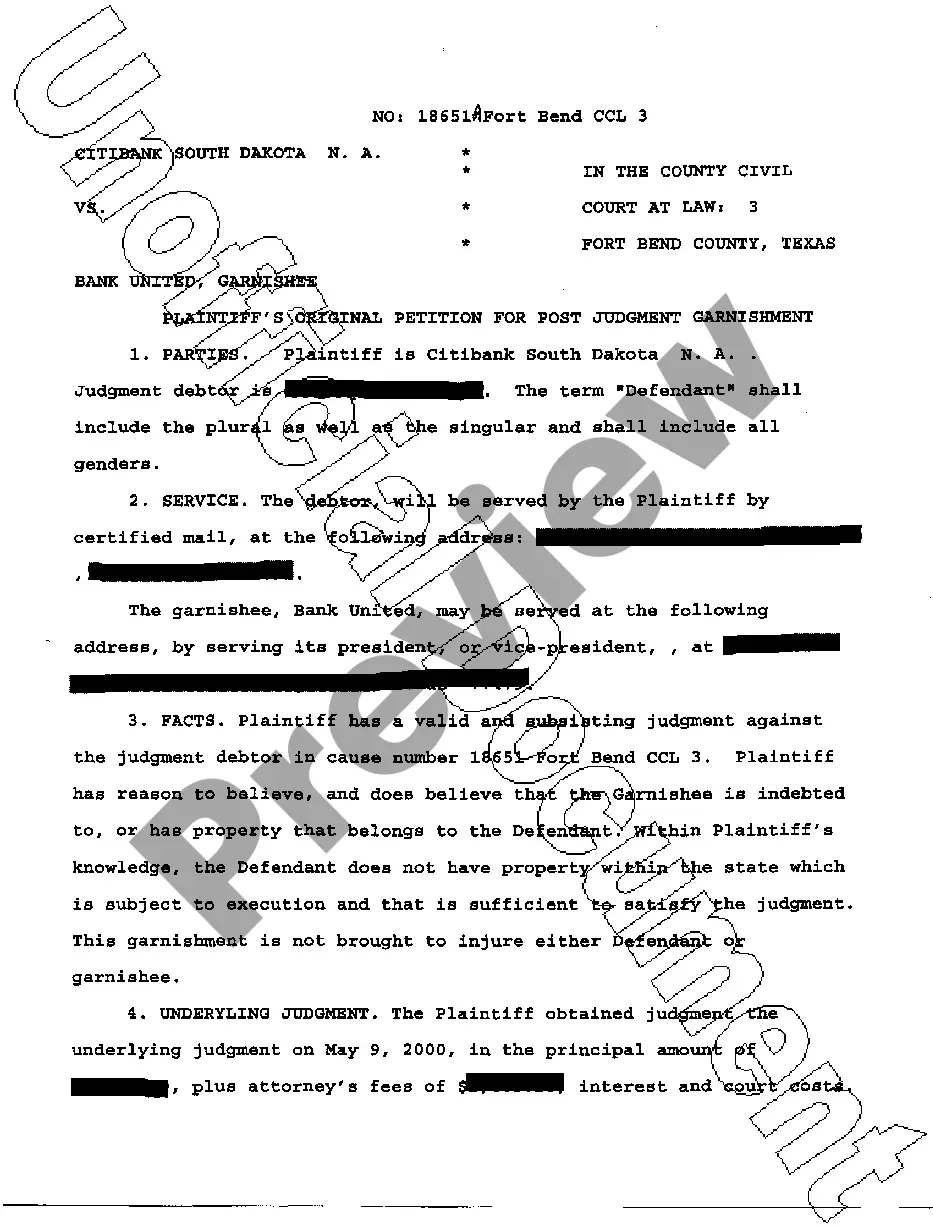

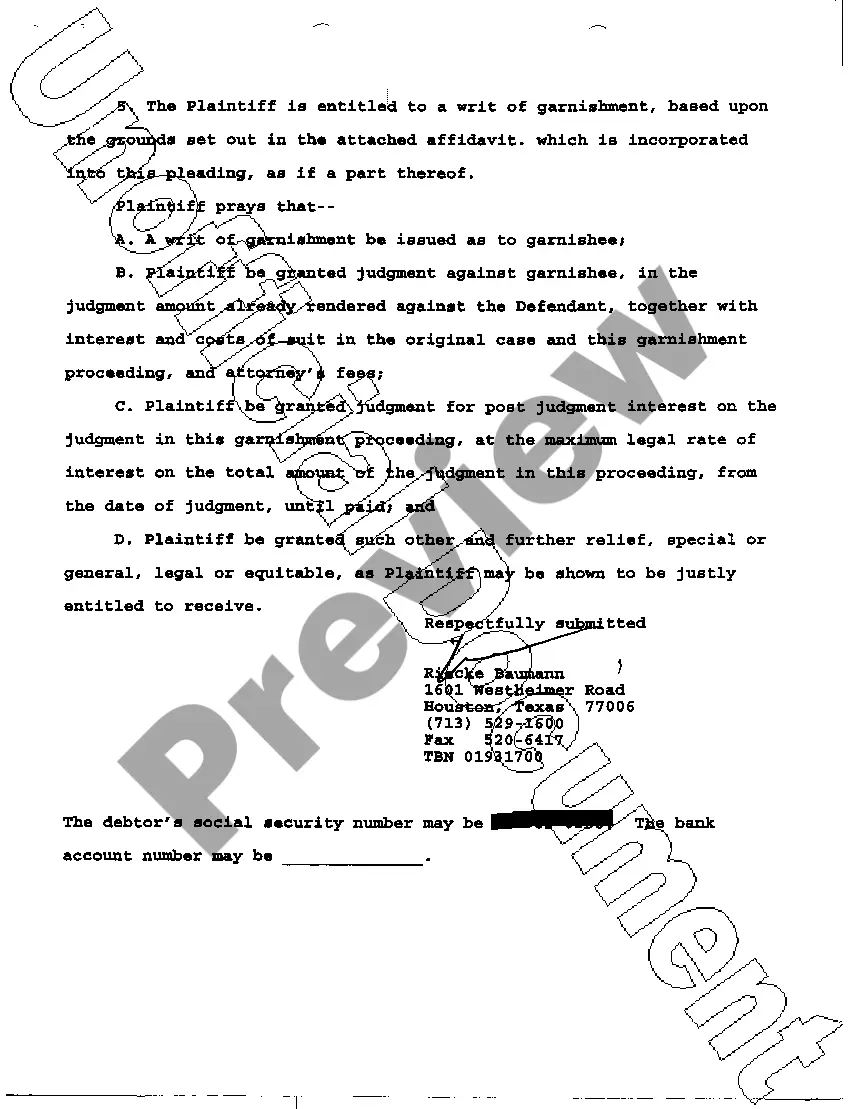

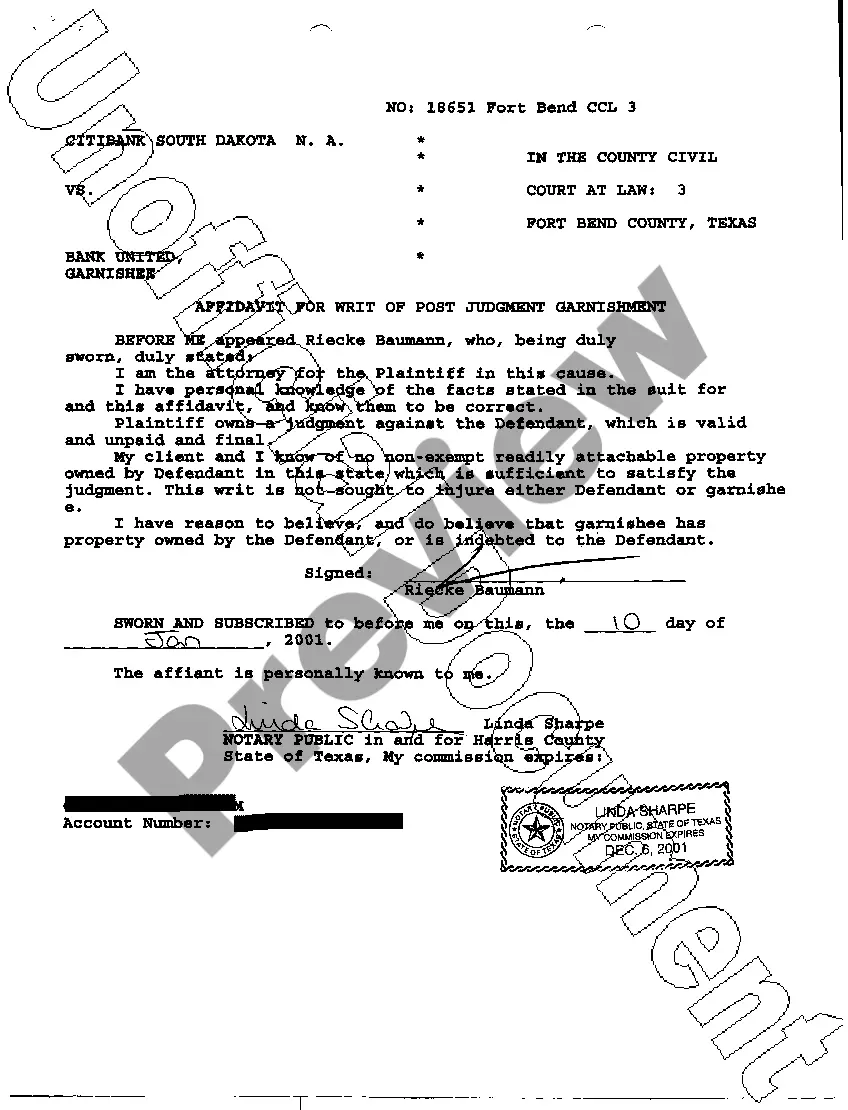

Wichita Falls Texas Petition Writ of Garnishment is a legal procedure used to collect debts owed by an individual or entity residing in Wichita Falls, Texas. This process enables creditors to obtain a court order allowing them to collect money owed by garnishing the debtor's wages, bank accounts, or other assets. Here, we will discuss the different types of Wichita Falls Texas Petition Writ of Garnishment. 1. Wages Garnishment: This type of garnishment allows creditors to collect a portion of the debtor's earnings directly from their employer. The employer deducts the specified amount and sends it to the court, which then distributes it to the creditor until the debt is fully satisfied. 2. Bank Account Garnishment: Wichita Falls Texas Petition Writ of Garnishment can also be used to freeze and seize funds in the debtor's bank accounts. The court orders the bank to freeze a certain amount of money, which is then transferred to the creditor to offset the debt owed. 3. Property Garnishment: In certain cases, creditors can seek to garnish the debtor's property, such as real estate, vehicles, or valuable assets, to satisfy the debt. The court may order the seizure and sale of these assets, with the proceeds going towards repaying the debt. 4. Non-Wage Garnishment: This type of garnishment is broader and encompasses various assets besides wages and bank accounts. It can include items such as tax refunds, insurance settlements, vendor payments, or other sources of income owed to the debtor. 5. Federal Debt Garnishment: Sometimes, federal agencies, such as the Internal Revenue Service (IRS) or the Department of Education, may use Wichita Falls Texas Petition Writ of Garnishment to collect outstanding debts owed to them. This could involve garnishing wages, bank accounts, or other assets under federal laws and regulations. It is important to note that each type of Wichita Falls Texas Petition Writ of Garnishment is subject to specific legal requirements and procedures, and it is highly recommended for both debtors and creditors to consult with a qualified attorney to ensure compliance and protect their rights throughout the garnishment process.

Wichita Falls Texas Petition Writ of Garnishment

Description

How to fill out Wichita Falls Texas Petition Writ Of Garnishment?

If you are looking for a relevant form template, it’s extremely hard to choose a more convenient platform than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can find a huge number of document samples for business and individual purposes by types and states, or keywords. Using our high-quality search feature, getting the most up-to-date Wichita Falls Texas Petition Writ of Garnishment is as easy as 1-2-3. Moreover, the relevance of every document is confirmed by a team of skilled attorneys that regularly check the templates on our platform and update them based on the most recent state and county demands.

If you already know about our platform and have a registered account, all you need to get the Wichita Falls Texas Petition Writ of Garnishment is to log in to your profile and click the Download button.

If you use US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have discovered the form you require. Check its information and make use of the Preview function (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the needed document.

- Affirm your selection. Select the Buy now button. Following that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the form. Select the format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Wichita Falls Texas Petition Writ of Garnishment.

Each form you save in your profile does not have an expiry date and is yours forever. You can easily access them via the My Forms menu, so if you need to have an extra copy for editing or creating a hard copy, you can come back and save it again whenever you want.

Take advantage of the US Legal Forms professional catalogue to gain access to the Wichita Falls Texas Petition Writ of Garnishment you were seeking and a huge number of other professional and state-specific templates in one place!

Form popularity

FAQ

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment.

A judgment is valid for 10 years and can be enforced at any time during those that time. It is not uncommon for a creditor to seek to enforce a judgment that is close to ten years old. There are also ways to renew the judgment, so that it can be enforced for even longer than ten years.

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

Some of the Texas justice courts have a form to request a writ of garnishment available on their website. If the justice court you intend to file with does not provide a form, a sample application is available at the link below.

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment.

How Long Is a Writ of Execution Good for? According to Texas Rule of Civil Procedure 34.001, a Writ of Execution for a money judgment can be applied for within 10 years of the entry of a judgment and is good for just as long. Within the 10 year period, the writ can be renewed at any time for an additional 10 years.

Filing a Writ of Execution 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

A creditor can stop a writ of garnishment by essentially asking the court to dismiss it.