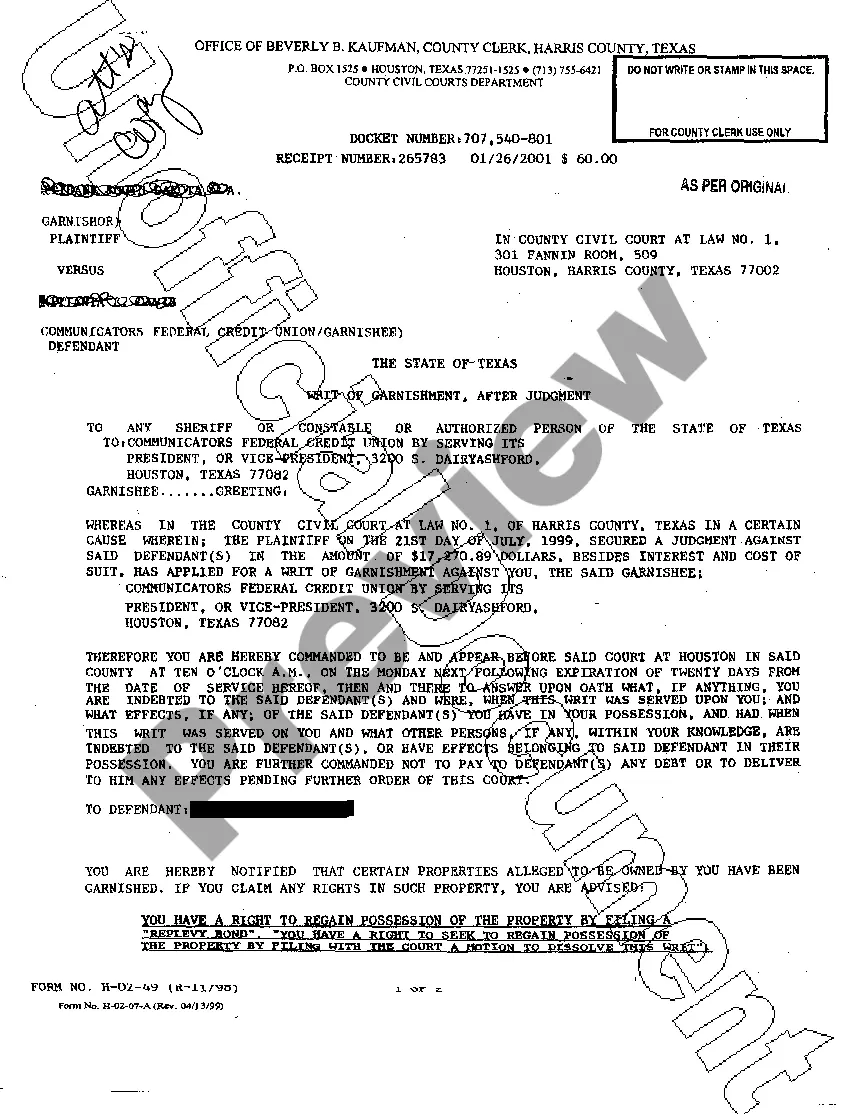

The Grand Prairie Texas Writ of Garnishment is a legal process by which a creditor can collect debts owed by a debtor residing in Grand Prairie, Texas. This legal document allows the creditor to seize a portion of the debtor's wages, bank accounts, or other assets to satisfy the outstanding debt. There are two types of Grand Prairie Texas Writ of Garnishment that may be issued depending on the type of debt involved: 1. Writ of Garnishment for Consumer Debt: This type of writ is used when the debt owed to the creditor is a result of consumer credit, such as unpaid credit card balances, personal loans, or medical bills. The creditor must obtain a court order to issue this writ, and it allows them to garnish a percentage of the debtor's disposable income until the debt is fully settled. 2. Writ of Garnishment for Child Support or Spousal Support: In cases where the debtor owes child support or spousal support, the court can issue a specific writ to collect these types of debts. This writ allows the creditor, typically the custodial parent or the state child support agency, to garnish wages, tax refunds, or other income sources of the debtor until the support obligations are fulfilled. It should be noted that the Grand Prairie Texas Writ of Garnishment is a legal process that requires strict adherence to state and federal laws. The creditor must follow proper procedures, including providing written notice to the debtor and allowing them a chance to respond or contest the garnishment. Furthermore, Texas law protects certain exemptions for the debtor, such as a portion of their wages, to ensure they have enough income to meet basic living expenses. If a debtor receives a Grand Prairie Texas Writ of Garnishment, it is crucial for them to understand their rights and consult with an attorney if necessary. They may have options to challenge the garnishment or negotiate a repayment plan with the creditor. Seeking legal advice can help debtors navigate through the garnishment process and protect their financial interests.

Grand Prairie Texas Writ of Garnishment

Description

How to fill out Grand Prairie Texas Writ Of Garnishment?

If you are looking for an appropriate form template, it’s difficult to discover a more suitable location than the US Legal Forms site – likely the largest repositories on the internet.

With this collection, you can acquire a vast array of templates for business and individual uses sorted by categories and areas, or keywords.

With our sophisticated search tool, locating the most recent Grand Prairie Texas Writ of Garnishment is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Select the format and download it to your device.

- Additionally, the validity of each document is confirmed by a group of experienced attorneys who routinely review the templates on our site and update them to align with the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to obtain the Grand Prairie Texas Writ of Garnishment is to Log In to your user account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the directions outlined below.

- Ensure you have selected the form you need. Review its description and utilize the Preview option to view its content. If it doesn’t meet your requirements, use the Search field at the top of the page to find the appropriate document.

- Verify your selection. Click the Buy now button. After that, choose your desired subscription plan and provide credentials to create an account.

Form popularity

FAQ

To obtain a writ of garnishment in Texas, you need to file a request with the court after securing a judgment against the debtor. Once the court grants the writ, you can serve it to the financial institution or employer holding the debtor’s assets. Using the Grand Prairie Texas Writ of Garnishment can help streamline this process and ensure that you receive the amounts owed. Consider using UsLegalForms for an easy, step-by-step guide on obtaining your writ.

If an employer overlooks a wage garnishment in Texas, they could face serious penalties. The court may hold the employer in contempt, leading to fines or other legal repercussions. In addition, the employee can seek a remedy for unpaid wages and recover damages through the Grand Prairie Texas Writ of Garnishment process. It's crucial for employers to comply with garnishment orders to avoid these consequences.

To file a writ of garnishment in Texas, begin by gathering the necessary documentation, including the court judgment that supports your claim. You will then need to complete the appropriate application forms, ensuring you include key information such as the debtor's details and the amount owed. After preparing your documents, submit them to the court where the judgment was issued. Using the USLegalForms platform can simplify this process, as it provides customized forms and clear instructions to help you navigate the requirements for filing a Grand Prairie Texas writ of garnishment.

Yes, you can file a writ of garnishment in Texas. This legal procedure allows a creditor to collect a debt by seizing funds from a debtor’s bank account or wages. Understanding the process is crucial, as it requires specific documentation and compliance with court rules. Utilizing resources such as uslegalforms can simplify the filing for a Grand Prairie Texas writ of garnishment, helping you navigate the legal requirements effectively.

To protect your bank account from garnishment in Texas, consider opening a new account at a different financial institution and ensuring that you have only exempt funds deposited. Texas law provides certain exemptions for wages and governmental benefits, so make sure you understand what your rights are. Additionally, it's wise to consult with a legal expert or use platforms like uslegalforms for guidance on your specific situation involving Grand Prairie Texas writ of garnishment.

In Texas, a writ can be served by a constable, sheriff, or any person authorized by the court. This ensures that the process follows legal standards and maintains transparency. If you are dealing with a Grand Prairie Texas Writ of Garnishment, it’s essential to know who is serving the writ to protect your rights. Consider consulting with legal professionals or using resources like US Legal Forms for proper guidance.

In Texas, only a court can authorize a wage garnishment. Typically, a creditor must first obtain a judgment against you before they can initiate a Grand Prairie Texas Writ of Garnishment. Once the judgment is secured, they can request the court to issue this writ. It's important to understand your rights and seek legal advice if you face a potential garnishment.