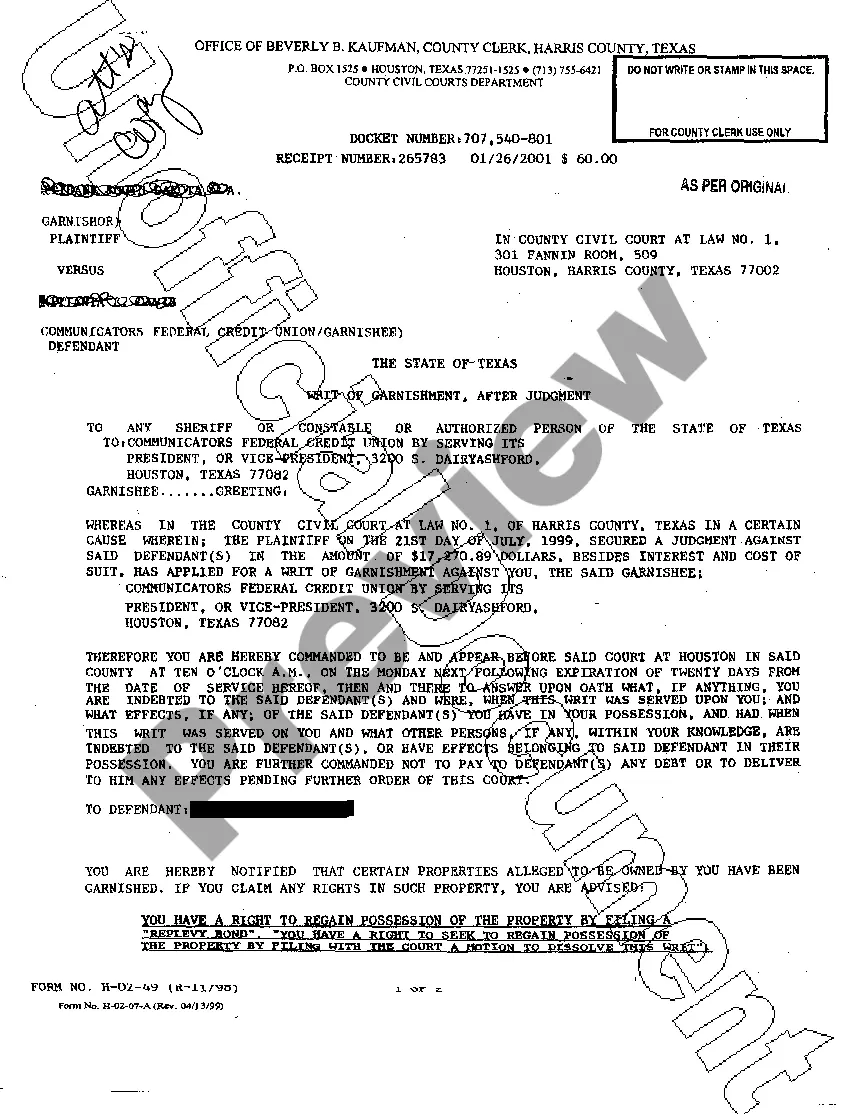

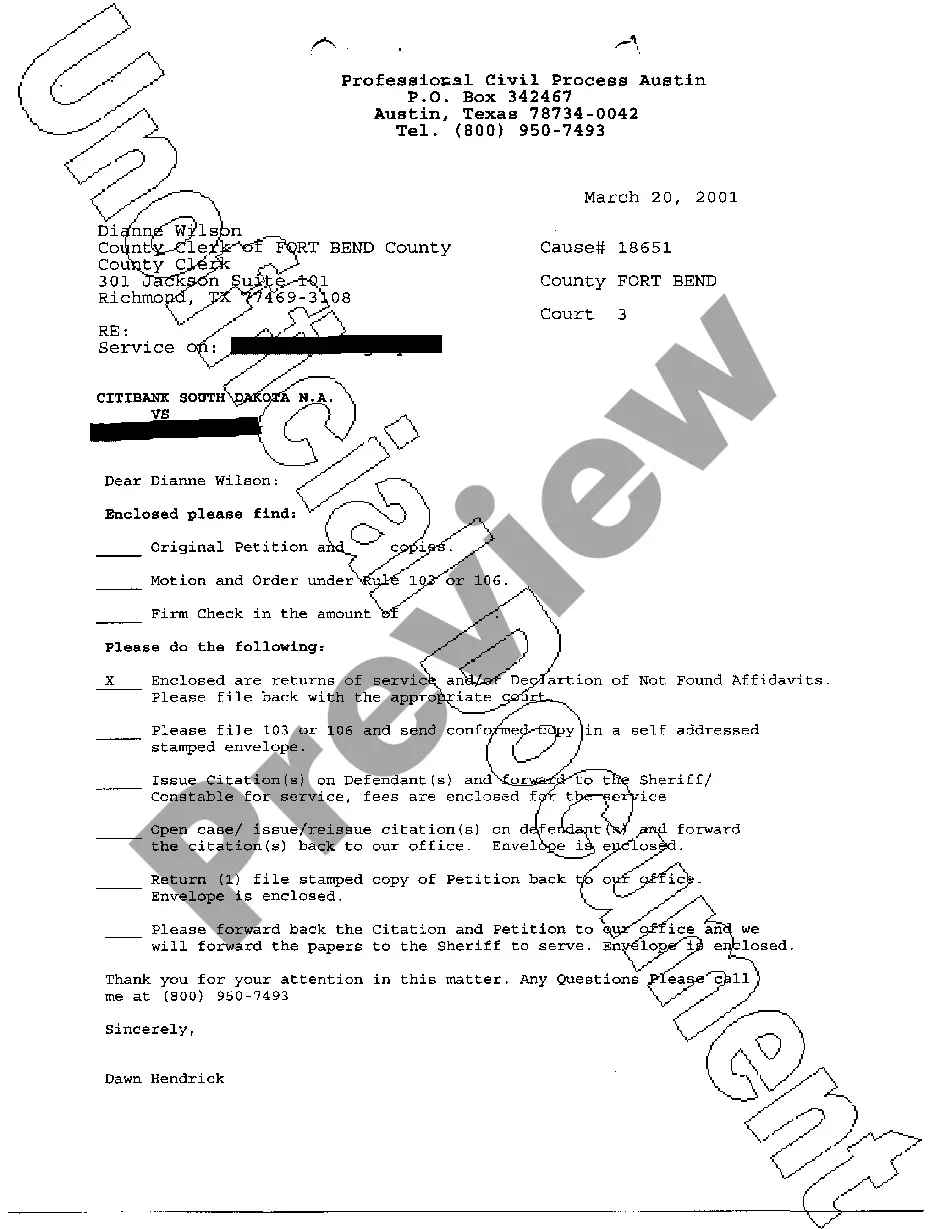

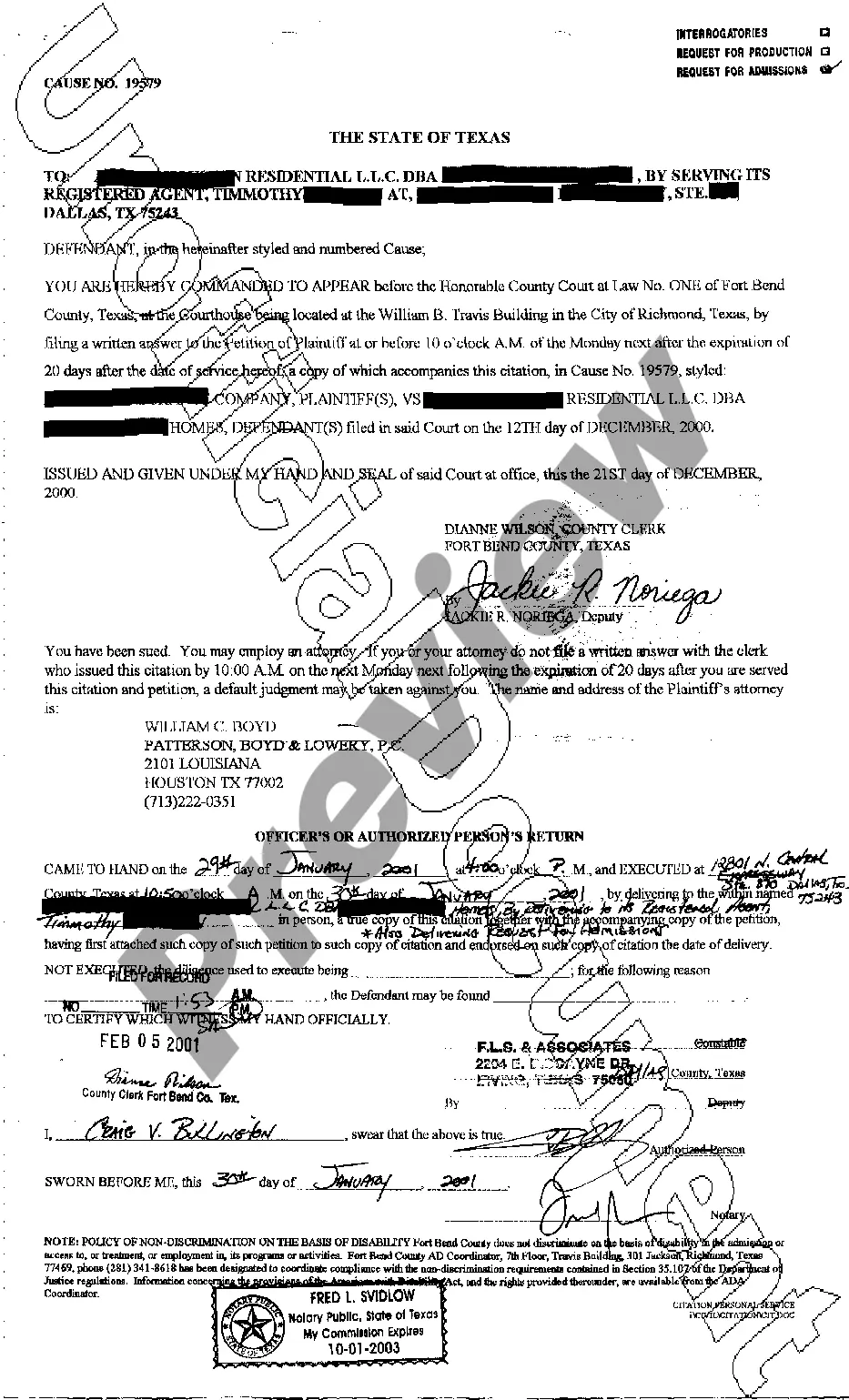

Corpus Christi Texas Writ of Garnishment: A Comprehensive Overview In Corpus Christi, Texas, a writ of garnishment serves as a legal tool used to collect outstanding debts owed by a debtor. It allows a creditor to claim a portion of the debtor's wages, salaries, bank accounts, or other assets to satisfy the debt. This detailed description will shed light on the different types of writs of garnishment found in Corpus Christi, Texas, offering valuable insights for individuals seeking a clear understanding of the process. 1. General Garnishment: The general garnishment is the primary type used in Corpus Christi, Texas, where a creditor can obtain a court order to garnish a debtor's wages. This order allows the employer to withhold a specific portion of the debtor's wages until the debt is fully satisfied. 2. Bank Garnishment: With a bank garnishment, a creditor can seek assistance from the court to access funds held in a debtor's bank account. If the court approves the garnishment, the funds will be frozen, allowing the creditor to recover the debt owed. 3. Property Garnishment: This type of garnishment involves seizing physical assets owned by the debtor, such as cars, real estate, or valuable possessions, under court order. The creditor can then sell these assets to recover the debt. 4. Federal Salary Garnishment: If the debtor is a federal employee or receives federal benefits, such as Social Security, the creditor may pursue a federal salary garnishment. In this case, the debtor's wages or benefits are subject to garnishment under federal laws and regulations. 5. Child Support Garnishment: Child support payments can be garnished in cases where the debtor fails to fulfill their child support obligations. Corpus Christi, Texas, allows for the garnishment of a portion of the debtor's income to cover unpaid child support. The process of obtaining a writ of garnishment in Corpus Christi, Texas, typically involves the following steps: 1. Filing a Lawsuit: The creditor initiates legal proceedings by filing a lawsuit against the debtor to pursue the outstanding debt owed. 2. Obtaining a Judgment: After a successful lawsuit, the creditor is granted a court judgment affirming the debt owed by the debtor. 3. Application for Garnishment: Once the judgment is obtained, the creditor can file an application for garnishment, specifying the type of garnishment sought. 4. Serving the Debtor: The debtor must be properly served with a copy of the garnishment order and related documents, providing them with a chance to dispute or challenge the garnishment. 5. Employers/Banks' Compliance: Upon receipt of the garnishment order, the debtor's employer or bank must comply by withholding the requested amount from the wages or frozen account. It is crucial for both debtors and creditors in Corpus Christi, Texas, to understand the various types of writs of garnishment available and the legal processes involved. Seeking advice from a qualified attorney knowledgeable in Texas garnishment laws is advisable to ensure compliance and protect individual rights.

Corpus Christi Texas Writ of Garnishment

Description

How to fill out Corpus Christi Texas Writ Of Garnishment?

If you are searching for a valid form template, it’s extremely hard to find a better place than the US Legal Forms site – one of the most comprehensive libraries on the web. With this library, you can find a large number of document samples for business and personal purposes by categories and states, or key phrases. Using our high-quality search option, finding the most recent Corpus Christi Texas Writ of Garnishment is as elementary as 1-2-3. Additionally, the relevance of each and every document is verified by a group of skilled attorneys that regularly review the templates on our website and revise them according to the latest state and county demands.

If you already know about our platform and have a registered account, all you should do to get the Corpus Christi Texas Writ of Garnishment is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have chosen the form you need. Check its explanation and make use of the Preview function to see its content. If it doesn’t meet your needs, use the Search field near the top of the screen to get the appropriate document.

- Confirm your selection. Choose the Buy now button. Following that, choose your preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Receive the form. Pick the format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the acquired Corpus Christi Texas Writ of Garnishment.

Every form you add to your profile does not have an expiration date and is yours forever. You always have the ability to access them via the My Forms menu, so if you need to receive an additional version for modifying or printing, feel free to come back and export it again at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the Corpus Christi Texas Writ of Garnishment you were seeking and a large number of other professional and state-specific templates on one website!