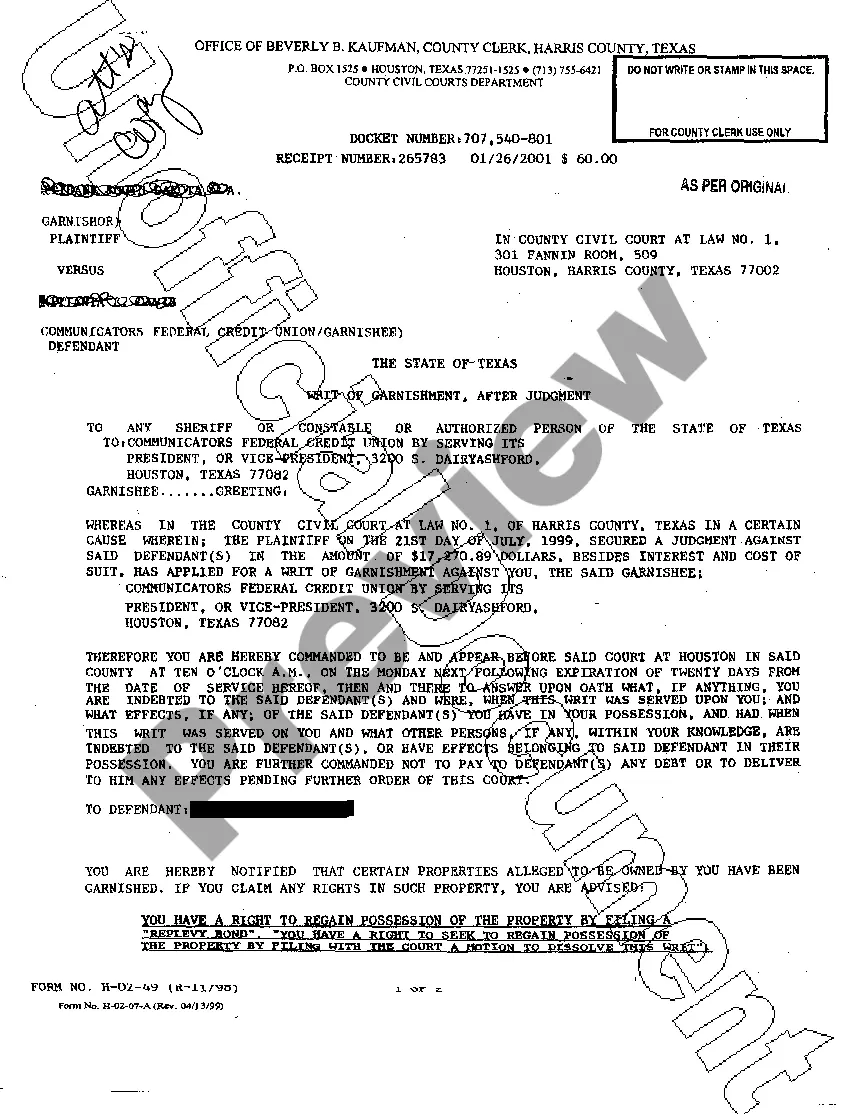

Irving, Texas Writ of Garnishment is a legal tool used to collect outstanding debts from individuals or entities residing or operating in Irving, Texas. This writ enables a creditor to intercept and seize the debtor's financial assets such as bank accounts, wages, or other forms of income to satisfy the owed debt. The process of obtaining an Irving, Texas Writ of Garnishment starts with the creditor filing a lawsuit against the debtor and successfully obtaining a judgment. If the debtor fails to pay the owed debt voluntarily, the creditor can then seek the court's permission to issue a writ of garnishment. This court order allows the creditor to legally collect the outstanding debt by intercepting specific assets of the debtor. In Irving, Texas, there are different types of Writs of Garnishment applicable to various financial assets. These types include: 1. Bank Garnishment: With a bank garnishment, the creditor can intercept funds held in the debtor's bank account, up to the amount owed. The bank is legally required to freeze the funds and turn them over to the creditor, ensuring debt repayment. 2. Wage Garnishment: A wage garnishment involves the creditor collecting the owed debt from the debtor's wages or salary. The employer is legally obligated to withhold a portion of the debtor's earnings and remit them directly to the creditor until the debt is paid off. 3. Property Garnishment: In some cases, the writ of garnishment can extend to property owned by the debtor. This could include real estate, vehicles, or other valuable assets that can be liquidated to satisfy the outstanding debt. 4. Account Receivable Garnishment: If the debtor is a business, the creditor can seek to garnish any accounts receivable owed to the business. This allows the creditor to intercept payments from customers or clients directly, ensuring repayment of the debt. It is important to note that the specific procedures and regulations surrounding Irving, Texas Writs of Garnishment may vary, and it is advisable to consult with legal professionals for accurate and up-to-date information. However, this legal mechanism serves as a powerful tool to help creditors collect overdue debts within the jurisdiction of Irving, Texas.

Irving Texas Writ of Garnishment

Description

How to fill out Irving Texas Writ Of Garnishment?

Take advantage of the US Legal Forms and gain instant access to any form template you desire.

Our helpful website with an extensive range of documents enables you to locate and acquire nearly any document example you need.

You can save, complete, and sign the Irving Texas Writ of Garnishment in just a few minutes instead of spending hours online searching for the correct template.

Utilizing our catalog is an excellent method to enhance the security of your document submissions.

Access the page with the template you need. Confirm that it is the form you were seeking: review its title and description, and use the Preview option if it is available. If not, use the Search box to find the required one.

Initiate the saving process. Click Buy Now and select the pricing plan that suits you. Then, create an account and complete your order using a credit card or PayPal.

- Our knowledgeable legal experts routinely review all documents to verify that the templates are appropriate for a specific state and comply with current regulations and standards.

- How can you obtain the Irving Texas Writ of Garnishment.

- If you possess an account, simply Log In to your account. The Download button will be visible on all the documents you view.

- Furthermore, you can access all previously saved files in the My documents section.

- If you haven't created an account yet, follow the instructions below.

Form popularity

FAQ

To protect your bank account from garnishment in Texas, consider setting up exemptions for certain types of income, such as Social Security or disability payments. Additionally, you might want to restructure your banking strategy to minimize the risk. Consulting resources from uslegalforms can provide you with detailed legal insights and protective measures tailored to your situation.

Receiving a writ of garnishment can be daunting, but it's essential to respond promptly. First, review the writ carefully to understand the details of the claim against you. You may have the right to contest the garnishment in court, or you can negotiate with the creditor. Legal tools and forms on uslegalforms can assist you in managing this situation effectively.

In Texas, a writ of garnishment can be served by a sheriff, constable, or a private process server. It is important that the individual serving the writ is authorized and follows the legal procedures. This ensures that all parties involved are notified properly. You can find additional guidance on whom to hire through platforms like uslegalforms.

Texas has specific rules governing garnishment, including limits on the amount that can be withheld from wages. Generally, the garnishment amount cannot exceed 25% of an employee's disposable income. Understanding these regulations can guide individuals and employers through the process of complying with an Irving Texas writ of garnishment effectively.

A writ of execution allows a creditor to seize specific property to satisfy a judgment, while a writ of garnishment targets a debtor’s wages or bank accounts. Essentially, the writ of execution is about taking assets, whereas the writ of garnishment focuses on income or funds. Knowing the difference is vital in managing a financial situation involving the Irving Texas writ of garnishment.

If your employer did not notify you of a wage garnishment, they may not be following the proper legal procedures. You have the right to inquire about any deductions from your paycheck. Understanding your rights surrounding the Irving Texas writ of garnishment is crucial, and legal assistance can be obtained if needed.

An employer in Texas typically has 20 days to respond to a wage garnishment order. This time frame allows the employer to process the order and start withholding the specified amount from the employee’s wages. Prompt action is essential to adhere to the terms of the Irving Texas writ of garnishment.

To serve a writ of execution in Texas, you need to deliver it to the appropriate law enforcement agency. They will assist in enforcing the writ against the debtor’s property. The process is often streamlined when utilizing services from platforms like US Legal Forms, especially for navigating the application of the Irving Texas writ of garnishment.

No, an employer cannot deny a legitimate garnishment order in Texas. If the garnishment is valid and correctly issued, the employer is legally required to withhold the specified amount from the employee's wages. Compliance with the Irving Texas writ of garnishment is essential to avoid any potential legal repercussions.

Yes, you can file a writ of garnishment in Texas. To do so, you must have a valid court judgment. The Irving Texas writ of garnishment can help secure the necessary funds from a debtor’s paycheck or bank account once the proper documents are filed.