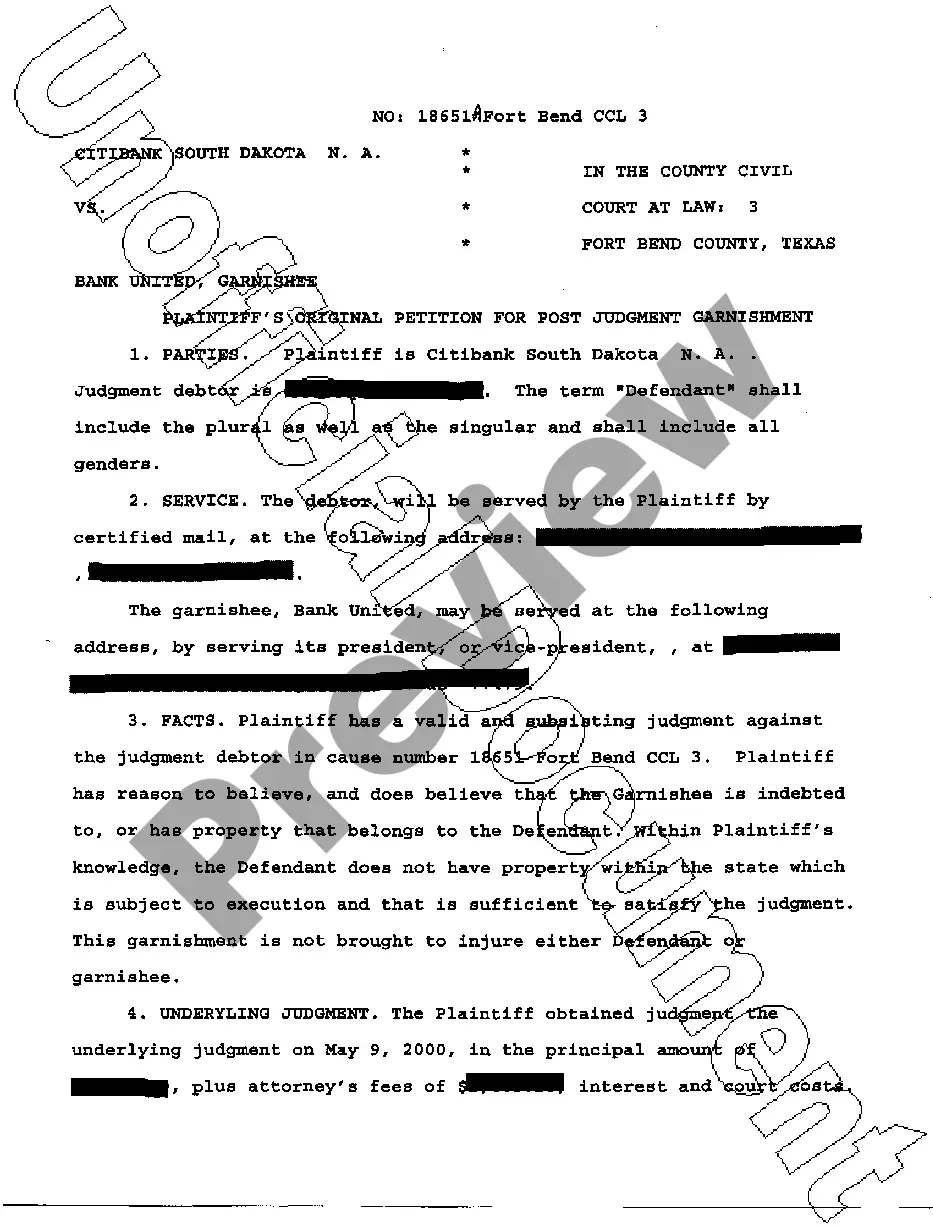

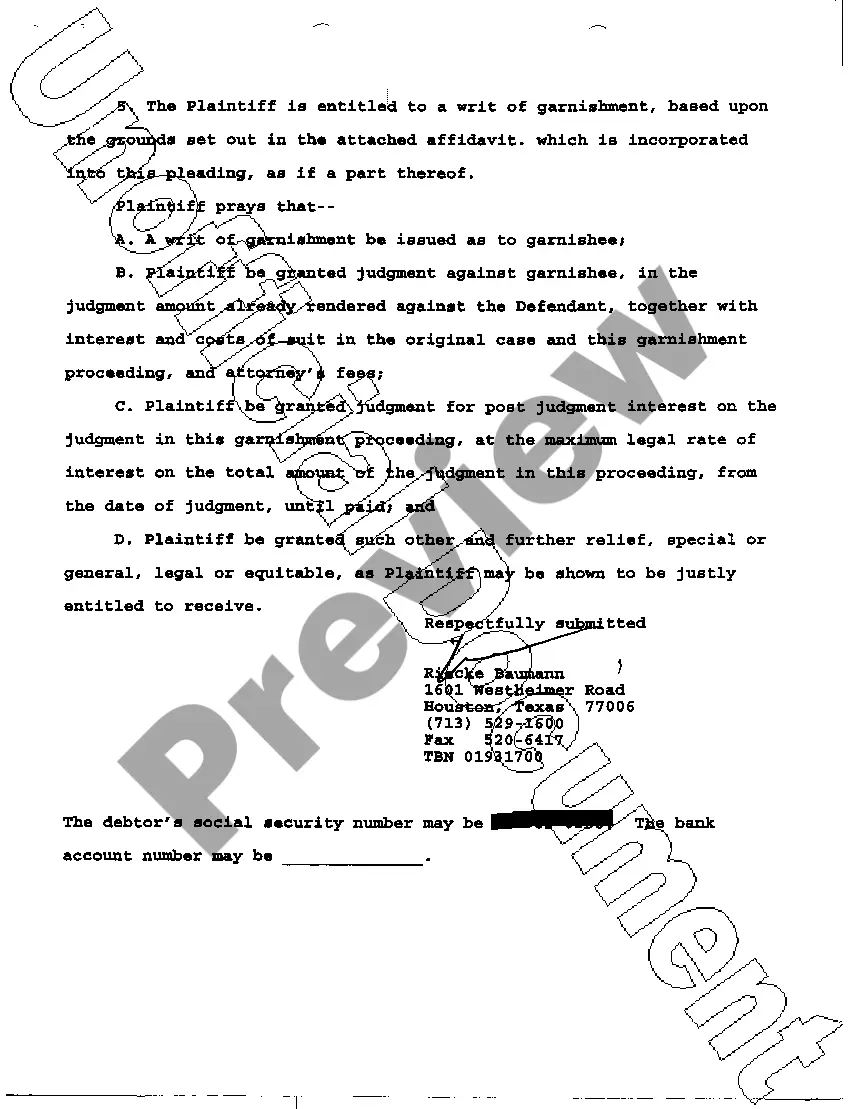

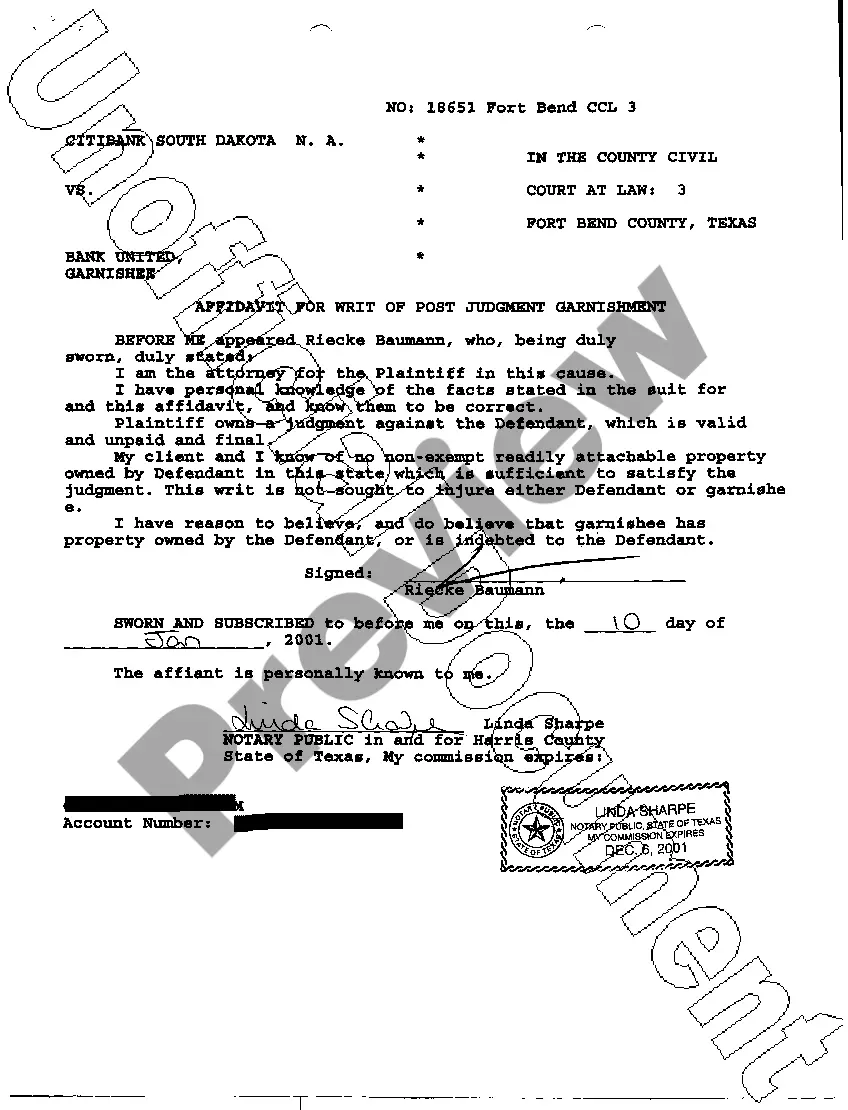

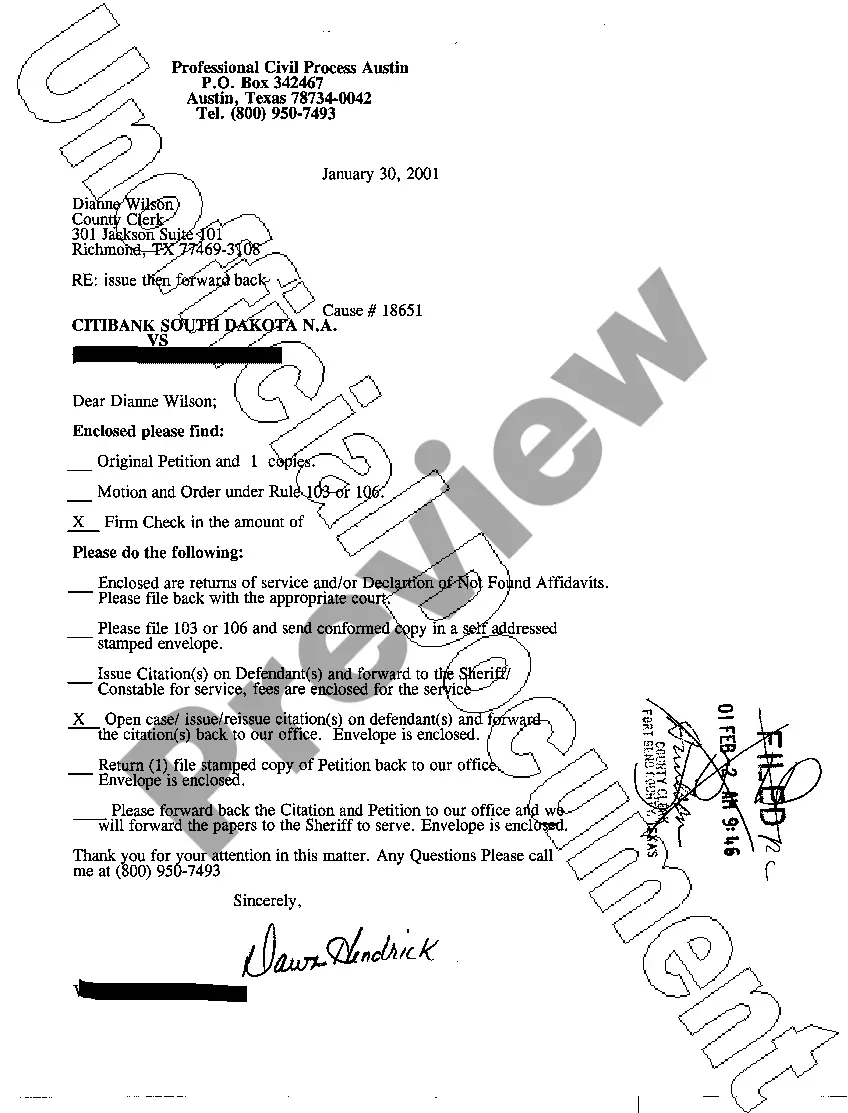

Pearland Texas Petition Writ of Garnishment: A Comprehensive Overview In Pearland, Texas, a Petition Writ of Garnishment refers to a legal process used to collect outstanding debts owed by an individual. This detailed description will provide insight into the purpose, procedure, and different types of Petition Writs of Garnishment prevalent in Pearland, Texas. Purpose of Pearland Texas Petition Writ of Garnishment: The primary purpose of a Petition Writ of Garnishment in Pearland, Texas is to enforce a court-ordered judgment against a debtor who has failed to meet their financial obligations. It allows the creditor or judgment holder to legally collect a portion of the debtor's earnings or seize their non-exempt assets to satisfy the debt. Procedure for Pearland Texas Petition Writ of Garnishment: To initiate the process of obtaining a Petition Writ of Garnishment in Pearland, Texas, the creditor must first file a petition with the appropriate court. The petition should contain detailed information about the debt owed, the debtor's identification, and the reasons for seeking garnishment. Once the court reviews the petition, it grants an order, commonly known as a writ, authorizing the garnishment process to commence. After receiving the writ, the creditor must provide it to the appropriate financial institution, employer, or other relevant entity responsible for holding the debtor's assets or income. The garnishee (the entity holding debtor's assets) is then legally obliged to withhold a specified amount from the debtor's wages, bank accounts, or other income sources. This amount is typically determined by state laws and may have certain exemptions depending on the debtor's circumstances. Different Types of Pearland Texas Petition Writ of Garnishment: 1. Wage Garnishment: The most common type of garnishment in Pearland, Texas is wage garnishment. It involves deducting a portion of the debtor's income directly from their paycheck until the debt is repaid or released. Some exemptions apply to protect a certain percentage of income. 2. Bank Account Garnishment: Bank account garnishment occurs when the creditor seeks to seize funds from the debtor's bank account(s) to satisfy the debt owed. However, certain exemptions may exist to protect funds necessary for basic living expenses. 3. Property Garnishment: Property garnishment is a type of garnishment where the creditor seizes the debtor's non-exempt property, such as real estate, vehicles, or valuable assets, to satisfy the outstanding debt. This process involves the sale of the seized property to obtain the necessary funds. It is important to note that the Pearland, Texas Petition Writ of Garnishment process must adhere to state and federal laws, ensuring the rights of both creditors and debtors are protected. Therefore, seeking legal advice from experienced professionals is highly recommended navigating through this process effectively and efficiently.

Pearland Texas Petition Writ of Garnishment

Description

How to fill out Pearland Texas Petition Writ Of Garnishment?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any law education to create this sort of paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes in handy. Our platform offers a huge collection with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Pearland Texas Petition Writ of Garnishment or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Pearland Texas Petition Writ of Garnishment in minutes using our trusted platform. If you are presently a subscriber, you can proceed to log in to your account to download the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps prior to downloading the Pearland Texas Petition Writ of Garnishment:

- Be sure the template you have chosen is specific to your area because the regulations of one state or area do not work for another state or area.

- Preview the form and go through a brief outline (if provided) of scenarios the paper can be used for.

- In case the form you picked doesn’t meet your needs, you can start over and look for the suitable document.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or create one from scratch.

- Select the payment method and proceed to download the Pearland Texas Petition Writ of Garnishment as soon as the payment is completed.

You’re good to go! Now you can proceed to print the form or fill it out online. Should you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.