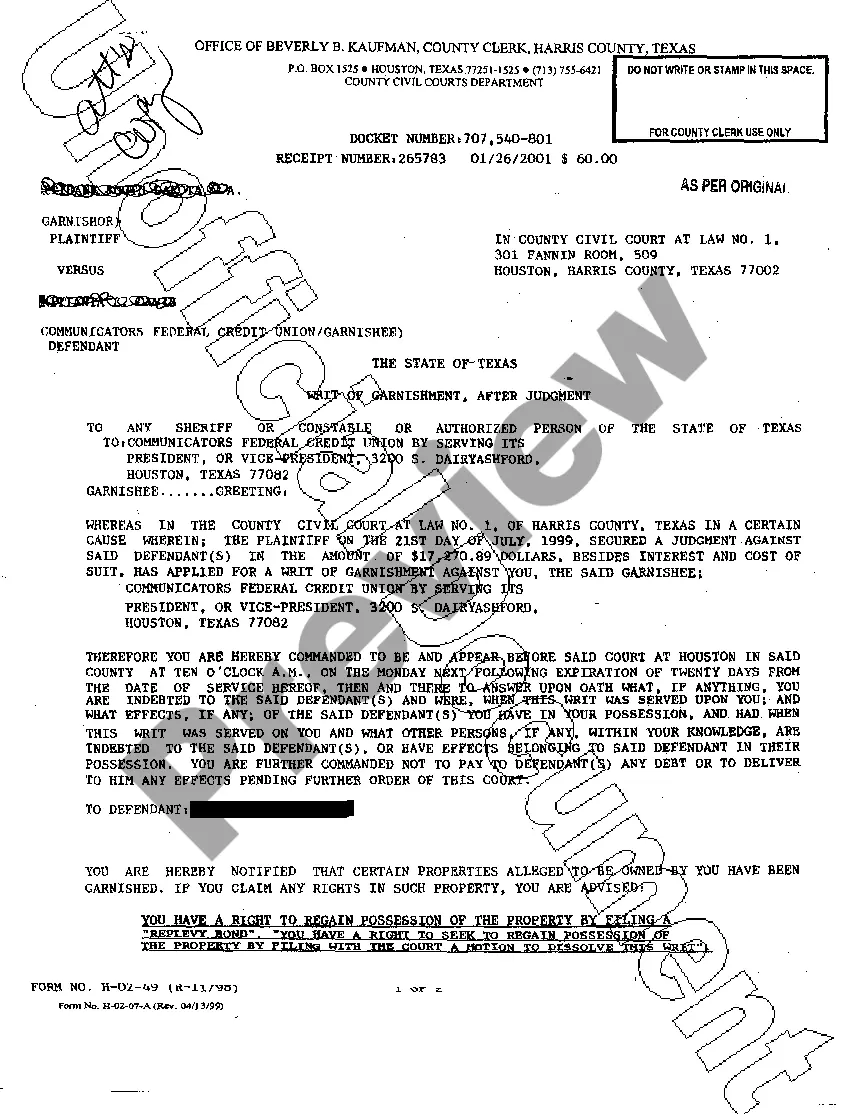

Harris Texas Writ of Garnishment is a legal process used by creditors to collect money owed to them by a debtor. It allows a creditor to obtain a court order to seize funds from a debtor's bank account or garnish their wages to satisfy a debt. This writ is specific to Harris County in Texas and follows the guidelines set by the Texas state laws. The Harris Texas Writ of Garnishment can be issued in various types of cases, including: 1. Consumer debts: This includes credit card debts, personal loans, medical bills, and other debts owed by individuals. 2. Child support and alimony: When a person fails to make court-ordered payments for child support or alimony, the custodial parent or spouse can seek a writ of garnishment to enforce payment. 3. Judgments: If a creditor has obtained a judgment against a debtor in court, they can apply for a writ of garnishment to collect the amount owed. 4. Tax debts: Government entities can also obtain a writ of garnishment to collect unpaid taxes, such as income tax or property tax. The Harris Texas Writ of Garnishment process involves several steps. First, the creditor must file a lawsuit and obtain a judgment against the debtor. Once the judgment is secured, the creditor can then apply for a writ of garnishment, which is issued by the court. The writ is then served on the garnishee, typically the debtor's employer or bank, notifying them of the need to withhold funds. It is important to note that there are certain exemptions and limitations regarding the amount of funds that can be garnished. Texas law protects a portion of the debtor's wages and bank account balance from garnishment, ensuring that they have enough to cover basic living expenses. In summary, the Harris Texas Writ of Garnishment is a legal tool used by creditors to collect outstanding debts. It allows for the seizure of funds from a debtor's bank account or garnishment of their wages, within the limits set by Texas law. This writ can be used in various types of cases, including consumer debts, child support and alimony, judgments, and tax debts.

Harris Texas Writ of Garnishment

Description

How to fill out Harris Texas Writ Of Garnishment?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone with no legal education to draft this sort of papers cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our service offers a massive catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Harris Texas Writ of Garnishment or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Harris Texas Writ of Garnishment quickly employing our trustworthy service. In case you are presently an existing customer, you can go on and log in to your account to download the needed form.

However, if you are unfamiliar with our library, ensure that you follow these steps before downloading the Harris Texas Writ of Garnishment:

- Ensure the form you have found is good for your location because the regulations of one state or area do not work for another state or area.

- Review the document and go through a short description (if provided) of scenarios the paper can be used for.

- In case the one you chosen doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment method and proceed to download the Harris Texas Writ of Garnishment once the payment is through.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.