garnishment.

Harris Texas Petition Writ of Garnishment

Description

How to fill out Harris Texas Petition Writ Of Garnishment?

If you’ve already used our service before, log in to your account and save the Harris Texas Petition Writ of Garnishment on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Harris Texas Petition Writ of Garnishment. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!

Form popularity

FAQ

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment.

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment.

Texas and Federal Law The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.

Some of the Texas justice courts have a form to request a writ of garnishment available on their website. If the justice court you intend to file with does not provide a form, a sample application is available at the link below.

A judgment is valid for 10 years and can be enforced at any time during those that time. It is not uncommon for a creditor to seek to enforce a judgment that is close to ten years old. There are also ways to renew the judgment, so that it can be enforced for even longer than ten years.

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

Filing a Writ of Execution 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

A creditor can stop a writ of garnishment by essentially asking the court to dismiss it.

More info

Texas Administrative Code (TAC) Administrative Code of Courts & Civil Cases. If you are looking for the court clerk's office for the case, but it is not where your case is listed, contact the county where your case was filed, or enter the address of the court clerk for the proper court in the search box at the top of this page. Possible Reasons for Not Filing a Small Claims If you have not filed your court papers before your court date, there are good reasons for that. For example, if you have been out of custody for a significant time and are not able to give your consent to the summons and complaint because you cannot attend your court date, you might not have filed your motion. If you are a disabled veteran or are not able to comply with some of the court's notices, or if you are a minor, you might not be able to comply with some of the court's notices.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.