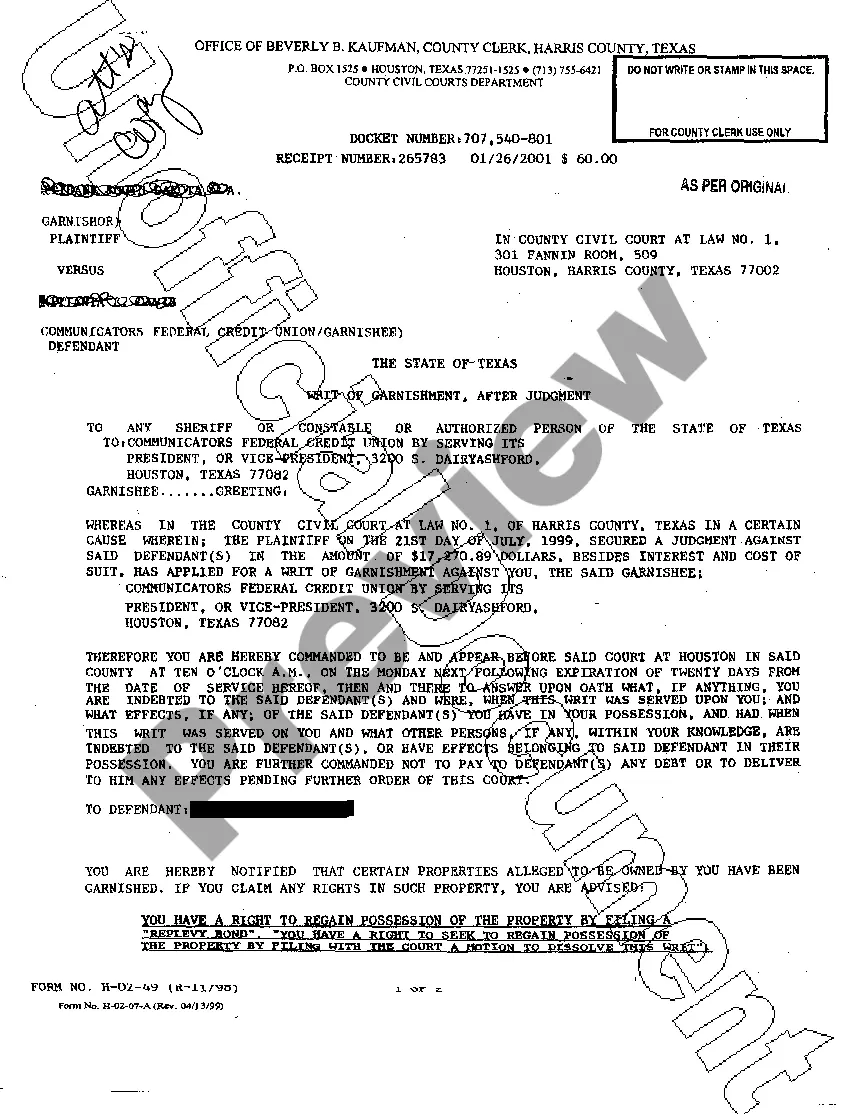

Lewisville Texas Writ of Garnishment: A Comprehensive Overview In Lewisville, Texas, a Writ of Garnishment is a legal mechanism used to enforce debt collection efforts. It allows a creditor to obtain a court order and withhold a certain portion of a debtor's wages or assets in order to satisfy a debt. The Writ of Garnishment is utilized when a creditor obtains a judgment against a debtor and wishes to recover the owed amount through the garnishment process. This procedure is regulated by the Texas Civil Practice and Remedies Code, specifically Title 3, Chapter 63. Key Components of the Lewisville Texas Writ of Garnishment: 1. Creditor's Petition: To initiate the garnishment process, the creditor must file a petition with the appropriate Lewisville court, stating the reasons for the request and providing evidence of the debt owed. 2. Court Order: Once the petition is granted, the court issues a Writ of Garnishment directing the employer or financial institution to withhold a specific sum from the debtor's income or assets. 3. Employer Notification: In cases of wage garnishment, the employer is served with the Writ of Garnishment and is legally obligated to deduct the specified amount from the debtor's wages until the debt is satisfied. 4. Financial Institution Notification: If the garnishment is targeting bank accounts, the financial institution is served with the Writ of Garnishment and is required to freeze the specified amount in the debtor's account until further notice. Types of Lewisville Texas Writ of Garnishment: 1. Wage Garnishment: This is the most common type of garnishment in Lewisville, where a portion of the debtor's wages is withheld by the employer and sent directly to the creditor until the debt is resolved. 2. Bank Account Garnishment: In this case, the creditor requests the court to freeze the debtor's funds in their bank account and transfer them to the creditor to satisfy the debt. 3. Property Garnishment: If the debtor owns valuable assets such as vehicles, real estate, or other property, the creditor can request a Writ of Garnishment to force the sale of the assets and use the proceeds to repay the debt. 4. Federal Benefits Garnishment: Certain federally protected benefits like Social Security, disability, and pension payments may be subject to garnishment, but the rules and limitations for these types of garnishments are more stringent. 5. Child Support Garnishment: When an individual fails to pay court-ordered child support, the custodial parent or Child Support Enforcement Agency could obtain a Writ of Garnishment to collect the delinquent payments. It is important to note that the Lewisville Texas Writ of Garnishment must adhere to federal and state laws regarding the maximum amount that can be garnished, exemptions, and the proper legal procedures to protect the debtor's rights and prevent any unlawful actions. If you find yourself facing a Lewisville Texas Writ of Garnishment, it is crucial to consult with a qualified legal professional who can guide you through the process and help protect your rights and interests.

Lewisville Texas Writ of Garnishment

State:

Texas

City:

Lewisville

Control #:

TX-G0310

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Writ of Garnishment

Lewisville Texas Writ of Garnishment: A Comprehensive Overview In Lewisville, Texas, a Writ of Garnishment is a legal mechanism used to enforce debt collection efforts. It allows a creditor to obtain a court order and withhold a certain portion of a debtor's wages or assets in order to satisfy a debt. The Writ of Garnishment is utilized when a creditor obtains a judgment against a debtor and wishes to recover the owed amount through the garnishment process. This procedure is regulated by the Texas Civil Practice and Remedies Code, specifically Title 3, Chapter 63. Key Components of the Lewisville Texas Writ of Garnishment: 1. Creditor's Petition: To initiate the garnishment process, the creditor must file a petition with the appropriate Lewisville court, stating the reasons for the request and providing evidence of the debt owed. 2. Court Order: Once the petition is granted, the court issues a Writ of Garnishment directing the employer or financial institution to withhold a specific sum from the debtor's income or assets. 3. Employer Notification: In cases of wage garnishment, the employer is served with the Writ of Garnishment and is legally obligated to deduct the specified amount from the debtor's wages until the debt is satisfied. 4. Financial Institution Notification: If the garnishment is targeting bank accounts, the financial institution is served with the Writ of Garnishment and is required to freeze the specified amount in the debtor's account until further notice. Types of Lewisville Texas Writ of Garnishment: 1. Wage Garnishment: This is the most common type of garnishment in Lewisville, where a portion of the debtor's wages is withheld by the employer and sent directly to the creditor until the debt is resolved. 2. Bank Account Garnishment: In this case, the creditor requests the court to freeze the debtor's funds in their bank account and transfer them to the creditor to satisfy the debt. 3. Property Garnishment: If the debtor owns valuable assets such as vehicles, real estate, or other property, the creditor can request a Writ of Garnishment to force the sale of the assets and use the proceeds to repay the debt. 4. Federal Benefits Garnishment: Certain federally protected benefits like Social Security, disability, and pension payments may be subject to garnishment, but the rules and limitations for these types of garnishments are more stringent. 5. Child Support Garnishment: When an individual fails to pay court-ordered child support, the custodial parent or Child Support Enforcement Agency could obtain a Writ of Garnishment to collect the delinquent payments. It is important to note that the Lewisville Texas Writ of Garnishment must adhere to federal and state laws regarding the maximum amount that can be garnished, exemptions, and the proper legal procedures to protect the debtor's rights and prevent any unlawful actions. If you find yourself facing a Lewisville Texas Writ of Garnishment, it is crucial to consult with a qualified legal professional who can guide you through the process and help protect your rights and interests.

Free preview

How to fill out Lewisville Texas Writ Of Garnishment?

If you’ve already used our service before, log in to your account and download the Lewisville Texas Writ of Garnishment on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Lewisville Texas Writ of Garnishment. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!