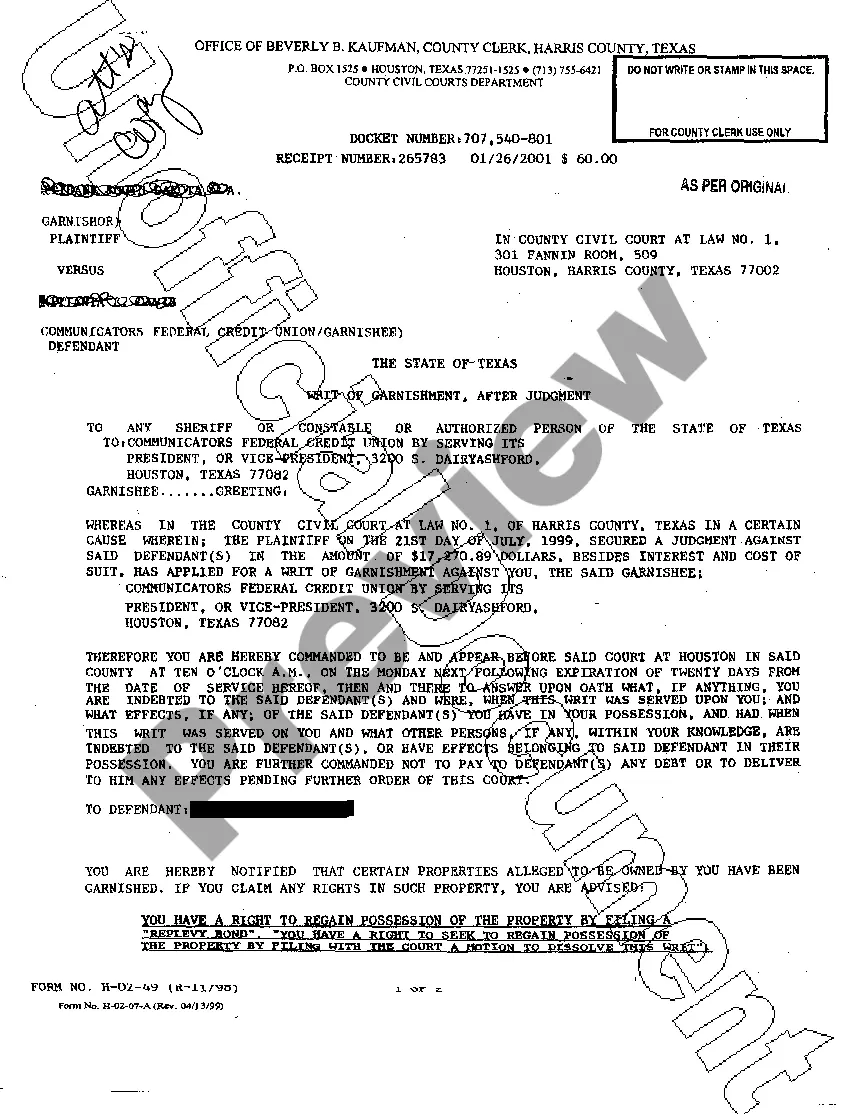

Title: Understanding the Different Types of Dallas Texas Writ of Garnishment Introduction: The Dallas Texas Writ of Garnishment is a legal tool that allows creditors to collect outstanding debts owed by a debtor who has failed to fulfill their financial obligations. This comprehensive article aims to provide a detailed description of the Dallas Texas Writ of Garnishment, highlighting its purpose, process, and different types available. Keywords: Dallas Texas, Writ of Garnishment, creditor, outstanding debts, financial obligations I. What is a Dallas Texas Writ of Garnishment? The Dallas Texas Writ of Garnishment is a court-ordered legal mechanism that enables a creditor to collect the unpaid debts from a debtor's income or assets. It is typically employed when other collection attempts, such as negotiation or demand letters, have failed to yield results. Keywords: court-ordered, legal mechanism, collect, unpaid debts, negotiation, demand letters II. Purpose of Dallas Texas Writ of Garnishment: The primary purpose of the Dallas Texas Writ of Garnishment is to provide a fair and enforceable means for creditors to recover their outstanding debts. It helps protect the rights of creditors and maintain the integrity of the financial system by ensuring that individuals and businesses meet their financial obligations. Keywords: recover, outstanding debts, protect rights, financial obligations, enforceable, financial system III. Process of Dallas Texas Writ of Garnishment: 1. Filing the Writ: To initiate the garnishment process, a creditor must file a Writ of Garnishment with the appropriate court in Dallas, Texas. This document outlines the details of the debt owed, including the amount and the judgment that supports the creditor's claim. Keywords: initiate, file, Writ of Garnishment, creditor, debt owed, judgment 2. Service of Writ: Once the Writ of Garnishment is filed, it must be served to the debtor and any other relevant parties, such as the garnishee (the individual or entity holding the debtor's assets). Keywords: served, debtor, relevant parties, garnishee, assets 3. Response Period: The debtor and other parties involved have a specified period to respond or object to the Writ of Garnishment. This allows them to raise any legal defenses or negotiate a payment plan to halt or modify the garnishment. Keywords: respond, object, legal defenses, negotiate, payment plan IV. Different Types of Dallas Texas Writ of Garnishment: 1. Wage Garnishment: The most common type of Dallas Texas Writ of Garnishment, it allows the creditor to collect a portion of the debtor's wages or salary directly from their employer until the debt is satisfied. Keywords: Wage Garnishment, collect, wages, salary, employer, debt 2. Bank Account Garnishment: This type of garnishment enables the creditor to collect the debt directly from the debtor's bank account, freezing the funds until the outstanding debt is cleared. Keywords: Bank Account Garnishment, collect, freeze funds, outstanding debt Conclusion: The Dallas Texas Writ of Garnishment serves as a valuable legal tool for creditors seeking to recover unpaid debts. Understanding the process and various types of garnishment, including Wage Garnishment and Bank Account Garnishment, is essential for both creditors and debtors to navigate the legal landscape effectively. Keywords: legal tool, recover unpaid debts, Wage Garnishment, Bank Account Garnishment, navigate, legal landscape

Dallas Texas Writ of Garnishment

Description

How to fill out Dallas Texas Writ Of Garnishment?

If you are looking for a relevant form, it’s extremely hard to choose a more convenient platform than the US Legal Forms site – probably the most considerable libraries on the web. With this library, you can get a huge number of templates for business and individual purposes by types and states, or keywords. Using our advanced search option, finding the newest Dallas Texas Writ of Garnishment is as elementary as 1-2-3. Furthermore, the relevance of each record is confirmed by a team of expert attorneys that on a regular basis check the templates on our platform and update them based on the latest state and county laws.

If you already know about our platform and have an account, all you need to get the Dallas Texas Writ of Garnishment is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have chosen the sample you want. Check its explanation and use the Preview function to check its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to discover the needed record.

- Affirm your decision. Click the Buy now button. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the transaction. Use your bank card or PayPal account to complete the registration procedure.

- Receive the form. Pick the file format and save it on your device.

- Make modifications. Fill out, revise, print, and sign the received Dallas Texas Writ of Garnishment.

Each form you add to your user profile does not have an expiration date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you need to have an extra duplicate for enhancing or creating a hard copy, you can return and export it again anytime.

Make use of the US Legal Forms extensive library to get access to the Dallas Texas Writ of Garnishment you were seeking and a huge number of other professional and state-specific templates in one place!

Form popularity

FAQ

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

The writ of garnishment orders the third party to surrender the defendant's assets to the court in order to satisfy a judgment against the defendant. With a writ of garnishment in place, creditors such as banks and credit cards can pull directly from defendants' bank accounts under Texas garnishment laws.

If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

How Long Is a Writ of Execution Good for? According to Texas Rule of Civil Procedure 34.001, a Writ of Execution for a money judgment can be applied for within 10 years of the entry of a judgment and is good for just as long. Within the 10 year period, the writ can be renewed at any time for an additional 10 years.

Some of the Texas justice courts have a form to request a writ of garnishment available on their website. If the justice court you intend to file with does not provide a form, a sample application is available at the link below.

A judgment is valid for 10 years and can be enforced at any time during those that time. It is not uncommon for a creditor to seek to enforce a judgment that is close to ten years old. There are also ways to renew the judgment, so that it can be enforced for even longer than ten years.

Once issued, the writ of execution directs the sheriff to seize the non-exempt property and sell it. The proceeds of the sale are given to the creditor to satisfy all or part of the judgment.

In Texas, wage garnishment is prohibited by the Texas Constitution except for a few kinds of debt: child support, spousal support, student loans, or unpaid taxes. A debt collector cannot garnish your wages for ordinary debts. However, Texas does allow for a bank account to be frozen.

A creditor can stop a writ of garnishment by essentially asking the court to dismiss it.

Interesting Questions

More info

So I ask for your assistance in the form of Writ of Execution, Writ of Possession, Certified Copies on Open Cases, or other legal process, where the debtor's interest is held hostage from the courts, the Court may compel repayment of money or property, or the court may make it impossible to sell or use that property. For more information contact the Clerk's Office at. I understand that I am required to execute the document. If I fail to comply with the writ, I am waiving my right to a Writ of Execution. The court holds the right of the garnishee, and it may not be taken to pay the judgment, for example in the event you have an insurance policy on the vehicle. I have read the requirements in the application and understand them. I will not violate the requirements of the writ or fail to comply. The clerk's office may require fees, court costs and service of the Notice of Judgment.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.