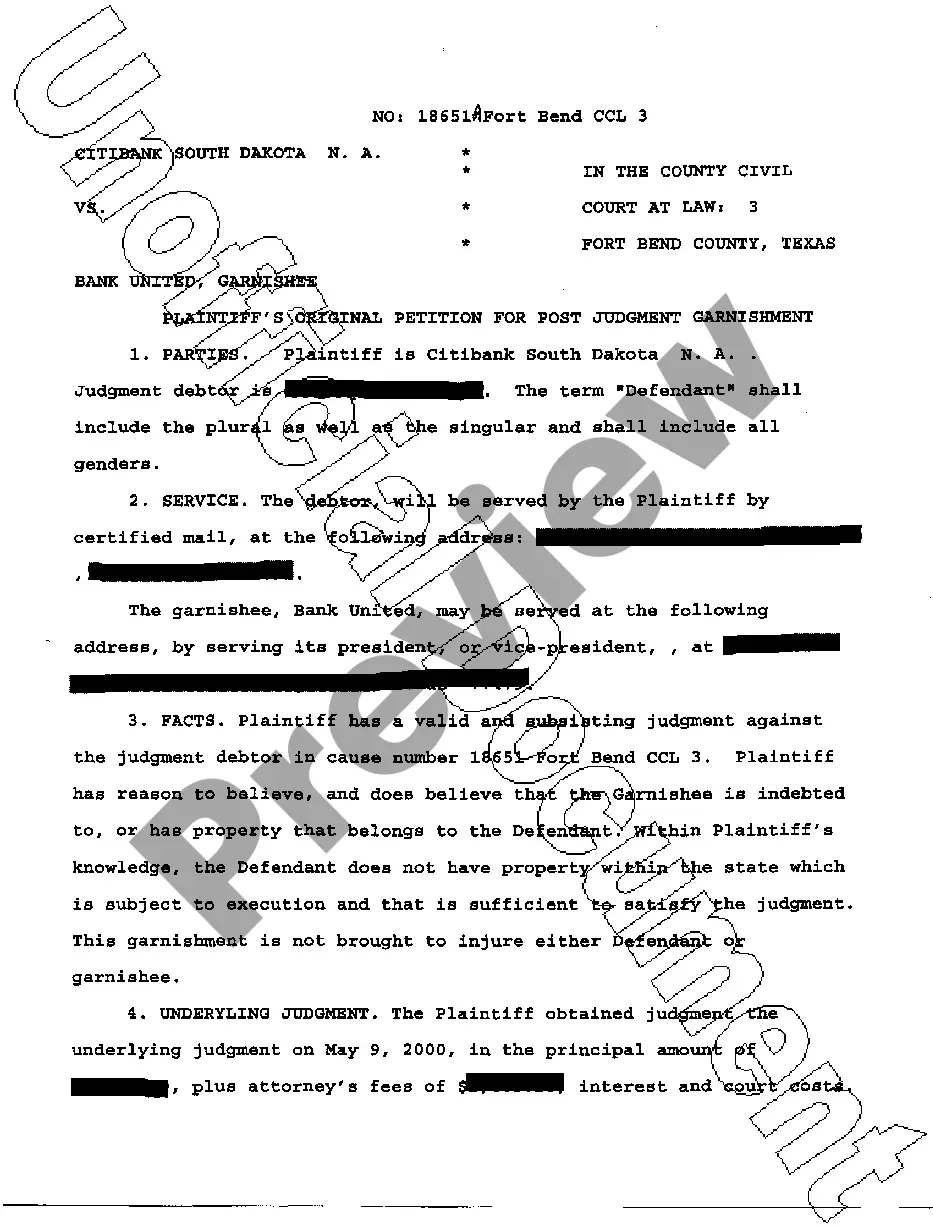

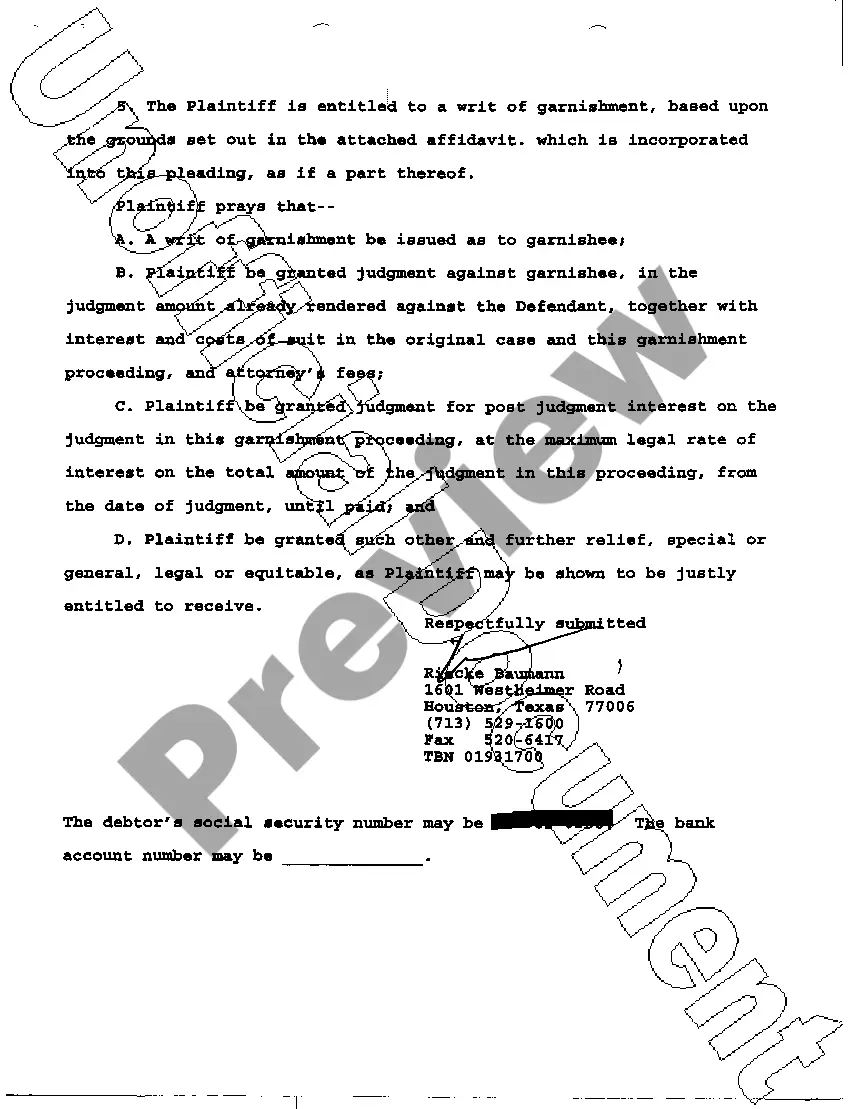

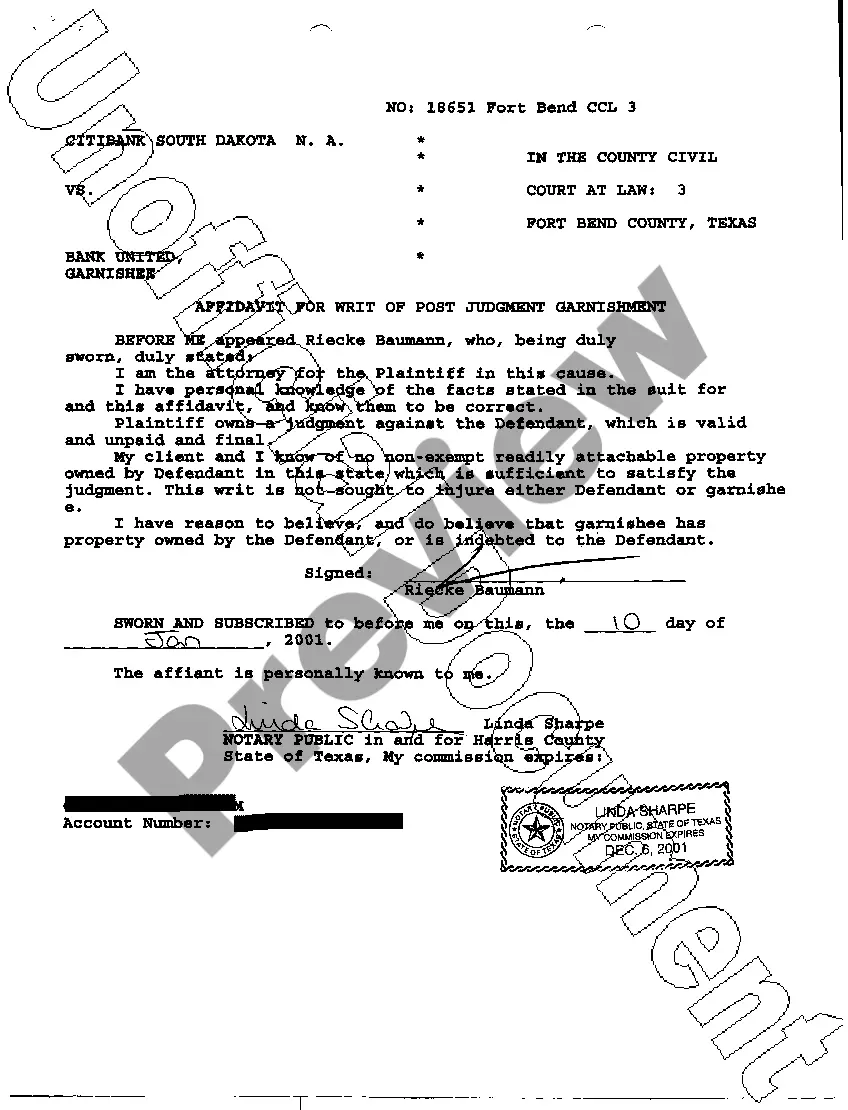

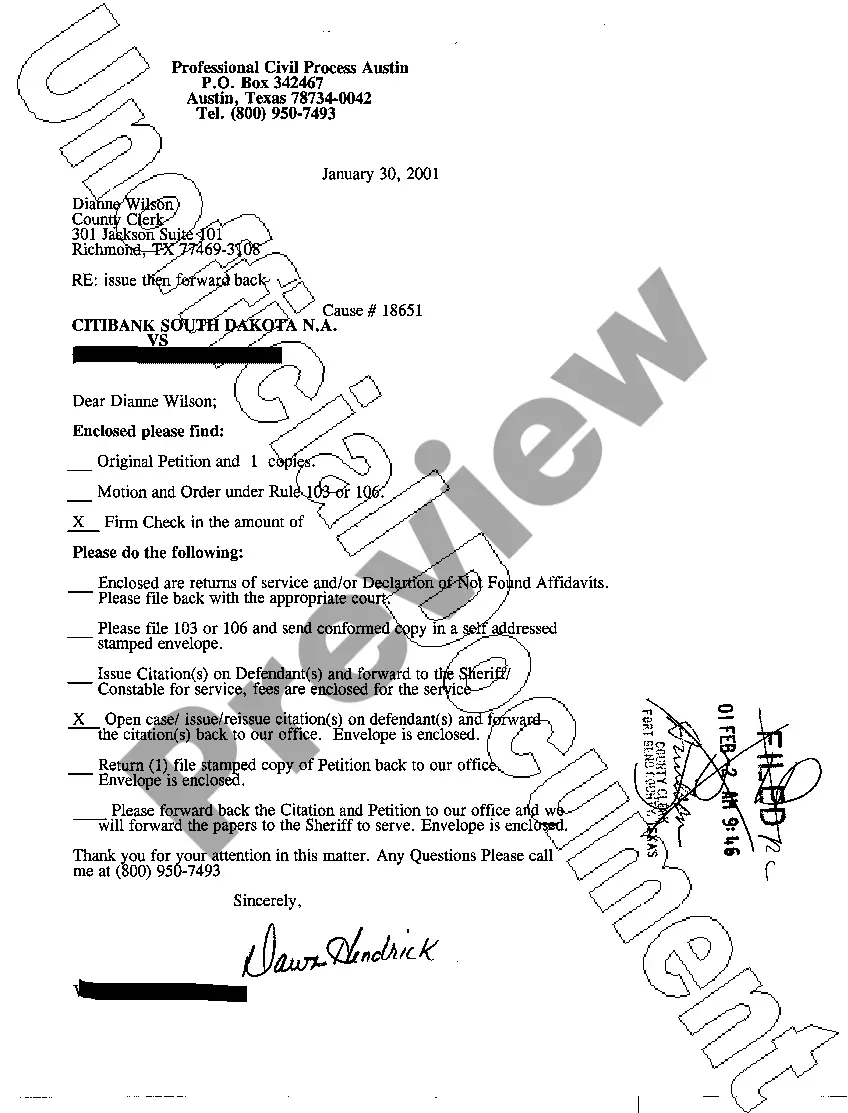

Tarrant Texas Petition Writ of Garnishment is a legal process used to collect outstanding debts owed by a debtor residing in Tarrant County, Texas. This writ allows a creditor to collect the owed amount from the debtor's wages, bank accounts, or other income sources. A Tarrant Texas Petition Writ of Garnishment is typically initiated when a creditor obtains a judgment against a debtor but is unable to collect the owed amount voluntarily. By filing a petition with the appropriate court, the creditor seeks authorization to garnish the debtor's assets to satisfy the debt. There are several types of Tarrant Texas Petition Writ of Garnishment, each targeting different income sources or assets. These include: 1. Writ of Garnishment For Wages: This type of garnishment allows a creditor to collect the debt directly from the debtor's paycheck. The employer is ordered to withhold a certain portion of the debtor's wages and remit it to the creditor until the debt is satisfied. 2. Writ of Garnishment For Bank Accounts: With this type of garnishment, a creditor can freeze and seize funds held in the debtor's bank accounts. The debtor's bank is required to hold the funds and release them to the creditor, up to the amount owed, once the writ is received. 3. Writ of Garnishment For Other Income Sources: This writ covers non-wage income sources such as rental payments, royalties, or commissions. If the debtor has any outstanding payments owed to them, the creditor can garnish these funds. 4. Writ of Garnishment For Self-Employed Debtors: When the debtor is self-employed, this type of garnishment allows creditors to collect the owed amount directly from the debtor's business income. The debtor's clients or customers are served with the writ and directed to remit the payments to the creditor instead of the debtor. To initiate a Tarrant Texas Petition Writ of Garnishment, the creditor must file a petition with the local court, providing details of the debt and supporting documentation. Once approved, the writ is served to the relevant party, such as the debtor's employer or bank, who must comply with the order and remit the funds to the creditor. It is important for both creditors and debtors in Tarrant County, Texas, to be aware of the laws and procedures surrounding Petition Writ of Garnishment to ensure their rights are protected during the debt collection process. Seeking legal advice from an experienced attorney specializing in debt collection can help navigate this complex legal area.

Tarrant Texas Petition Writ of Garnishment

Description

How to fill out Tarrant Texas Petition Writ Of Garnishment?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, usually, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Tarrant Texas Petition Writ of Garnishment or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Tarrant Texas Petition Writ of Garnishment complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Tarrant Texas Petition Writ of Garnishment is proper for you, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!

Form popularity

FAQ

The law requires proper notice to defendants of a lawsuit against them. Any resulting default judgment against the defendant is voidable if a defendant has inadequate notice of the action.

Interested persons may find Texas judgment records in the court clerk's office, and depending on the court, the person may contact the county, district, or city clerk. The appellate courts in Texas have an online search tool to make the process an easy one.

Do Judgments Expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant.

Yes. By its very design, a default judgment is a judgment entered in the trial court when a defendant (you) hasn't filed a response in a timely manner. If you failed to respond to a complaint in a timely manner, the odds are you may also be unable to respond to the motion for default which follows.

If you received a notice of default judgment from a Texas court, your only option is to file a motion to set aside the default judgment. Normally, you would have 30 days from the judge's order granting the motion to file a motion to set aside default judgment. There are some exceptions to this 30 day rule, however.

If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

There are several ways to collect on a judgment in Texas. First, if you have a Texas judgment, you can begin the collections process immediately by filing an ?abstract of judgment? in the county clerk's office where you believe the judgment debtor owns ?non-exempt? real property.

Do Judgments Expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant. You can attempt to revive a dormant judgment in order to continue to try and collect the debt.

You can try and get your money (called 'enforcing your judgment') by asking the court for: a warrant of control. an attachment of earnings order. a third-party debt order. a charging order.

If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

Interesting Questions

More info

A. The Clerk's Office will give you the following instructions if you make a Writ of Possession: 1. Submit your petition’s) in writing, unless your order states that it should be made orally. 2. Fill out the Tarrant County Writ of Possession petition: A) Type of Petition — Name of Petitioner, Filing Address, and Mailing Address B1 Name of Defendant, Filing Address, and Mailing Address B2 Name of the Lien Holder, Filing Address, and Mailing Address B3 Name of Lien Holder, Filing Address, and Mailing Address A Form Title of petition to have the Writ or a Garnish levied. B1, B1b, C Name of Lien holder, Filing Address. B2, B2b, C2 Name of Lien holder, Mailing Address. C1-D2 Name of Lien Holder, Filing Address, and Mailing Address. D1-D2d, D2d1-D2f Name of Lien Holder, Mailing Address. A-E2-G2 Name of Lien holder, Filing Address, and Mailing Address and Form Title of order giving the Writ or Garnish E.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.