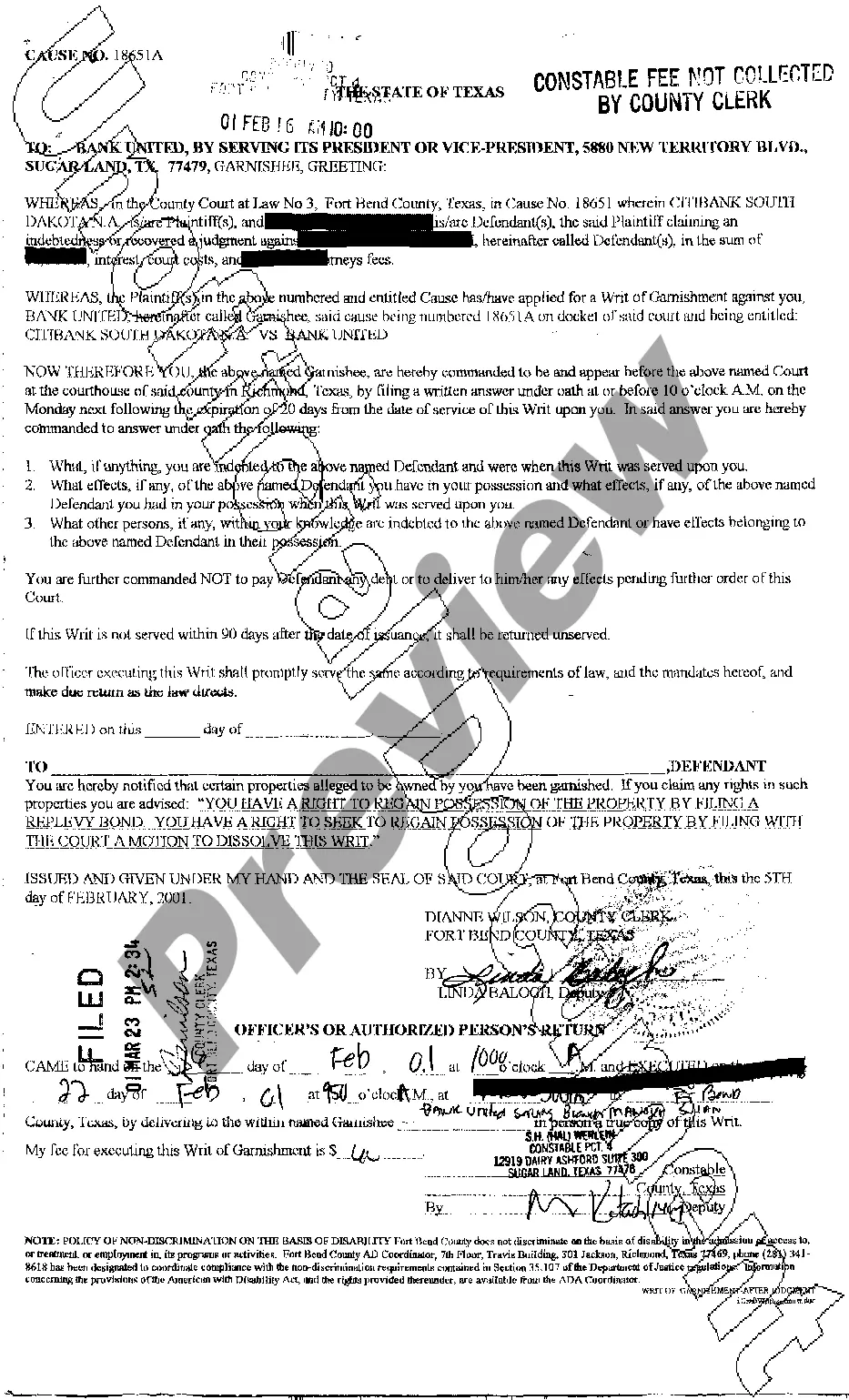

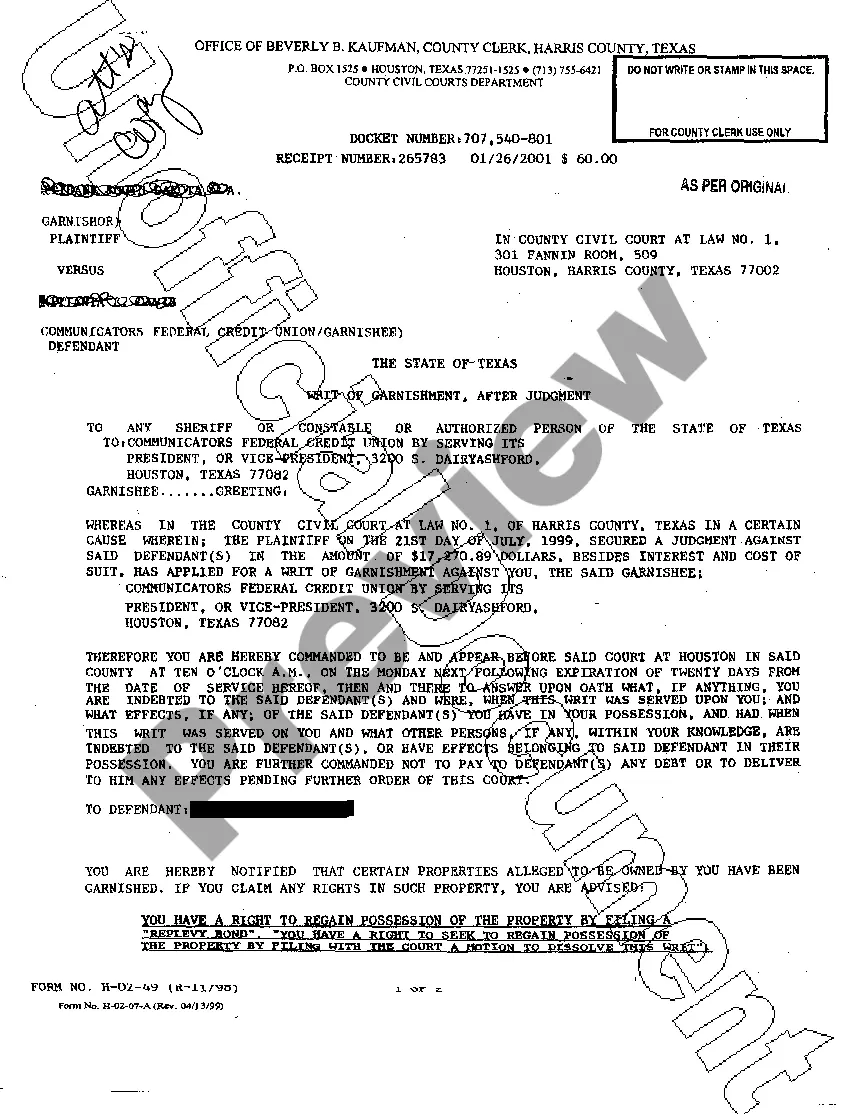

The Fort Worth Texas Writ of Garnishment is a legal document that allows a creditor to collect a debt from a debtor by securing funds directly from the debtor's wages, bank accounts, or other assets. This process is an essential tool for enforcing judgments and ensuring that a creditor receives the payment they are owed. Just like other states in the United States, Texas has its own laws and procedures regarding writs of garnishment. In Fort Worth, Texas, there are two types of garnishment: wage garnishment and non-wage garnishment. 1. Wage Garnishment: This type of garnishment allows a creditor to collect a debt directly from the debtor's paycheck or salary. Once a creditor obtains a writ of garnishment, it is sent to the debtor's employer, who is then legally obligated to withhold a portion of the debtor's wages and remit them to the creditor. The amount that can be garnished from a debtor's wages is usually limited by law to a certain percentage, ensuring that debtors have enough income to cover their basic needs. 2. Non-Wage Garnishment: In addition to wage garnishment, Fort Worth, Texas also allows for non-wage garnishment. This type of garnishment allows a creditor to collect a debt directly from the debtor's bank accounts, rental income, or any other assets that can be seized. The process involves obtaining a writ of garnishment, which is then served to the financial institution holding the debtor's funds or any other party responsible for the assets. Once received, the institution or party must freeze the debtor's accounts or assets and transfer the frozen funds to the creditor. It is important to note that a writ of garnishment can only be obtained after a judgment has been issued against the debtor by a court. To begin the process, a creditor must file a lawsuit, usually referred to as a debt collection lawsuit, and successfully obtain a judgment. Once the judgment is secured, the creditor can then initiate the garnishment process by obtaining the necessary writ. While the writ of garnishment is a powerful tool for creditors seeking to collect their debts, it is also subject to certain limitations and protections for debtors. For example, Texas law allows exemptions for certain types of income, such as Social Security benefits, workers' compensation, and child support payments. These exemptions protect debtors' essential income sources and ensure they can meet their basic needs. In conclusion, the Fort Worth Texas Writ of Garnishment is a legal mechanism that enables creditors to collect debts from debtors by garnishing their wages or seizing other assets. It includes two types of garnishment: wage garnishment and non-wage garnishment. The process involves obtaining a writ of garnishment after obtaining a judgment in a debt collection lawsuit. Both debtors and creditors must understand the relevant laws and protections associated with Fort Worth's writs of garnishment to ensure fair and legal debt collection practices.

Fort Worth Texas Writ of Garnishment

State:

Texas

City:

Fort Worth

Control #:

TX-G0310

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Writ of Garnishment

Free preview

How to fill out Fort Worth Texas Writ Of Garnishment?

If you're in search of a pertinent form, it's exceedingly challenging to select a more suitable platform than the US Legal Forms site – arguably the most comprehensive collections online.

Here you can discover a vast array of document samples for both corporate and personal use categorized by types and regions, or keywords.

With the top-notch search feature, locating the latest Fort Worth Texas Writ of Garnishment is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the file format and download it onto your device.

- Furthermore, the relevance of each document is verified by a team of skilled attorneys who consistently review the templates on our site and refresh them according to the latest state and county requirements.

- If you’re already familiar with our platform and possess a registered account, all you need to do to obtain the Fort Worth Texas Writ of Garnishment is to Log In to your account and click the Download button.

- If this is your initial time using US Legal Forms, simply adhere to the instructions below.

- Ensure you have selected the form you need. Read its description and use the Preview option to review its content. If it doesn’t fulfill your requirements, utilize the Search function located near the top of the page to find the correct file.

- Confirm your choice. Click the Buy now button. Then, select your desired subscription plan and provide details to create an account.

Form popularity

Interesting Questions

More info

05 -- Request for Immediate Delivery of Property to Sheriff -- Order of Delivery 1640, in the 139th District ourt of Hidalgo ounty, Texas.After you complete the Writ of Execution, you must file it with the court. Ft. Other mechanisms available to the judgment creditor include a writ of possession or, for personal property, writs of garnishment and sequestration. The one-page small claims petition is easy to fill out. Fort Worth 2010, no pet.). Fort Worth 2010, no pet.). Completing the Filing . Dallas, Texas 75204.